China’s biggest banks reinforced their primacy even in the face of crisis.

The coordinated intervention by governments and central banks working with the global banking sector to stabilize their respective economies took many forms. Stimulus programs were directed at individuals and households in the form of billions of dollars of direct fiscal stimulus checks and additional unemployment benefits, as well as through eviction moratoriums.

Banks also worked aggressively with retail and commercial clients to provide relief through loan modifications and extension of additional credit. Consequently, banks had tremendous inflows of cash from their customer base which, combined with factors such as the substantial drop-off in consumer spending, resulted in the significant expansion of bank balance sheets by the end of 2020, the date of reference for our rankings of the 50 Biggest Global Banks.

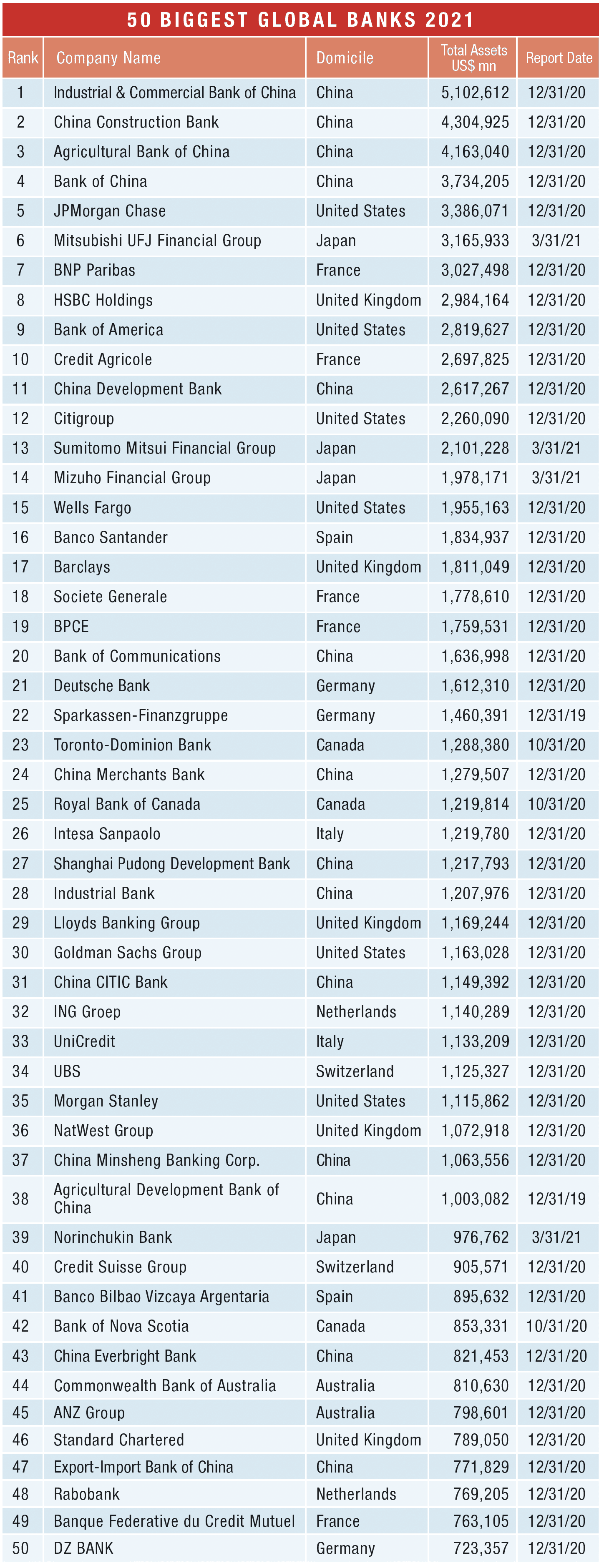

Total assets of these institutions rose 17% compared to 2019 and in aggregate represent $86.6 trillion, while the threshold for inclusion in our rankings increased 15%, or $95 billion, to $723 billion. There are only 12 banks on the list below $1 trillion in assets, versus 29 last year.

Chinese banks retained the top four spots, with leader ICBC assets topping $5 trillion for the first time, up 18% year over year in excess of the average for these rankings. Moreover, China’s representation on the list grew to 14 with the addition of The Export-Import Bank of China at No. 47.

J.P. Morgan Chase is now the fifth largest bank, rising two positions as assets rose 26% and outpaced the average of 17% among its US peers, which included Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley.

European banks hold 20 slots in this year’s top 50 with some solid asset expansion in Italy (+25%), France (+19%), The Netherlands (+15%), and Switzerland (+14%). Institutions advancing as a result include Intesa Sanpaolo (up 12 to No. 26), BNP Paribas (up two to No. 7), and Barclays (up two to No. 17). Other countries saw slightly slower asset growth in bank assets, including in Spain (+11%) and Germany (+9%).