THE AMERICAS Sudden Rally Erases High-Yield Losses

The sun came out in the high-yield corporate bond market in November, narrowing spreads to treasury securities with record speed and eliminating most of the markets steep losses for the first 10 months of 2002.

The half-point interest-rate cut by the Federal Reserve, along with signs of improvement in corpo-rate earnings, bolstered investors risk appetite and reversed the nearly year-long flight to quality that had widened spreads dramatically, analysts say.

The credit sector was certainly overdue for im-provement, given the cheapening that occurred over the prior few months, says Kenneth Hackel, chief US fixed-income strategist at Merrill Lynch in New York.But the magnitude of the leap tighter [in spreads] leaves investors facing a sector with a much less attractive risk/reward trade-off, he adds.

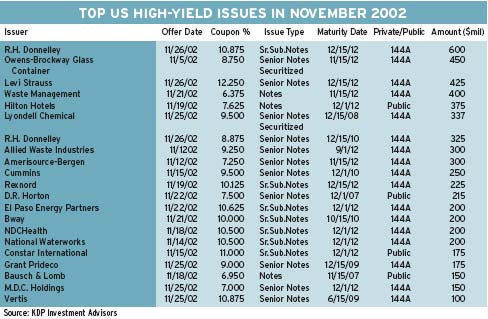

Credit-sensitive high-yield issues posted a strong monthly total return of 7.63%, and primary issuance also was strong, says Dennis Adler, bond market analyst at Citi-groups Salomon Smith Bar-ney in New York. Inflows to high-yield funds were strong in November, total-ing $2.6 billion, and issuers added deals because of favorable market condi-tions,Adler says.Monthly spread narrowings in investment-grade and high-yield corporate sectors were the largest in our 15-year history, he says.

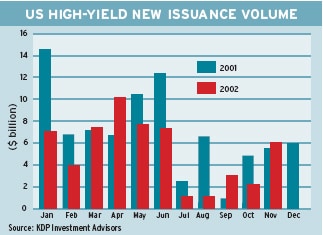

High-yield new-issuance volume surged to $6.1 bil-lion in November from $2.2 billion in October, ac-cording to Vermont-based KDP Investment Advisers.

BondTicker Tracks Spreads on Web

The NASD has taken a significant step forward in promoting price trans-parency in the corporate bond market through the Trace corporate bond pricing feed, says Richard McVey, CEO of Market-Axess.We have taken the NASD raw data feed, tai-lored it for the institu-tional market and com-bined it with other elements of our trading platform.

Gordon Platt