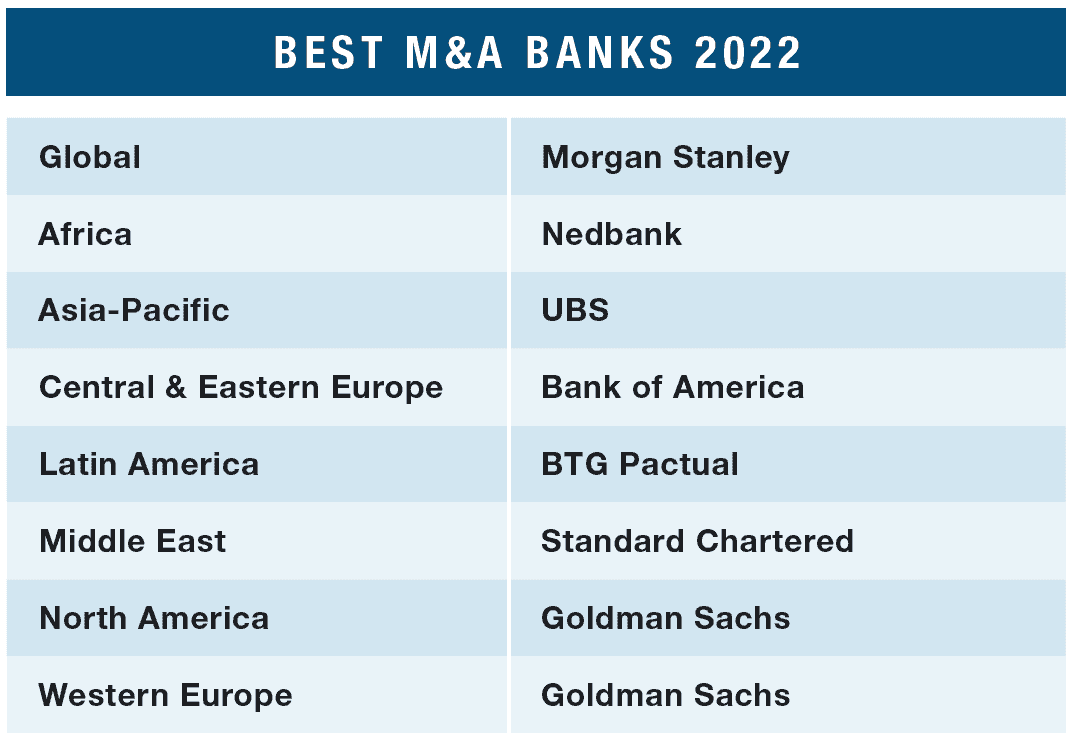

The world’s biggest investment banks reinforced their dominance in a year that broke all sorts of records.

Worldwide, 2021 was a historic year for mergers and acquisitions. Corporate deal-making soared to $5.63 trillion, shattering the record of $4.42 trillion set in 2007, Dealogic finds The figures represent a 60% jump over 2020. No surprise, then, that global investment banking fees for M&A also soared—by 46%—past $100 billion for the first time, Deutsche Bank says.

While the record-breaking activity was geographically widespread, some areas saw more growth than others. Australia led with a 287% jump for the year, with Africa and the Middle East in second place at 185%, followed by Canada (107%), Latin America (83%), the US (74%), Europe (51%) and Asia (25%). Japan was the only developed economy to see less M&A activity.

Although technology maintained its lead position as the most active in terms of sectors, the year’s largest deal was the Discovery and Warner Media merger, announced in May. —TM

GLOBAL

Morgan Stanley

In the hotly contested M&A market, Morgan Stanley stood out by expanding its presence with substantial gains in market share in Europe, the Middle East and Africa. The bank also had a record-breaking year in the US, with a total of 263 deals that amounted to $870 billion in total activity. Those figures helped push the behemoth investment bank over the $1 trillion mark in global M&A activity for the first time, a monumental 57% year-on-year rise. Among the bank’s largest deals, the $31 billion Canadian Pacific acquisition of Kansas City Southern stands out.

Morgan Stanley’s long-term positioning in the special-purpose acquisition companies (SPAC) market also helped propel its record year. The bank secured a 116% year-on-year rise and a total of $7.8 billion in deals. Rob Kindler, global head of M&A at Morgan Stanley, sees further growth soon. “While it may not be another record year, all the key elements that made the 2021 M&A market so strong are largely still in place,” he said in a January statement. —TM

AFRICA

Nedbank

South Africa–based Nedbank, our pick as this year’s Best M&A Bank in Africa, has an extensive presence in Africa, covering 39 countries. It also has a track record of leveraging strategic alliances across six continents to deliver a global perspective along with market access for comprehensive advisory capabilities. Through its 20% stake and partnership with Ecobank Transnational, Nedbank extends its capacity to provide advisory and financing solutions to a combined 18 million clients across Africa.

The first carbon-neutral bank in Africa, Nedbank is leading the industry in promoting ESG values. It was the first South African bank to join the Principals for Responsible Banking, and the first to list a renewable-energy bond on the Johannesburg exchange. Nedbank was the first African bank to become a member of the Equator Principles and to cease financing for new coal-fired power plants. Its M&A transactions included acting as an adviser on the divestment by Sasol of a 30% interest in the Republic of Mozambique Pipeline Company representing a value of approximately $300 million. —DS

ASIA-PACIFIC

UBS

Asia’s 25% year-on-year growth in M&A activity would have been a great mark in any year in history—except 2021. Instead, Asian figures largely trailed the rest of the world. UBS, with well-established operations in multiple markets, secured nearly 13% share in M&A in Asia-Pacific. The bank boasts an 8% share of China’s M&A market and participated in 26% of deals in the Philippines and 41% of deals in Australia, the world’s fastest-growing M&A market this year.

Among the key transactions, UBS advised Thailand’s second-largest-ever consumer and retail M&A deal, the $13 billion Siam Makro Public acquisition of Thai-based CP Retail Development. UBS was sole financial adviser in the $2.1 billion sale of China Logistics Property Holdings to JD Property—the largest takeover in Asia’s property logistics sector in three years. The Swiss bank also participated in the first “de-SPAC” of a Hong Kong–based company, namely the $1.7 billion merger between Artisan Acquisition and Prenetics Group. —TM

CENTRAL & EASTERN EUROPE

Bank of America

M&A activity was up 51% in Europe, at a value of $1.26 trillion, according to Dealogic. Bank of America Securities’ share of the total was £371.5 billion ($488.3 billion) cross 128 transactions, in a group dominated by the major banking groups—Goldman Sachs, JPMorgan Chase, Morgan Stanley, Citi, Rothschilds, Lazard, etc. BofA’s share of M&A in Central and Eastern Europe jumped by over 58% over the prior year, to $13.1 billion across nine deals, almost double the rise seen by league-table leader JPMorgan, while Goldman Sachs’ share decreased by 22%, placing it third.

M&A volume led to the banking giant reporting a better-than-anticipated 30% increase in quarterly profit to December 2021, after billions of dollars’ worth of deals generated fees of $850 million—up 55% from a year earlier. BofA was deemed by data and analytics firm GlobalData to be the top M&A adviser in the automotive sector for Q1-Q3 2021 by value, having advised on seven deals worth $15.4 billion, the highest of all advisers. —DR

LATIN AMERICA

BTG Pactual

Latin America’s monumental 83% rise in M&A activity in 2021 included two major trends. First, a deepening of Brazilian leadership in the region’s economy: Brazil provided 70% of Latin America’s domestic and cross-border M&A activity. Secondly, the power of rising commodity prices for the largest companies.

Five of the six largest M&A advisers in the region are Brazil-based. Hence, BTG Pactual was perfectly positioned to secure the region’s most significant deals of the year. The award “crowns an historic year, with a record volume of M&A transactions for the region and BTG Pactual,” says Bruno Amaral, managing director partner for Investment Banking at BTG Pactual. “We are proud to have advised many landmark transactions, such as the Hapvida-Intermédica and Americanas-B2W mergers in Brazil, the Ecopetrol acquisition of ISA in Colombia and the sale of Colbun Transmision in Chile, among many other important deals.” —TM

MIDDLE EAST

Standard Chartered

Standard Chartered Bank’s extensive footprint and long tenure across nine markets in the Middle East is unrivaled: The bank has operated for a century in Bahrain and Jordan, and decades in many other Gulf countries. These well-established roots enable the bank to leverage cross-border advisory mandates with its global brand. In the MENA and GCC regions, the firm is on top of the league table rankings in several bond and sukuk issuance categories with market shares of approximately 14%, according to Bloomberg. Demonstrating its expertise in the clean-energy industry, the firm acted as the exclusive financial adviser to Alcazar Energy Partners in its sale to China Three Gorges—a deal that involved the largest independent renewable-power producer in Egypt and Jordan. The firm advised UAE investment firm SHUAA Capital in the sale of its 20% stake in UAE independent power and water company Mipco to Japan’s Sojitz Corporation. The landmark deal represented the first direct investment in a water and power asset in the UAE by a foreign investor. —DS

NORTH AMERICA

Goldman Sachs

Goldman Sachs demonstrated its dominance in advisory, retaining the top position—as it has for 22 of the past 23 years. Goldman participated in over $1.8 trillion of announced transactions during 2021, representing a 31% market share. According to Refinitiv, the bank capitalized on the M&A wave to see fee income surge 89%, to $4.9 billion. In addition to robust M&A activity in the health care and industrial sectors, Goldman also captured key mandates in the technology sector, including acting as the exclusive financial adviser to Microsoft in its $20 billion acquisition of Nuance Communications, a leader in cloud technology and artificial intelligence software. In its fourth-quarter earnings call, the firm cited a robust backlog of deal flows. In a November 2021 survey, Goldman’s clients identified three main drivers of M&A strategy: the need to scale for growth in their respective industries, competitive positioning through the acquisition of new technology, and operational synergies to create efficiency. —DS

WESTERN EUROPE

Goldman Sachs

Goldman Sachs’ share of European deal making was $703.8 billion across 221 transaction, putting it at the top of the league tables, up from second place in 2020. The value of individual transactions was also higher than rival JPMorgan’s. Goldman led across all major markets, including Austria, Finland, Greece, Iceland, Italy, the Netherlands, Spain and the UK, and was a close second in Portugal and Ireland.

In Germany, Goldman Sachs acted as financial adviser to Deutsche Wohnen in the acquisition by larger rival Vonovia that would create Europe’s largest residential real estate group, with a combined market capitalization of around €45 billion and more than 500,000 apartments with a combined real estate value of around €90 billion. Europe’s second-biggest M&A deal of the year was worth around $22 billion. —DR