High rates and looming recession continue to put a damper on activity, yet there are still deals to be made.

When 2021 ended, investment bankers called it “a year of superlatives,” says Bryan Cummings, managing director at Canaccord Genuity. The M&A business was booming, especially in the US where it was up 82% over 2020.

Dealmakers looked to 2022 with hope. Cummings says, “It seemed to many professionals that we had the risks quantified and had a sense for how the environment might evolve.” But investment banking faced one headwind after another: Russia’s invasion of Ukraine stalled the bond and equities markets; there was record inflation; and interest rates spiked higher than expected, courtesy of the US Federal Reserve. On Sept. 13, a volatile stock market recorded its worst day since June 2020 and regulators took a tough stance against consolidation. There were also follow-on impacts across numerous categories—from sanctions to shipping.

“Macroeconomic uncertainty returned,” Cummings adds.

Events so far in 2023 will likely dampen deal activity, too. The collapse of Silicon Valley Bank and New York’s Signature Bank, coupled with the liquidation of crypto lender Silvergate, continues to have ripple effects across the globe as fears spread of a so-called contagion. A consortium consisting of JP Morgan Chase & Co., Morgan Stanley, Citigroup, Bank of America and Wells Fargo rescued First Republic, while UBS swooped down on a bleeding Credit Suisse. It’s considerably darker when held up against the first six months of 2022 when there were no bank failures and dealmakers inked an impressive $2.2 trillion in transactions. According to Refinitiv, the level of activity continued a two-year streak of $1 trillion-plus quarters.

The second half of 2022, however, totaled just $1.5 trillion. That’s a 32% decline—the largest second-half percentage drop since 1980. The total number of worldwide deals for the year was nearly 55,000, a 17% dip compared to 2021 levels and a two-year low.

Two of the biggest price tags from last year were Microsoft’s $68.99 billion acquisition of Activision Blizzard and Broadcom’s purchase of VMware for $67.99 billion, according to S&P. But as of March 2023, those transactions have yet to close. Therefore, Elon Musk’s $44 billion Twitter splurge is technically the largest deal that came to fruition.

But it was in the first quarter that a record was broken. In February, Morgan Stanley acted as financial adviser to First Horizon in its $13.4 billion deal with Toronto-Dominion Bank. The adviser received $82 million in fees; the largest sum ever paid for any US bank on an M&A agreement in this century thus far.

Meanwhile, initial public offerings (IPOs) fell off a cliff. Refinitiv reported just over 1,300 global IPOs, a decrease of 64% with just $148 billion raised. This was partly due to the chill experienced across the US, where Refinitiv reported IPOs were down a staggering 95%, raising just $8 billion (the smallest number since 1990).

Europe also saw a big decline in new listings, down 84% to $14 billion, according to Refinitiv. Between the US and Europe, the top IPOs included German car maker Porsche ($8.8 billion), financial services firm Corebridge Financial ($1.7 billion), private equity firm TPG ($1.1 billion), self-driving tech innovator Mobileye Global ($990 million), eye care company Bausch & Lomb ($630 million) and natural gas distributor Excelerate Energy ($384 million).

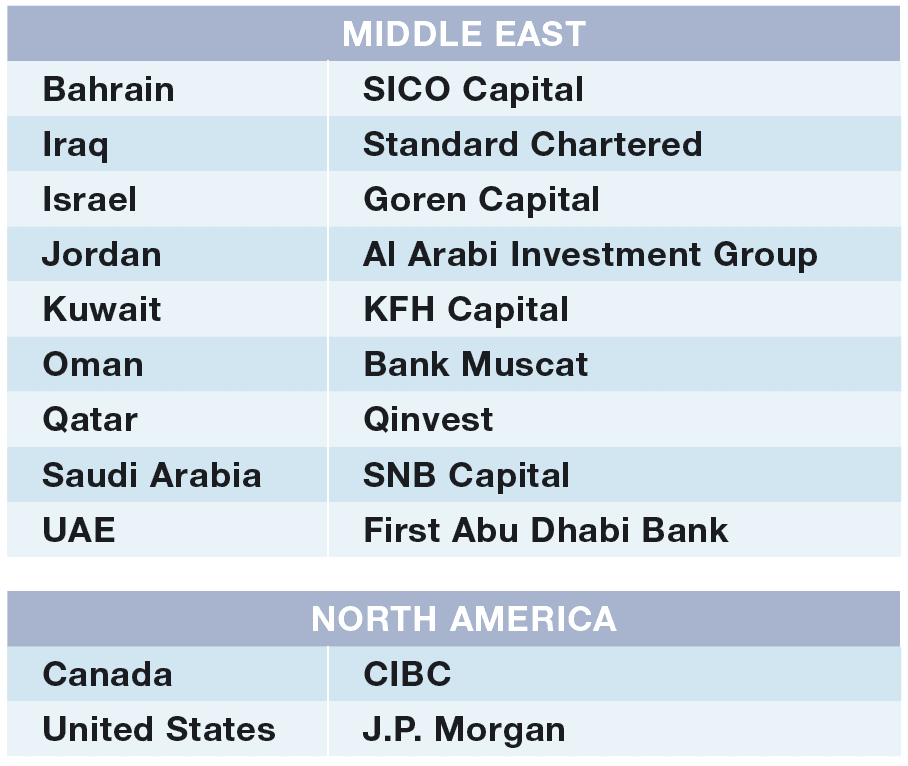

Investment banks found IPO opportunities elsewhere, namely the Middle East, which actually bucked the trend. The value of IPOs throughout the region spiked by just under two-thirds (63%) compared to 2021, according to Refinitiv. One of the biggest IPOs of the year was Dubai Electricity and Water Authority, which raised more than $6.1 billion in its stock market debut in April. The state utility’s IPO is the second largest in the Middle East and North Africa region in history.

China also touted a busy year for IPOs. In fact, the Shanghai market, dubbed the STAR Market, raised about $34 billion in IPOs for 2022. Nasdaq and NYSE combined couldn’t raise that much. The biggest listing by a Chinese company was medical radiology equipment manufacturer Shanghai United Imaging Healthcare Co., which raised more than $1.6 billion on the STAR Market.

One trend was the shift away from environmental, social and governance (ESG) goals. In 2021, bankers hyped it up as something that went hand-in-hand with corporate responsibility—in 2022, not so much. Refinitiv suggests that investors’ varying values and perceptions, plus shoddy data and increased scrutiny (e.g., Tesla’s removal from the S&P 500 ESG index while Exxon remains) likely “played into political differences and opened the door to a range of vocal critics to share their misgivings.”

And for those who already thought we were on a path to a recession, the current climate will likely exacerbate that thinking. If and when that happens, private equity firms will be at the ready. After all, per Bain & Company’s 2023 Global Private Equity Report, “The industry ended 2022 with a record $3.7 trillion in dry powder.”

General partners will be eager to put that money to work as soon as possible, the firm claims.

Bill Hanlon, partner and bankruptcy lead at law firm Seyfarth Shaw, agrees. “The flip side is there are opportunities,” he says.

There’s still a lot of liquidity and a lot of opportunities to buy assets at a reduced value, he explains, citing the uptick in bankruptcies—a 12-year high for the US in the first two months of 2023.

“One door closes and another opens,” Hanlon adds. “In times of uncertainty, that money will go to well-run organizations that could be improved by good management.”

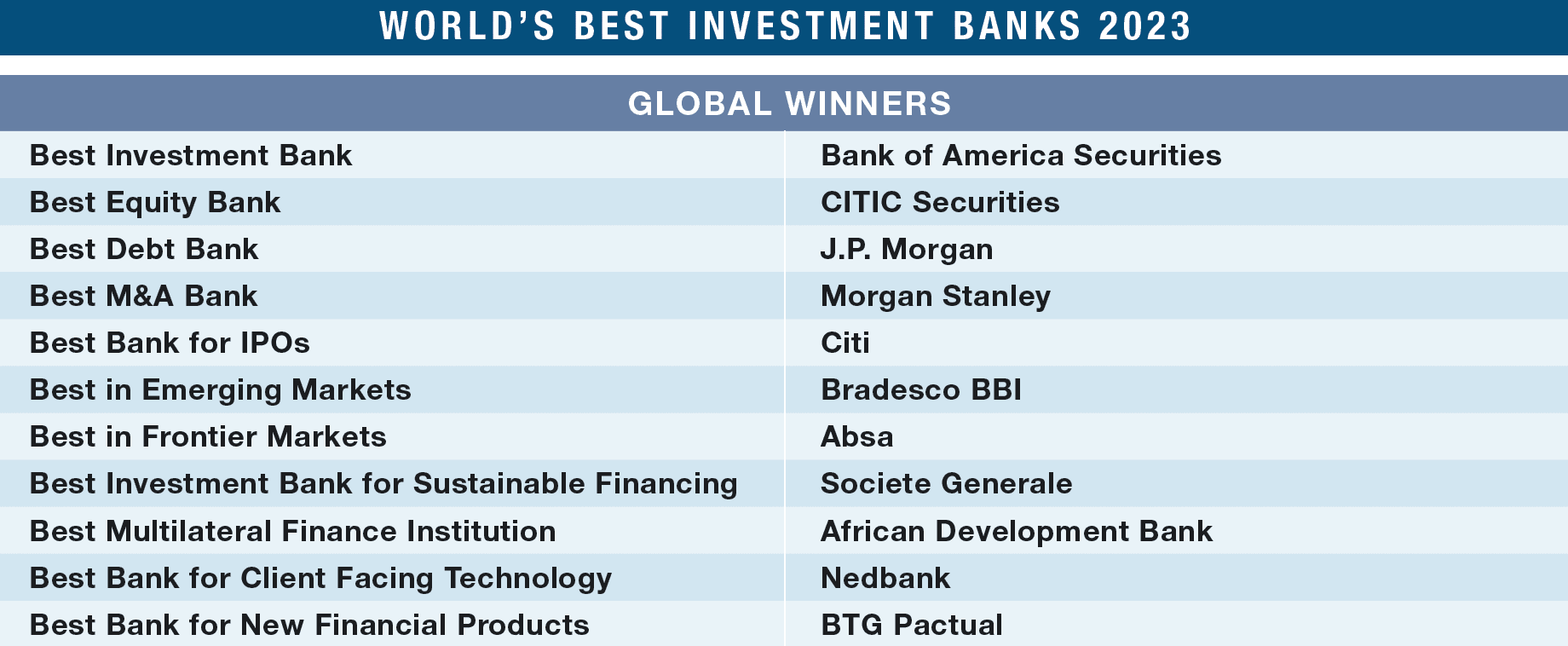

Until we get the full picture of what 2023 entails, let’s recognize the financial institutions that made do over the previous 12 months. This year’s competition examined data from more than 100 countries and territories representing all the regions of the globe. However, we selected winners from only 68 countries and territories. Read on for Global Finance’s 24th annual awards for Best Investment Banks.

Research and analysis were executed by Thomas Monteiro, David Sanders and Lyndsey Zhang, who reviewed entries as well as other information. Global Finance editors reviewed their assessments and made the final selections. Monteiro, Sanders and Zhang are the authors of the following pages; their individual contributions are indicated by initials.

Methodology: Behind the Rankings

Global Finance editors and researchers, with input from a range of executives, investors and consultants worldwide, used a series of criteria to select the winners of these awards, including market share, number, size and complexity of deals, service and advice, structuring capabilities, distribution network, efforts to address market conditions, innovation, aftermarket performance of underwritings and market reputation.

We used information provided by the banks, as well as material gathered from other sources, to score and select winners, based on a proprietary algorithm. Deals announced or completed in 2022 were considered.

In the review process, Global Finance considers full spectrum of banks, from relatively small ones in frontier markets that have barely appeared on Wall Street’s radar to global banks that lead the league tables for equity, debt and M&A worldwide.

Many winners submitted, in support of their applications, information and perspectives that may not be publicly available. Banks that do not submit entries can still be selected as winners through Global Finance’s review process, because editors execute their own unbiased original research in addition to evaluating entries. However, experience shows that the banks that submit entries successfully presenting themselves as model financial institutions, with detailed explanations of differentiation in services for corporate clients as compared with services provided by peers, achieve better results.

Financial institutions that submitted entries provided information in the following areas:

- Key financials, including earnings, return on equity, and market share;

- Details of key capabilities and services offered, including deal-structuring capabilities, distribution network and staff dedicated to investment banking;

- Innovation in financing and new product introduction; and

- Competitive pricing and after-market performance of underwritten securities.

Global Finance adheres to journalistic best practices for protecting the confidentiality of information.

|

GLOBAL WINNERS |

|---|

BEST INVESTMENT BANK

Bank of America Securities

Rampant inflation, followed by aggressive rate hikes by the world’s central banks, stoked fears of a global recession. As the sector endured the economic ramifications, ongoing geopolitical tension and declines in global equity markets, investment banking mandates plummeted, with a falloff in M&A activity and debt capital markets proceeds. Despite these challenges, Bank of America Securities earned our 2023 global award for Best Overall Investment Bank. The New York–based firm navigated the environment well and expanded its ranking in overall fees for 2022 to No. 3 from No. 4 in 2021, according to Dealogic. Its commitment and ever-expanding investment banking platform serves 95% of Fortune 1000 companies. In overall debt capital markets proceeds, the bank rose to No. 2 from No. 3 year-over-year and took the top spot in investment-grade debt volume. Its ESG business remains a priority. The bank rose in the rankings of global ESG bond proceeds to No. 2 from No. 3, and to No. 2 from No. 6 in global green bonds, per 2022 data from Refinitiv. —DS

BEST FOR IPOS

Citi

It has been a time of ups and downs in the global initial public offering market. After a record-breaking 2021, higher capital costs and the general global stock market selloff forced companies to avoid going public in 2022. As a result, IPOs finished the year down roughly 50% in the number of deals, and a whopping 71% in total value. Nevertheless, there were some bright spots, such as the Porsche IPO on the Frankfurt Stock Exchange for 78 billion euros ($84 billion)—Europe’s biggest listing in over a decade—and the demerger of GlaxoSmithKline’s Consumer Healthcare business through an IPO on the London Stock Exchange for $36.4 billion. With key participation as a joint bookrunner in both of those deals, Citi managed to weather the difficult scenario to post a better-than-average year and gather market share where it matters the most. The behemoth bank also maintained its focus in the red-hot Gulf IPO market, participating in the all-important debut of Emirates Central Cooling Systems Corp (Empower) for $34 billion. —TM

BEST BANK IN EMERGING MARKETS

Bradesco BBI

Amid a challenging year for global capital markets, emerging markets stood out as a bright spot, posting a 5% increase in return on equity (ROE) to approximately 14% in 2022. Boosted by greater exposure to commodities, Latin American markets outperformed. Against this backdrop, Bradesco has emerged as the year’s Best in Emerging Markets. With a significant presence in Brazil, Argentina, Mexico, the Cayman Islands, China, the US and the UK, Bradesco leveraged its privileged market positioning to deliver solid growth. Among its main deals for the year were a $600 million debt issue for Vast Infraestrutura in January, a $136 million follow-on to IGUATEMI in September and a $223 million M&A deal for EDP’s sale of Mascarenhas HPP, for which Bradesco served as advisor. These deals helped cement the bank’s strong positioning as a leading presence in all major investment banking categories in the region. Moreover, Bradesco achieved a 13% ROAE, one of the best among its peers. —TM

BEST IN FRONTIER MARKETS

Absa

Demonstrating its commitment to economic growth and sustainability across its African footprint, South Africa–based Absa has differentiated itself among its peers and is recognized as the Best in Frontier Markets. Its franchise covers 12 African markets and has a presence in major international financial centers. The bank facilitates investment in the region by executing complex financing and advisory transactions in frontier markets across the continent. This strategic role has led to participation in leading transactions in a range of sectors including energy, infrastructure, mining and sustainable finance. Absa participated in a lending facility to Genser Energy to finance a natural gas pipeline in Ghana. In the telecommunications sector, the bank arranged a debt offering for MTN Nigeria Communications. In Zimbabwe, Absa advised the sale of cement maker Lafarge. Recognizing the vulnerability to climate change for many frontier markets, the bank’s sustainable solutions address significant environmental challenges. It also established $6 billion goal in sustainable finance by 2025. In 2022, Absa advised Egypt-based Infinity Group and Africa Finance Corporation on the acquisition of Lekela Power. This $1.5 billion transaction represented the largest renewables deal in Africa and includes wind assets in the frontier market of Ghana. —DS

BEST MULTILATERAL FINANCE INSTITUTION

African Development Bank

Since 1964, African Development Bank’s goal is to spur sustainable economic development and social progress across 54 African and 27 non-African countries. This involves the dual objectives of inclusive growth and the transition to green growth, as it implements projects to improve the lives of all the communities it reaches. Global Finance recognizes African Development Bank’s ability to initiate a broad range of projects across the continent. This is accomplished by robust governance and strong executive leadership that operates effectively through a comprehensive strategy and policy framework. The bank’s initiatives are guided by internal mechanisms to ensure progress and include compliance reviews, environmental and social assessments, integrity and anticorruption reports, and extensive disclosure through a compendium of statistics on the bank’s projects. This vast array of projects and investments convey a sense of urgency with its mission. Bound by 17 sustainable development goals, the bank emphasizes research and knowledge-sharing to perform rigorous evaluations to make the most informed decisions with its projects to ensure sustainable development and poverty reduction. —DS

BEST BANK FOR CLIENT FACING TECHNOLOGY

Nedbank

The ability of leading investment banks to provide corporate clients with integrated banking services is essential to attracting and retaining business clients. Nedbank’s corporate and investment banking division offers a robust platform with Nedbank Business Hub and is recognized as our winner for Best Bank for Client Facing Technology. NBH is a single channel that allows Nedbank’s business clients in South Africa and across its African footprint to apply for new credit and banking products and make transactions efficiently through over 130 service offerings. Additionally, there is seamless access to multiple banking platforms, including NedTreasury, for global trade, FX, investment products and cross-border transactions, and NetBank Business, for cash management and payment transactions. Clients benefit from a range of functionality to deliver efficient account management through a robust user experience. The platform’s interface displays a single view of all product offerings, with secure access through the Nedbank Business Authenticator app for identity verification, and it features a simplified engagement process through digital documentation capabilities. —DS

BEST INVESTMENT BANK FOR SUSTAINABLE FINANCE

Societe Generale

Aiming to help clients gain a competitive advantage in both sustainable development and ESG risk management, Societe Generale holds the leading position on Sustainability Financing. It received various recognitions from international organizations and rating firms, such as IFR and MSCI. Societe Generale also raised 157 billion euros ($169 billion) in 2021, which significantly surpassed its 2020 sustainability-financing goal of raising €120 billion by 2023. The company set up a series of new commitments in 2022, including a new target to facilitate €300 billion of sustainable finance by 2025 to cover both environmental and social objectives and to reduce portfolio emissions with several emissions-related goals targeting intensive sectors such as power generation and oil and gas. In addition to its sustainability financing goals, Societe Generale’s “ESG by Design” program aims to implement ESG objectives into its operations by offering corporate social responsibility and decarbonization-related trainings to all employees. —LZ

BEST BANK FOR NEW FINANCIAL PRODUCTS

BTG Pactual

When the environment gets challenging and proceeds stop flowing at the same levels as in the past, banks tend to quickly cut investments in innovation and go back to the basics. Such wasn’t the case with BTG Pactual, our Best Bank for New Financial Products for the second year in a row. With a strong balance sheet for the year, the Brazilian-based giant maintained a focus on its long-term commitment to bring new and exciting products to its institutional clients in the fast-moving Latin American banking ecosystem. BTG innovated by creating small follow-ons that allowed retail trading for companies that had executed IPOs under ICVM 476, a piece of legislation that mandated an 18-month lock-up period for such offerings. Furthermore, the bank deepened its SME product offering with solutions that helped the segment’s credit market. As a result, the bank’s SME portfolio reached 14.1 billion Brazilian reals ($2.65 billion), with a more than threefold increase in comparison with the same period the previous year. Lastly, BTG invested heavily in integrating its digital platforms, further expanding the offering of financial products in both the fixed-income and crypto spaces. —TM

|

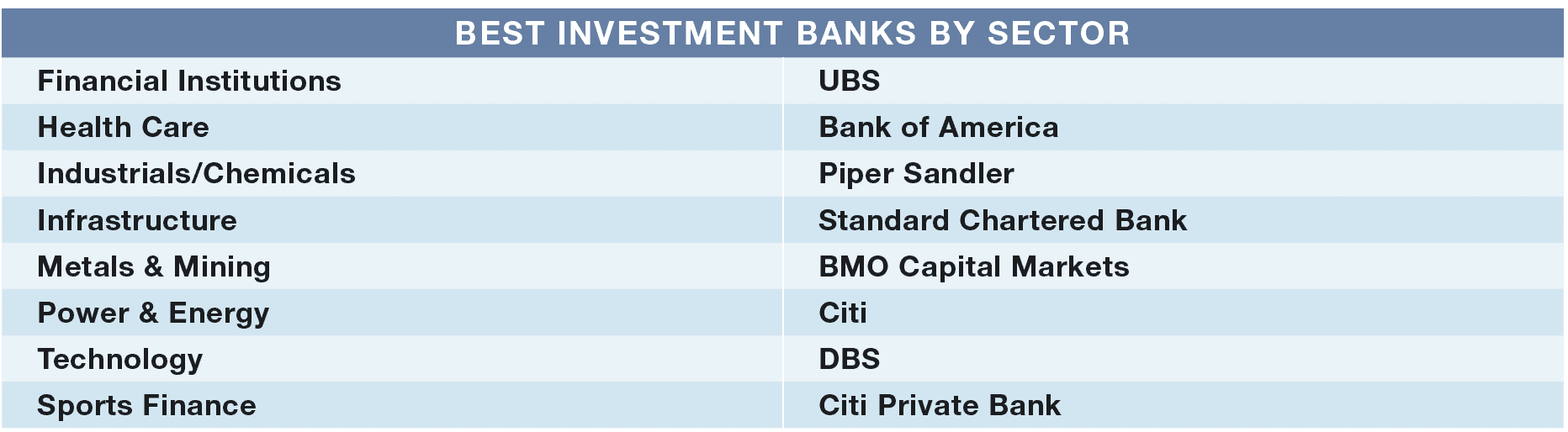

GLOBAL WINNERS BY SECTOR |

|---|

FINANCIAL INSTITUTIONS

UBS

UBS displayed exceptional guidance and delivery of strategic objectives amidst the geopolitical and market volatility that shaped the financial landscape throughout the year. Rather than just following the market, the Swiss-based giant set the tone by deploying its market expertise to assist clients across the finance industry when they needed it the most. In doing so, it cemented its position as a leading global reference for financial institutions and won Best Bank for Financial Institutions in 2022.

The successful sale of LeasePlan to ALD Automotive for €4.9 billion in January 2022 was a standout moment for the bank. It enabled the combined businesses to become the leading global mobility player, well positioned to lead the digital transformation of the industry and capture mobility sector growth. UBS also played a crucial role in the sale of Piraeus Bank’s real estate servicing entity in October 2022, furthering Piraeus’s broader strategic objective of delivering cost efficiencies and targeted asset utilization. Furthermore, UBS’s March 2022 participation in the sale of HSBC Greece to Pancreta Bank helped accelerate the transformation of HSBC’s European wholesale banking franchise.

HEALTH CARE

Bank of America

Bank of America (BofA) is our leading bank in health care and life sciences sectors. The bank views increasing investment in primary care as enabling access to quality medical care, driving economic mobility, and building stronger communities. In 2022, BofA took on several initiatives to advance health-care service equality and inclusivity, particularly for medically underserved communities. Among the initiatives were a $40 million finance deal for the development of community health care centers and other primary care facilities across the US, as well as a $25 million collaboration with leading health organizations to improve health outcomes in communities of color. BofA is also the largest private investor in non-profit community development financial institutions (CDFIs) in the US, with a total portfolio exceeding $2 billion. BofA also provided low-cost funding to CDFIs to enable these partners’ financing capacity to serve nationwide health care providers, particularly for low-income communities, such as a Federally Qualified Health Center in a Florida community where over half of residents live in public housing. —LZ

INDUSTRIAL CHEMICALS

Piper Sandler

In 2022, the massive rise in natural gas prices and increasing global borrowing costs combined to create a volatile environment for the industrials and chemicals industry. Despite the challenges, the sector saw a 2.2% growth throughout the year, albeit much weaker than the 6.1% growth in 2021. Against this backdrop, Piper Sandler’s strategic advice and dealmaking proved key for the industry at large. The bank was the lead advisor on three of the largest chemical LBOs of the year, including the acquisition of Nouryon by Carlyle Group and GIC; the acquisition of Solenis by Platinum Equity; and the acquisition of the specialty ingredients division of Lonza by Bain Capital and Cinven. Those deals totaled $21.6 billion in value. Piper Sandler also managed to finish the year strong; with the last three months of 2022 representing its best quarter of the year. On a full-year basis, the bank generated adjusted net revenues of $1.4 billion, generating an 18.8% operating margin and adjusted EPS of $11.26, making 2022 the second strongest year behind 2021. —TM

INFRASTRUCTURE

Standard Chartered Bank

Since 2020, many governments have prioritized infrastructure to stimulate post-pandemic growth. At the same time, transitioning to a low-carbon economy is becoming more urgent. Driven by the concurrent trends, supporting and facilitating sustainable infrastructure emerged as a significant opportunity for stakeholder collaboration and sustainability development. The inadequate infrastructure issue was escalated during the pandemic as evidenced by a widening infrastructure-financing gap. In Africa, Standard Chartered Bank remains committed to financing infrastructure to enhance economic growth. Notable infrastructure financing projects include the development of critical water supply infrastructure in Angola, and the technology operation platform establishing a digital lending solution for retail businesses in Nigeria. In Asia, Standard Chartered partnered with public-sector organizations such as UK Export Finance (UKEF) to provide funding for sustainable energy project, which helped facilitate the Asian economy’s green transformation. —LZ

MINING & METALS

BMO Capital Markets

As the foremost investment bank in the metals and mining sector, BMO Capital Markets assisted clients in navigating the volatile commodity markets in 2022 to lead financing mandates and advise on acquisitions and divestitures. It retained its status as the top metals and mining investment bank from our 2022 Best Investment Bank rankings. A long track record of leadership in the sector continues with advisory mandates covering 12 transactions for a value of $13 billion—a level that is almost double its next competitor. BMO is also first in the North American equity capital markets with over $800 million in issuance. Its commitment to critical materials within the sector is increasing with expanded research coverage of the battery materials space, and as an advisor to a large holder of lithium resources in the US. This emphasis will be reflected in its industry-leading annual conference with significant attendance expected from the auto sector, including battery manufacturers. With leading positions in ESG structuring and underwriting, the bank seeks to be a trusted partner in its clients’ move to net-zero with the establishment of an Energy Transition Group. It has adopted ambitious sustainability goals with a target of $300 billion in sustainable finance mandates by 2025. —DS

POWER & ENERGY

Citi

As volatility in the financial markets depressed the underwriting environment in 2022, one bright spot was found in the Middle East. Through its participation in large transactions across the power and energy sector, plus its ESG initiatives specific to its power and energy investment banking franchise, Citi is our winner for Best Bank in this sector. In addition to participating in the $1.3 billion Saudi Aramco Base Oil IPO, Citi also acted as a joint global coordinator on the Dubai Electricity and Water Authority (DEWA) IPO, which represented one of the largest issuances since Saudi Aramco in 2019. It’s also part of Dubai’s larger plan to list 10 state industries to raise new capital. DEWA indicated it intends to supply all of Dubai’s desalinated water capacity using clean energy by 2030, and this offering should assist with this transition. Through its recently established sustainability and transitions group with its power and energy business, Citi is accelerating its ESG goals by engaging with clients to assess net zero initiatives across its debt and equity underwriting and lending platforms with a target for corporate borrowers in the energy sector to cut emissions by 29% by 2030. —DS

TECHNOLOGY

DBS

DBS outperformed its international peers thanks to the bank’s decades-long technology evolution driven by customer-centric strategy. Its digital banking operation is built around four key pillars: augmented banking, open banking, automation banking, and intelligent banking—all of which are based on digital and data evolution aiming to enhance customer experiences and engagement. DBS’s digital transformation strategy started in 2014 with the bank’s significant investment on technology re-architecture. Three milestones that were achieved in 2018 have established DBS’s technology operation system: first, the Platform Operating Model that enables internal collaboration across the bank on 33 platforms, including shared data, resources, and reusable assets; second, an AI-powered engine that provides self-service digital options to customers; third, the Risk Platform that simplified credit procession with machine learning and on-demand cloud-based analysis. Since 2019, the bank tapped into new technologies and accelerated innovation programs. In addition to launching the DBS Digital Exchange and the DBS-Social Alpha Social Entrepreneurship program, DBS established programs like Climate Impact X to provide corporates with high quality carbon credits. —LZ

SPORTS FINANCE

Citi Private Bank

2022 was a year to remember in sports finance. With big American banks jumping into the European and Latin American markets, the sector’s M&A activity grew at an unprecedented rate. By October, Dealogic had documented 81 sports deals in the year, an impressive figure amid a slowing year for global M&A activity. Under the leadership of Ivo Voynov, Citi Private Bank, which leads the bank’s sports financing, stepped on the gas to take advantage of the year’s trend, securing solid growth. Citi largely benefited from its deal with UEFA to distribute seven billion euros to the region’s clubs throughout the year. But while the focus of global sports finance was European soccer, and also managed to participate in important deals in American sports including baseball and football. The bank now has over $1.5 billion in commitments across the four major North American sports leagues. Citi also had the vision to find opportunities outside the mainstream, by participating in the Aston Martin F1 deal, for example. —TM