LATE THROUGH THE GATE

By Rebecca Brace

With less than a year to go before the SEPA migration end date of February 1, 2014, companies operating in Europe must get migration projects under way or face disruptions to their payments processes.

|

| Photo Credits: MIKHAIL POGOSOV/ Shutterstock.com |

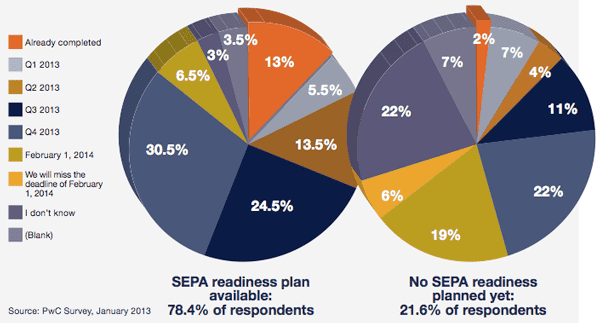

The race to reach Single Euro Payments Area (SEPA) compliance is on, yet many companies have barely begun planning for it, never mind having fully SEPA-compliant payments in place. Adoption figures show there is much work to be done before industrywide migration is complete. As of December 2012, only 34.9% of credit transfers and 1.9% of direct debits in the SEPA zone were SEPA-compliant. And although many companies are now focusing squarely on SEPA migration, 55% risk missing the deadline, according to research published by PwC in January.

For some treasurers, SEPA migration has had to wait its turn behind the eurozone crisis. Marianna Polykrati, group treasurer of Greek food and beverage company Vivartia, is beginning to plan for the company’s SEPA project. “I know we’re starting late, but we’ve had several other priorities within the group,” says Polykrati. “In Greece all the large companies have been focusing on euro contingency planning, and as a company which is almost 100% based in Greece this has been a priority for Vivartia. We’ve made a lot of changes to how we work and our strategic-planning procedures.”

|

|

Van Rood, AkzoNobel: We have more work to do on direct debits and the recorcing of mandates |

Even companies that are already in the process of SEPA migration cannot slack off. Raffi Basmadjian, head of group cash management & treasury IT at France Telecom, says the company’s SEPA migration is under way but there is plenty left to do before the project is complete. “The corporate-to-bank connectivity is in place: We are able to communicate through SWIFTNet and EBICS [Electronic Banking Internet Communication Standard] and will soon be ready to use [SWIFT’s multibank digital identity solution] 3SKey,” says Basmadjian. “We haven’t yet migrated our credit transfers to SCT [SEPA Credit Transfer standards] or XML 20022 [messaging standards] for non-euro countries, but we know how the migration will be organized, and the only thing left to do is set the schedule.” Also to come is SEPA Direct Debit (SDD). Basmadjian says that SDD billing is due to be in place by the third quarter of 2013 but notes that additional time will be needed to undertake testing with the banks.

Meanwhile, Dutch paint and coatings company AkzoNobel began migrating in 2010 with the introduction of a SEPA-compliant payment factory. According to Peter van Rood, the company’s corporate director of treasury, the payment factory is 95% complete across Europe, and as a result the company is set in terms of the SEPA Credit Transfer. “Where we have more work to do is on the direct-debit side and the recording of mandates,” says van Rood. “We don’t have a harmonized ERP landscape yet, so we are having to make changes to the local ERP systems, which can be quite onerous at times.”

|

|

Basmadjian, France Telecom: SEPA migration is under way, but there is plenty left to do before the project is complete |

MIGRATION HEADACHES

Migrating to SEPA brings many different challenges. Supporting the right data formats is one. “Corporates need to check whether their systems are capable of processing the necessary SEPA formats [cash management (CAMT) and payments initiation (PAIN) messages],” says Garry Young, director of corporate services at systems provider CGI. “They’ll also need to factor in the change in format of payment and collection files to SEPA XML ISO 20022,” Young adds, “and be aware of the requirement to use BIC [bank identifier code] and IBAN [international bank account numbers] for specifying accounts and banks.”

When it comes to SEPA-compliant XML formats, there may be opportunities for companies to use conversion services provided by banks or third parties. “Some countries and banks appear to be coming up with ‘cushioning’ services, and if you use a SWIFT bureau you can interact with the bureau in any format you like: The bureau should do the transformation and send out XML data from your BIC,” says Bob Lyddon, general secretary of international banking alliance IBOS.

While some payments industry players are prepping fallback solutions to prevent major hiccups in euro payments processing after the deadline and ensure they are not inundated with non-compliant payment and direct debit instructions that require manual repair or rejection, this could be problematic, says Bas Rebel, director at PwC Treasury Advisory. “The February 1, 2014, deadline has to be sacrosanct as it is included in governing documents and [has been] broadcasted for a long time. If regulators [do] allow such conversion services, it should be for a limited time only. Without a time limit, we will never get an integrated payments clearing market for euros.”

In addition, says Lyddon, there is some risk that conversion services won’t be accepted. “There are opinions in the German and Austrian communities that customers must adopt XML in their environments and no other formats can be sent.”

For many companies, the main challenges in migration relate to the two SEPA Direct Debit schemes: Core—which anyone can use—and Business-to-Business, which is only for B2B direct debits. Young points out that for Core DD mandates, “in most countries legacy mandates are granted ‘grandfather rights.’ That makes life easier because it means they can be migrated across. Companies will still need to add the mandatory data required for SEPA—for example, a Unique Mandate Reference and Creditor ID.”

“Some countries and banks appear to be coming up with ‘cushioning’ services, and if you use a SWIFT bureau you can interact with the bureau in any format you like.”

– Bob Lyddon, IBOS

Incorrect mandate data is a big issue for companies using the SDD. Andrew Owens, senior vice president, enterprise payments, at SunGard AvantGard, says that corporates can do a lot to cleanse their master data, and that a lot of companies already have BICs and IBANs for their beneficiaries. “But if corporates start sending their banks payments with invalid bank account information, then I would expect these to be handled as failed payments and charged to the corporate as such,” he says. “What we expect to see is quite a high level of failures during the early adoption of SEPA Direct Debits because of invalid mandate information, mainly related to bank details.”

“In Greece all the large companies have been focusing on euro contingency planning. We’ve made a lot of changes to how we work and our strategic-planning procedures.”

– Marianna Polykrati, Vivartia

SEPA DIRECT DEBIT IN PRACTICE

Thomas Wolpert, senior credit manager at Union Tank Eckstein and the company’s SEPA project manager, says the firm began its SEPA migration project in early 2010. As direct debits are the main means of settling payments for the company, the focus has been on the SDD scheme from the outset.

UTA opted to use the SEPA Business-to-Business Direct Debit scheme because of the credit risk associated with the Core scheme’s eight-week refund period. The first test transaction took place in December 2010, and the company began converting its customers to SDD in October 2012.

To migrate customers, UTA sends them a SEPA package consisting of a letter, three pre-completed SEPA mandates and a confirmation of acceptance, as well as an information sheet outlining the necessary steps in the process. “The aim of the SEPA package was to make the transition as easy as possible for UTA customers,” says Wolpert. “Direct debits are already being collected with the uniform SEPA system in 12 countries. Unfortunately, problems are still arising with many regional banks. “Although the technical modifications have been made everywhere, not all of the processing agents as yet have the necessary detailed knowledge.”

Bank-related errors include mixing up the Core and B2B SDD schemes, mistakes in entering the mandate information into the banking system and delays leading to preventable direct-debit returns. “For processing SEPA direct debit returns, UTA has now developed a special clarification process with various degrees of escalation,” says Wolpert. “Furthermore, all SEPA processes are documented in a so-called ‘SEPA Process House.’”

Although Wolpert is confident that UTA is prepared for the February 2014 deadline, most companies are at a somewhat earlier stage in the process—and some have not yet started migrating. Given the obstacles companies face in becoming SEPA-compliant, it seems clear that many will not meet the deadline.

Readiness By The Numbers

SEPA readiness split by companies that have planned and have not yet planned their activities.

QUESTIONS TO ASK SEPA PAYMENTS PARTNERS

• How will payment and collections continuity be maintained during the migration?

• How will bank account errors be handled?

• What data format requirements must we be aware of?

• Is migration to XML ISO 20022 standards necessary?

• What are payment partners offering for non-XML format conversion?

• Is it necessary to migrate all at once, or is it possible to roll out gradually?

• What impact would a gradual rollout have on specific payment types, such as supplier payments and payroll?

• How will supplier mandates be managed under SDD?

SEPA Readiness Checklist

Which systems generate euro payments within our organization and our outsourcing partners? (ERP, payroll, expense systems, CRM, other)

• What systems interface with banking back-offices for payment instructions?

• Can these interfaces be upgraded to the SEPA standard?

• Do we need to upgrade systems to get access to SEPA-compliant versions of these systems?

• Do we currently make use of (local) payment products that will be phased out shortly after February 1, 2014?

Which systems manage vendor and customer master data? (ERP, payroll, expense systems, CRM, other)

• Can all these source systems store the required SEPA-related master data (IBAN / BIC) for domestic third parties?

• How do we update third-party master data in source systems?

In what territories within the SEPA area does our organization initiate direct-debit transactions?

• Can we manage SDD mandates according to the SEPA standard?

• Have we implemented the client information requirements correctly?

• How will we split first-time and recurring SDD transactions properly? Can we reflect this split properly in our cash flow forecast and liquidity management reports?

• Can we comply with the national migration plan for each territory in which we continue to use direct debits?

Do the general terms and conditions of our business incorporate all SEPA-related requirements?

How do we ensure that all of our clients are able to pay us uninterrupted after February 1, 2014?

How do we ensure that our key suppliers will be able to deliver to usuninterrupted?

Will our financial systems be able to auto-match the items reported on bank statements after February 1, 2014?

Source: PwC SEPA Readiness Thermometer