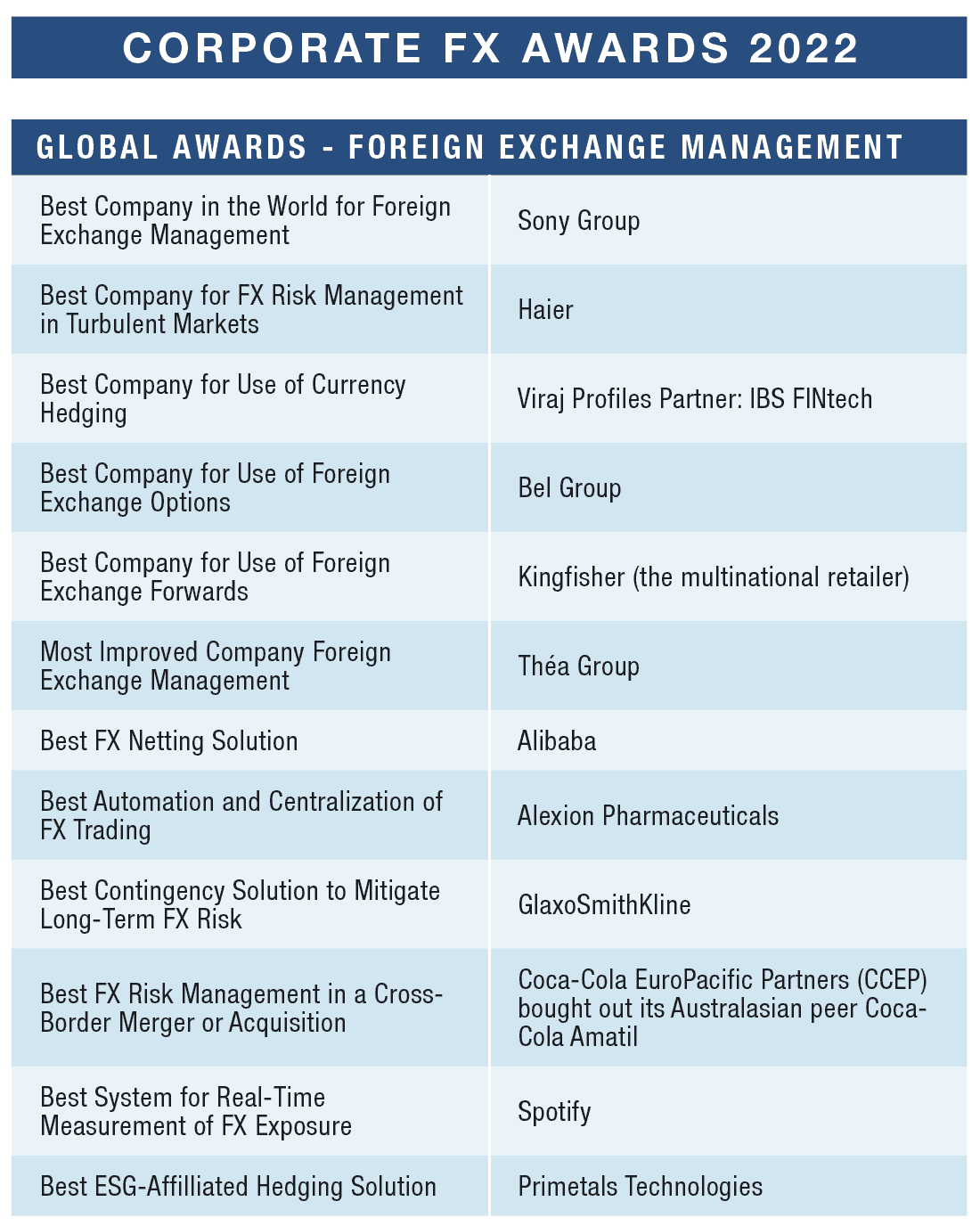

Global Finance honors this year’s best corporate FX providers.

As companies react to the impact of ongoing uncertainties while preparing for a post-pandemic future, the role of treasury departments in monitoring and managing foreign exchange (FX) exposure is being highlighted.

Whether driven by international expansion, heightened market volatility or regulatory and accounting changes, treasuries are increasingly looking to electronic platforms and innovative tools in their execution of FX trades. The companies chosen for this year’s Global Finance Corporate FX Awards combined innovative technologies with a clearly defined FX strategy to protect themselves from currency fluctuations.

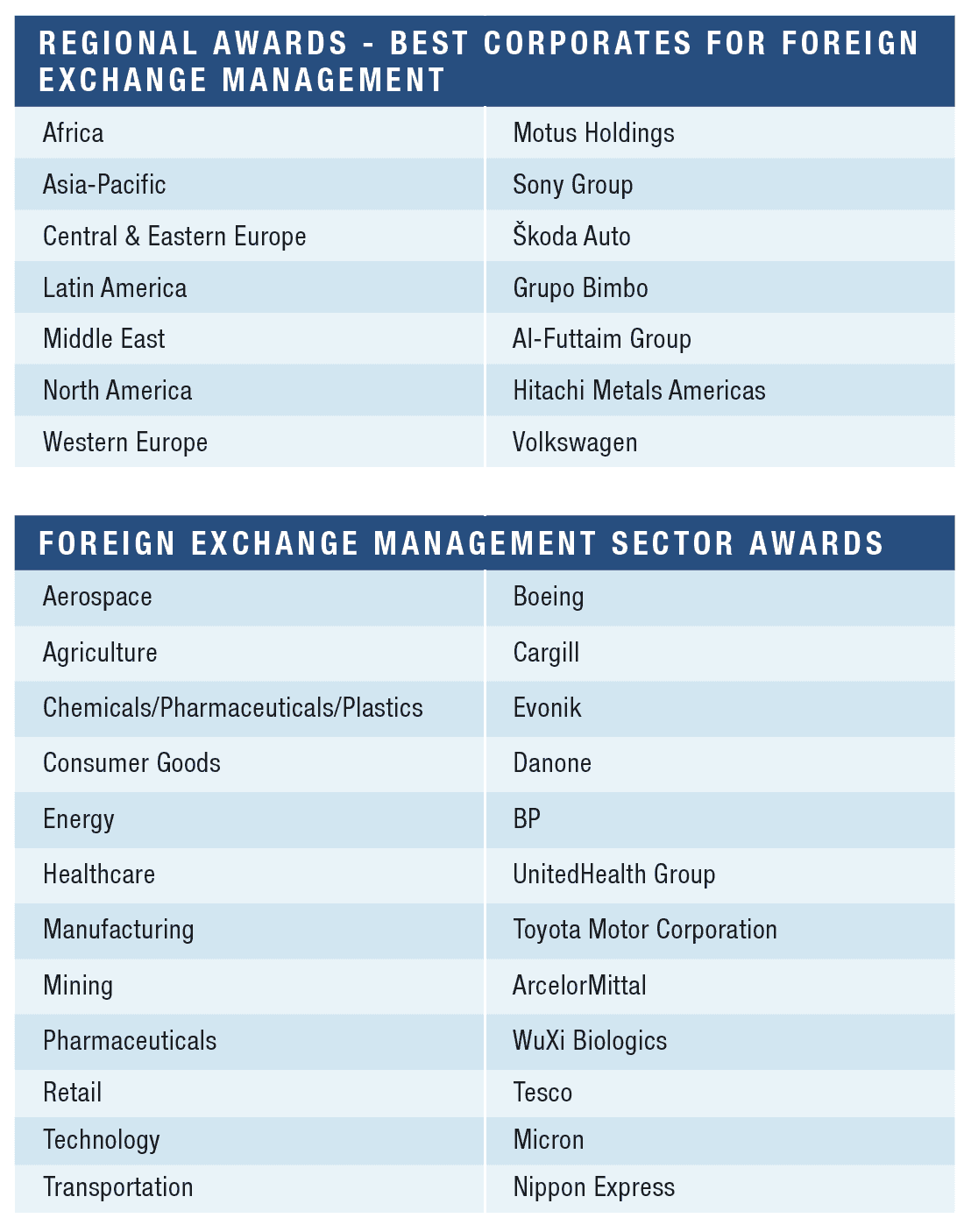

Alexion Pharmaceuticals, winner of the Best Automation and Centralization of FX Trading award, completed a treasury transformation in 2020, establishing an integrated, cloud-based infrastructure for FX, cash management, investments and reporting.

The Mining FX winner, ArcelorMittal, also chose a fully integrated, cross-asset treasury management system (TMS) to manage its end-to-end treasury needs, including trading, operations, liquidity, funding, regulatory reporting and hedging.

Our Consumer Goods FX winner, Danone, experienced rapid growth across 17 Asian markets in 2019, and a review of its treasury technologies helped identify vital areas in need of improvement. Danone chose Bloomberg’s FXGO to gain complete visibility into real-time liquidity and automate comparisons to receive prices in real time.

Following the unbundling of Motus from Imperial Holdings, Africa FX winner Motus Holdings chose TreasuryONE as its outsourced treasury services provider, which directly linked the firm to the local South African Banks via host-to-host connections.

Al-Futtaim Group, the Middle East FX winner, has five core divisions and more than 1,000 bank accounts, giving it many banking partners that it needs to manage. Having implemented SAP’s TMS, the Dubai-based conglomerate ditched Excel spreadsheets in favor of straight-through processing. Implementing robotic process automation (RPA) and deploying Bloomberg services allows Al-Futtaim to track and analyze FX trade data and instantly approve FX deals via mobile phones.

Using RPA within its treasury operations allows Spotify, which took home the award for Best System for Real-Time Measurement of FX Exposure, to spend more time and effort on FX, such as investing in spot and forward settlements.

Sony Group achieved automation of the FX trading process during its treasury transformation and won this year’s Best Company in the World for Foreign Exchange Management award. To see how, read Hiroyuki Ishiguro’s account (page 34).

Hedging Tools

Automation makes exposure calculations more efficient, so, unsurprisingly, hedging tools are a popular choice for treasuries. The Best Company for Use of Currency Hedging award winner, Viraj Profiles, exports stainless-steel products to more than 1,300 customers across 90 countries on six continents. By using IBS FINtech’s Treasury 6i–Currency Module to monitor its hedge policy, specify threshold limits at various levels and set up real-time alerts, the company can now better protect its cash flows from FX risk.

This year’s winner in the Chemicals sector, German firm Evonik, combined cross-border payments with integrated hedging and risk management during its TMS implementation. UnitedHealth Group, the winner in the Healthcare sector, is leveraging technology to deliver a payment and FX workflow that offers seamless connectivity. In contrast, Technology sector winner Micron implemented a cross-currency sweep solution to enable real-time FX conversion.

The winner of this year’s Most Improved Company for FX Management award, Théa Group, has operations in 70 countries and exposures in 30 currencies, from both purchasing and sales. The European eye-care specialist implemented the Kantox currency management tool to automate exposure reporting and hedging.

Haier Group, named the Best Company for FX Risk Management in Turbulent Markets, established an intelligent risk-management platform that connects its internal accounting system and funds settlement system with external financial data resources, including financial data provider Refinitiv, to provide timely analysis. Risk-management scenarios and simulations and real-time monitoring of business exposure helps the Chinese multinational to adjust its hedging strategy dynamically.

UK home-improvement retailer Kingfisher, winner of the Best Company for Use of Foreign Exchange Forwards award, has significant transactional exposure from purchasing inventories denominated in US dollars, which it hedges using forward foreign exchange contracts. It hedges committed inventory purchases and a proportion of forecast inventory purchases arising in the next 18 months, which are monitored continuously.

Škoda Auto, the winner of the Central & Eastern Europe FX regional award, through regular monitoring manages the risk and impact of changes in exchange rates using standard hedging instruments, while the winner of the Latin American FX regional award, Grupo Bimbo, carefully hedges commodities to protect itself from rises in commodity prices.

Western Europe FX regional winner Volkswagen doubled its commodity derivatives portfolio within two years, putting a third of the hedge against nickel as the company increased its notional holding almost tenfold to €2.3 billion.

The Paris shared-services center of cheese manufacturer Bel Group, which won the Best Company for Use of Foreign Exchange Options award, handles payments and collections for most of its 60 globally dispersed business units, operating through more than 200 accounts with 31 banks. Bel, which is particularly active on the options market, embedded Kyriba’s FX risk management to oversee the wide range of financial instruments it deploys.

Alibaba, this year’s winner of the Best FX Netting Solution award, won for its cross-bank pair trading initiative, which matches FX transactions in opposite directions across the group and its subsidiaries, thereby eliminating FX risk and reducing the bid/ask spread and slippage by 95%.

Best Contingency Solution to Mitigate Long-Term FX Risk winner GlaxoSmithKline (GSK) manages subsidiary companies’ cash surpluses and borrowing requirements centrally, using forward contracts to hedge future repayments back into the originating currency. To reduce foreign currency translation exposure, GSK denominates borrowings into US dollars, euros and sterling. It also uses forward contracts in major currencies to minimize exposure to overseas assets.

Our Best FX Risk Management in a Cross-Border Merger or Acquisition award goes to Coca-Cola EuroPacific Partners (CCEP). The company put in place a slew of deal-contingent hedges when it bought out its Australasian peer, Coca-Cola Amatil, to cover both the exchange rate risk and, with the help of contingent forwards, the interest rate risk.

Deutsche Bank drew up a Sustainable Finance Framework with Primetals Technologies, winner of the Best ESG-Affiliated Hedging Solution award, for the engineering and plant-construction company to hedge its currency risk with FX options with the bank over four years. In addition, should Primetals fail to meet agreed-upon sustainability targets, it must pay a predefined sum to a contractually defined non-governmental organization.

Hitachi Metals Americas, which won the North America FX regional award, saw a significant reduction in overall costs from lower FX spreads and no transaction fees, following the implementation of the GTreasury platform and integration with Goldman Sachs’ transaction banking portal.

The cash flow hedges of Boeing, the winner of the Aerospace sector award, include foreign currency forward contracts, commodity swaps and commodity purchase contracts. Forward contracts help manage currency risk of forecasted sales and purchases made in foreign currencies. Commodity derivatives, such as fixed-price purchase commitments and swaps, protect against potentially unfavorable price changes for items used in production. WuXi Biologics, the winner of the Pharmaceuticals sector award, has also engaged in a series of forward contracts to manage its currency risk.

Cargill, which won the sector award for Agriculture, entered a three-part liquidity solution, including NostroCollect, multibank cash sweep and cross-border sweeping to help manage currency risk in commodities trading. Meanwhile, BP, the Energy FX sector winner, raised $12 billion in a hybrid bond sale with a multicurrency five-tranche deal.

The winner of the Manufacturing sector award, Toyota Motor Corporation, boosted profits through successful pooling and favorable FX movements. Nippon Express, the Transportation sector winner, undertook pan-Europe cash pooling, with a tailored mechanism with an extended country scope and improved cut-off times.

Tesco, which won the Retail sector award, hedged the entire $10.6 billion sale of its operations in Thailand and Malaysia with 50% vanilla options and 50% forward, resulting in an extra £50 million (approximately $67 million) above the sum it would have received if it had converted the proceeds at the prevailing spot rate on completion.

A treasury’s handling of FX risk management has a significant bearing on an organization’s profitability and its ability to weather whatever challenges come its way. Recent events have brought this to the fore, as treasuries worldwide needed to manage the impact of global and regional events on currencies—a task that has been improved through the adoption of FX technologies.