Global Finance’s best TCM suppliers in systems and services are focusing on niches and building more AI into offerings.

Five years ago, Niels van Daatselaar was heading a commercial banking team at Rabobank in the Netherlands, when he got wind of an in-house competition called Moonshot. The contest encouraged bank employees to trade in their suit and tie for “startup style jeans and trainers” and devise innovative ideas for transforming everyday banking and business processes.

Van Daatselaar’s Easytrade solution, which simplifies foreign exchange (forex) hedging for small and mid-cap companies by automatically converting invoices or forecasts into transactions, ended up being one of four moonshot ideas that the bank took up and developed.

“Any forex exposure that companies don’t hedge can cost them serious P&L,” says van Daatselaar. “For example, companies looking to make a new order to China will want to hedge their forex exposure. We’ve automated all of that process, where so many errors are made, replicating what companies do today in Excel. Companies just need to add all their invoices, which are automatically aligned with their hedging policy. We net their payables and receivables. We also calculate their exposure and swap positions.”

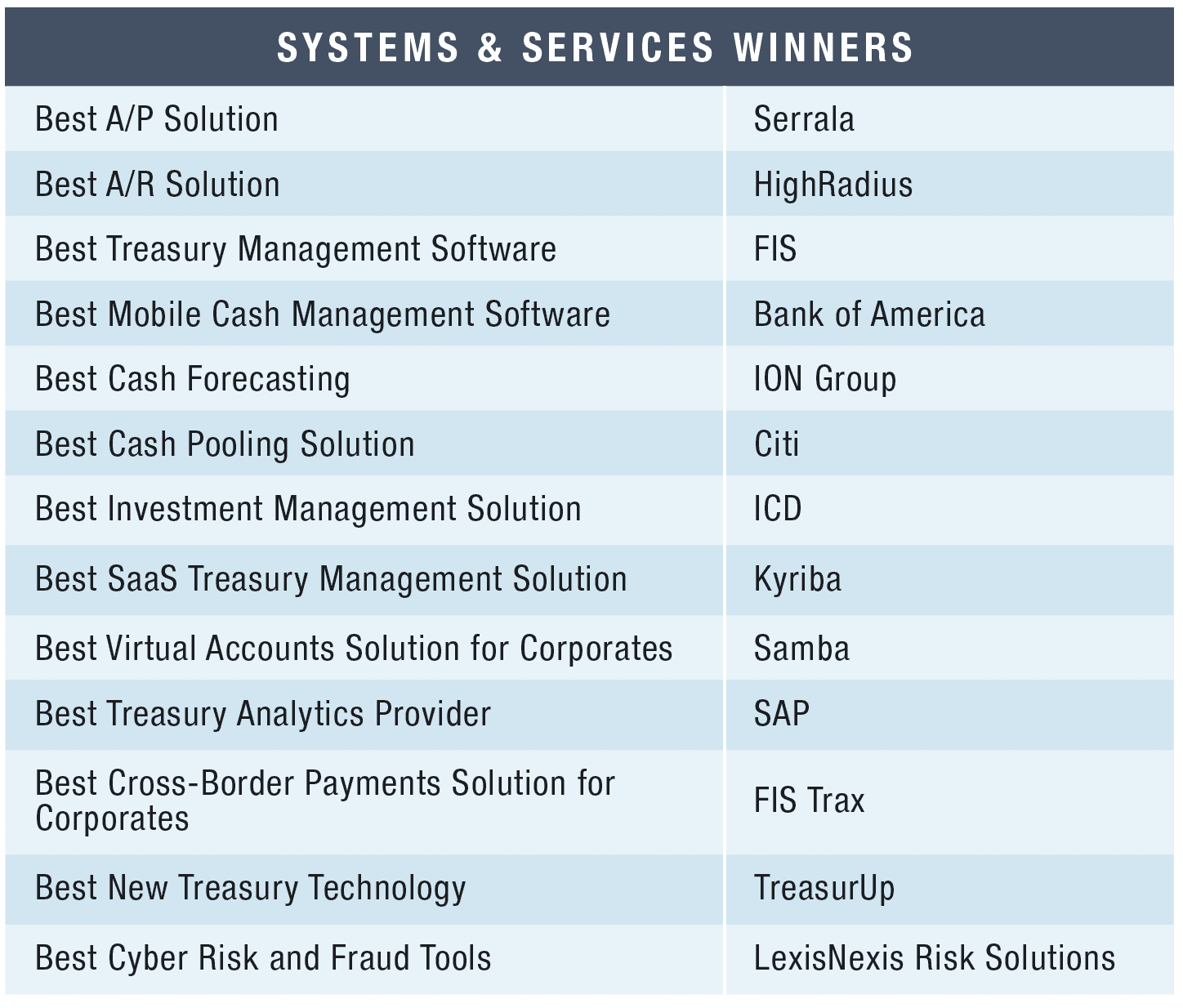

The solution, which has since changed its name to TreasurUp, is 2021 Best New Treasury Technology, a new category in Global Finance’s Treasury and Cash Management Awards. TreasurUp is used by approximately 5,000 corporates and supported by banks including OP Bank in Finland; KBC in Belgium; and Nordea, which offers the service in Norway, Denmark and Sweden.

Having refined van Daatselaar’s original concept, Rabobank now provides TreasurUp as a white-label service to banks, which in turn offer it as part of their online proposition. Small and medium-size corporates are still the target user group. Van Daatselaar is also turning his attention to treasury management systems (TMSs), which he says need a tech refresh.

“Traditional treasury management software vendors are so trading- or IT-oriented that they tend to forget about the treasurers located in small commercial areas next to the highway,” he argues. “Treasury management systems are also expensive to run and implement, but most companies end up using only about 20%. We also believe banks should start offering such light treasury management solutions, as they turn out to be a logical start and end point of the treasurer’s user journey.”

TreasurUp, which is slated to be spun out of Rabobank in the next few months, is one of a small but growing number of fintechs looking to address specific market segments or niches underserved by traditional treasury software providers. These fintechs are representative of a younger, more tech-savvy generation of treasury specialists who are challenging the notion that TMSs need to be monolithic IT stacks that fail miserably at providing treasurers all the functionality they need from day one.

While a comprehensive TMS is still the holy grail of many treasurers, the emergence of software as a service (SaaS) has changed how these services are accessed. More companies are accessing treasury management solutions using pure SaaS models like Kyriba’s and private cloud-based environments like the one FIS provides for its Quantum TMS. Cloud treasury services give treasurers at small to mid-cap companies access to treasury management functionality that they would not have otherwise been able to afford due to budgetary and IT constraints.

Powered by AI

The pivot to digital in the post-pandemic world has become something of a mantra in financial services. But those segments of the treasury management community that still rely on Excel spreadsheets to perform basic treasury functions don’t appear to have gotten the memo.

Some software providers are investing in different forms of artificial intelligence (AI), such as machine learning, robotic process automation and natural language processing, to automate treasury functions that remain stubbornly manual and to help treasurers migrate to more-intelligent, data-driven business models.

“We’ve started a journey to further enhance the use of artificial intelligence in the liquidity forecasting space,” states FIS, which takes the award for Best Treasury Management Software for the second straight year. “While we recognize that Quantum’s functionality has assisted many customers in the past, we also understand that unexpected economic scenarios and their impact on financial modeling and forecasting will play a bigger role in the future.”

ION Group, the winner for the Best Cash Forecasting solution, has built an AI-powered treasury hub that aims to improve cash forecasting accuracy and speed from days to seconds. HighRadius, which takes the Best Accounts Receivable Solution award for the second year in a row, uses machine learning and rich accounts payable and receivable payment and operational data to help receivables and treasury departments reduce the manual effort required for transaction processing and statistical forecasting.

“More than 98% of treasury departments still forecast cash using cumbersome spreadsheet models, which demand manual effort and time to build and input data but generate output that cannot be confidently relied upon,” says Sayid Shabeer, chief product officer at HighRadius.

The key to more-accurate cash forecasting and receivables management for HighRadius is human-machine collaboration. Machine-learning algorithms and AI-enabled digital assistants help treasurers and receivables managers better forecast their cash position and predict likely customer defaults and invoice payment dates.

“The pandemic has been the black swan event that accelerated the need for digital adoption,” says Shabeer. But even though more companies recognize the need for digital transformation, studies in recent years by McKinsey & Co. and Everest Group found that a large majority of such projects fail to reach their stated goals. “The largest IT project will fail to transform a process if leaders fail to define the right performance benchmarks and measure against those benchmarks.”

Bumps in the Road

AI is a treasury buzzword right now, one that promises a lot by way of realizing more-predictive and data-driven treasury operations. But treasurers aren’t exactly sure how to get there.

One of the biggest hurdles is not technical but managerial: creating a stronger digital-talent pool. Asia Pacific treasurers and CFOs who participated in DBS Bank’s 2020 Digital Treasurer Survey cited speed of change (80%), execution complexity (75%) and lack of digital talent (64%) as their top three challenges in adopting new digital technologies.

Additionally, while digital technology can deliver cost savings and insights that help treasurers better manage their cash and liquidity, it also exposes them to increased risk of fraud and cyberattack. In early February, the global banking cyberintelligence sharing organization FS-ISAC announced that “last year, more than 100 financial services firms were targets of a wave of distributed-denial-of-service extortion attacks conducted by the same threat actor.” Threatening to disrupt firms’ websites and digital services, the criminals targeted a range of providers including banks, asset managers, fintechs, exchanges, card issuers and payment companies.

Indeed, 2020 was a landmark year for the opportunities it afforded money launderers and other criminals, says LexisNexis Risk Solutions, award winner for Best Cyber Risk and Fraud Tools, a new category this year. Its Future Financial Crime Risks 2020 report highlights the increasing sophistication of cyber criminals, concluding that financial institutions as well as fintechs and challenger banks need to be better prepared for the digital battle.

Where does that leave treasurers, who rely on their banking and software partners for solutions to securely manage their cash and liquidity? Automating treasury operations is still imperative, since fragmented IT systems and spreadsheets, which don’t provide an electronic audit trail or visibility of financial information, also leave companies vulnerable to attack. Expect to see an increased focus on security as more treasurers make the move to digital.