High energy prices could prove to be a tonic for a market that has been under the weather for the past few years. Global Finance selects the winners from a shrinking group of banks with the appetite to take on some big risks.

THE PROJECT FINANCE

market is stirring once again, following several years of declining activity and the exit of a number of major banks from the business.We are seeing a surge of activity now, says Chris Beale, a managing director and global head of project and structured trade finance at Citigroup. My people are working longer hours and going home later. Current high energy prices and a shortage of natural gas in the United States are fueling an upsurge in a wide range of energy-related projects, from LNG production facilities, ships and receiving terminals to oil and gas platforms and pipelines, Beale says.

The biggest energy projects planned will be in the Middle East and Russia, as well as in the rest of the former Soviet Union,Africa and Latin America, he says.The LNG import terminals will be built in the US and Europe. Meanwhile,the blackout in parts of the US and Canada in August is expected to eventually result in the upgrading of power networks.The energy patch is not the only area showing signs of recovery. Infrastructure is bursting with project activity,which is centered on Western Europe and the countries getting ready to join the European Union.

This year, Citigroup is once again the winner of Best Global Bank in Project Finance, as well as Best Global Telecom Bank, and it won top regional honors in North America, Latin America and the Caribbean, and Asia. The only global giant in project finance left standing, as other major banks have retrenched, Citigroup continues to lead the market in every category, including advice, loans and project bonds.Many of its competitors have dispersed project finance staff to other areas and are approaching the market on an ad hoc basis.

The thinning of the ranks of financiers has made some major project sponsors nervous about debt capital drying up,Beale says.But the Japanese banks are coming back into the market,which is a good sign, he adds, and the pure investment banks occasionally lend using the project structure. Meanwhile, more sponsors are turning to local bond markets.

Taking advantage of its global reach, Citigroup has arranged more local-currency finance than its competitors, thereby greatly reducing currency risk to its borrowers.

Jeff Thornton, head of infrastructure finance at Royal Bank of Scotland in London, says worries about the availability of financing may be overdone. Several recent projects have been heavily oversubscribed, he says.There are also some new banks entering the market, and sponsors are relying more heavily on project-bond investors.Royal Bank of Scotland is winner of Best Global Infrastructure Bank and Best Bank in Western Europe.The latter region was the most-active area in the first half of 2003, with 43 deals worth $13 billion, according to Dealogic ProjectWare,which maintains a global database covering project finance transactions.

The largest deal to close in the first six months was Metronets $4.87 billion London Underground PPP, or public-private partnership.Metronet,a private-sector consortium, will rehabilitate and maintain two of three groups of lines in the London subway system.

Not only was Royal Bank of Scotland mandated lead arranger for Metronets PPP, but it also is advising on the proposed $13 billion Crossrail project, which will link east and west London. The project involves a purposebuilt tunnel that will cut the journey time for conventional surface trains through the center of the city.

Analysts say there are plenty of new projects coming down the pike, with major petrochemical plants in China, an Egyptian LNG facility and renewable-energy projects such as windmill farms on the drawing boards.

In selecting the Best Project Finance Banks, Global Finance editors considered the banks quantitative performances in the year through June 30, 2003, as well as subjective criteria, including innovations in structuring and financing deals and strength of project finance teams.

GLOBAL

CITIGROUP

Citigroup is the most global participant in the project finance market, with the ability to deliver financial advice and funding for projects in developed and developing countries.

Citigroup raised $40.5 billion of capital in public and private markets last year for 80 projects in 34 countries. It advised on another 34 projects in 19 countries with a financing value of $49 billion.

The bank also took a leadership role in developing the Equator Principles,which have become the industry framework for ensuring that projects are developed in a socially responsible manner and according to sound environmental management practices.

Citigroup is the only bank that has been number one in project bonds,loans and advisories for the past two years. It has provided innovative financing in local currencies and opened up new markets to project financing. Citigroup was sole financial adviser to Algerian Cement and sole lead arranger of a $156 million financing to build a cement plant. The deal, which closed in March 2003,was the first limited-recourse financing in Algeria. In Nigeria, Citigroup was sole financial adviser to the sponsors of a $1 billion project for Nigeria LNG. Using separate deal teams, the bank acted as both international lead arranger and local lead arranger for the financing, which was the largest nonrecourse financing ever in sub-Saharan Africa.It also advised on the $460 million financing of four LNG vessels that will be dedicated to the project.

Citigroup arranged $794 million of Chinese yuan funding for the Integrated Petroleum Site power project in China, $486 million of Malaysian ringgit for cellular operator Celcom, and $147 million of Indonesian rupiah for Telkomsel. It also arranged $95 million of Thai baht funding for the Star Petroleum Refinery project, $85 million of Jamaican dollars for the Mossel cellular project, and $35 million of Venezuelan bolivars for Digitel. Such local-currency financing reduces currency risk and provides a better match of project revenue to borrowing.Citigroup has widened the project bond market by making use of official agency-backed bonds and by combining bond financing with bank loan financing for more advantageous terms to its clients.

GLOBAL INFRASTRUCTURE

ROYAL BANK OF SCOTLAND

Royal Bank of Scotland rules the transportation league tables. The bank was bond lead arranger on Metronets $4.87 billion London Underground PPP, or public-private partnership. Metronet, a private-sector consortium, will upgrade and maintain two-thirds of the London subway system.

RBS was mandated for the $1.3 billion Western Sydney Orbital Road project in Australia, the countrys biggest urban toll-road project. Also in Australia, the bank was joint lead arranger of debt for the Alice-to-Darwin Railway,which will complete a north-south trans-continental crossing by the rail network.

Infrastructure was the best-performing sector overall during the first half of 2003, according to Dealogic ProjectWare.Some 48 infrastructure projects, worth $15.2 billion, closed in the first half, compared with 49 projects, worth $11.3 billion, in the same period of 2002.

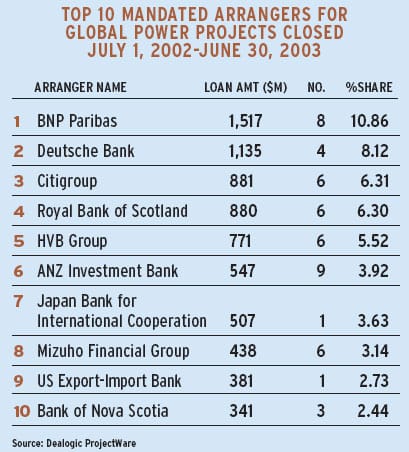

GLOBAL POWER

BNP PARIBAS

BNP Paribas arranged numerous power-sector transactions worldwide in the 12 months through June 2003. The Paris-based bank was lead arranger for the $1.92 billion acquisition of Interpower, the third generating company privatized by Enel of Italy. BNP Paribas also was lead arranger for the $900 million acquisition of the Tirreno Power portfolio of power plants in Italy.

In the US,the bank was co-arranger of the $1.3 billion Entergy refinancing and the $203 million Great Plains Energy refinancing. In Australia, BNP Paribas was co-arranger with Deutsche Bank of the $714 million United Energy refinancing. It also led the $107 million Lake Bonney Windfarm project financing in South Australia.

The bank arranged power plant construction deals for Rijnmond of the Netherlands and Ankara Bo of Turkey.

GLOBAL OIL AND GAS

WESTLB

WestLB is a repeat winner as the best global oil and gas project finance bank, with a string of notable accomplishments. The German bank was the lead arranger and bookrunner for the $325 million financing of the Cameron Highway Oil Pipeline Project.The 390-mile pipeline system will transport crude oil from deepwater drilling platforms in the Gulf of Mexico to refineries in Texas.The financing, which closed at the end of June 2003,was a combination of bank debt and a private placement.

The bank was the sole lead arranger for $395 million of financing for the construction and operation of a methanol plant in Trinidad and Tobago.Atlas, a joint venture of BP International and Methanex of Canada, is building the facility, which will be the largest in the world.

WestLB closed on a $300 million sale and leaseback of three platforms for Brazilian oil company Petrobras late last year.The bank also was lead arranger of $200 million in financing for the purchase of a 6,000-mile natural gas pipeline from Oklahoma-based Williams by a unit of AIG Highstar Capital.

GLOBAL TELECOM

CITIGROUP

Citigroup acted as sole financial adviser, sole bookrunner and global coordinator to the largest telecom financing in sub- Saharan Africa, the $252 million financing for Cell C, the third national cellular operator in South Africa. In September 2002 Citigroup closed the largest project finance deal in the Latin American telecom market last year, a $515 million facility for Digitel, Venezuelas third-largest mobile operator and the largest GSM operator in the country. In a financing for Indonesian mobile phone operator Telkomsel, Citigroup arranged for the German and Swedish export credit agencies to provide the highest level of cover available for political and commercial risk for a euro term loan,without a sovereign or bank guarantee. Citigroup also was involved in the $2.4 billion refinancing of the Jupiter Telecommunications expansion project in Japan.

NORTH AMERICA

CITIGROUP

Citigroup was the number one mandated arranger for North American projects in the year through June 2003, according to Dealogic ProjectWare. In February 2003 the bank closed on a $125 million tax-exempt bond offering by the New Jersey Economic Development Authority on behalf of Port Newark Container Terminal.Citigroup acted as sole lead arranger and underwriter and issued a $127 million letter of credit on behalf of the bondholders.The tax-exempt financing enabled the borrower to achieve long-term, low-cost financing for the project, which will combine two existing terminals.

Last December the bank closed a $430 million non-recourse leverage-lease financing of a coal-fired generation facility in Choctaw County,Mississippi.The financing was executed in a difficult market with sole credit support from a Tennessee Valley Authority power-purchase agreement.

LATIN AMERICA AND CARIBBEAN

CITIGROUP

Citigroup acted as joint lead arranger of a $515 million project finance deal for Digitel of Venezuela, structuring the transaction to balance the borrowers financial requirements with the capacity constraints of an uncertain market.The deal was funded using a shareholder support that triggers a six-month debtservice guarantee and contingent equity support. The transaction successfully introduced the sponsor,Telecom Italia Mobile, one of the largest telecom operators in the region, to the limited-recourse project finance market.

For the Altamira II financing of a gas-fired power plant, Citigroup persuaded NEXI of Japan to provide extended political risk cover for a Mexican project for the first time ever.This is the first power project where a Pemex subsidiary is directly responsible for the supply and transportation of fuel.

Citigroup also arranged local-currency financing for the Mossel cellular project in Jamaica.

WESTERN EUROPE

ROYAL BANK OF SCOTLAND

Royal Bank of Scotlands financial strength and underwriting capabilities have helped it to climb to the top of the league tables for Western Europe.The bank has project financing expertise in a wide range of sectors, from infrastructure to UK public housing finance and energy-related projects.The banks involvement with the modernization of the London subway and its advisory role for the London Crossrail project demonstrate its infrastructure prowess.

RBS is able to handle all steps of major projects,from initial feasibility studies to the structuring and arranging of finance. It has a lot of experience with the public-private partnership model, which is being exported from the UK to the Continent and elsewhere.

CENTRAL & EASTERN EUROPE

SG

SG and fellow French bank Crdit Agricole served as mandated lead arrangers for Maritza East III, the first private power project in Bulgaria.The French banks were able to secure co-financing arrangements with four Bulgarian banks to provide $400 million in loans to help rehabilitate the coal-fired power plant near the southern city of Stara Zagora. The financing demonstrated the viability of arranging multiple sources of funding for project finance structures in the Balkans.Maritza East III is a joint venture between US-based Entergy and Bulgarias government-owned electric company.

SG also is leading a syndicate that is providing $400 million in loans to finance the purchase of equipment to complete the Cernavoda- 2 nuclear power plant in Romania. The loans are fully guaranteed by the Romanian government.

ASIA

CITIGROUP

Citigroup was involved in several landmark deals in the Asian region in the 12 months through June 2003. It was financial adviser and co-coordinating lead arranger for the largest limited- recourse project financing ever completed in China, the $1.05 billion financing of an integrated petrochemical site in Nanjing. The transaction also was notable for the cooperation involved between foreign and Chinese banks.The financing provided for a common-terms agreement for the US-dollar- and yuan-denominated debt. Citigroup was able to secure its lead-arranger role by making a $700 million sole underwriting commitment.

Citigroup was financial adviser and sole lead arranger and facility agent for a $147 million financing in November 2002 for Telkomsel to build a nationwide GSM network in Indonesia. The financing, which was supported by export-credit agencies Hermes of Germany and EKN of Sweden, was accomplished with neither a sovereign nor a bank guarantee.

AUSTRALASIA

ANZ INVESTMENT BANK

With a team of 100 project finance specialists, ANZ Investment Banks main geographic focus is on the Asia-Pacific region, including its home base of Australia.While project finance activity worldwide has slumped in recent years,Australia continues to be active.ANZ has taken a lead arranger role in almost all of the significant transactions in Australia, where the bank is also extending its reach to a larger number of smaller projects.

ANZ provided $260 million of financing for TM Energys 50% interest in the Tarong North coal-fired plant in Queensland. Complex structuring and security arrangements are included in the projects 20-year electricity agreement with Tarong Energy, which is owned by the Queensland government.

The banks $790 million refinancing of Hazelwood Power in Victoria for majority owner International Power was the largest merchant power deal that closed in Australia last year.

MIDDLE EAST & AFRICA

BNP PARIBAS

BNP Paribas maintains an extensive network in the Middle East and is setting up an Islamic finance unit in Bahrain. The Paris-based bank also manages the largest banking network in French-speaking Africa. The bank has advised, structured, funded and syndicated project financing in all major markets, with a focus on power and oil and gas.

The bank was the mandated lead arranger for the $969 million Omifco fertilizer project in Oman.The venture of Oman Oil and two Indian cooperatives will produce ammonia and urea to supply the Indian market. BNP Paribas also was lead arranger of the $1.16 billion Oryx GTL natural gas-to-liquids project in Qatar.

In Africa, the bank was lead arranger for the $2.1 billion Nigeria LNG-Plus expansion project, which will supply liquefied natural gas to the US market.

Gordon Platt