Good News for the Global EconomyTranslates Into Bad News For Dollar

Improvement in the global economic outlook spells trouble for the dollar, which is losing its allure as a safe haven amid growing concern about ballooning US government debt.

BY GORDON PLATT

The recent improvement in the global economic outlook is spelling trouble for the dollar. As the flow of funds to emerging markets picks up and global risk-taking resumes, the dollar is losing its allure as a safe haven. What stands out instead is the huge amount of debt the US government is accumulating and the long-term effects of printing more money, analysts say.

The rally in risk-correlated foreign exchange assets could continue for a while longer, according to analysts at London-based Barclays Capital. Many investors are still overly pessimistic, and an element of risk-aversion lurks in the background, suggesting further room for improvement in risk appetite and equity markets, the bank’s analysts say. “Fundamentally, the bulk of the global stimulus will have an effect now and in the quarters ahead,” they say. The bank notes that recent forward-looking data, such as manufacturing- and service-sector surveys in the United States, have included some positive news.

Michael Woolfolk, senior currency strategist at The Bank of New York Mellon, says that so-called “green shoots” are overshadowing such near-term concerns as the swine-flu scare and the US bank stress tests. Much depends on market sentiment and the continued rally in global equities, he says. “If and when equities reverse course, risk aversion is likely to prompt renewed buying of the dollar,” he asserts.

Market volatility will continue to be elevated for the remainder of the year, so now is not the time to let one’s guard down, Woolfolk says. The dollar reacted negatively to the April employment report, which showed US job losses slowing. However, any disappointing economic reports could provide an excuse to take profits in the stock market, benefiting the dollar, he adds.

Economic Panic Subsides

The dollar is no longer a flight-to-safety beneficiary, says Paul Lennox, corporate treasurer at Custom House, a provider of global payment services that is based in Victoria, British Columbia, Canada. “The economic panic seems to be unwinding, and it will continue to do so at the expense of the dollar,” he says.

“Now that the panic is largely over and the bottom for the economic recession appears to be in sight, traders and investors have a higher risk-to-reward propensity, and this means unwinding ‘safe’ dollar holdings and venturing forth into higher-risk equity, commodity and currency plays,” Lennox says.

The longer-term dollar uptrend, which began in July 2008, appears to have been breached, judging by the level of dollar index futures, Lennox says. “The technical setup certainly seems to be dollar-negative, as the charts reflect subtly changing market sentiment toward the dollar,” he says.

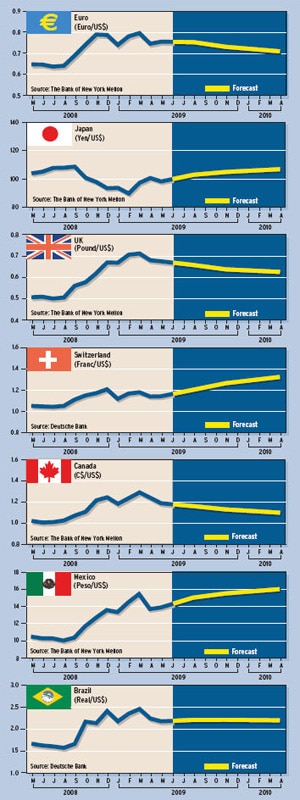

The dollar’s outlook for the rest of the year will depend on the ability of the Federal Reserve to contain deflation risks, according to analysts at Barclays Capital. “If the Fed is seen as successful, the dollar will be vulnerable,” they say. Barclays Capital forecasts the euro will rise to $1.45 by the end of this year.

Appetite for US Debt

So far, the dollar has been surprisingly resilient in the face of the rapidly deteriorating US fiscal position and the implementation of quantitative easing, says David Woo, London-based head of global foreign exchange strategy at Barclays Capital. “To understand why the dollar is strong, we need to understand why foreign appetite for US government bonds does not seem to have been negatively affected by the combination of extremely expansionary US fiscal and monetary policies,” he says. “One plausible explanation is that with US headline inflation falling faster than in most other countries, perceived US real [inflation-adjusted] interest rates have gone up, at least in relative terms,” he suggests.

If investors use current inflation as a proxy for future inflation, US real long-term interest rates are the highest among the major developed economies, Woo says. The US economy is operating significantly below potential output, with capacity utilization at a decade low, which means that downward pressure on inflation is unlikely to abate in the near future, he says.

Investors are mistakenly worried that the Fed is hell-bent on creating inflation, says Marc Chandler, global head of currency strategy at New York-based Brown Brothers Harriman. “Although many of the Fed’s critics seem to think it can do no right, they assume the Fed will be successful in reigniting inflation,” he says.

Fundamental Confusion

The Federal Open Market Committee’s decision in March to purchase $300 billion of

treasury securities fanned new inflation worries, Chandler says. However, unemployment in the US is rising, and employment costs are weak, he adds. “These key macro-economic variables are most certainly not inflationary or conducive to inflation,” he says.

The reality is that the Fed’s balance sheet has stopped increasing, as the decline in the use of various Fed facilities is more than offsetting the pace of the Fed’s purchases of assets, according to Chandler. “The cynics and critics do not appreciate that some of the Fed’s programs are already producing such successful results that they are not needed as much as was previously the case,” he says.

The results of the US bank stress tests did not reveal any major surprises and added to the perception that financial and economic conditions are improving, according to Chandler. “Of course, there is a risk that when the economy recovers, the Fed may be too slow to unwind its accommodation, causing an inflation problem down the road,” he says. “Yet, given the self-liquidation feature of several of the Fed’s facilities, a sharp increase in inflation is neither inevitable nor necessarily the most likely scenario.”

Some volatility in exchange rates is likely as market participants try to figure out the dollar’s fundamental trend in light of the improving economic outlook, Chandler says. “We believe that after the current period of vulnerability for the buck, it will all come back to relative growth rates, which gives the US a distinct advantage over the eurozone, the UK and Japan,” he says.

Beginning of the End

The dollar is starting to retreat as expectations are rising that the global recession is nearing an end, according to foreign exchange analysts at London-based Standard Chartered. The dollar’s weakness will accelerate in the second half of 2009, as risk capital is put to work, the analysts predict.

Due to their higher growth potential, emerging market currencies will lead the way as the dollar falters, according to Standard Chartered. “The improvement in global risk conditions has driven a significant improvement in interbank funding conditions, which should be dollar-bearish,” the bank’s analysts say.

The latest purchasing managers’ index readings are off their lows in the US and Europe and are in expansionary territory in China and India, the bank’s analysts point out. The global industrial cycle appears to be stabilizing, and this should trigger eventual growth in Asian exports and a rally in Asian currencies, they add. The rally may be relatively shallow, however, given the length of the global recession and ongoing deleveraging worldwide.

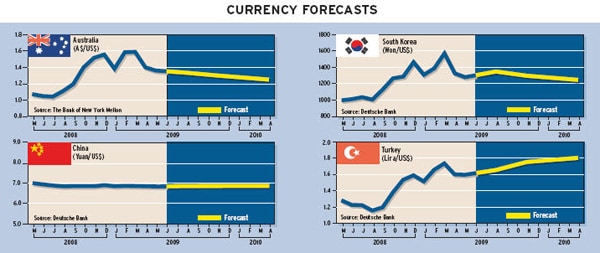

“The worst of the panic from the global credit crisis is behind us, and the [South] Korean won will lead the way higher, just as it led the way down,” according to Standard Chartered. “Going forward, we expect Indonesia’s trade balance to improve as commodity prices find a floor.” Latin American currencies also should benefit from higher commodity prices, the UK-based bank says.

Covered Bond Buyer

Meanwhile, the European Central Bank lowered its refinancing rate to a record low of 1% from 1.25% last month and announced a plan to buy about $80 billion of covered bonds. “The ECB seems to surprise the market once a year,” says Chandler of Brown Brothers Harriman. “Last July the ECB surprised the market when it hiked interest rates at the peak in commodities, especially oil, just as the region’s economy and other major industrialized economies were about to fall off a cliff,” he says. “It appears to have gotten this year’s surprise out of the way with its May 7 decision to purchase covered bonds.”

The typical covered bond is issued by a financial institution and is collateralized by a pool of mortgages. In this regard, it is similar to a mortgage-backed security, Chandler says. However, in the case of a covered bond, the mortgages in the collateral pool remain on the financial institution’s balance sheet and the institution must hold some capital reserves against them.

Part of the challenge in the US is that securitized mortgages are not backed by the capital of the loan’s originator, Chandler points out. “The fact that the ECB has targeted the covered bond market shows a commitment to easing conditions in a segment of the market that has been severely hit by the financial market turmoil of the past year,” he says.

The ECB also announced that it would extend the maturity of its existing lending from six months to one year, a move that was widely expected. ECB president Jean-Claude Trichet did not rule out lowering rates further. “We have not decided that the new level of our policy rates was the lowest level,” he told a press conference called to announce the central bank’s decisions.

The Bank of England announced last month that it would keep UK interest rates unchanged at 0.5%. The central bank also said it would pump an additional $75 billion into the economy by buying government and corporate debt, extending the size of its quantitative easing to a total of about $188 billion.

The British pound rose to a four-month high against the dollar following the central bank’s announcements. The Bank of England has the option to increase its debt purchases further if necessary. There have been some signs, however, that the UK economy is beginning to emerge from its slump, or at least that the decline is slower than it has been in recent quarters. The purchasing managers’ index for the services sector rose to 48.7 in April from 45.5 in March, reaching its highest level in eight months.