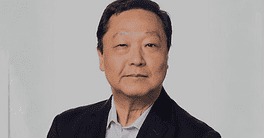

Challa Sreenivasulu Setty took over as chairman of the State Bank of India, named Best Consumer Bank, in August of last year. He discusses SBI’s digital journey, the trajectory of its consumer banking businesses, and the challenge posed by AI and fintechs.

Global Finance: The State Bank of India (SBI), the country’s largest bank, posted solid returns in 2024. How did you achieve this, and is it repeatable?

Challa Sreenivasulu Setty: Our strong fiscal-year 2025 performance stemmed from a disciplined growth strategy, prudent risk management, and leveraging our diversified portfolio. We saw healthy credit growth across the retail, SME, and corporate segments. Most importantly, we achieved these returns while improving asset quality, led by robust underwriting, rigorous credit monitoring, and recovery efforts. We balanced loan book expansion with strong low-cost deposits, ensuring stable margins. This was underpinned by cost efficiencies from digitalization. We are confident that these results are sustainable as they rest on the pillars of consistency, productivity, and resilience. As India’s economy continues to expand, we see opportunity for SBI to grow while maintaining our capital position, technology edge, and customer trust.

GF: What are the latest consumer banking milestones SBI has reached on its digital transformation journey?

Setty: SBI’s digital journey is spearheaded by our flagship You Only Need One [YONO] platform, which offers both mobile and branch banking.

YONO has surpassed 90 million registered users, with over 65% of savings account openings and over 40% of personal loans sourced digitally. We also have 140 million registered users on our Retail Internet Banking platform, besides 7.2 million registrations on WhatsApp Banking, which is currently being offered in six languages.

This scale demonstrates our success in driving digital inclusion; we are bringing millions of customers, from urban millennials to rural users, onto digital banking. Initiatives like YONO Business, YONO Global, video-KYC onboarding, and end-to-end loan processing are redefining convenience. The next phase is embedding generative AI for hyper-personalization and predictive engagement, making digital not just a channel but the core of our customer experience.

All these efforts underscore SBI’s digital transformation journey. From an institution with over 200 years of legacy, we have reinvented ourselves as a future-ready, digital-first bank.

GF: How is SBI improving customer experience in consumer banking? What role does AI play?

Setty: Enhancing customer experience is central to everything we do at SBI, driven by an unwavering customer obsession that shapes our decisions and priorities. To improve service quality, we measure customer experience using various metrics and are simplifying processes to reduce turnaround times. Our omnichannel and multilingual approach ensures seamless transactions across platforms.

By using analytics and AI, we are moving toward an anticipatory customer service approach rather than merely pushing generic offers as a reactive approach. Branches are being reimagined as advisory hubs while routine services are being migrated to digital channels. Our mission to be the Bank of Choice is built on trust and rests on delivering superior, personalized experiences at every touchpoint.

GF: Where do you see growth in the coming year for consumer banking and the geographies SBI serves?

Setty: Domestically, SBI already has unparalleled reach, but we see significant headroom to grow further in consumer banking across India’s length and breadth. The growth in consumer banking will primarily come from proactively fulfilling the evolving needs of people as the middle-income classes grow and scaling of firms creates new wealth and redistribution opportunities.

SBI’s retail personal loan book grew in the range of 11% to 14% in the last few quarters owing to robust growth in housing loans. Retail credit, particularly home loans and personal loans, will remain our growth engines. We are also expanding in semiurban and rural geographies, supported by financial inclusion initiatives and government schemes.

Internationally, we see potential in markets with large Indian diaspora populations, and digital expansion through YONO Global roll-out is enabling us to serve geographies where we do not have significant physical presence. We are deepening our reach by selling more products per customer and widening it by entering new markets across the globe.

This two-pronged approach gives us confidence that SBI will continue to expand vigorously, both at home and abroad.