CORPORATE FINANCING NEWS — FOREIGN EXCHANGE

GREEK DEBT CRISIS MORPHING INTO EURO PROBLEM

By Gordon Platt

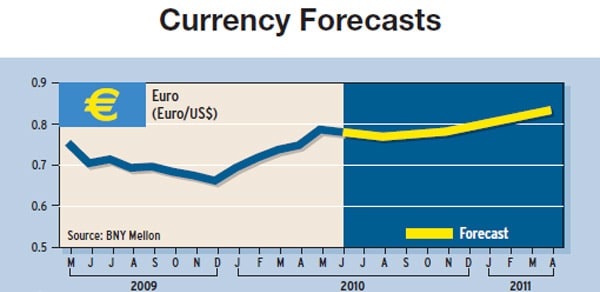

The nearly $1 trillion plan to defuse Europe’s debt crisis headed off speculation in credit default swaps, bank equities and bond spreads, but there remains one avenue of attack—the euro. The single currency rallied briefly in response to news of the European Stabilization Mechanism, but negative sentiment returned quickly amid a slew of doubts about the plan’s implementation and side effects.

“The euro is now the only way to express a bearish view on the eurozone,” says David Gilmore, partner and economist at Foreign Exchange Analytics, based in Essex, Connecticut. “All roads now lead to the euro autobahn, with only central banks trying to impose a speed limit,” he says.

The European Union and the International Monetary Fund are temporarily underwriting credit default swaps (CDS), bank stocks and bond spreads, according to Gilmore. While the program does open a door of liquidity for the distressed sovereigns, mainly the Mediterranean countries of southern Europe (dubbed “Club Med” by credit analysts), it does nothing to resolve the question of solvency, especially in the case of Greece, he says.

Economic growth can be a decisive factor in determining solvency, Gilmore adds. Without growth, countries with relatively better balances, like Spain, can get pushed toward insolvency relatively rapidly, he says.

“The near bottomless pit of potential aid for the Club Med (and any comer) is not going into a rigged outcome like US banks enjoyed in the last 18 months,” Gilmore says. “Instead, it should remind boat owners of a never-ending black hole of expenses and an ever-depreciating asset.”

Austerity measures make restarting the local economies of Greece and Portugal more difficult, Gilmore says. “In the case of Greece, it may well be past the tipping point of the debt death spiral,” he says. “More austerity measures demanded for funding [the debt] drive the economy deeper into recession and indebtedness.”

Watching the euro trade in initial response to news of the European Central Bank’s role in the bailout was interesting, Gilmore says. First, the euro sold off on news of the ECB’s planned purchase of government bonds, only to reverse when the ECB finally issued its own statement indicating that it would sterilize the bond purchases and thereby not engage in quantitative easing.

“The ECB has gone off the reservation of price stability and independence,” Gilmore says. “And with the CDS and European bank stocks relieved from trench warfare for the time being, the focus should shift to the euro. A confluence of selling that was previously split between eurozone bank stocks, sovereign CDS and bond spreads may now get channeled into the euro,” he says.

The sovereign debt crisis is a sequel to the financial crisis of 2008, Gilmore says. “The reality is that the banking system in Europe is starting to freeze up, and it is now a monetary problem demanding a monetary response,” he says. “The world financial system is again skating on thin ice.”

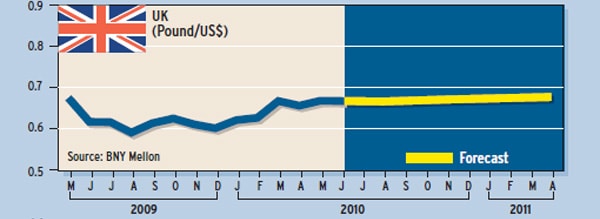

There are several questions with Europe’s bailout program, including the lack of details, the social implications of the latest austerity measures, and no real initiative to address competitiveness problems within the eurozone, according to a report by analysts at Brown Brothers Harriman in New York. Flight-to-quality trades appear to be coming back on, and the markets are expressing doubts that the plan will be successful in preventing eventual debt restructuring for Greece and the other peripheral countries in the eurozone, the report says. “While panic has been reduced, the negative euro sentiment remains in play,” it says.

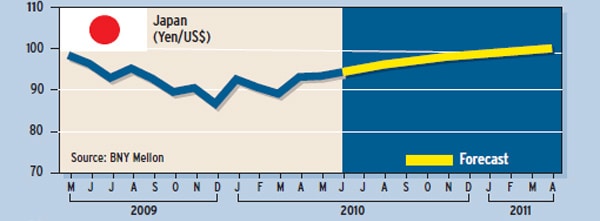

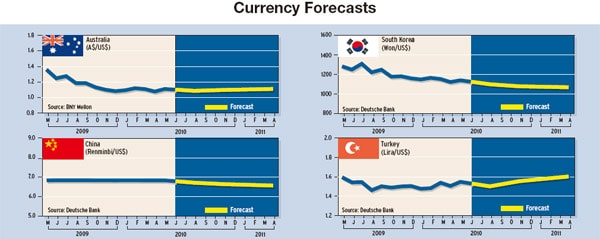

The crisis in Europe is likely to keep most central banks in a wait-and-see mode for the next several months, says Win Thin, senior currency strategist at Brown Brothers Harriman. “Despite the fact that strong growth in China and the US is buoying the Asian exporters, a big chunk of the region’s exports still go to the eurozone,” Thin says. The share of South Korean exports going to the EU is around 12%. The share for India and Pakistan is 21% and 22%, respectively. Japan’s share is 14%.

“So, a deepening slowdown in parts of western Europe could certainly have an impact on Asian growth,” Thin says. With the exception of China and India, which have strong domestic economies, monetary tightening plans are going to be pushed further out in most Asian countries, he says.

In terms of the euro, the resolution of the liquidity issue for peripheral euro area governments is a positive, given that it eases the risk of negative market dynamics exacerbating the fiscal problems for these countries, says Adarsh Sinha, currency strategist at Barclays Capital, based in London. “However, the key problem for the currency remains the solvency issues, which continue to exist and are not directly tackled by these [rescue] packages,” he says.

Spain, Italy and Portugal do not have the same degree of fiscal problems as Greece, but they will be under similar pressure to undertake fiscal tightening, Sinha says. “This will weigh on growth in these countries for a substantial period, and associated loose monetary policy is likely to remain negative for the euro,” he says. Significant weakness in the euro remains likely as part of the adjustment process, he adds.

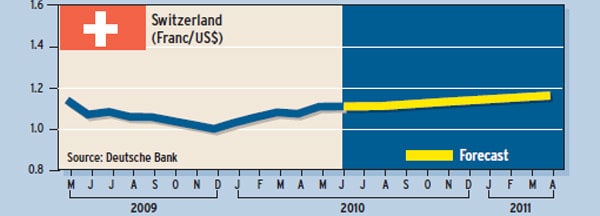

With German chancellor Angela Merkel seeing the bailout plan as grounds for abandoning intended tax cuts, and Deutsche Bundesbank president Axel Weber worrying about non-existent inflationary risks, German policymakers are committing continental Europe to deep recession, if not depression, says Charles Dumas, economist at Lombard Street Research in London. “But the basic force sapping risk-asset prices is China, where inflation is accelerating, with incipient monetary tightening soon to intensify,” Dumas says.

With China’s economy overheating, there will be a progressive monetary tightening, he says. “This means curbing the chief source of monetary growth over the past 15 months,” Dumas says. “China is the fundamental source of the liquidity squeeze that is breaking the weakest links in the chain (Greece) but sapping risk assets, especially hard commodities, everywhere,” he says.

Fears of monetary tightening by China would only exacerbate current market jitters, in turn favoring the “risk off” trade and supporting both the dollar and the yen, according to Brown Brothers Harriman.