FOREIGN EXCHANGE

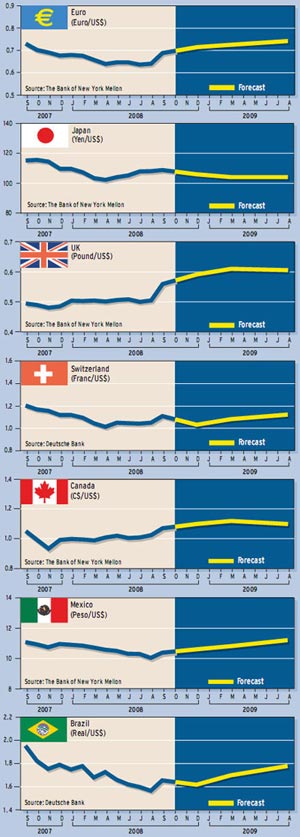

Get ready for some unpleasant surprises on the earnings front as a result of the dollar’s sudden recovery from a record low of $1.60 against the euro in mid-July. By early last month the euro was trading at an 11-month low of $1.42.

Get ready for some unpleasant surprises on the earnings front as a result of the dollar’s sudden recovery from a record low of $1.60 against the euro in mid-July. By early last month the euro was trading at an 11-month low of $1.42.

The unusually sharp dollar advance against the euro and other major currencies means that many corporations will likely experience dramatic negative impacts to profitability due to foreign-exchange-related losses, which will be reported in the current earnings season beginning at the middle of October, says Wolfgang Koester, chief executive of Scottsdale, Arizona-based Fireapps, which provides software to measure and manage foreign currency exposure.

“Even though there are proven methods to insulate corporations from currency volatility, many are inadequately prepared to deal with this surge in the dollar’s value,” Koester says. “The free ride that international corporations have been getting on foreign exchange is about to end.”

Not only will the rising dollar have significant effects on revenues and commitments of companies with overseas operations, but it also will affect procurement trends, Koester says. “With volatility increasing in the foreign exchange market, companies will have less confidence in providing guidance on earnings,” he says. “CEOs, CFOs and treasurers are accountable for these currency-related losses, and they will be facing some tough questioning from board members.”

Fireapps works with multinational companies on a day-to-day basis to help them monitor their changing currency exposures. “We have automated the work flow so that a treasurer, at the push of a button, can aggregate data from a variety of sources and see the company’s true FX exposure,” Koester says. As finances become more complicated, there is a lot of room for foreign exchange to go astray, he says.

During the current quarter, formerly solid gains due to currency translation due to the value of the dollar not only will diminish but will turn into losses, Koester says. “For companies with a lot of currency in a large number of subsidiaries that are doing business with each other, currency relationships quickly become a complex problem,” he points out. Manufacturing and technology companies that benefited most from the dollar’s decline will be most affected by the shift in the FX landscape with the dollar rising, he says.

Marc Chandler, global head of currency strategy at Brown Brothers Harriman, based in New York, says that until recently the weaker dollar has helped boost foreign earnings of US multinational companies. “However, we think the dollar’s multi-year bear cycle has ended, and equity analysts may have to begin factoring this into their models,” he says. The euro’s 5.6% slide against the dollar in August was one of the euro’s worst monthly performances ever in the single currency’s short life, he says.

Investors need to appreciate that companies that have greater international exposure do not always outperform in a weak-dollar environment or under-perform in a stronger-dollar environment, according to Chandler. Moreover, how companies manage their foreign exchange risk through hedging, financing and investment strategies is critical to understanding how dollar moves will affect their earnings, he says.

Google Could Take a Hit

Mountain View, California-based Google, which runs the world’s most popular Internet search engine, gets more than half of its revenues from overseas operations. For the past 10 consecutive quarters Google has benefited from a favorable exchange rate as it translated these overseas revenues into dollar terms. In the quarter ended September 30, however, Google is expected to take a $22 million sequential hit to its gross revenue, due to unfavorable exchange rates, according to a report by senior research analyst Sandeep Aggarwal at independent investment bank Collins Stewart, based in San Francisco.

Google’s gross revenue from overseas is expected to come in at $3.03 billion for the third quarter, as against the $3.25 billion anticipated had the exchange rate remained unchanged, Aggarwal says. Despite this, Google is expected to post worldwide revenue of nearly $5.77 billion in the third quarter, up from $4.83 billion in the same period a year earlier.

Hewlett-Packard, the Palo Alto, California-based computer maker that recently completed the $13.9 billion acquisition of Electronic Data Systems, reported profits for the three months ended July 31 of $2.5 billion, up from $1.78 billion in the same period a year earlier. The company’s overseas revenue accounted for about 68% of the total. Other technology companies with big overseas sales include Oracle and IBM.

The weak dollar and strong growth overseas had helped major US exporters do well this year, despite weakness in the domestic market. But now the tables have turned, and the dollar is strengthening while growth in many foreign economies is slowing and some are on the verge of recession. Among the big US industrial companies with the largest overseas sales are General Electric, General Motors, Ford Motor, ExxonMobil, Chevron and Procter & Gamble. Big US importers, which stand to gain from the rising dollar, include mass retailers Wal-Mart and Target.

The weak dollar and strong growth overseas had helped major US exporters do well this year, despite weakness in the domestic market. But now the tables have turned, and the dollar is strengthening while growth in many foreign economies is slowing and some are on the verge of recession. Among the big US industrial companies with the largest overseas sales are General Electric, General Motors, Ford Motor, ExxonMobil, Chevron and Procter & Gamble. Big US importers, which stand to gain from the rising dollar, include mass retailers Wal-Mart and Target.

Rising exports were the biggest factor in the rebound in growth in the US economy in the second quarter. US gross domestic product increased at a 3.3% annual rate in the three months through June 30, following a 0.9% rate of gain in the first quarter of this year. The weaker value of the dollar contributed to the rise in exports and helped keep the US economy from falling into recession.

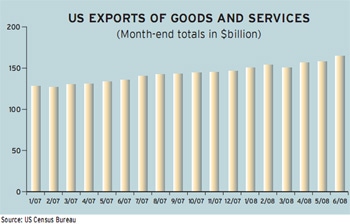

US exports in June, which are the latest data available, rose to a record $164.4 billion, according to the US Census Bureau. US exports of goods alone in June totaled $116.7 billion, also a record.

While a falling dollar helps to reduce the US trade deficit by boosting the international competitiveness of US exports, it also worsens inflation through higher import prices, Federal Reserve chairman Ben Bernanke pointed out at a monetary conference in Barcelona, Spain, in June. The connection between a weak dollar, rising oil and other commodity prices and risks of higher embedded inflation is now working in reverse. Commodity and oil prices have been declining since early July, while the dollar has been rising.

|

|

Wolfgang Koester, CEO of Fireapps. |

Slower Growth in Rest of World

Foreign exchange market participants who favor the dollar are now reacting to slower growth in the rest of the developed world, as well as to the end of the Fed’s interest rate cuts. The eurozone economy contracted in the second quarter, and there are indications that gross domestic product (GDP) could shrink further in the third quarter. The UK economy is also on the ropes, and the British pound has been falling sharply against the dollar, hitting a two-and-a-half-year low in early September.

As Europe feels the effects of the credit crunch and falling house prices, Japan’s economy has stalled, and the Bank of Japan is likely to keep rates on hold at the lowly level of 0.5% for at least the next few quarters, according to Chandler of Brown Brothers Harriman.

“There are a number of drivers in the FX market currently, including oil prices, relative growth and interest rate trajectories, market positioning and technicals,” Chandler says. The Chinese yuan has risen less than 1% during the dollar’s rally since July, he says. In part this reflects the fact that the bulk of speculative foreign positions is in non-deliverable forwards rather than onshore Chinese assets, he notes. China is the last bastion of strong FX fundamentals in Asia, he says. The country has significant currency under-valuation, a large current account surplus and high long-term growth expectations.

“While much has been made of the so-called ‘hot-money’ flows into China this year, we don’t believe many of these flows are all that hot,” Chandler says. “In our view, much of the inflow is a play on China’s growth, and as the government relaxes macroeconomic policy and the rest of the world continues to slow, it is difficult for us to see why this flow should reverse abruptly,” he says.

Catalysts to Dollar’s Rebound

The confirmation that the eurozone economy has seen its first negative quarterly GDP growth since the inception of the euro, as well as the sharp decline in commodity prices resulting from slowing global demand, have been the key catalysts to the dollar rebound, says Ashraf Laidi, chief FX strategist at CMC Markets US, based in New York. Speculative flows have also helped drive the dollar rally, as futures traders unwound their short positions in the dollar against the euro, the British pound and the Japanese yen, he says.

The confirmation that the eurozone economy has seen its first negative quarterly GDP growth since the inception of the euro, as well as the sharp decline in commodity prices resulting from slowing global demand, have been the key catalysts to the dollar rebound, says Ashraf Laidi, chief FX strategist at CMC Markets US, based in New York. Speculative flows have also helped drive the dollar rally, as futures traders unwound their short positions in the dollar against the euro, the British pound and the Japanese yen, he says.

Although European Central Bank president Jean-Claude Trichet and his colleagues have not hinted at any interest rate cuts, their increased acknowledgement of the widely anticipated technical recession in the eurozone is prompting bond market participants to expect ECB monetary policy easing to begin in 2009, the same year in which the Fed is widely expected to begin raising interest rates, Laidi says.

“Nonetheless, our view remains that the Fed will cut interest rates by at least half a point this year, while the ECB will follow suit in the second quarter of 2009,” Laidi says. The reasons for expecting a US rate cut, he adds, are the deteriorating macroeconomic fundamentals, worsening conditions in the US credit markets and persistent uncertainty in the US financial system. “Slumping consumer demand and rising joblessness as well as significant slowing in foreign demand for US products are adding credence to our established view of renewed easing by the Fed before year-end,” he says.

The rise in the August US unemployment rate to a five-year high of 6.1% from 5.7% in July leaves little doubt to currency traders that the dollar rally remains largely a manifestation of broadening economic weakness outside of the US, rather than any signs of strength at home, according to Laidi.

Does Dollar Rally Have Legs?

David Gilmore, economist and partner at Foreign Exchange Analytics, based in Essex, Connecticut, says the European Central Bank is not nearly as pessimistic on growth as are FX market participants, and the ECB is not in the least bit considering rate cuts ahead. “I am skeptical that the steepest rally in the dollar arguably since the Plaza Accord in 1985 has Plaza Accord-like legs,” he says. “Yes, the world needed to come to terms with weakening growth in the rest of the world outside of the United States. It has now done that,” he adds.

The dollar may not be able to rise further on this same story, Gilmore says. “I just can’t buy into it,” he says. “A more logical response is that the bear cycle for the dollar was broken, but a bull cycle was not born.”

Gilmore says range trading is his best guess for the dollar in the months ahead, and not ever-higher highs for the dollar. If the US needs ever-greater foreign savings to cover current investment and consumption, then US rates have to rise, he notes. “This will put more stress on credit and economic growth, even if it helps stabilize the dollar,” he says.

“If you like the dollar, then you have to be counting on lower oil prices and lower commodity prices, which will be driven by demand destruction,” Gilmore says. “How does the US economy hold up in a global slowdown, with a broken banking system, falling home prices, elevated consumer indebtedness and declining corporate earnings?” he asks. “So, I am of the view that, in time, the correlation between the dollar and oil will break down,” he says.

“I really think the Fed is out of the picture beyond simply being lender of first and last resort to banks and investment banks,” Gilmore says. Lower rates will not result in increased lending to companies and individuals in a world where credit markets are saying “No way!” because the borrower may default, he says.

The Japanese yen surged to a one-year high against the plummeting euro in early September and to a two-month high against the dollar. “We continue to favor the yen as the next best alternative to the dollar, due to the rapid deterioration in global risk appetite,” says Laidi of CMC Markets US. The yen is the second-best-performing currency since the beginning of the year.

Global growth concerns and reeling stock markets have encouraged investors to flee the carry trade, which involves borrowing in a low-interest-rate currency to invest in a riskier but higher-yielding currency, says Tobias Davis, global options specialist at British Columbia, Canada-based Custom House, a global payments company and foreign exchange dealer.

“When investors see uncertainty, they flee from risky assets and reinvest somewhere safer,” Davis says. “The carry trade carries a higher degree of risk because the holder is exposed to a swinging currency market, which can wipe any potential gains off the books in a matter of hours.”

Japan has habitually been the home of cheap debt, Davis says. Therefore, any form of global deleveraging will see the yen gain as repatriation increases demand for the Japanese currency, he says.

Why Dollar Crisis Never Came

Contrary to what many pessimists anticipated, the latest respite from sustained dollar declines is a reminder of how relatively benign the greenback’s long downward adjustment has been, Robert DiClemente, chief US economist at Citi, wrote in a recent report. “In contrast with the persistence of low bond yields, Cassandras have warned for years about a US dollar crisis involving both a currency plunge and a rise in US yields relative to foreign yields,” he says.

The sources of concern have ranged from unsustainable current account deficits to accusations of excessive Fed accommodation, according to DiClemente. The weakness of the US financial system also poses significant downside risks for the dollar, he says.

“Yet we continue to view the chances of a dollar crisis—involving a persistent and substantial widening of the gap between US and foreign bond yields—as quite low,” DiClemente says. The key to avoiding such a crisis when the dollar corrects, he says, is the credible commitment of the Fed to anchor long-term inflation expectations. “That credibility is best highlighted by the enormous contrast between the impact of commodity price shocks on long-term inflation expectations and bond yields in the late 1970s and in recent years,” he points out.