Leaps in digitalization and automation, plus critical macro insights, are helping banks pull North American businesses through the Covid-19 crisis.

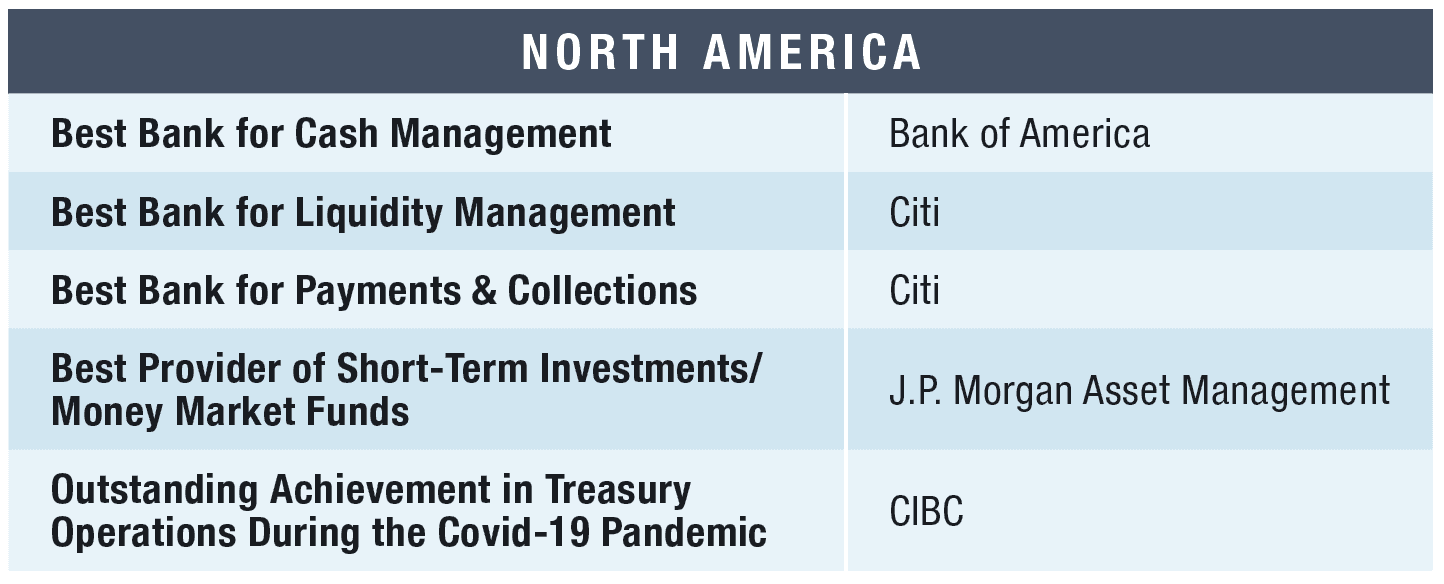

Facing heavy pressure to stabilize the supply chain and explore working capital management solutions amid a global health crisis, businesses are relying more than ever on banks—and creating opportunities for them in the process. Citi, Global Finance’s Best Bank for Liquidity Management and Best Bank for Payments and Collections in North America for the second year in a row, reports increased adoption of its platforms by corporate treasuries alongside expanded use by existing clients.

Luckily, says Tapodyuti Bose, global head of Digital Channels, Data & Analytics for Citi, the technology has kept pace.

“Huge leaps forward in digitalization and automation have totally redefined how treasury and finance professionals tackle their jobs—even how their jobs are defined,” he says. “This includes a generation of new technologies and faster processing speeds that have recalibrated expectations about the velocity, efficiency and transparency of activities that are so critical to their jobs.”

Key digital trends and initiatives that Bose sees impacting corporate treasuries include real-time straight-through processing (STP) with instant payments and application programming interface connectivity “driving 24/7 commerce”; ecosystems that multilayer treasury, banking and non-treasury systems, for example by integrating financial partners directly into core business systems such as client-facing mobile apps; automation that reduces manual touchpoints, and STP for cash management operations, including reconciliation and payments; advanced analytics that enable better-informed decision-making on investments, liquidity, risk management and other matters; more-robust infrastructure that mitigates cyber and other risks to digital platforms; and finally, modeling and simulation that make treasury and liquidity structure and policies more adaptable to market changes.

Keeping Operations Going

Thanks to these improved capabilities, businesses have fewer manual touchpoints, more robust infrastructure to mitigate and shield them from cyber risks and improved modeling and simulation tools that help them figure out how to carry on when, for many, operation has all but stopped or been severely curtailed.

CIBC, recipient of the new award for 2021, Outstanding Achievement in Treasury Operations During the Covid Pandemic, was quick to ensure that its Canadian treasury clients could stay operational when work-from-home edicts arrived. The bank made changes allowing clients to scan signed credit documents when making borrowing requests or requests to amend credit terms. It also launched a special offer with Global Payments, giving clients free Wi-Fi and virtual terminal rentals, allowing them to continue collecting payments while working remotely. With 90% of applications for various government business relief programs being made digitally, CIBC helped clients secure 81,000 loans totaling over C$3.2 billion.

CIBC also increased its communication with clients regarding potential fraud scenarios and launched extra measures to prevent fraud, such as transitioning clients from single-user cash management workflows to more-secure multiuser workflows.

Bank of America is this year’s Best Bank for Cash Management in North America on the strength of the actionable insights it provides its clients. “We have an extremely good view of the macro economy, global interest rates and overall consumer sentiment—all factors that inform client decisions around treasury strategy and cash investment,” says Matthew Davies, managing director and head of Global Transaction Services (GTS) for Europe, the Middle East and Africa and global co-head of corporate sales for GTS at Bank of America. “In today’s environment, we are advising our clients on how to prepare for negative interest rates. It’s critical to be one step ahead of such a situation and make the necessary changes to your operations and technology platforms now.”