Corporate Debt

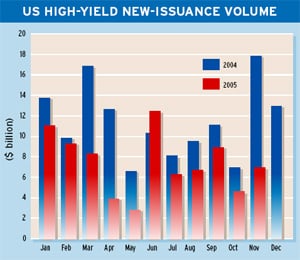

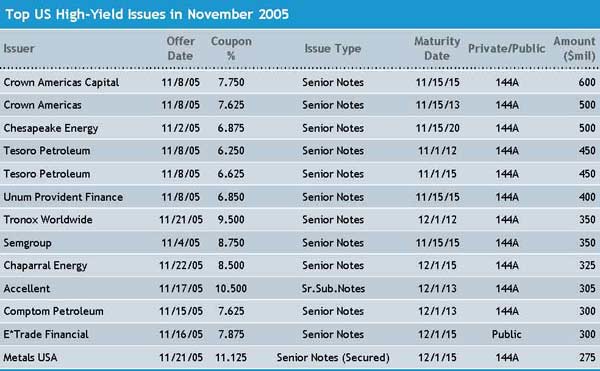

A series of debt-refinancing issues in the energy sector, as well as borrowing to pay for a major acquisition in the natural-gas industry, have helped to fire up activity in the US high-yield bond market. The volume of new issues rose 52%, to about $7 billion, in November from a month earlier, according to Montpelier, Vermont-based KDP Investment Advisors.

Global debt capital market volume, including sovereign issues, totaled $429 billion in November, down 15% from a year earlier, according to London-based Dealogic. The Americas was the leading world region in November, accounting for 47% of global volume, down 7 percentage points from a year earlier.

Among investment-bank advisers, Barclays topped global debt-capital market volume rankings in November with an 8.2% market share, Dealogic said, while JPMorgan topped the revenue rankings with a 7.1% share.

Oklahoma City-based Chesapeake Energy, the second-largest independent producer of natural gas in the United States, placed $500 million of senior notes due in 2020 with private investors in the US high-yield market. The notes, which carry an interest rate of 6.875%, were priced to yield 7% to maturity.

Chesapeake Energy also placed $600 million of senior unsecured contingent convertible notes due in 2035, as well as $500 million of cumulative preferred stock, to help pay for its acquisition of Charleston, West Virginia-based Columbia Natural Resources for $2.2 billion in cash and the assumption of $750 million in liabilities.

The acquisition would make Chesapeake the third-largest holder of natural-gas reserves in the United States, following ExxonMobil and ConocoPhillips. Chesapeake purchased Columbia from Triana Energy Holdings.

Chesapeake plans to rapidly expand natural gas production in the Appalachian Basin, including West Virginia, Kentucky, Ohio, Pennsylvania and southwestern New York. Columbia operates 8,200 gas wells in the region, including 3,500 in West Virginia.

Aubrey K. McClendon, Chesapeakes CEO, says less than 1% of the 400,000 wells drilled to date in the Appalachian Basin have penetrated below 7,500 feet, leaving substantial deeper-exploration opportunities available for Chesapeake to pursue.

Chesapeake plans to spend $200 million a year for the foreseeable future to further develop the acquired properties. In 2004 the company was the most-active driller of new wells in the US, drilling 561 wells of its own and participating in another 890 new wells drilled by other operators. Its drilling-success rate was 96% in 2004 and 97% in the first three quarters of 2005.

Separately, Philadelphia-based Crown Holdings completed a refinancing consisting of $1.3 billion of new credit facilities and $1.1 billion of senior notes. Crown Bevcan Europe & Middle East, a division of Crown Holdings, plans to build a new beverage-can production facility in Kazakhstan to serve the Central Asian region, where a number of soft-drink and beer companies are increasing their capacity.

Gordon Platt