The Biden administration moves to make the American economy a more level playing field.

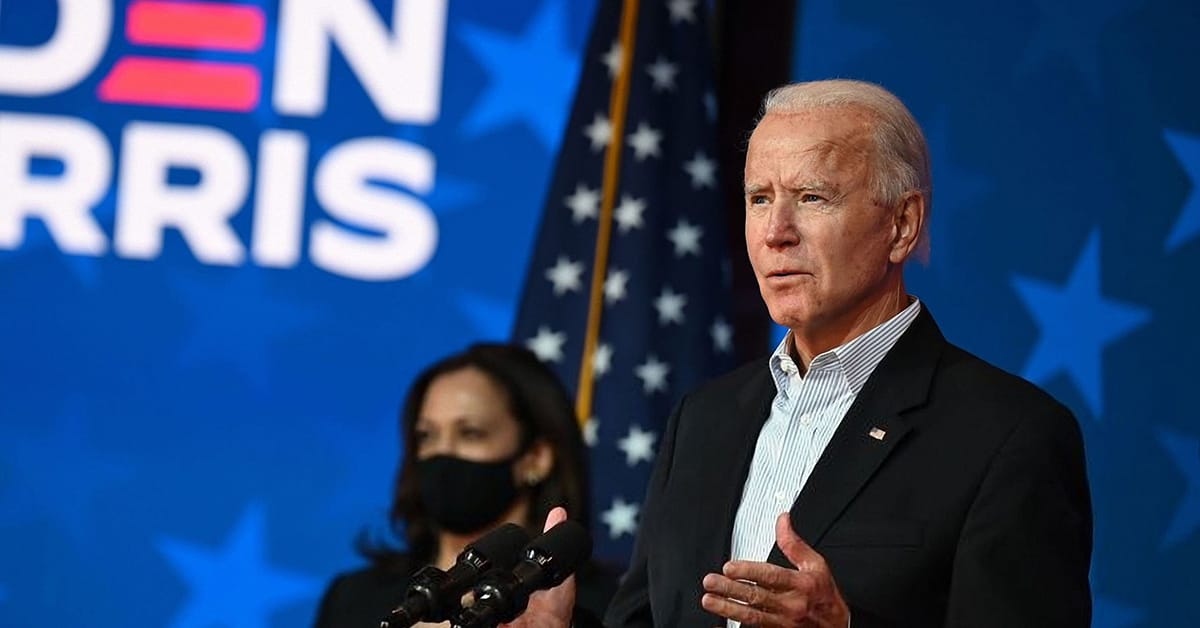

This summer, US President Joe Biden put into motion an overhaul of an American corporate consolidation culture dating back at least 40 years. In a sweeping executive order listing 72 initiatives and involving more than a dozen federal agencies, the Democrat detailed his plan to target big tech, big pharma, big agriculture and big banks. The president wants to promote greater merger scrutiny and drive down prices of prescription drugs and internet services.

“To keep our country moving, we have to bring fair competition back to this economy,” Biden said.

Over the past four decades, the world’s largest economy has lost 70% of its banks, with more than 10,000 bank closures, the White House said, citing data from the St. Louis Federal Reserve. The rate of creation of new businesses, an indicator of economic health, has fallen by almost 50% over the same period, according to Economic Innovation Group.

Biden directed the Department of Justice and other federal agencies to update guidelines on banking consolidation. Federal agencies haven’t formally rejected a bank merger application in more than 15 years, White House officials said.

The move comes amid expectations of further consolidation among regional lenders such as PNC, Huntington Bank and M&T, following BB&T’s acquisition of SunTrust in 2019.

Critics of Biden’s policy say imposing new regulations without cutting the red tape may have the opposite effect of encouraging mergers to share the compliance burden.

“Open banking is a goal worth pursuing but smaller banks are going to be hit by the costs of changing their organization,” says John Berlau, senior fellow for banking and finance at Competitive Enterprise Institute, a Washington-based think tank known for its libertarian views.

Berlau cited a study from Harvard’s John F. Kennedy School of Government, concluding that the regulatory costs of Dodd-Frank Wall Street reforms have accelerated the decline of community banks.