Islamic finance is seen as an increasingly legitimate alternative to traditional, interest-based finance.

Starting on January 1, the International Monetary Fund (IMF) will include Islamic finance in its financial sector assessments of select countries, evaluating the regulation and supervision of Islamic finance institutions under Shariah law by incorporating guidance from the Islamic Financial Services Board. The decision is a game-changer: By green-lighting oversight of Islamic banking, the fund seeks to speed up the incorporation of a large and expanding set of institutions, and the markets they serve, into the global financial system.

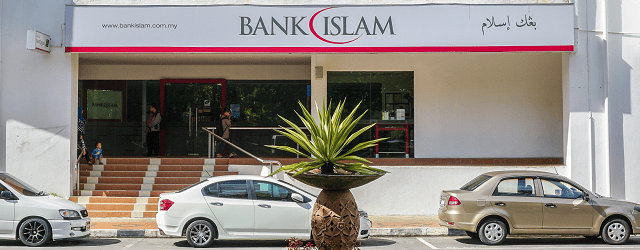

“The Islamic finance sector continues to grow and evolve,” the IMF opined in a working paper, Core Principles for Islamic Finance Regulations and Assessment Methodology, published in May: “Global Islamic financial assets have reached about US$2 trillion, with the banking sector accounting for about 85 percent of the total assets. Islamic banking exists in more than 60 countries and the industry has become systemically important in 13 jurisdictions.”

“The IMF usually focuses on conventional banking, but for the past 20 years, it has been collaborating closely with many regulators overseeing Islamic finance to provide technical advice,” says M. Kabir Hassan, professor of finance at the University of New Orleans. “This is an important breakthrough, because … this development points towards an international recognition of Islamic finance and the effectiveness of regulation and supervision of Islamic banking.”

By making Islamic finance a globally accepted system parallel to current interest-based financial services, the IMF also hopes to bolster reporting transparency and funding diversification and to reduce the percentage of unbanked populations across Muslim countries. The fund also wants to prevent the rise of a dual-jurisdiction regime in which some banks are regulated in accordance with Shariah law and others fall under conventional financial watchdogs. The IMF’s initiative, says Hassan, does that and more: “Not only does it encourage more consistency in applying Islamic finance rules and principles, but it also helps achieve the UN’s Sustainable Development Goals.”

The work, however, has just started. To implement the plan effectively and ensure compliance with the new rules, says Hassan, countries from Saudi Arabia to Indonesia will need to build capacity and develop supervisory resources. “Countries with significant Islamic finance industry must create formal units to supervise the sector, devise plans to address regulatory shortcomings, and develop human resources,” he says.