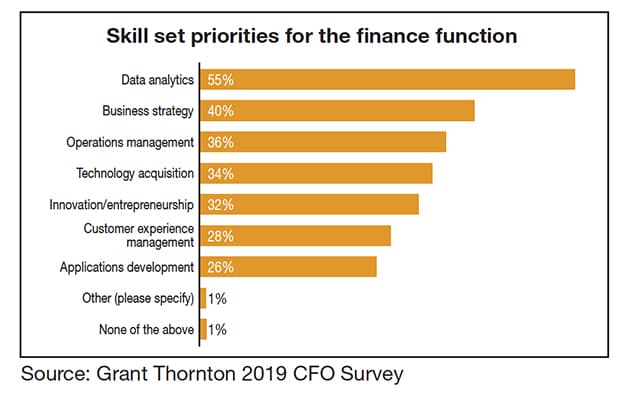

The importance of analytics and technology-related skills are rising.

More than half of senior finance executives (55%) surveyed late last year identified data analytics as the number one skill they want to develop within the finance function. This surpasses business strategy (40%), operations management (36%) and technology acquisition (34%), according to 2019 CFO Survey from the US arm of global audit, tax and advisory firm Grant Thornton International, which polled 378 senior finance executives in the US at companies with revenues between $100 million and $20 billion in November and December 2018.

Ninety-five percent of finance executives agreed that the finance function of the future must possess increased levels of technology expertise, including data analytics. “One of the key areas of changing responsibilities for CFOs is serving as the steward of data, not just for their own function but throughout the enterprise,” says Chris Stephenson, a principal in the company’s Bellevue, Wash. office.

Firms significantly boosted their technology investments over the past year , with the most significant increases going into machine learning at 21%; artificial intelligence (AI), at 17%; robotic process automation at 17%; advanced analytics at 14%; distributed ledger technology (DLT) at 14%; and optical character recognition at 8%. Grant Thornton and partner CFO Research carry out the survey each year.

Many firms plan to dedicate additional resources to frontier technologies over the next two years, including: AI, 41%, robotic process automation, 41%, and drones and robots, 30%.

In addition, 40% of executives plan to invest in blockchain technology within two years. That’s on top of the 22% who report their firms have already implemented blockchain. Grant Thornton didn’t even ask about this technology in its 2018 CFO Survey. The degree of blockchain implementation reported in the 2019 survey was unexpected, “stunning,” according to Stephenson.

As their firms’ data stewards, CFOs will need to learn more about emerging technologies like AI, machine learning and blockchain, adds Stephenson: “These are technologies that the CFO and CIO (chief information officer) will have to quarterback together.”

Overall, financial executives must “alter their mindset when it comes to technology investments,” says the report. “CFOs must be willing to experiment—and incur failures along the way—or risk falling behind.”