The safest Islamic banks in the GCC get a break via oil markets, but also seek to help their countries shift to economies that are more balanced and sustainable.

Aided by the resurgent oil market, Islamic banks in the Gulf Cooperation Council (GCC) continue to recover from the pandemic with stronger balance sheets and improved profitability. Central banks in the region, their currencies pegged to the US dollar, have followed the US Federal Reserve in raising interest rates. This contributed to expanding net interest margins among some GCC banks.

Islamic banking is forecast to grow 10% in full-year 2022, according to Standard & Poor’s, and the sector continues to embrace innovation and sustainability to further develop Islamic finance. Collaboration with the fintech sector represents a critical opportunity. The UAE is leading the MENA region through accelerators such as the Dubai International Finance Centre to advance digital initiatives to offer customized Shariah-compliant products and services.

The concept of sustainability in finance aligns with the values of Islamic finance, hence green and sustainable bonds are gaining traction, as are new ESG funds with a Shariah-compliant focus. Continued progress depends on legal and regulatory standardization, as ESG sukuk adds a layer of complexity to traditional Shariah compliance.

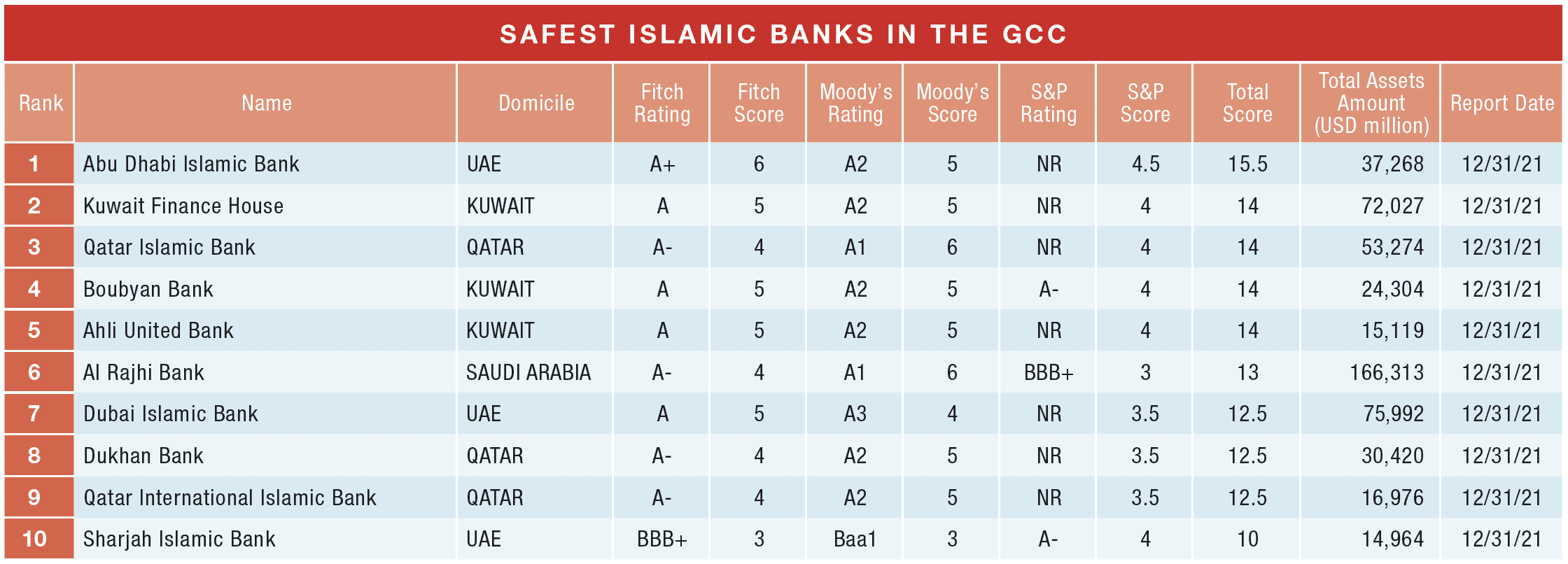

Our 2022 ranking of the Safest Islamic Banks in the GCC reflects a shifting peer group, due largely to rating-agency actions in Kuwait and Qatar. Fitch downgraded Kuwait, and consequently many of its banks. Boubyan Bank, while also downgraded by Fitch, was buoyed by a Moody’s upgrade citing strong profitability from its retail and corporate franchise. Fitch downgrades in April pushed Dukhan Bank down three spots to No. 8 The UAE’s Abu Dhabi Islamic Bank rose one position to the top. Qatar Islamic Bank rose one spot, to No. 3, with a notch higher rating from Moody’s than its in-country peers.

Persistence finally paid off for Kuwait Finance House. Following years of trying to overcome regulatory hurdles, the bank completed its acquisition of Bahrain’s Ahli United Bank, elevating it to the No. 2 Islamic bank by assets globally, behind Saudi Arabia’s Al Rajhi Bank. The bank’s Kuwait subsidiary is No. 5 in our rankings.