Regional banks spur growth in new product offerings.

As pandemic-related lockdowns have mostly dissipated, corporates—and the banks that serve them—are refocusing on the fundamentals.

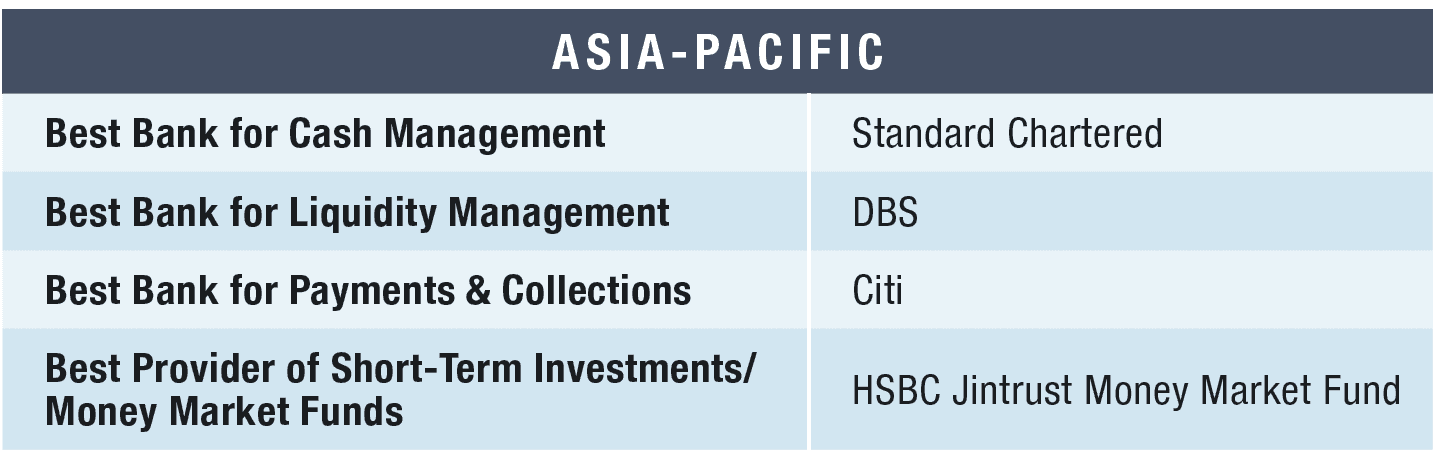

One of the essential themes in coming months will be a “resurgent focus on business resiliency and rise of regionalization, coupled with a reconfiguration in Asia,” according to Rachel Chew, group Cash Product Management head, Global Transaction Services at DBS, winner as the Best Bank for Liquidity Management in the Asia-Pacific region. “In a world of uncertainty where costs of doing business are increasing, solutions to de-risk treasury operations and fortify business resilience are in demand,” she adds.

Digital transformation has only accelerated since the pandemic. This process requires that treasury functions be a part of a broader organization-wide emphasis, which will need a cultural mindset shift to allow the greater use of machine-driven tools. “Digital transformation is a continuous journey for organizations willing to take a leap of faith,” Chew says.

Citi, our repeat winner for Best Bank for Payment and Collections, has supported its customers in the Asia-Pacific region and globally through its Citi Global Instant Payments–which delivers connectivity to more than 30 instant payment schemes, reaching over 60 countries around the world, with the broader aim of helping customers remain competitive in today’s digital economy.

And digital transformation includes blockchain. DBS, JP Morgan and Temasek are behind Partior, a payments system that’s an interbank network supporting multicurrency payments. The recent investment in Partior by Standard Chartered—our Asia-Pacific winner as Best Bank for Cash Management—says David Rego, global head of payments in transaction banking at Standard Chartered, “will allow us to use blockchain technology to bring the speed, efficiency and visibility of domestic settlement systems to cross-border transactions.”

Standard Chartered also introduced its first programmable payout capability powered by a modular and interoperable application programming interface. Rego explains that a payouts-as-a-service offering is “a bank-grade fintech solution that allows digital and traditional businesses to seamlessly manage one-to-many payments to parties in their ecosystem.”

Fintechs are biting at the heels of large, established financial institutions to wrest away the mantle of technological innovation. “The explosion of fintechs gave rise to a myriad of payment solutions, and accelerated onboarding experiences have created healthy competition for all financial institutions,” Chew says. Moreover, she explains, “Beyond the certainty of settlement, we see the next frontier of instant fulfillment in cross-border connectivity.”

On another front, the HSBC Jintrust Money Market Fund, a repeat winner as Best Provider of Short-Term Investments/Money Market Funds, is an open-end fund incorporated in China and an excellent option for corporates in search of short-term liquidity solutions. The fund, which invests in relatively short-term securities, meets liquidity objectives and capital preservation needs.

Meanwhile, macro concerns are front and center in the Asia-Pacific region. “Geopolitical concerns, high inflation and spurring interest rates have caused significant stress on corporate balance sheets in 2022 and are likely to be top of mind in 2023,” cautions Ankur Kanwar, head of Cash Management for Singapore and the Association of Southeast Asian Nations, and global head of structured solutions development at Standard Chartered.

What’s more, the supply chain disruptions from the Covid-19 pandemic still drive change. “Many corporates have to adjust inventory levels and move toward a ‘just-in-case’ approach instead of ‘just-in-time’ for inventory management,” Kanwar says.

Other macroeconomic wild cards for 2023 for TCM include the impacts of the reopening Chinese economy on regional and global growth and economic patterns. Furthermore, high inflation and highinterest rates—for the first time in more than a decade—along with reduced liquidity from monetary authorities have resulted in greater pressure on treasury and cash management operations throughout the Asia-Pacific region.

“Market volatility is here to stay through 2023,” according to Philip Panaino, global head of Cash at Standard Chartered. And it will “make the effective management of the balance sheet even more critical.”