Foreign Exchange

BY GORDON PLATT

Signs that the US economy is bottoming out and hopes that the Federal Reserve will deftly handle the transition to a less accommodative monetary policy are boosting the dollar, analysts say. They say market participants are confident that the Fed can time the shift in policy soon enough to head off inflation but late enough to keep the recovery going.

The better-than-expected non-farm payroll numbers for May, which showed the smallest decline since

September 2008, prompted the federal funds futures market to begin pricing in the possibility of a Fed tightening before the end of 2009.

“This one report has allowed the futures markets to begin pricing in a 30% chance of a movement toward tighter Fed policies as soon as the mid-August meeting and has given it an even greater probability of the Fed moving to tighten rates at its late September meeting,” says Dennis Gartman, Suffolk, Virginia-based publisher of The Gartman Letter advisory service. “This is not going to happen,” he says. “The likelihood of the Fed moving to tighten rates until it is very, very clear that the economy is out of recession and that unemployment is at least no longer rising is small, if not infinitesimally so.”

However, Atlanta Fed president Dennis Lockhart and Kansas City Fed president Thomas Hoenig warned against waiting too long to raise rates. “I suspect we are experiencing the first signs of the markets’ concerns [about inflation] in the rising rates and increased volatility in longer-term treasury markets,” Hoenig said in early June. “We need to be alert to the markets’ message and begin in earnest to bring monetary policy into better balance before inflation forces our hand.”

The market is probably getting ahead of itself in terms of anticipated tightening and reducing the fiscal stimulus, says Marc Chandler, global head of currency strategy at New York-based Brown Brothers Harriman. “The only thing that has happened with regards to US economic data is that the pace of decline has slowed,” he says. “We question whether the recovery could withstand premature hiking [of interest rates] this year.”

Nonetheless, the United States is thought to be the strongest of the major industrialized countries, Chandler says. “Our big-picture view has been that the aggressiveness of the US policy response, coupled with the unprecedented pace that businesses have slashed inventories and fired workers, boosts the chances that the US recovers first,” he says.

The surge in the US unemployment rate to a 26-year high of 9.4% in May suggests that some caution is warranted, says Michael Woolfolk, senior currency strategist at The Bank of New York Mellon. “Unemployment is headed above 10% this year, whether the White House acknowledges it or not,” he says. “We expect the unemployment rate to break above 10% later this year, prompting work on a second stimulus plan this fall targeted on job creation.”

While severe recessionary conditions appear to have subsided, and US consumer confidence has showed a decided improvement, the economic recovery is not here yet, according to Woolfolk. “Market sentiment continues to trump economic fundamentals in foreign exchange markets, with expectations swinging from irrational pessimism six months ago to irrational exuberance today,” he says.

Ashraf Laidi, chief market strategist at London-based CMC Markets, says the day of reckoning will come for the dollar when the next economic recovery emerges. When real demand for commodities combines with improved risk appetite for investments in emerging markets, the dollar will suffer from the rush of investments toward commodity currencies and away from the fiscal deficiencies of the US economy and the excess reflationary build-up accumulated by the Fed, he says.

Exactly one year after former US treasury secretary Hank Paulson urged Arab Gulf nations to maintain their dollar-based currency regimes, treasury secretary Tim Geithner has persuaded Asian monetary officials to talk up the dollar’s role as a reserve currency, Laidi says. “It is clear that such Asian support is out of necessity, considering the $3.2 trillion in US treasuries held by Asian nations,” he says. “They have little alternative to say anything else.”

China does not expect the dollar to lose its role as the world’s reserve currency any time soon, according to China Construction Bank chairman Guo Shuqing. “The chairman’s comments carry weight as both a party leader and as the former head administrator of China’s foreign exchange reserves,” says Marc Chandler of Brown Brothers Harriman.

There has been little evidence that China or other reserve managers are diversifying out of US treasuries, Chandler says. Foreign central bank holdings of treasuries at the Federal Reserve have been increasing, he adds.

The country that appears to have stepped up its purchases of treasuries the most is Japan, an unlikely source, Chandler says. In the first quarter of 2009, Japan boosted its treasury holdings by almost $60 billion, more than all of its purchases for 2008. This came at a time when Japan’s reserves actually slipped, Chandler says.

The dollar is seriously overvalued against the Chinese renminbi and other Asian currencies, according to a study by the Washington, DC-based Peterson Institute for International Economics. The renminbi needs to rise by about 20% on a trade-weighted average basis and by about 40% against the dollar, according to William Cline and John Williamson, economists and senior fellows at the institute.

The financial crisis created a significant safe-haven effect for the dollar and led to sharp declines in oil prices, the study said. As a result of this, the dollar has returned to significant overvaluation, according to the study. To help rebalance the global economy, China should change its peg from the dollar to a basket of currencies, or resume the upward crawl of the peg against the dollar, it said. Over the past few months, the renminbi has remained unchanged against the dollar.

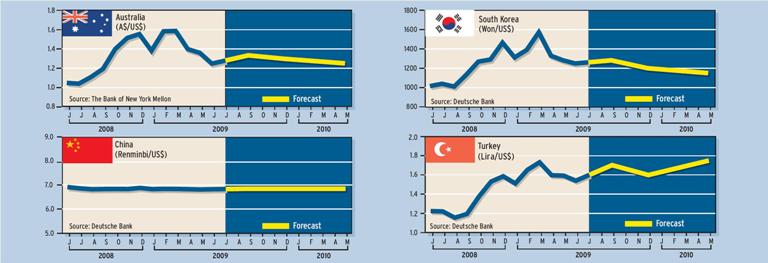

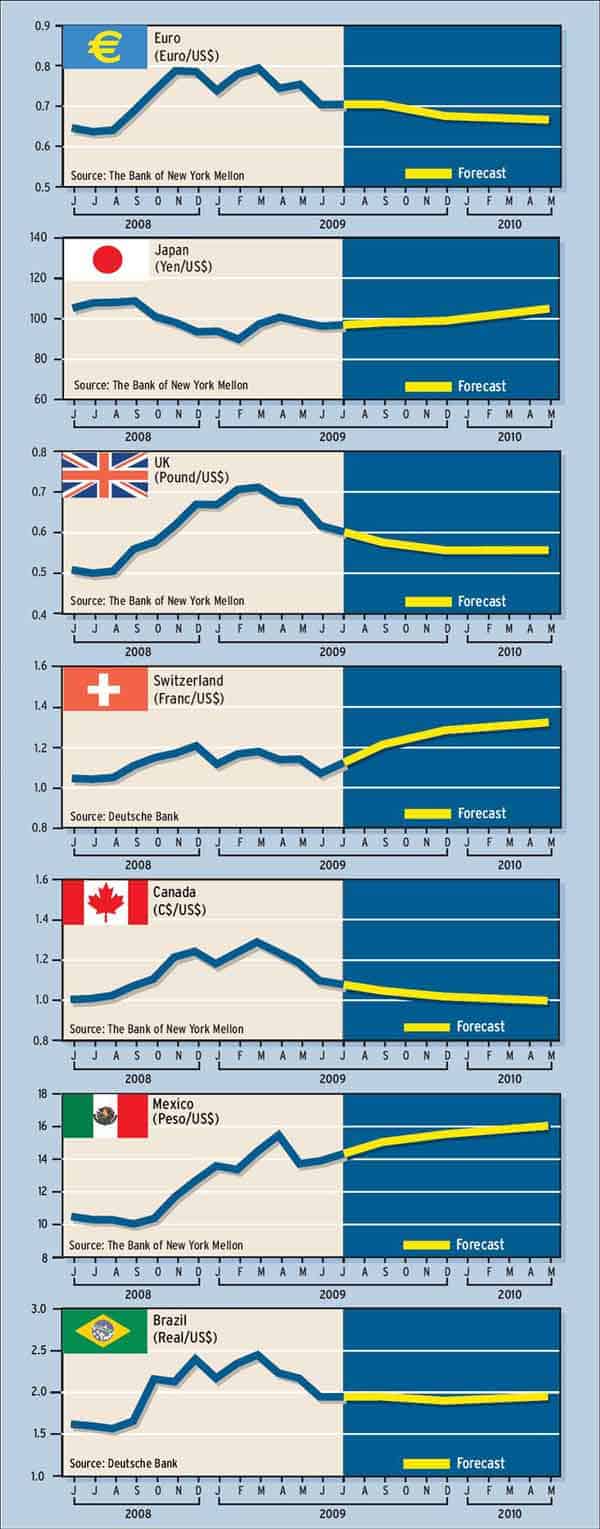

Currency Forecasts

Currency Forecasts