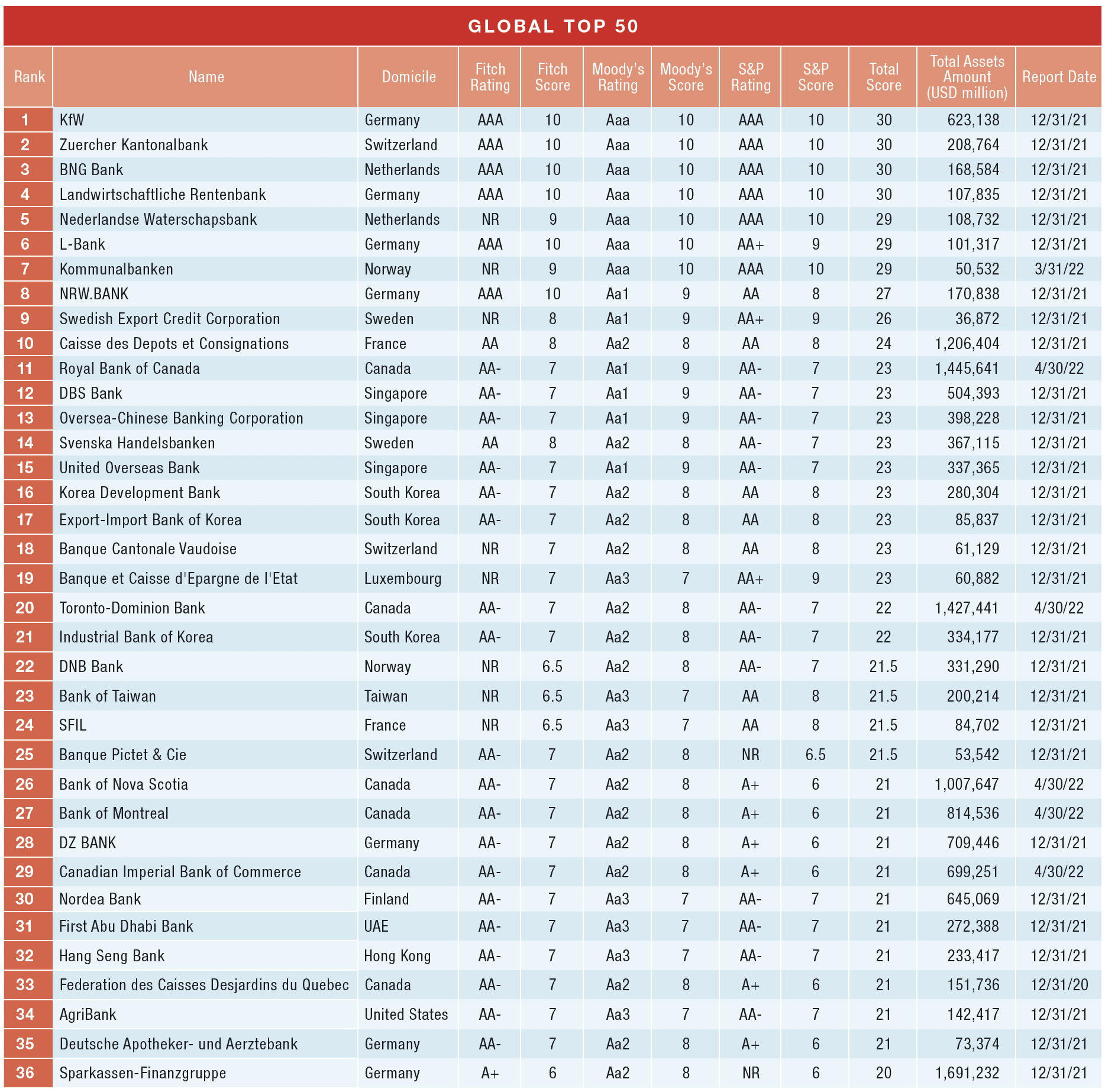

The leaders on ourannual World's Safest Banks ranking, compiled last summer, show continued stability despite the global banking upheaval.

It’s no secret that markets can—and often will—turn on their heads without warning. Yet, not even the most pessimistic expected the first three months of 2023 to bring back so many ghosts of the global financial crisis of 2008.

The failure of Silicon Valley Bank in early March—the second largest in US history—shook the financial world, leading to the closure of Signature Bank and the dramatic rescue of Switzerland’s second-largest bank, Credit Suisse, through a forced merger with its long-time rival UBS.

As many now wonder who will be the next shoe to drop, knowing the world’s safest banks has become even more essential to finance professionals worldwide. Global Finance magazine reviewed the leaders from our annual World’s Safest Banks analysis, published in November 2022, to confirm the rankings still stand.

And—according to our methodology—they do. The only change in our top 25 safest banks came from France-based SFIL bank, which jumped up 11 positions in the list primarily due to Moody’s upgrade in its credit rating. No changes were made to our best regional list of 16 banks.

The perceived stability in our ranking doesn’t imply there have been no updates to these banks’ credit ratings during that period. In fact, 15 of our top-ranked banks were reviewed by one or more of the top-3 global credit rating agencies (CRAs) and have remained stable.

This scenario reinforces the perception that the world’s safest banks have remained resilient and are in a good position to navigate the current crisis.

Ann Rutledge, Founding Principal & CEO of Creditspectrum Corp/R&R Consulting and author of two books on the topic, explains that CRAs are generally more effective in guaranteeing the safety of very safe banks than predicting the actual risks of not-so-safe ones.

“That’s true of all classes of ratings,” she says. “To a great extent, ratings are self-fulfilling anyway—they are a confidence game—but after 2008, when they pushed that confidence game to the limit and beyond, they were pulled back.”

Do Credit Ratings Lag Reality?

It’s no secret that CRAs played a significant role in the 2008 crisis by mispricing the risks associated with US mortgage-backed securities. However, that led to significant changes in regulation. First, the Dodd-Frank Act of 2012 established the Office of Credit Ratings (OCR), an agency that oversees US-based CRA operations. The act also increased the legal penalties for issuing inaccurate ratings and lessened the pleading standards for private actions against CRAs.

But while those measures have resulted in greater public faith in the agencies’ trustworthiness, market participants still claim that CRAs may lag in spotting banks on the verge of failure. Silicon Valley Bank, for example, was not downgraded until its failure was imminent. On the other hand, the downgrade of First Republic Bank a couple of weeks later almost led to the self-fulfilling closure of the bank.

CRAs must be very careful. A lower credit score can have severe practical implications for a bank, such as increased borrowing costs and fewer capital inflows. “Ever since Rockefeller created a global market for oil, ratings have been a valuable, unique piece of financial infrastructure,” explains Rutledge.

Anywhere Sikochi, a professor of Business Administration at Harvard University, has found credit agencies to still be valuable, despite lags and missteps: “Should we continue to rely on ratings, given all the times that ratings have been shown not to be correct? The results of my research suggest that the answer is yes, especially given improvements since the financial crisis.”

“As the likelihood of issuer default grows,” Sikochi continues, “the threat of reputational harm from discovered rating failures increasingly mitigates the rating agencies’ strategic behavior incentivized by the issuer-pay model.”