CORPORATE DEBT

|

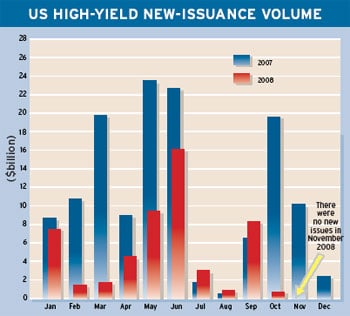

A combination of heavy supply and rising defaults makes it difficult to forecast a bottom for the credit markets in 2009, analysts say. The new-issue market in US high-yield bonds remained frozen solid late last year, with no new issues at all in November, according to KDP Investment Advisors.

Credit spreads are expected to widen to new records as the market enters the center of the default storm, says Bob Janjuah, London-based chief credit strategist at The Royal Bank of Scotland. The forward-looking nature of risk assets should see them bottom out sometime in the second half of 2009, he says.

There is no need for investors to try to pick the bottom right now, Janjuah says, because credit assets will remain cheap for some time after they have troughed. “Senior financial [services company] debt is well supported by government guarantees and remains a good place to park cash,” he says. Major corporations that are truly too big to fail can be added to that category, he notes.

“The conundrum for the credit market is that, unlike most other markets, it is priced for a pretty awful outcome,” says Kit Juckes, head of debt markets research at RBS. Current spread levels over US treasuries are significantly wider than they were at the depths of the Great Depression in 1932, he says.

Can spreads really peak, and, even more importantly, can they really start to narrow when we are not yet at the trough of the economic cycle and a long way from the peak in the default cycle?” Juckes asks.

Credit derivatives, which have been a focal point of the market, are continuing to function, especially in the more commoditized instruments, says Michael Gooch, CEO of New York-based GFI Group, an inter-dealer broker specializing in over-the-counter derivatives and related products. The credit default swaps (CDS) market in particular remains liquid and is operating smoothly, he says.

More than $500 billion in Lehman Brothers’ exposure was successfully closed out by the Depository Trust & Clearing Corporation (DTCC) last September in the largest such operation in DTCC’s history, Gooch says. DTCC netted all amounts due on $72 billion of Lehman Brothers’ credit default swaps, which resulted in approximately $5.2 billion owed to net buyers of protection on Lehman debt, he adds. There was no impact on the clearing corporation’s retained earnings or participants’ clearing fund deposits.

“A liquid, transparent and cleared CDS market will play a crucial role in the unfreezing of the credit markets and the recovery of the global economy,” Gooch says.

Credit default swaps have recently become a hedge fund-driven product, says James Higgins, head of North American credit brokerage at GFI. “This is a hugely liquid market with low margin requirements and the ability to close out and assign trades, with dealers absorbing all counterparty risk,” he says.

The existence of a central counterparty is the key, Higgins adds. The standardized CDS contract of the future will look more like a bond and will have greater transparency, he predicts. “Future regulation is a wild card,” he says.

CDS did not cause the credit crisis, Higgins says, although they did contribute to the volatility surrounding the crisis.

The five most active CDS for November in the United States were CIT Group, Countrywide Home Loans, Merrill Lynch, Morgan Stanley and Hartford Financial, according to the number of trades executed by GFI. The top five for Europe were Gazprom, Telecom Italia, Marks & Spencer, Vneshtorgbank and Telefonica. In Asia the most active CDS in November were Toyota Motor, Nomura Securities, Mitsui Sumitomo Insurance, Kazkommertsbank and Kobe Steel.

Meanwhile, Market-Access, which operates a platform for electronic trading of corporate bonds and other fixed-income securities, and Markit, a financial information services provider, announced an alliance to integrate Markit Quotes into MarketAccess.

“With industry-wide focus on improving the CDS market structure, electronic trading has never been more relevant,” says Kelley Millet, president of MarketAccess. “Our highly complementary integration with Markit will address the demand from institutional investors for greater transparency and electronic trading technology that will best support changes in the credit markets,” he says.

Gordon Platt