Pandemic responses turn out to be a springboard for profits.

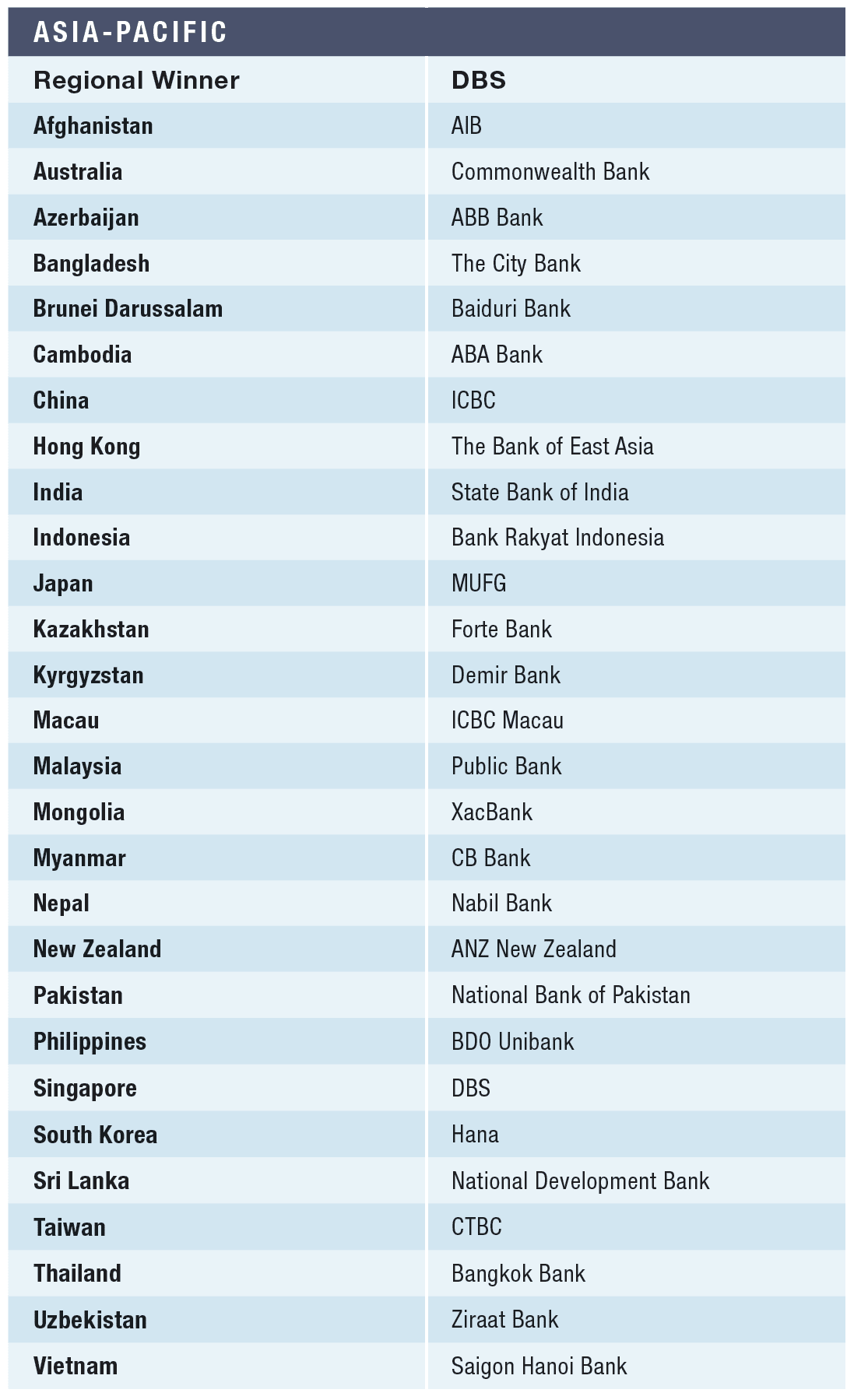

Some banks in the Asia-Pacific (APAC) region achieved stunning percentage increases in profits, thanks to the base effect of 2020’s free-fall; although there were some standouts whose total profits hit record highs, most notably DBS, our oveerall regional winner. In the APAC region excluding China and Japan, return on equity (ROE) was a respectable 7.4%. Including China, the region accounted for a staggering 55% of global banking profits.

The region’s incumbent banks continued to face intense competition for deposits from digital startups—particularly in jurisdictions with high interest margins and underbanked populations, such as Indonesia, the Philippines and Vietnam. Alongside this pressure was a scramble to fully embrace environmental, social and governance (ESG) concerns and grasp the credit implications for corporate clients.

China, Hong Kong, Macau and Taiwan

Bank lending in China hit a record 19.95 trillion renminbi about ($3.1 trillion) last year, due to two reserve requirement ratio cuts that released 1.2 trillion renminbi of long-term liquidity to the banks.

Nevertheless, deleveraging was the theme of 2021. China’s debt-to-GDP ratio was slashed by 10%, and the country’s banks engaged in asset-structure optimization and offloaded nonperforming loans (NPLs). At the same time, capital levels in the banking system surged by 18.6%, confirming China’s banks as the best capitalized in the world.

ICBC, the world’s largest bank by assets, boldly ticked the superlative box in the capital stakes by booking the highest tier-1 capital ever recorded (US$439.9 billion) thanks to a chunky $59.7 billion infusion of new capital.

Deleveraging was in evidence–NPLs fell 16 basis points to 1.4%–and provisioning against sour loans shot up 18% to a heady 205% cover. The standout in the composition of ICBC’s 10.3% increase in operating profit was the contribution of non-interest income, which surged 13% on the back of solid earnings in net fees and commissions. Total profit was a gargantuan 348.3 billion renminbi ($54.8 billion).

The bank focused on new manufacturing, new services and new basic industries in its lending mix in 2021, with a keen eye on sustainability. It lead its bulge-bracket China peer group in terms of green bond investments, with its portfolio containing sustainability-linked and rural vitalization bonds.

Over the Hong Kong Strait, Bank of East Asia, Hong Kong’s largest independent and family-run lender, scored an enviable 45% rise in full-year profit as it built on its efforts to revamp its mainland operations and address a surge in NPLs in 2019. The bank has long focused energy on its retail operations and opened green lending by launching its Green Mortgage Plan last December.

ICBC Macau is 89% owned by its mainland China namesake and enjoys the benefit of implicit support from the world’s largest bank. The bank is taking advantage of the Macau government’s plan to develop the former Portuguese colony into a “smart city” through its e-payment services, promoting cross-border and cross-industry services.

Meanwhile, Taiwan’s largest privately owned bank, CTBC, maintained its balanced, diversified business model in 2021, booking the highest earnings among the country’s bank holding companies in the first three-quarters of the year. After tax, full year profit came in at 29.8 billion Taiwanese dollars (US$1 billion), representing a solid 9% gain on 2020. Fee income growth was notably strong last year, with the wealth management segment storming ahead, clocking 21% growth.

Australasia

In Australia, Common-wealth Bank (CBA) registered a particularly strong footprint in the investment banking segment last year, topping the Bloomberg league tables for primary bond issuance and winning out in the syndicated loan stakes via a combined 15.5 billion Australian dollars (about $11 billion) of deals.

Cash net profit after tax gained a comfortable 19.8%, helped by Australia’s economic recovery, expanding volumes in all of CBA’s core business lines and reducing loan impairment expenses.

ESG remained at the core of the bank’s strategic framework. It signed Australia’s first Green Development last September for Charter Hall Group’s AUS$202 million financing.

ANZ New Zealand, the country’s biggest bank by assets, enjoyed a 44% rise in profit last year on the back of record demand for residential property, reduced provisioning and customer remediation. As a result, both deposits and loans rose in 2021 by 3.5% and 6%, respectively.

The bank is aligned with New Zealand’s radical climate change legislation, passed last October, requiring large financial institutions to report the impact of climate change on their business. Beyond that commitment at the bank level, ANZ last year broadened its move to connect businesses with ESG as it began to market Toitu Envirocare’s Carbon Assess tool, enabling users to track their reduction in carbon emissions.

Northern Asia

Japan’s financial market participants described last year as “one to forget” in the face of rising NPLs, technical outages at Mizuho and vast losses sustained by Nomura thanks to exposure to a US-based hedge fund. Apart from base-effect profit surges at the megabanks, the picture is less than auspicious.

The country’s largest bank, MUFG, stood out, with ordinary profits up 66% to ¥1.3 trillion ($10.1 billion).

South Korea’s Hana Bank saw glimmers of the better days with net interest margins returning to 1.4%–a rise of 13 basis points in the first half–and the cost-to-income ratio pulling down to 44%, around six basis points inside the pre-pandemic average.

ESG sat front and center of the bank’s operations last year. In January 2021, Hana issued its inaugural social covered bond, a €500 million trade ($539 million), which was a testament to the bank’s ambition in the ESG bond market as well as its innovative thinking; it followed up in June with a $600 million sustainability bond and ESG subordinated debt.

The Subcontinent

For too long, the Indian banking landscape has been tarnished by cozy corporate lending relationships and the concentration risk they bring. It will take years of effort in NPLs disposal and balance sheet restructuring to bring full functionality to the system, but the will is there.

State Bank of India, the country’s largest lender—with a 20%-25% market share—is making progress in those stakes. It continued cleaning up its balance sheet last year, restructuring 2.6 trillion rupees ($34 billion) in the final quarter of 2021 to bring its total restructuring book to 32.9 trillion rupees, insulating the loan portfolio via contingency provisions to prevent further balance sheet shocks.

Asset quality improved at the bank, with NPLs dropping from 6.1% to 4.95% versus 2020. However, in a measure of the need to continue fully freeing up the balance sheet for the normalization of lending and ingrained leeriness toward corporate lending, loans fell by 3%. Retail lending was bolstered by solid domestic housing demand, which contributed to the bank’s healthy 14% ROE, a convincing surge from the 9.5% booked the year before.

National Bank of Pakistan (NBP) is the best capitalized bank in Pakistan, holding 286.2 billion Pakistani rupees ($1.5 billion) of net assets and an overall 20.4% capital adequacy requirement (CAR), more than 6.5% above the regulatory minimum. Geographical and product diversification mark it out from the domestic competition, with its subsidiaries stretching from the financial–asset management, foreign exchange and brokerage–to the nonfinancial sectors. Profit after tax in 2021 came in at 52 billion Pakistani rupees, the highest number in NBP’s history, representing an 8.3% gain in 2020. A highlight last year was NBPs Islamic banking franchise hitting the milestone of 100 billion Pakistani rupees in total assets.

In Sri Lanka, National Development Bank (NDB) built on its solid track record last year–powered by its 2020-25 “Voyage” strategy. The bank grew total assets by 8% up to the third quarter of 2021, with gross loan growth outpacing NDB’s peer group 12.4% average by 2.5%. Post-tax profits rose by an impressive 26%. Standouts collaborated in TradeLens, a venture with Maersk Shipping and IBM to provide digital trade finance. NDB’s NEOS mobile app is popular in Sri Lanka’s banking domain and underpinned its solid asset growth last year.

The first private sector bank in Nepal, Nabil Bank, provides a range of commercial banking services with a strong strategic focus on small and midsize enterprises (SMEs) and SME lending. Last year, in alignment with the government’s Digital Nepal Framework, the bank launched the Nabil Digibank Portal, which integrates a range of banking facilities for customers.

Bangladesh’s City Bank brought in 157,000 new customers in 2021, with trade businesses volumes hitting $6.5 billion, representing 6% of the country’s total trade. Bangladesh’s top card issuer, with a 36% market share. Between 2020 and 2021, it launched three revolutionary digital services via its Digital Nano loan service.

Southeast Asia

In 2021, Singapore’s DBS seized the opportunity presented by Covid-19 to enable its mission statement of embodying the “bank of the future.” The backdrop of the secular growth of Asia; fundamental changes, such as the maturing of blockchain and artificial intelligence (AI); the rise of digital currencies; and a sharpened focus on ESG and the climate crisis framed the bank’s course.

In response to this rapidly changing environment, DBS leveraged its digital capabilities, diversified its franchise via new business launches and closed several inorganic transactions. The mix delivered stunning bottom-line results: The bank booked a record 6.8 billion Singapore dollars (about US$5 billion) in profit for a steep 44% year-on-year surge. Wealth management, transaction banking and treasury markets business drove much of the growth, according to CEO Piyush Gupta.

“DBS’ wealth management business grew from mid-single-digit percent of the group’s total income to 20% today,” he notes. “In 2021, wealth management fee growth was 19% which was off the charts; however, we’ve never grown less than 10% over the past five years. … In transaction banking, cash management is up about 10 times in the past decade after adjusting for interest rates. Trade finance, whether open account trade or supply chain financing, has also been very robust. Digitalization helped power this business, and we believe we are only just scratching the surface in tapping opportunities for growth.”

Malaysia’s Public Bank topped the class among its Malaysian peer group for net ROE of 12.4%, or around 2% ahead of the pack average; as well as the lowest cost-to-income ratio, 31.7%; the lowest NPL rate, 0.3%; and the highest loan loss cover, 320%.

Within this, standouts are Public Bank’s dominance of the commercial property financing and passenger vehicle financing segments and of private unit trusts.

The Philippines’ BDO is the country’s largest and most systemically important bank, enjoying a 17% share of local deposits. Even though its NPL rate is high, at 3.1%, it is better than the domestic industry average of 4%. Last year there were signs that BDO’s loan-loss buffers would continue to decline and loan growth rise. Instead, the bank’s profits grew 51% due to gradual domestic economic recovery: 6% positive loan growth and a 12% rise in noninterest income boosted that number.

ESG is central to BDO’s long-term growth strategy. The BDO ESG Equity Fund, launched in 2015, is a unit investment trust fund that invests in Philippine companies with strong ESG standards and mission statements.

Vietnam’s Saigon Hanoi Bank (SHB) received a boost to its franchise in April, when it won the State Bank of Vietnam’s approval to increase its charter capital from 19.3 trillion Vietnamese dongs (about $839 million) to 26.7 trillion dongs, which will boost the lender’s scale.

SHB distinguished itself in the sustainable finance stakes by providing cofinancing for a $75 million risk-sharing fund with the World Bank and the Green Climate Fund to fund sustainable energy projects in Vietnam.

Bank Rakyat Indonesia (BRI) has long been a market leader within Indonesia’s sustainable finance sector, and 65.5% of its 2021 lending activities involved sustainable business activities–it owns the country’s most extensive sustainable loan portfolio–with BRI’s sustainable loan growth coming in at 12.2% in 2021.

At the same time, the bank focused on micro, small and midsize enterprise (MSME) credit growth, which registered a 13% surge last year that was aided by BRI’s empowerment of 500,000 agents in Indonesia via its AgenBRILink, attracting 1.14 trillion Indonesian rupiahs (about $78.9 million) of new transactions.

Meanwhile, Thailand’s Bangkok Bank sought margin outside its home turf via its 2020 acquisition of an 89% stake in Indonesia’s Bank Permata. The complete integration of the bank boosted its 2021consolidated net profits and underscored Bangkok Bank’s expansionary ethos. The Permata integration boosted the bank’s net interest income, rising 6.6% in 2021 thanks to aggressive cost management at the Indonesian subsidiary. Noninterest income was an eye-popping 25.7% through increased net fees, service income from Bangkok Bank’s securities arm, loan-related services, bancassurance and mutual funds, and mark-to-market gains on financial assets.

Brunei’s Baiduri Bank embarked in 2021 on a strategic revamp of its organizational structure via changes in senior management to lead its business banking, wealth management and Baiduri Capital units. The bank’s digital engagement ramped up last August while it transmitted pandemic-related information to clients via an AI chatbot, which increased the engagement rate by 13% to 78%. As a result, total assets rose by 4.2%, ROE dipped to 12.33% and the bank trimmed its cost-to-income ratio by 4.6% to 49.9%.

Myanmar’s CB Bank managed to provide essential banking services at the height of the pandemic, having invested in upgraded IT systems, launching a series of digital platforms: CB Card+, Viber Chatbot and CB Marketplace. The bank aims to achieve synergy across its four strategic segments: retail banking, wealth banking, corporate banking and SME banking.

ABA Bank in Cambodia grew total assets by 29.2% in 2021 and embarked on a rationalization program that restructured 13,905 loans for $750 million in total. The bank also cooperated with the Cambodian government to provide affordable loans to SMEs, paying a below-market 7% interest rate for tenors for up to seven years. ABA remains focused on its strategic digital transformation, with an eye on its role in sustainable social development.

Central Asia and the Caucasus

The winner of Best Bank in Krygystan, Demir Bank, was the first international joint-venture bank established in the country under the auspices of the International Finance Corporation, the Netherlands’ FMO and the European Bank for Reconstruction and Development. Demir is actively engaged in innovating in the local market, introducing instalment payment cards and developing the mortgage lending market in partnership with local construction companies. The bank serves retail, financial institutions, corporate and SME customers via its 40 service points.

Mongolia’s XacBank boosted profits by 230% last year and continued to distinguish itself in the eco-lending sector, having disbursed 89 billion Mongolian tughriks ($29 million) to renewable energy projects. The bank completed a financial close on the Govisumber solar power plant, funded in partnership with the Green Climate Fund, and a project to restore pasture and herders’ livelihoods in Khentii province.

Meanwhile, Forte Bank ranks first in terms of liquidity and capital adequacy among banks in Kazakhstan. In recent years, Forte has gone about a major refocus around digital technology. In 2021, its consolidated net profits were up 20%, S&P Global upgraded the bank’s outlook to positive from stable and the bank launched a partnership with Eco Network to promote a culture of smart consumption and segregated waste collection.

The state-owned ABB Bank is Azerbaijan’s largest bank by assets. Last year, it reported a 61% rise in its net profit year-on-year to 208.8 million Azerbaijani manats ($122.9 million). Fitch Ratings upgraded the bank’s long-term issuer default rating to B citing moderation of risks on ABB’s unhedged short open currency position, which makes up 77% of regulatory capital.

AIB is Afghanistan’s largest lender. It enjoyed solid liquidity and a track record of profitability. It boasted a robust 15.4% CAR last year and has embarked on a digital transformation, “Digital at the Core,” helping it boost its noninterest income, which came in at 64% of total revenue.

Uzbekistan’s Ziraat Bank, a subsidiary of Turkey’s Ziraat Bankasi, benefits from the implicit support of its parent. The bank’s asset quality is tied to economic growth in the country and is somewhat constrained by its relatively small size and limited business diversification. Still, it is supported by solid recurring income and strong capitalization.