Loan portfolios continue to grow along with the economy.

After a slower-than-average 2021, Caribbean economies had recovered from the pandemic-driven slump in 2022. Tourism finally picked up, and higher commodity exports fueled the region’s GDP growth, which ended the year at an average of 13.5%, compared to the global average of 3.4%, according to a recent study by the International Monetary Fund (IMF).

The region’s banks quickly took advantage of the trend by increasing their loan portfolios and investing in financial inclusion via digitalization, providing financial support for individual and institutional customers in the economic rebound.

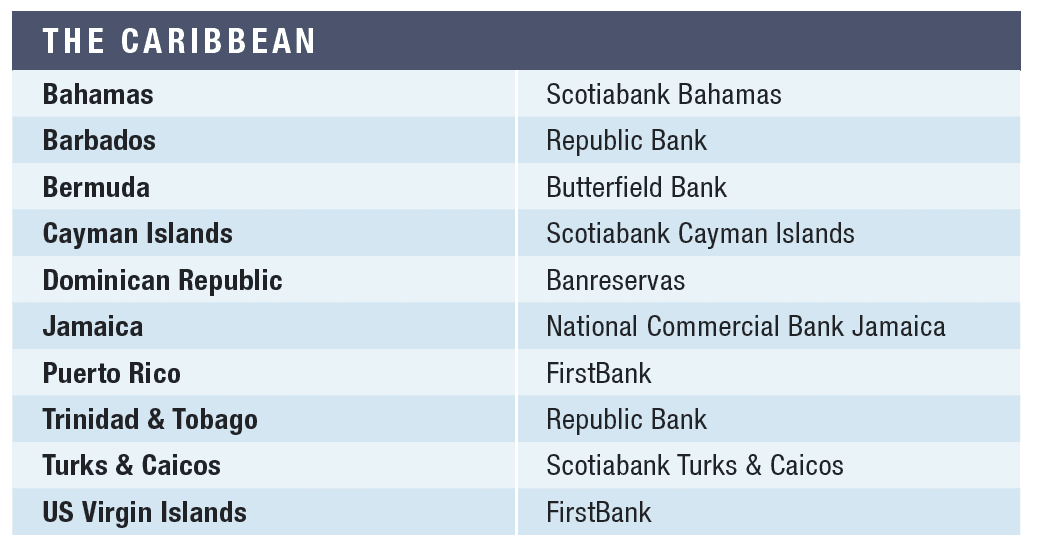

Banreservas, our best bank in the region, was able to seize the many opportunities created by this thriving environment and post best-in-class growth throughout the year.

The bank’s deposits reached a remarkable $14.2 billion, up by $1.3 billion from 2021, giving the bank an estimated 41% market share in the domestic Dominican banking system. Furthermore, the private sector deposits rose to $9.9 billion, while the public sector’s reached $4.3 billion.

Banreservas also achieved outstanding profitability ratios, with a 2.3% return on assets, for 6% growth compared to December 2021; and a 34.9% return on equity (ROE), for 8% growth in the same period. In addition, the bank demonstrated its financial strength through a solvency ratio of 13.8%, a risk coverage of 752.7% and a 68.7% efficiency rate.

“This award is a recognition of our permanent support for the progress of the communities we serve,” says José Obregón, Banreservas’ senior general director of International Business and Corporate Governance.

“We showed our arduous commitment to the sustainable development of the main productive sectors of the Dominican Republic, as well as to the most vulnerable strata of Dominican society,” adds Obregón.

In December 2022, Banreservas became the first bank in the Dominican Republic to reach the impressive benchmark of $18.1 billion in assets. For that, Banreservas also takes our award for the best bank in the Dominican Republic.

Elsewhere, Scotiabank was the other big winner in the region for the second year in a row. The Canadian-based bank reaped the rewards from its resilient investment strategy during the crisis driven by the pandemic and propelled its market positioning in several countries amid the brighter outlook of 2022. Thus, it takes our award as the best bank in Turks and Caicos, the Bahamas and the Cayman Islands.

The bank’s main achievements for the year are the highest profitability margin since 2009 in the Bahamas, with a net income of $48.2 million, and five consecutive quarters of double-digit ROE with a metric of roughly 13%.

Scotiabank’s recurring investments in technology set the tone for the success of its operations in Turks and Caicos, with a 36% growth in digital usage and financial products. One is Scotiabank’s mortgage prequalification platform, a tool that helped support the region’s real estate industry’s jump in 2022. In the Cayman Islands, the increase in lending volume guaranteed hefty profitability and growth for the year.

Republic Bank was our best bank in Trinidad and Tobago as well as Barbados due to its strong financial performance and community initiatives. In Trinidad and Tobago, the bank used its top market share in total loans (35.6%) and deposits (33.6%) to attain 34.1% growth in net profits with a healthy 16.7% ROE. In Barbados, on top of its strong balance sheet, the bank launched the Power to Make a Difference program, testifying to its commitment to the region’s social development.

FirstBank is also a multicountry winner, taking our award in Puerto Rico and the US Virgin Islands. Despite the challenging conditions in dollarized economies due to the US Federal Reserve liquidity squeeze, the bank managed to secure solid loan portfolio growth in both countries.

In Puerto Rico, the impressive $210.5 million jump in loans during the first nine months of last year came after a very successful 2021 that had pushed the bar higher for the US-based bank. In the Virgin Islands, growth also exceeded expectations, totaling $6.1 million for the period.

Butterfield Bank took our award in Bermuda again this year with a risk-balanced performance, putting the bank in an excellent position to outperform in the challenging market of 2022.

In Jamaica, National Commercial Bank won our award, due to its increased commitment to financial inclusion through digitalization, reaching 96% of transactions through electronic channels at the end of the year.