Business upheaval and historic volatility in capital markets let regional investment banks show they can arrange sophisticated deals as more companies look to buy and sell.

Along with navigating a global pandemic and related business shutdowns, US regional investment banks last year had to contend with some of the most volatile capital markets in history.

Now that the banks’ corporate clients “see a light at the end of the pandemic tunnel” and are pivoting from the defensive stance they took through much of 2020, many are evaluating growth opportunities through acquisition, says Stephen Philipson, executive vice president and head of fixed income and capital markets with U.S. Bank, a subsidiary of US Bancorp, Global Finance’s regional winner in the Midwest.

“The changes in consumer and corporate behavior, coupled with the attractive cost of capital in the marketplace, is leading the vast majority of our customers to more closely evaluate and pull the trigger on M&A opportunities,” he says.

At the same time, many midmarket business owners are giving serious consideration to selling, says John Cristiano, partner, strategies and transactions with advisory firm Grant Thornton: “They just went through a pandemic and may not want to wait for the other shoe to drop.” Add in low interest rates, lots of “dry powder,” and the proliferation of special purpose acquisition companies (SPACs)—making for an easier path to public listing—and the result is a frothier market for mergers and acquisitions, he says.

Regional banks that succeed at investment banking tend to offer the same key propositions. One is a deep knowledge of the businesses in a particular geographic footprint. “They have an understanding of that space as well as the relationships,” says Patrick DellaValle, director in the financial services advisory and compliance practice at consultant Guidehouse. Regionals with expertise in specific verticals also benefit. “We saw a really high premium on domain expertise” over roughly the last year, he says, as some deals went to smaller firms owing to their understanding of specific sectors.

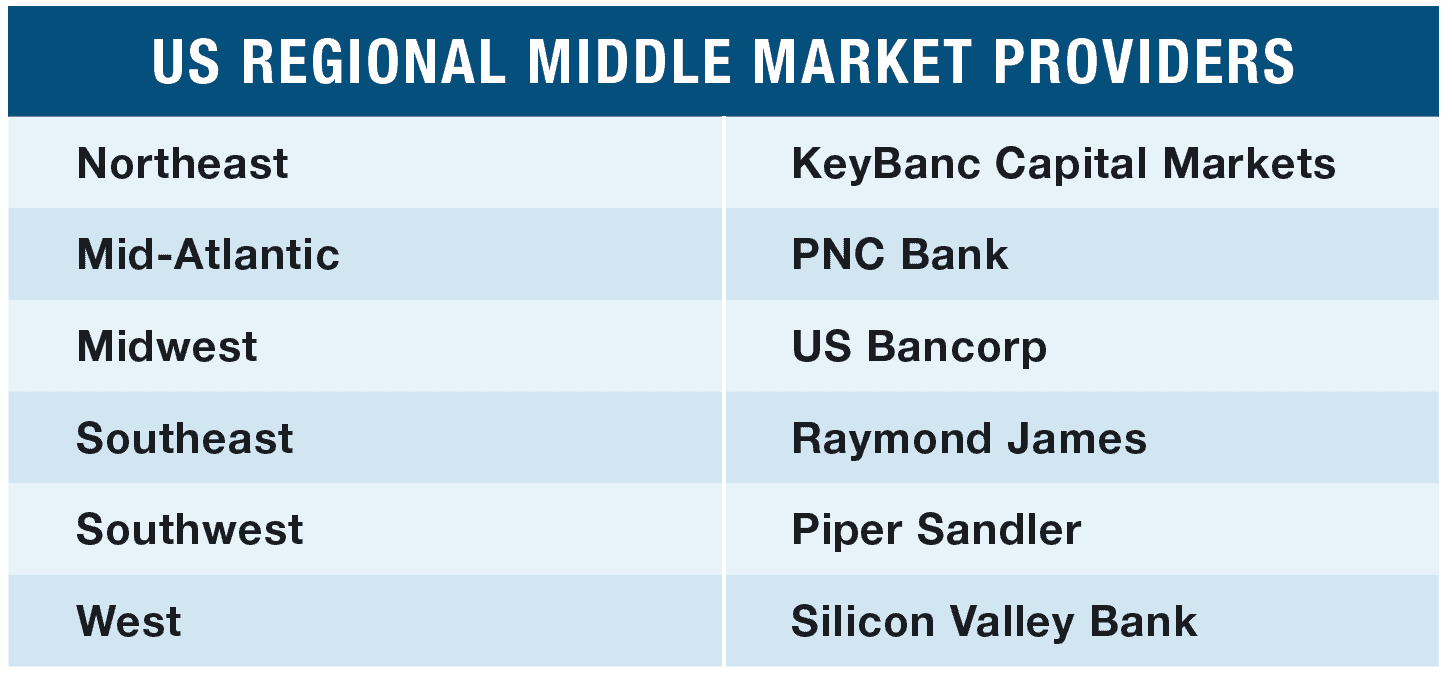

Northeast

KeyBanc Capital Markets takes the honors as Global Finance’s Best US Regional Middle Market Provider for the Northeast. With a deep focus on health care services, medical technology and life sciences, Cain Brothers, KeyBanc’s health care investment banking division, enjoyed record investment bank revenues in 2020 and started 2021 with a record M&A backlog.

Among other deals, it advised CareSource, an Ohio-based Medicaid nonprofit health insurer, on setting up a for-profit management services organization to access additional capital while maintaining its nonprofit status and charitable mission: likely the first transaction of its kind, according to Randy Paine, president of Key Institutional Bank.

Mid-Atlantic

Over the past few years, Harris Williams & Co., a subsidiary of our winner, PNC Bank, says it has completed more than 60 transactions across multiple verticals, including consumer products, food and beverage and retail. Early last year, it advised United PF Partners, a large developer within the Planet Fitness system, on its sale to affiliates of American Securities. In December, Harris Williams advised Inspired Pet Nutrition, a UK-based pet food manufacturer, on its pending sale to funds advised by CapVest Partners.

Midwest

US Bancorp focuses on fixed income markets, where it provides origination, sales and trading in corporate bonds, private placements, syndicated loans and other services, along with advisory services on capital structure.

The bank was especially active in two segments last year: utilities and sports, says Philipson. As Covid-19 hit, utility companies looked to bolster liquidity to ensure they could maintain service. US Bancorp provided $3 billion in capital to the industry, leading more syndicated loan transactions than any bank along with numerous bond deals and rate locks. It was also first in both number and volume of deals for sports teams and leagues in 2020.

Southeast

The capital markets group of Raymond James Financial earned record annual revenues of $1.3 billion and pretax income of $225 million for the year ended September 30. Among other transactions, it acted as financial adviser on Dollar Mutual Bancorp’s acquisition of Standard AVB Financial, a $158 million, all-cash transaction.

Southwest

Piper Sandler, the product of the January 2020 merger between Piper Jaffray Companies and Sandler O’Neill + Partners, focuses on midmarket companies in health care, energy, technology and other verticals. Post-merger, the company exceeded $1 billion in revenue. In one notable deal, Piper Sandler was financial adviser to Momentive Performance Materials in the sale—terms undisclosed—of its consumer sealants business to Germany’s Henkel. It was the first deal completed by The Valence Group, which Piper Sandler acquired last April as its chemicals and materials group.

West

In December, Silicon Valley Bank (SVB) announced a partnership with Clearbanc, a large e-commerce investor and funding platform, aimed at accelerating the growth of early-stage tech companies in the US. Clearbanc plans to provide more than $50 million in nondilutive capital to some of SVB’s clients, to use for growth, advertising and inventory financing.

Remaining Competitive

The transactions these regional banks completed during a global pandemic highlight the outsized role they can play in the investment banking world. While many are small enough to develop close relationships with their clients, they are also large and sophisticated enough to craft creative financing structures, says Joanna Chai, managing director, strategies and transactions at Grant Thornton.

During the 2008-09 financial crisis, many of the largest firms lost share to boutiques, Chai notes. The same thing could happen again, given that the deal process today—especially since Covid struck—is more streamlined, as many road shows move to virtual formats. Moreover, if talented individuals continue to leave costly urban areas for smaller towns, a few will start businesses, Some may look for boutique investment banks, Cristiano argues.

To continue to succeed, regional banks need to use their knowledge of local companies to bring together businesses in different industries, says Jason Langan, a managing partner in the M&A transaction services practice of Deloitte & Touche.

“With business models changing, folks who can marry business firms with the skills they need, like an industrial firm with a technology firm, can succeed,” he says.

Regional firms need to continue demonstrating “execution ability,” DellaValle says, showing they can place transactions, work with new structures like SPACs and offer systems for legal and regulatory compliance.

Trust remains an essential factor, Philipson adds: “Clients trust that the people on our team have the capabilities, appropriate insights into the marketplace and a strong balance sheet; and they trust that we will always do the right thing.” For banks that can offer these qualities, the future looks promising.