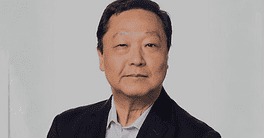

Levan Gomshiashvili, chief Marketing and Digital officer at Bank of Georgia, explains the importance of technology and partners in providing exceptional user experience.

Global Finance: What steps have you taken to create a seamless and intuitive digital banking experience?

Levan Gomshiashvili: Creating a seamless digital banking experience is all about putting the customer first. At Bank of Georgia, we believe that a truly exceptional digital banking experience is built on deep customer insights. That has been instrumental for us in designing intuitive interfaces and streamlined processes.

To cater to the increasingly mobile-centric lifestyle, we have adopted a mobile-first approach. Our app is designed to be the primary touch point for our customers, offering a seamless experience for managing their finances on the go.

Ultimately, our goal is to create a digital banking ecosystem that puts customers at the heart of everything we do. By combining customer-centricity with cutting-edge technology, we’re building a future-proof platform that exceeds expectations.

GF: How do you prioritize customer feedback and incorporate it into product development?

Gomshiashvili: We understand that the key to successful product development lies in listening to and understanding our customers. We have seamlessly integrated customer feedback management into our product development process, leveraging customer data, artificial intelligence [AI] and tools like Medallia and Fullstory. Our teams across multiple departments—such as Customer Experience, UX Research, Customer Success Management, etc.—actively engage with our customers to identify their needs and gather valuable feedback.

This feedback is transformed into actionable recommendations for product improvements. Their insights directly shape our offerings, ensuring that our products are aligned with their expectations and needs.

GF: How are you using AI and machine learning to enhance customer experiences and improve decision-making?

Gomshiashvili: At Bank of Georgia, we leverage AI and machine learning to significantly enhance customer experiences and improve decision-making.

Overall, we have more than 50 AI models in production. Our largest AI use-case is naturally in credit decisioning, where we have achieved over 95% automation for consumer loans. This allows customers to obtain loans online under two minutes, 24/7.

On the sales side, we have implemented an AI-powered recommendation system in our mobile app, which has increased digital sales by 10%. This system provides personalized recommendations to customers, improving customer engagement.

Another use-case for us is automating a third of our customer chat interactions using an advanced AI chatbot. This automation provides instant responses to common queries and allows our human representatives to focus on more complex issues, enhancing overall operational efficiency as well as customer satisfaction.

GF: What do you see as the future of banking, and how is your bank positioned to capitalize on emerging trends?

Gomshiashvili: The future of banking is undeniably digital, personalized and inclusive. We foresee a landscape driven by AI, blockchain and open banking, enabling hyper-personalized financial solutions and seamless customer experiences.

Our bank is strategically positioned to capitalize on these trends. We are investing in digital infrastructure, data analytics and cybersecurity to deliver innovative products and services. By fostering a culture of innovation and agility, we are well equipped to partner with fintechs and leverage emerging technologies to create new revenue streams. Our focus on customer-centricity ensures we stay attuned to evolving needs and expectations, enabling us to maintain a competitive edge.

GF: How do you choose the best partnership ecosystem to expand your offerings?

Gomshiashvili: Building a successful partnership ecosystem requires a strategic approach. We prioritize partners who align with our customer-centric vision and complement our core competencies. We seek collaborations that expand our market reach, enhance our product offerings, and drive innovation. By carefully evaluating partners based on their strategic fit, technological capabilities and shared values, we aim to create mutually beneficial relationships that deliver exceptional value to our customers.