CORPORATE FINANCING NEWS — CORPORATE DEBT

By Gordon Platt

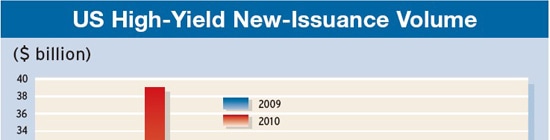

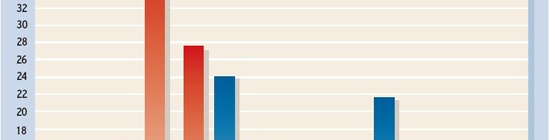

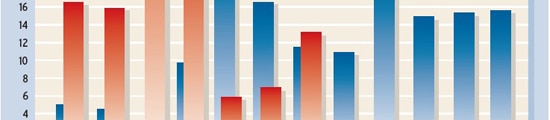

The volume of global corporate high-yield debt issues in the first half of 2010 set an all-time record for any six-month period, according to Thomson Reuters. The total of $130.7 billion was more than double the level of the same period a year earlier.

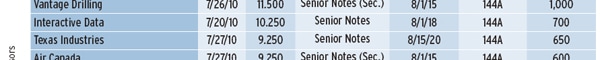

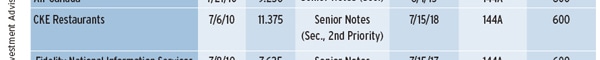

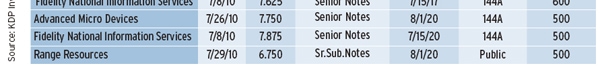

Although new issuance of high-yield bonds slumped in May and June, amid market disruptions caused by the sovereign debt crisis in Europe, the back-to-back monthly record increases in March and April were sufficient to secure the first-half record. With the European debt problems settling down, new issuance of high-yield bonds rebounded to more than $13 billion in July from less than $7 billion in June, according to Montpelier, Vermont–based KDP Investment Advisors.

J.P. Morgan was the top underwriter of global high-yield debt in the first half, followed by Bank of America Merrill Lynch, Credit Suisse, Citi and Goldman Sachs. With 43 transactions, the industrials sector was the most active for high-yield debt issuance in the first six months of this year.

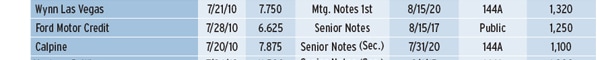

Casino operator Wynn Las Vegas sold $1.32 billion of 10-year first-mortgage notes in the private-placement market on July 21. The high-yield issue was the largest for the month and was sold at a yield of 7.75%. The joint lead managers were Deutsche Bank, Bank of America Merrill Lynch, J.P. Morgan, Morgan Stanley, RBS and UBS. Wynn Las Vegas said it would use the proceeds to repurchase outstanding debt.

In the public market, Ford Motor Credit sold $1.25 billion of seven-year senior notes with a coupon of 6.625% on July 28. The financing arm of Ford Motor last tapped the corporate bond market in April, when it sold $1.75 billion of five-year notes with a 7% coupon.

Average spreads on high-yield issues tightened by 202 basis points in the first half, compared with the same period a year earlier, and were 646 basis points above comparable US treasury bonds.

Overall global debt capital markets activity, including investment-grade debt, asset-backed securities and sovereign debt, totaled $2.6 trillion during the first half of 2010, a decline of 23% from the same period a year earlier, according to Thomson Reuters. Underwriting fees decreased by 8%, Freeman Consulting estimated.

Barclays Capital was the leading overall debt underwriter in the first half, thanks to a strong showing in investment-grade debt and international bonds.

US investment-grade corporate bond volume declined by 19.2%, compared with the first half of 2009. Corporate debt issuance of international bonds declined by 28% in the first half. May was the quietest month for the euro corporate sector since August 2005, as European bank borrowing hit a record low because of poor liquidity and funding conditions.

“The total debt coming due for rated US borrowers will climb steadily through the next four years, peaking at $550 billion in 2014,” says Standard & Poor’s Ratings Services. As this wave of refinancing surges, S&P; expects the proportion of debt in the speculative-grade category to continue to grow. The amount of speculative-grade debt coming due in 2011 will account for about 41% of the total. That percentage will grow to 46% in 2012, 58% in 2013 and 72% in 2014, S&P; says.