Preparing for disruption in corporate banking business models

Alert: Looming disruptions ahead in the net interest income maximization paradigm of corporate banks

Corporate bankers accustomed to the time-tested practice of lending at X percent, paying depositors at Y percent, and leaving off the spread i.e. (X-Y) are in for a rude awakening in the near future. A relatively new breed of dynamic discounting fintech platforms could be disrupting fundamentals of the banking industry by downsizing volumes of short-term corporate bank deposits, while simultaneously reducing accounts receivable financing offtake.

Though skeptics may ignore such suggestions of disruption without a second thought, it might be prudent to consider a few salient data points pertaining to dynamic discounting platforms:

- More than 1,000,000 buyer-supplier relationships were enrolled in Taulia’s network, a dynamic discounting platform, as on September 20, 2016

- US$1.4 billion transferred as early payments on Taulia’s platform during six months ending July 31, 2016

- Taulia reported 200 percent y-o-y growth in new bookings in Q2 2016

- Collaborative Cash Flow Optimization (C2FO), another dynamic discounting platform, reported 425 percent y-o-y growth in working capital flows in Q3 2015

Why Dynamic Discounting, And Why Now?

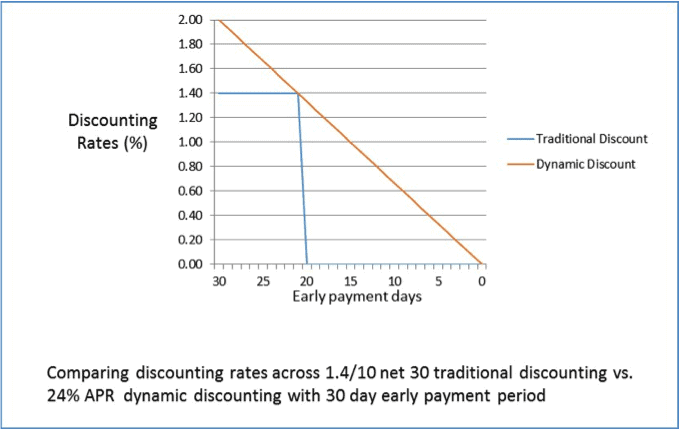

While the concept of discounting is certainly not new, traditional ‘X/Y net 30’ discounting models have been hamstrung by the relative inflexibility of zero discounts for early payments before the Yth (cut-off) day. Significant adoption of electronic invoicing, enhancements in automation, self-service capabilities, and integration with enterprise resource planning (ERP) systems have created an enabling ecosystem for the emergence and growing popularity of technology-driven, dynamic discounting platforms. These platforms calculate discounts dynamically on a sliding scale, driven by early payment days and a pre-agreed annualized percentage rate (APR), thereby clearly offering a flexible alternative to traditional discounting.

Dynamic discounting, despite having been around even before 2010, has recently moved closer to mainstream in the US and continental Europe, while being in an early adoption stage in Asia region.

Adoption has been aided by competitive yields from early payments, coupled with enabling regulatory tailwinds in Europe in the form of EU’s e-invoicing in Public Procurement Directive 2014, which stipulates that all public bodies have to accept electronic invoices by 2020, a pre-condition for dynamic discounting.

Discounting is a win-win proposition for both buyers and suppliers alike. Buyers benefit from superior yields on early payments, while suppliers benefit from substantially improved liquidity position as a result of reduction in days sales outstanding (DSO) metrics. Further, many suppliers are small enterprises and have to rely on high-cost factoring or expensive bank credit reflective of their weak credit profiles. For such suppliers, dynamic discounting provides an affordable financing alternative.

Ascertaining The Impact On Banks

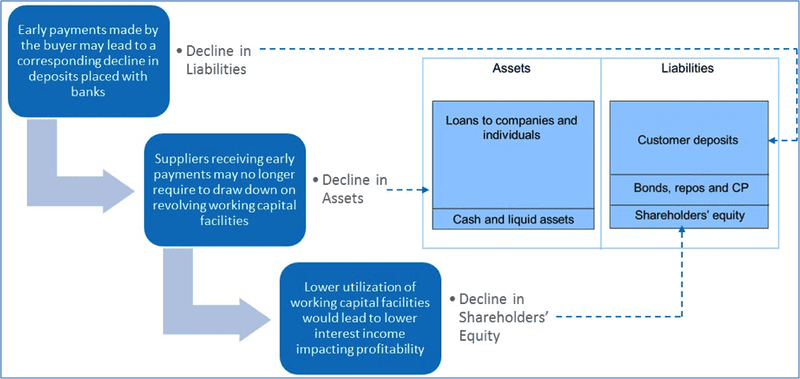

Banks could face two-fold adverse impact on their balance sheets due to dynamic discounting transactions. Advance payments, made by buying organizations, to avail discounts poses a threat to short-term deposits, which buying organizations would otherwise have deployed with banks. Likewise, suppliers who have received early payments may no longer choose to avail funds for post-shipment working capital. This leads to a drop in outstanding loans, which in turn, would result in lower interest income affecting profitability.

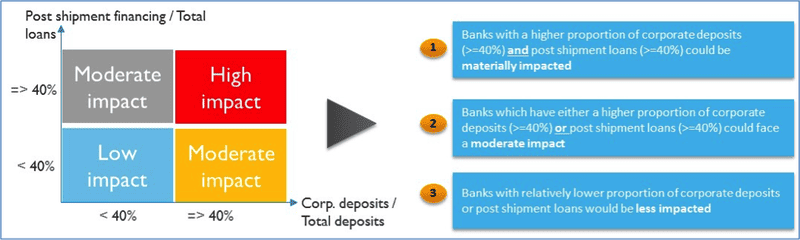

Of course, not all banks will be impacted to the same extent by the advent of dynamic discounting platforms. Overall impact on banks would be a function of the composition and profile of deposits and loans in the bank balance sheet. Answers to the following questions could help provide a qualitative estimate of the impact of emergence of dynamic discounting platforms:

- What is the percentage of corporate deposits of the total deposits held by the bank as on the latest reporting period end date?

- What is the percentage of working capital post shipment loans of all loans and advances made by the bank as on the latest reporting period end date?

The following matrix provides an impact assessment estimate for banks:

For Banks, The Time To Act Is Now

The traditional corporate banking business model is at an inflection point and banks act now! Banks may choose to:

- Create discounting platform — Danske Bank developing its own unique DynamicPay solution which is positioned as a bank independent platform supporting dynamic payments

- Partner with existing discounting platforms — RBS partnered with Taulia since October 2014 for electronic invoice submission and dynamic discounting capabilities

- Acquire existing discounting platforms — JPMorgan acquired Xign Corporation, which arguably pioneered dynamic discounting, way back in 2007 before shutting down the unit in 2013

It is important to note that there is no one, right approach to be adopted. Each bank should carefully assess its strategy on the basis of its investment threshold, risk appetite, technological expertise and overall climate / cost of regulatory compliance in target markets. The “create / partner / acquire” decision must be arrived at after comprehensive due-diligence. However, not preparing a roadmap to respond to dynamic discounting is clearly not an option. Banks which do not plan ahead will be left behind by dynamic discounting platforms and other banks alike, leading to a self-perpetuating downward spiral, which could eventually render them irrelevant in tomorrow’s digital ecosystem.

Author profiles

Prashanth Krishnamoorthy is an Industry Principal and heads the Banking Domain Consulting Practice in Infosys. With over 20 years of experience across banking and financial services, he has worked in consulting, development, re-engineering, and validation solutions with global clients. For more information, contact the author at prashanthk@infosys.com

Subhasish Dasgupta is a Senior Consultant for the banking domain in the Consulting Practice at Infosys. He has over ten years of experience across banking and IT consulting. He focuses on corporate lending, underwriting, regulatory reporting, and core banking transformation programs. For more information, contact the author at subhasish_d@infosys.com

Sponsored by:

References

2. http://www.bizjournals.com/kansascity/news/2015/10/19/c2fo-volume-skyrockets-to-1b-a-week.html

5. https://investor.shareholder.com/jpmorganchase/releasedetail.cfm?releaseid=238582

6. https://www.paystreamadvisors.com/chase-exits-the-world-of-einvoicing/

7. https://ec.europa.eu/growth/sectors/digital-economy/e-invoicing_en

8. https://www.finextra.com/newsarticle/29861/santander-invests-in-b2b-supply-chain-platform-tradeshift

9. http://online.wsj.com/mdc/public/page/2_3022-bondbnchmrk.html (Bond data as on December 13, 2016)