Volatile markets spur innovation.

The past couple of years have been a roller coaster of foreign exchange (FX) volatility as the coronavirus pandemic has severely affected markets, resulting in plummeting oil prices and interest rate cuts. To help navigate such a challenging FX environment, banks and corporations have needed to dig deep to ensure they have reliable and timely data to make correct valuations, hedging strategies that balance risk and reward sufficiently and an understanding of FX exposures to uncover hidden risks.

Thankfully, technological innovation can help with these problems and has been at the forefront of the response to ongoing crises; and, as in other industries, technological innovation has been accelerated by Covid-19. Increased electronic trading, automated workflows and cloud-based offerings have helped the FX industry become more agile and resilient and provide the tools to solve liquidity sourcing, trade execution and fair access to market data—all areas of specific concern.

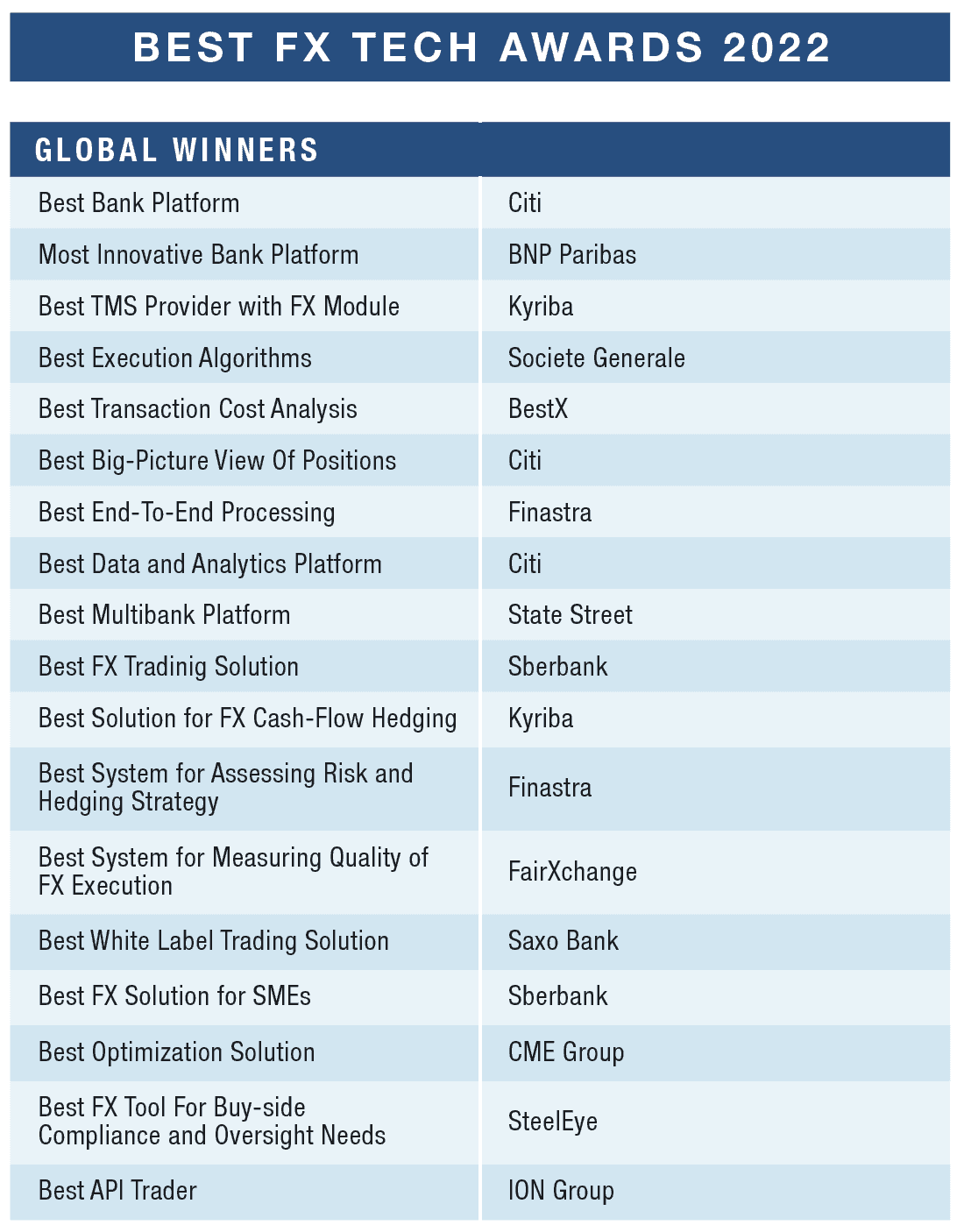

Citi, which won Best Bank Platform, Best Big-Picture View of Positions, and Best Data and Analytics Platform, invested heavily in technology in both CitiFX Pulse, its FX trading platform for corporate clients; and Citi Velocity, which provides data and analytics across the entire trade lifecycle, from pre-trade, to execution and post-trade to help clients with execution strategies and with regulation and compliance requirements. A recent upgrade incorporated environmental, social and governance (ESG) scores into the platform, helping clients to understand their ESG exposure within their portfolios and report on their investments from a sustainability perspective.

BNP Paribas, which won Most Innovative Bank Platform for its Cortex FX platform, expanded its artificial intelligence–driven digital trading assistant, ALiX, to cover its full FX product suite. Originally developed for algorithmic trading, ALiX can now also assist with spot trades, forwards, swaps, options and orders.

The increasingly electronic nature of FX markets boosted FX algorithmic trading volume.

A 2018 study by industry research firm Greenwich Associates, revealed that “58% of traders (including corporates) found that algorithms materially reduce overall trading costs.” At the same time, more than a quarter of traders polled responded that using trading algorithms for their simple orders provided them more time to address their complex orders.

Emerging technologies are helping banks create sophisticated algorithmic trading suites to suit risk appetites. Societe Generale, Best Execution Algorithms winner, offers algorithmic execution tools to suit a wide array of clients. The bank’s TWAP+ algorithm lets clients trade along a predefined scheduled profile to get an average price over a set period and includes a random camouflage mode to vary intervals, helping avoid detection by other traders. Its Nightjar algorithm is stealthier still—putting passive orders into the market, spread into different liquidity pools—taking liquidity when opportunities arise. The Falcon algorithm, meanwhile, targets several liquidity pools, executing orders as quickly as possible.

Simple Solutions Bring Clarity

The winner of Best FX Trading Solution and Best FX Solution for SMEs, Sberbank, developed an algorithm that ensures execution at Russia’s central bank rate plus the fee—providing a guaranteed rate for a fixed cost—a simple solution with full transparency.

To make hedging more amenable to small and midsize enterprises (SMEs), “We decided to focus on our sales strategies and come up with explanations of derivatives that can be easily understood by nonprofessional FX customers,” explains Alexander Zozulya, senior managing director of Global Markets at Sberbank. “With that in mind, we carried out a series of interviews with our SME clients. For SMEs, we present forwards as an instrument to fix an exchange rate and other parameters today but pay at an agreed-upon date in the future. Forwards can help SMEs in several ways, such as helping to avoid currency fluctuations and therefore achieve more-stable cash flows and better planning, given that the costs for currency exchanges are fixed and known in advance.”

Sberbank also emphasizes sharing its knowledge and expertise with its SME customers—providing, for example, a series of articles and media content about the nature of currency risk, common strategies to decrease it and specific offerings that Sberbank already provides.

Kyriba, the winner of the Best TMS Provider with FX Module and Best Solution for FX Cash Flow Hedging awards, provides several ways to help clients gain a full picture and understanding of their data. “The hardest problem corporate risk managers face when it comes to managing currency risk is having access to timely, complete and accurate exposure data,” explains Wolfgang Koester, chief evangelist at Kyriba. “Automation and data collection workflows with built in data-integrity checks allow corporate risk managers to shift the focus from data gathering and validation to in-depth exposure and risk analysis. Combining automation with analytics and business intelligence across a fully connected platform empowers corporate risk managers to focus on optimizing their FX risk management programs to consistently achieve their FX risk reduction objectives in the most cost-effective way.”

BestX, the Best Transaction Cost Analysis winner, has improved the way liquidity providers (LPs) can better understand their level of performance with clients. By enhancing its methodology with the release of RFQ Par—a new analysis tool that provides an expected win rate relative to the panel size—a buy-side client can see where its LPs are delivering the best value, while sell-side firms can assess their own performance.

State Street, which won best Multibank Platform for its FX Connect, offers a multicurrency, multibank FX trading platform that provides real-time FX execution, comprehensive trading capabilities and process efficiencies. Meanwhile, Finastra, who took home both the Best End-to-End Processing and the Best System for Assessing Risk and Hedging Strategy awards, developed SeamlessFX, an end-to-end eFX platform across distribution, position-keeping, post-trade and payments. It offers a tailored solution that integrates with any existing dealing and back-office systems.

Best System for Measuring Quality of FX Execution was awarded to FairXchange, a financial market data-science firm, for its Horizon analytical tool, which brings clarity and transparency to execution performance. The software achieves this through the provision of independent data that it has designed to help users collaborate with counterparties to produce better outcomes.

Saxo Bank, with its outsourced multiasset trading and investment infrastructure for banks, brokers, fintechs, insurance companies and wealth managers won Best White Label Trading Solution; while Best Optimization Solution went to CME Group, whose TriOptima risk mitigation services help financial firms optimize resources, keep pace with regulatory requirements and implement market best practices to lower costs, reduce risk and improve counterparty exposure management. In September, the exchange operator launched a 50/50 joint venture with IHS Markit, dubbed Osttra, which is the new home of the TriOptima services.

Rather than solving individual regulatory problems, SteelEye, which won Best FX Tool for Buy-side Compliance and Oversight Needs, captures, cleanses, indexes and analyzes vast volumes of clients’ structured and unstructured data from a range of sources. Once in the SteelEye platform, clients can then use one or more of SteelEye’s compliance offerings to reduce their risk, lower costs and “unleash the power” of their data.

ION Group won Best API Trader for its MarketFactory futures product, which covers all FX workflows and instruments, with speeds of 5-7 microseconds, giving access to equities, energy, rates and agriculture. Following a recent upgrade, MarketFactory’s Whisperer API now supports all FX instruments: spot trades, forwards, nondeliverable forwards, swaps, nondeliverable swaps, options and futures.

This year’s FX winners all developed innovative ideas that bring improved clarity and efficiency to the FX markets; but if a June 2021 report by financial services research and advisory firm Celent is true—The Future of FX Technology, stating that “FX is at the greatest inflection point since [then US President Richard] Nixon decoupled the dollar from gold in 1971”—then disruption and transition across the FX industry will continue at pace.