Despite a tough year, the market remained somewhat resilient, with exciting deals keeping the global economy running.

When it came to M&A, 2022 was anything but stellar. Total activity dropped a whopping 37% year-on-year. Equities, IPOs, and debt issuances also lagged significantly. However, some of the drag factors actually boded well for M&A. Thus, the market remained somewhat resilient. Such is the case of currency fluctuations, which led to a stronger dollar against the euro and the pound. The war in Ukraine also helped propel the trend as companies and governments scrambled to find alternatives for Russia’s and Ukraine’s lowering commodity exports. In terms of sectors, the perspective remained unchanged, with technology still running the show on the back of Broadcom’s acquisition of VMware for $61 billion and Elon Musk’s takeover of Twitter for $44 billion. The pharma, medical, and biotech industries came in second place, with $254.7 billion worth of total M&As. —TM

|

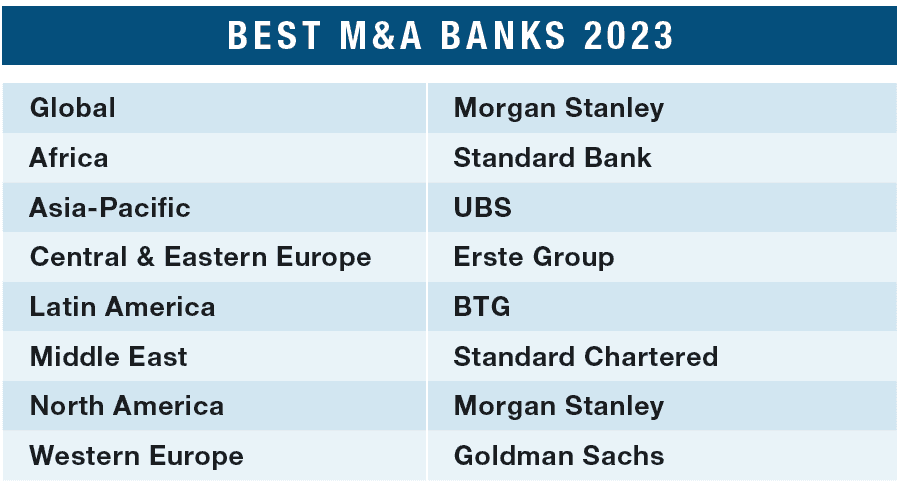

BEST BANKS FOR M&A |

|---|

GLOBAL

Morgan Stanley

In a year that saw a hefty decline in global M&A activity, Morgan Stanley stood out from the competition by positioning itself as an essential player in several major deals. While others lost market share, the bank remained stable in its position in the global M&A industry as the best bank for M&As for the second year. The financial behemoth took on a critical role in Elon Musk’s acquisition of Twitter for $44 billion, as well as in Broadcom’s acquisition of VMware. Morgan Stanley also won mandates to work with Amazon and One Medical on one of the year’s biggest M&A deals, with the online retail giant agreeing to buy the primary-care clinic operator for $3.9 billion. Furthermore, Morgan Stanley earned around $80 million in fees thanks to the Horizon sale to Amgen.

Morgan Stanley’s success in navigating complex M&A transactions in a challenging year demonstrates the bank’s expertise and credibility in the industry. It was also the top-performing bank when it came to M&A in North America. —TM

AFRICA

Standard Bank

Through its comprehensive investment-banking platform, Standard Bank has become the leading M&A advisor in Africa through transactions that unlock synergies and contribute to growth by attracting foreign direct investment to the continent. Serving as advisor and joint funder, the bank facilitated the acquisition of EnviroServ, the largest private waste and water management business in sub-Saharan Africa, by a consortium led by French utility SUEZ. The deal brings international expertise to the South African waste management sector and supports environmental concerns and goals for the country. Acting as sole financial advisor, the bank assisted Walmart on its $385 million acquisition of 48% of Massmart, Africa’s second-largest consumer retailer. In a landmark transaction, the bank advised Allianz on its joint venture with Sanlam, one of Africa’s largest financial institutions, creating the largest pan-African insurance provider with a presence in 27 countries. While in Nigeria, the bank led advisory roles including BUA Foods on its $1.7 billion listing, and also with a mandate in the telecommunications sector. —DS

ASIA-PACIFIC

UBS

UBS is the leading international investment bank in China with its one-stop platform and comprehensive products in ECM, LDCM and M&A. In 2022, UBS was recognized as the most experienced placement bookrunner, the best ECM house in the Hong Kong market, and the leading adviser in China M&A. With total deal value over $9 billion, which represents 2% of China M&A deals, UBS advised high-profile M&A transactions as the sole financial advisor for both foreign investors and local Chinese parties. Notable deals included global mobility tech company ECARX’s $3.4 billion business combination with COVA Acquisition Corp.; French transportation company, Wagas Group’s China exit via a 60% stake sale to Advent International; Singapore investor Recco Control Technology and Dazheng Group’s privatization takeover of NASDAQ-listed Hollysys Automation Technologies. These successful deals and the wealth of China M&A experiences have positioned UBS at the forefront of the key market in designing and delivering innovative solutions for businesses that maximize shareholder value and continuously define trends. —LZ

CENTRAL & EASTERN EUROPE

Erste Group

In 2022, M&A transactions in Central and Eastern Europe (CEE) remained surprisingly stable—albeit losing roughly 20% in value, according to data from CMS, one of the region’s largest tax firms. Against the backdrop of the Russian invasion of Ukraine, neighboring economies resorted to mergers to secure important supplies of mining and energy commodities, driving the number of deals upward. In the face of this volatile backdrop, Erste Bank used its strategic vision and long-term commitment to the energy industry to secure its position as the top bank for M&A deals in the CEE in 2022. Among the bank’s main deals in the region is the financing for Energy Power Holding to acquire Canada’s Jade Power Trust’s green energy generation capacities in Romania last November. Furthermore, the bank’s strategic moves included acquisitions of its own, such as the takeover of Commerzbank’s Hungarian subsidiary and the purchase of Sberbank Czech’s loan portfolio. —TM

LATIN AMERICA

BTG

Despite a decrease of 35.9% in total deal volume from the previous year, the M&A market in Latin America remained active in 2022. Total transaction value reached an impressive $106.9 billion for the year. Among the countries in Latin America, Brazil maintained its position as the most active, accounting for 56% of all deal volume in the region year to date. Amid this challenging yet rewarding environment, our best bank for M&As in the region for the second year in a row, BTG Pactual, stood out from the competition by using its ability and privileged market positioning to advise on key deals and maintain its impressive financial performance in the face of crisis.

Among the Brazilian-based bank’s top deals in the year were the acquisition of CELG-D from Enel Brasil by Equatorial for 7.6 billion reais and the merger of Aliansce Sonae with brMalls for 11.5 billion reais. Those deals helped the bank post an impressive financial performance for the entire year, with an all-time high in M&A proceeds compensating for a slowing equity market. —TM

MIDDLE EAST

Standard Chartered

Standard Chartered Bank is firmly entrenched in the Middle East with its long-established tenure in eight countries across the region. Through its depth of industry coverage and consistent deal execution, it is a trusted advisor among the region’s sovereign and corporate clients and is recognized as the Best M&A bank in the Middle East. These capabilities help it win large and high-profile mandates. It was the sole financial advisor on Saudi Aramco’s $15.5 billion gas pipeline divestiture to Vision Invest, a Saudi Arabian investment firm that was part of the investor consortium. In Dubai, the bank advised Maritime port terminal operator DP World on selling minority stakes in three UAE assets of DP World involving a $5 billion investment by CDPQ, a global investment firm. The bank also acted as the sole financial advisor to Abu Dhabi National Oil Company (ADNOC) on its 100% divestment of waste management assets. —DS

NORTH AMERICA

Morgan Stanley

In spite of the challenging landscape, Morgan Stanley was able to participate in high-profile advisory mandates to preserve its league table rankings and expand its share in several markets. The bank advised Elon Musk on his $44 billion acquisition of Twitter, and Mitsubishi UFJ Financial Group on its sale of Union bank. These deals helped Morgan Stanley retain its top-tier position with a 22% share of global M&A volume. In the US, its number three spot reflected a 29% share of deal volume. The bank improved its position in the APAC (ex-Japan) region as the leading bank in M&A volume. With depressed equity markets, a decline in valuations may spur M&A activity in distressed companies and assets. However considerable uncertainty remains. Going forward, Morgan Stanley has identified some areas of opportunity in 2023: well-capitalized companies making acquisitions in their core business; transactions with financial sponsors as they invest new companies or sell portfolio companies; advisory mandates involving shareholder activism; and cross-border M&A. —DS

WESTERN EUROPE

Goldman Sachs

As higher capital costs took a heavy toll on global M&A markets, European activity remained surprisingly resilient. The trend was mostly driven by a nearly 35% spike in energy M&A, against the backdrop of the war. The old continent saw 1,229 M&A transactions. That’s up 5.6% from the previous year. However, the total deal value fell short of 2021’s record, amounting to $38.9 billion and plummeting 20.3% on the year. The 10 largest banks in the region had a tougher time, with a 10.27% drop in the number of M&A deals from 2021 and a 35.65% drop in value. Amid this challenging scenario, Goldman Sachs used its market expertise to overtake its rival JP Morgan for the first position in M&As in the region with an 8.4% market share, according to Refinitiv data. The firm advised some 22 deals that were more than, or equal to, $1 billion in value. Four of those deals had price tags of more than $10 billion. —TM