FOREIGN EXCHANGE

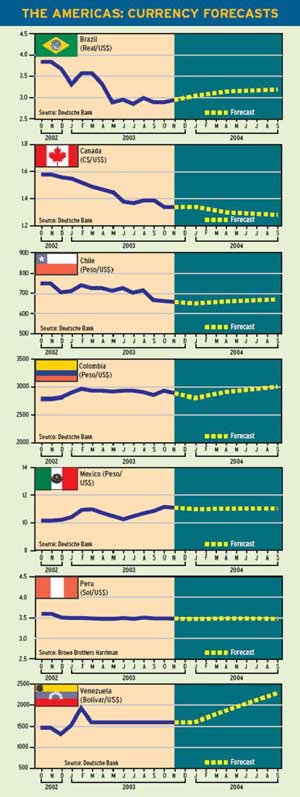

THE AMERICAS

Analysts Fear Dollar Decline Could Spin Out of Control

The Bush administration is seeking an orderly decline in the dollar ahead of the US presidential election in 2004 in the belief that a weaker dollar will mean more exports, more jobs and more votes, analysts say. They warn, however, that the dollars slide could accelerate to the point that it becomes difficult to control.

President Bush himself has called for a level playing field in the currency market, and there is no indication that US policymakers are even remotely concerned about a potential problem in funding the current- account deficit, says David Gilmore, partner and economist at Essex, Connecticut-based Foreign Exchange Analytics.

By assigning a low probability to a currentaccount funding problem for the US, the Bush administration is, in effect, elevating the risk of a dollar crisis, Gilmore says.

To be fair, the administration has achieved an orderly dollar decline in the last year since the policy was put into place, he says.But our problem is, What happens if the dollar decline spins out of control and becomes disorderly? he asks.

In periods of strong directional trades like the present, with the dollar marching steadily lower, the foreign exchange market usually keeps pushing the trend until official opposition is flushed out, Gilmore says.The market has a strong tendency to overshoot once a trend has set in.

A dollar crisis is looming on the horizon, says Michael Rosenberg, global head of foreign exchange research at Deutsche Bank in New York.The US current- account deficit will reach such high levels that it will be difficult to finance, he says.As the US economy recovers and capital spending picks up, the trade deficit could widen further.

According to Rosenberg, the meeting of finance ministers and central bank governors of the Group of Seven major industrial nations in Dubai in late September might prove to be a watershed event for the foreign exchange markets.

The G-7 recognized that the dollar needs to weaken to facilitate a narrowing of the currentaccount imbalances, Rosenberg says.The G-7 communiqu made it clear that the major policymakers would like to see less intervention and more emphasis placed on freely floating exchange rates.

What this implies, he adds, is that not only will private capital inflows to the US remain weak, but official capital flows from foreign central banks should moderate as well, as authorities around the world intervene less aggressively than in the recent past.

Foreign official buying of US Treasury securities has kept a lid on US interest rates until now, but if this buying diminishes, it spells trouble for the US bond market, Rosenberg says.

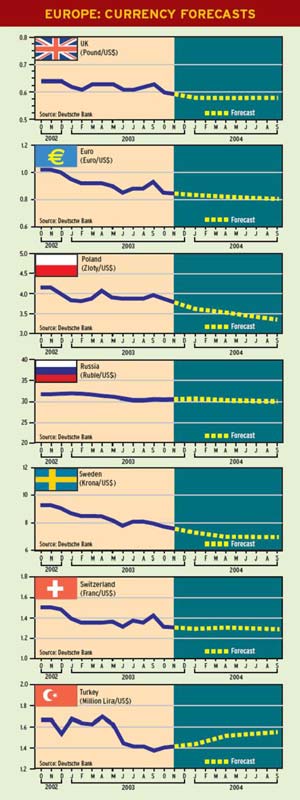

EUROPE

Russia Considers Pricing Oil in Euros

Russian President Vladimir Putin indicated in early October that he did not rule out pricing Russias oil exports in euros instead of US dollars.

This remark by Putin raises a red flag but should come as no surprise, says Jes Black, currency analyst at MG Financial Group in New York. It is a necessary reaction to the US-sanctioned policy of allowing its currency to fall.

Meanwhile, German Chancellor Gerhard Schroeders visit to Russia in October highlighted the possibility of increased trade between Europe and the East, including Russia, China and the Middle East, Black says.

This growing bilateral trade could result in oil being priced in euros and lead to much-needed European capital investment, he says.

Since oil exporters currently recycle their petrodollars into US assets, and since most countries that import oil are required to hold dollar reserves, a shift to petroeuros could make it more difficult for the US to finance its twin deficits, Black says.

The advent of a petroeuro market would be a losing proposition for Americans, but a lucrative one for Europe and oil exporters around the world if the euro were to be viewed as a more-stable reserve currency, he adds.

As the dollar slumps in the wake of the Dubai communiqu, analysts are pondering how high the euro could rise.The currency options market could provide some clues, according to Marc Chandler, chief currency strategist at HSBC Bank (USA) in New York.

Indicative pricing in the options market suggests a low probability that the euro will trade as high as $1.45 in the next 16 months, Chandler says.

In 1995, the last cyclical high for the European currencies, the value of the euro would have translated to about $1.45, had it existed, he says.

Arguably, the extremes reached in 1995 were a function of an overshoot of the deutsche mark and the dollar,Chandler says.The euro is no deutsche mark.

Another message to be gleaned from indicative pricing in the options market, he says, is that the odds of seeing the euro drop back to par with the US dollar in the next 16 months are also slim.

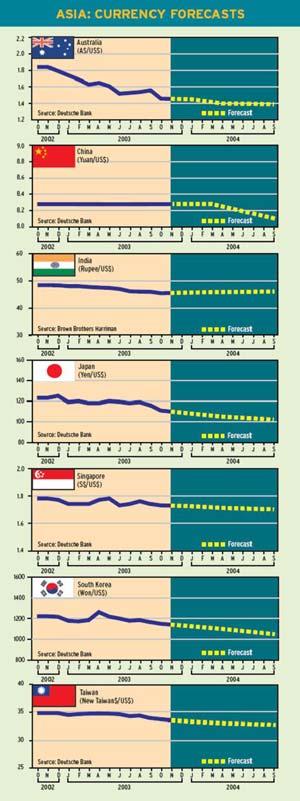

ASIA

Japan Cant Quit Intervention Habit

As the Japanese yen shot to a three-year high against the US dollar in early October, the Bank of Japan resumed its massive intervention to restrain its soaring currency.

The Japanese authorities stayed out of the market around the time of the Dubai Group of Seven meeting, but it didnt take long for them to go back to their former policy of trying to prevent a rise in the yen, communiqu or no communiqu.

The Japanese central bank sold a record $40 billion of yen in September without achieving much in terms of keeping the yen down, says Dennis Gartman, editor and publisher of The Gartman Letter. This doesnt mean, however, that intervention efforts will always fail, he says.

Intervention against ones currency often can be successful for a very, very long period of time, Gartman says.Remember, the Japanese are intervening in hopes of weakening their currency, and the BOJ has the ability to create yen out of the ether in any amounts the authorities deem necessary.

When selling ones domestic currency, the supply for sale is infinite,he says.The central bank can simply print more yen.

The Bank of Japan unexpectedly raised the upper end of its target for banking system liquidity at its meeting in October.The slight easing of monetary policy was designed to support the countrys fragile economic recovery and to keep the stockmarket rally going.

In addition, the central bank extended the maturity limit on securities it repurchases from six months to one year.

The modest easing step was more symbolism than substance, says Anne Mills, director of currency research at Brown Brothers Harriman in New York.

The higher ceiling does not really add much new room for liquidity expansion, she says.And even if it did, the past few years have shown that more BOJ liquidity need not mean more loan growth.

The key message, Mills says,was aimed at a domestic audience, and the gist of it was that the bank isnt going to tighten policy any time soon, even if consumer prices stop declining.

Japans current-account surplus and reviving economy are two fundamental factors that will keep the yen strong for some time to come, analysts say.This likely will keep the Japanese authorities actively intervening in the foreign exchange markets, whether it does any good or not. Old habits are tough to break.