The nation’s banks have benefited from a strengthening economy, but now they must look overseas for growth. And there lies more risk.

Taiwan’s banks at first blush seem to be in an enviable position. The nation’s economy is in recovery, even as Asia feels the headwinds of a slowing China, which in early March offered its lowest growth target for decades at 7%. Meanwhile, Taiwan has been revising its projections upward on the back of stronger US demand, robust domestic consumption and lower energy prices.

In an unusual circumstance, the wind seems to be at Taiwan’s back—at least for now.

GDP will grow by 3.8% this year, the government said in early March, an improvement over the 3.7% growth reported for 2014 and better than the 3.5% figure that was the consensus of earlier projections.

The nation is doing better thanks to exports, which account for over 60% of Taiwan’s GDP. That improvement has occurred even though the New Taiwan dollar has depreciated less than the Japanese yen and Korean won during the recent rise in the US dollar. Vivien Hsu, president of Fubon Financial, told Global Finance this could attract foreign investors and fund flows.

Taiwan’s relative stability, in her view, may be an asset as growth on the mainland slows. “China’s economy is experiencing a transition from high-speed growth to a modest yet more sustainable pattern,” says Hsu, noting that Taiwan has already gone through such a transition.

As banks, we need to survive in this congested environment. Going overseas will be very important to us.

~ Joseph Jao, Taishin Financial Holding

All this is to Fubon’s benefit, she asserts. The bank’s 50-year history will provide the institutional knowledge necessary to enable Fubon to “seize the growth opportunity in China,” Hsu claims, adding that this expected pickup in business has already begun. She points to strong premium growth in Fubon’s China insurance unit, noting that “Fubon Bank China presented an improving trend in asset quality in 2014 [against] the backdrop of the economic slowdown.”

But such interest on the part of Taiwanese banks in China and elsewhere in Asia has not gone unnoticed by the rating agencies, where it is registering with some alarm.

OFFSHORE EXPOSURE

Fitch Ratings, for instance, observed on March 1 that Taiwan banks’ offshore exposures will continue to grow as a percentage of all assets. It seems likely. The country’s legislature at the start of the year amended the national banking law, raising the cap on banks’ overseas investment to 40% of net worth. The previous limit had been 40% of paid-in capital. According to the rating agency, the higher ceiling means the banking sector will have an additional 400 billion to 500 billion New Taiwan dollars

($13.3 billion to $16.7 billion) to invest in offshore acquisitions.

“The regulatory changes indicate that the authorities are prepared to adopt a more accommodative position when it comes to offshore investment, rather than stifle the banks’ growth, since domestic prospects are more muted,” notes Cherry Huang, financial institutions analyst for Fitch in Taipei. She adds, “The rule changes also point to efforts to diversify regional exposure and reduce concentration risk in China.”

So what’s the problem? As Fitch sees it, Taiwan’s banks have little choice but to seek their fortunes overseas in Asia, and their risk management is likely to be tested as a result. The best-case scenario is that risk is not built up exclusively in China but diversified into developing markets across Asia.

“Taiwan is a very competitive market,” Taishin Financial Holding president Joseph Jao told Lloyd’s List, estimating its size at $500 billion. “Basically, the market is very congested.” The economic boom years are over, he concedes. “We don’t expect to see the economy ever grow at 10% per annum,” Jao says. “As banks, we need to survive in this congested environment. Going overseas will be very important to us.”

REGIONAL EXPANSION

Banks are indeed looking beyond China for expansion opportunities this year. Taishin as well as First Bank, Cathay United Bank and E.Sun Bank opened branches in Myanmar last year. Mega International Commercial Bank, Shin Kong Commercial Bank and Bank of Taiwan have received licenses to set up representative offices in the nation. Several banks opened representative offices in Laos in 2014. CTBC has extended a sizable footprint into neighboring countries in Southeast Asia, with 11 branches in Indonesia, 24 in the Philippines and offices in Singapore and Vietnam.

And the expansion is not just restricted to the “frontier” markets of the Association of Southeast Asian Nations (Asean). Taiwanese banks, for example, have opened branches in Mumbai, India.

But the rush to Myanmar is an instructive example of why diversification from China risk is easier in theory than in fact. Competition is so intense in Taiwan’s banking market that as soon as the government granted permission to establish a presence in Myanmar’s recently opened economy, virtually all the banks moved to recreate the same competitive situation they were fleeing at home.

In fact, banks don’t leave competition at home when expanding in Southeast Asia, where the environment is increasingly saturated and the size of the economies relatively small—compared with the mighty mainland. In China, banks face a market where competition may be fierce in commoditized banking, but as Hsu of Fubon Financial implies, a bank with experience can find a lucrative corner and grow safely, or at least hope to do so.

That’s why Taiwan’s bankers see little alternative but to tackle the challenge of China. Some are pushing the limits with their investments. Hsu says that Taipei Fubon Bank’s China exposure was around $4.9 billion as of January 15, in compliance with Taiwan regulators’ rule that banks’ aggregate China exposure should not exceed a bank’s book value.

But the definition of exposure is broad, including traditional lending, interbank lending, investments in the China subsidiary itself and other investments related to China counterparties. That requires the banks to apply all their risk management acumen. “We take precautions to manage China risks along with the growth,” says Hsu. These include pre-screening of clients’ profiles, using criteria that include qualifications of a client’s charter public accountant firms, as well as a client’s market position and financial ratios. Many other steps come into play, from analyzing industries comprehensively to setting a high level of approval authority on credits to creating detailed know-your-customer profiles.

Taishin Bank, which has a leasing unit in China, is waiting for the government to remove an obscure banking regulation that has kept it from opening a full-blown commercial banking branch there. The rule requires Taiwan banks that open a branch on the mainland to also have a presence in an Organization of Economic Cooperation and Development country.

“In Taiwan, the way we differentiate ourselves is through innovation and risk management,” Jao says. “We have our own risk management team. Most of the other banks in Taiwan basically utilize services from outside providers. But our in-house capability allows us to be faster in response, more nimble.”

Taishan has exported this culture to China.

“A leasing company is not a bank. It is not allowed to take deposits. The credit side is doing well, but on the funding side we do have some difficulty. We are only allowed to leverage up to ten times the capital injected. Risk management is therefore extremely important. The Peoples’ Bank of China has a centralized credit system, and we’re currently working with local banks to obtain that kind of credit information.”

Jao says that with the bank’s nonperforming loan ratio at around 3% in China, “we’re doing okay.” Nonetheless, Taishin sees fit to charge a higher interest rate there, reflecting the rise in China’s risk premium.

“Fingers crossed,” he says, “we’re still hoping that we will be able to set up commercial banking in China.”

When the government removes its OECD rule, Taishin will export some techniques it has been developing in its home market, including the use of big data. Says Jao: “This will allow us to know customer behavior better, helping us to avoid risk and look for business opportunity. It will also help us build a more diversified portfolio. When we’re ready, we can transfer this to China.”

At the moment, Taishin is actually behind the curve there. On December 16, five banks in China—the Bank of China, Bank of Communications, China Minsheng Bank, Bank of Nanjing and the China Development Bank—and five Taiwanese institutions—Fubon Financial, Bank of Taiwan, Taiwan Cooperative Bank, Land Bank of Taiwan and CTBC—signed a memorandum of understanding (MOU) for cross-strait syndication cooperation. Under the agreement, banks can refer clients in their respective jurisdictions and share industry information for syndicated loans business.

Fubon’s Hsu says the agreement will help it develop new clients, cross-sell services including trade finance and cash management, and benefit from loan syndication, without taking on extraordinary levels of risk. “We expect the benefits will come from various perspectives under the MOU,” she says.

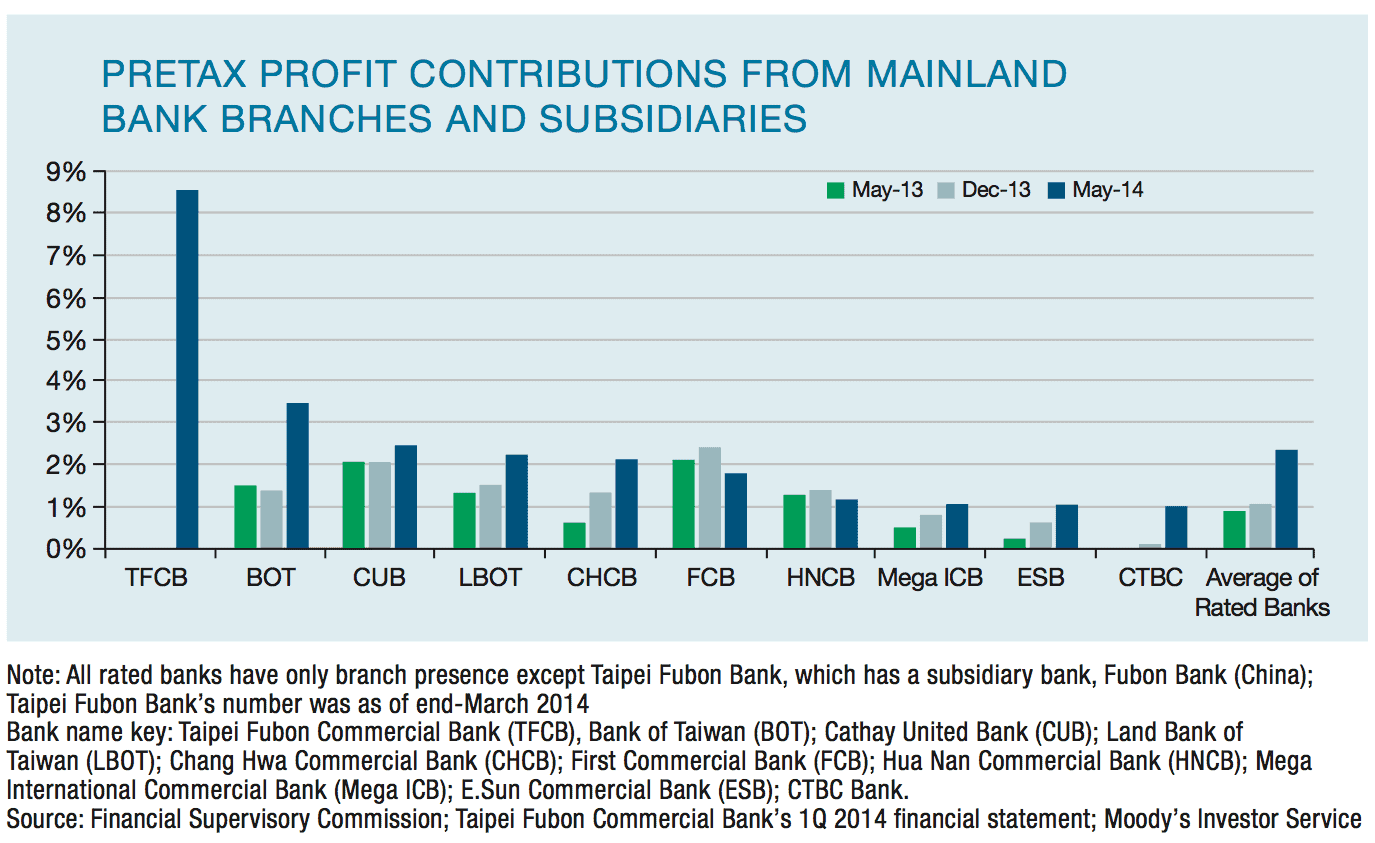

The rating agencies acknowledge that China is creating formidable growth opportunities for Taiwan’s banks. Fitch says that offshore lending, primarily to China, has grown at an annual compound growth rate of 21% from 2010 through the first half of last year. In comparison, lending in Taiwan for local banks grew only 4% during the same period.

Fitch also concedes that despite the high China growth rate—it has come off a low base—that banks’ China exposure “has not had a significant credit impact yet.”

But the pace of lending is accelerating. Fitch expects loans by Taiwanese banks’ offshore units will rise to 19% of total loans by end-2016, from 15% at the end of June last year. “Chinese loans alone should account for 12% of total lending by end-2016,” says Fitch’s Huang. She says trouble could be brewing as a result.

“Taiwanese banks’ ratings could come under pressure,” Huang warns, “especially if they are not adequately mitigated through higher risk buffers.” Adding to the problem, Taiwan’s banks are generally not as well-capitalized as other internationally active banks in the region, Huang says. “This limits their relative capability to withstand potential economic or other credit-quality shocks.”

That scenario doesn’t deter the likes of E.Sun Bank, whose investor relations head, Anthony Cheng, insists that the relative weakness of Taiwan’s banks compared with international competitors in the realm of credit could be a competitive advantage to E.Sun. “We’re a conservative lender, and we’ve never been in a rush to expand beyond our capacity to manage risk,” he says. “This has been hammered into our culture as a bank. It’s going to help us as we expand overseas.”

The authorities are prepared to adopt a more accommodative position when it comes to offshore investment, rather than stifle the banks’ growth, since domestic prospects are more muted.

~ Cherry Huang, Fitch Ratings

A report by Moody’s Investor Service last year supports Cheng’s claim. The rating agency upgraded E.Sun Bank, saying “On the lending front, the bank has increased its business focus towards higher-margin businesses, such as lending to small and medium-size enterprises versus lower-margin segments, such as residential mortgages. It has achieved this shift without weakening its asset quality.”

E.Sun Bank’s parent company, E.Sun Financial, has repeatedly raised equity and funneled the proceeds into strengthening the bank’s capital adequacy ratio, a factor that also led to the upgrade. Cheng says that E.Sun is now ready to use this strength in China and Southeast Asia, where risk-conscious banking coupled with innovative marketing could carry the day.

He describes the banking environment as “exciting” and welcomes the challenges that the rating agencies contend lie ahead. Says Cheng: “May the sturdiest competitors win.”

GFmag.com data Summary: Taiwan

Central Bank: Central Bank of the Republic of China (Taiwan) |

|||

|---|---|---|---|

|

International Reserves |

N/A |

||

|

Gross Domestic Product (GDP) |

$505.452 billion |

||

|

Real GDP Growth |

2012 |

2013 |

2014* |

|

GDP Per Capita—Current Prices |

$21,571.626* |

||

|

GDP—Composition By Sector* |

agriculture: |

industry: |

services: |

|

Inflation |

2012 |

2013 |

2014* |

|

Public Debt (general government |

2012 |

2013* |

2014* |

|

Government Bond Ratings |

Standard & Poor’s |

Moody’s |

Moody’s Outlook |

|

FDI Inflows |

2011 |

2012 |

2013 |

* Estimates

Source: GFMag.com Country Economic Reports