Australia

Michele Bullock: Too Early To Say

Reserve Bank of Australia veteran Michele Bullock took the helm as the bank’s first female governor in September last year during intense soul-searching at the institution, which had come under critical scrutiny during the tenure of her predecessor, Philip Lowe. As such, Bullock has been hyped as a change agent at the RBA, although the only notable change under her watch has been the transfer of decisions on the crucial cash rate to an interest-rate-setting board, while another board takes care of the RBA’s day-to-day operations.

Since February, monetary policy decisions have been made at two-day meetings held eight times a year rather than the previous one-day, once-a-month regime. The cash rate remains at a 12-year high of 4.35% in the face of stubborn inflation, which hit 3.8% in the second quarter, outside the RBA’s 2%–3% target.

Azerbaijan

Taleh Kazimov: B+

Central bank Governor Taleh Kazimov, in office since 2022, had a boost in July when Fitch Ratings upgraded Azerbaijan’s long-term foreign currency issuer default rating to BBB- from BB+ with a stable outlook. Fitch cited a robust external balance sheet, noting that the country’s sovereign currency assets—80% of which are held by the country’s sovereign wealth fund, SOFAZ, with the remainder at the central bank—will hit $74 billion this year. This equates to 98% of projected GDP and is well above the 55% recorded when the agency first rated Azerbaijan as investment grade in 2010.

Government debt is low, at around 23% of GDP, and headline inflation was a scant 0.7% in June. This allows for an increasingly relaxed monetary regime, with the refinancing rate held steady at that month’s central bank meeting following five consecutive rate cuts. Fitch estimates 2024 inflation at 2.5%, comfortably inside the central bank’s 4%, plus or minus 2%.

Bangladesh

Ahsan Mansur: Too Early To Say

Bangladesh is in turmoil following Prime Minister Sheikh Hasina’s July flight from the country, which resulted from widespread student-led civil unrest. After 15 years at the helm of an often brutal regime, Hasina provided the last act of a dynasty in power on and off since independence in 1971. Nobel peace laureate Mohammad Yunus was appointed interim prime minister, and in August, he selected Ahsan H. Mansur to be central bank governor.

The political turmoil fuelled a spike in inflation, which hit 11.66% in July amid fast-dwindling foreign exchange reserves. Mansur announced plans to hike the benchmark rate by 50 basis points to 9%, and stated that rates would hit 10% within the coming months. Negotiations were opened, with the IMF agreeing to supplement a $4.7 billion bailout program hammered out in January 2023 by an additional $3 billion.

Bangladesh has suffered years of financial system dysfunctionality. Still, the full extent of the malfeasance of Hasina’s Awami League regime is set to emerge, as Mansur described the “designed robbery of the financial system” in a BBC interview given shortly after his appointment.

Deposits have fled, and non-performing loans have soared.

“They took the money and put it in Singapore, Dubai, London and elsewhere. So, the first effort would be to try to take people to task and get the money back,” said Mansur, who is establishing a banking commission to undertake a comprehensive audit of domestic banks, replace management and inject capital. He estimates that the country’s Islamic banks must be recapitalized to $15billion to $30 billion.

Cambodia

Chea Serey: A-

Neophyte Governor Chea Serey, who assumed office in July 2023, has enjoyed a “Goldilocks” opening act to her tenure, following in the footsteps of her well-respected and market-savvy father.

Executing monetary policy is a tricky balancing act in a country that uses the US dollars and a local currency. The Cambodian riel has been gifted a fortuitous tailwind in the form of buoyant international reserves that have surged 12.3% in 2023 to $20 billion, covering seven months of goods and services imports.

Riel stabilization has been achieved by prudent circulation management and foreign exchange market intervention, usually involving selling US dollars versus the domestic unit on the open market.

According to World Bank data, inflation fell to zero in March as food prices decelerated. The current account recorded an unprecedented surplus last year as the trade deficit contracted and tourism surged. Despite a slowdown in domestic credit growth, GDP expanded by 5.6% in 2023 and is forecast to hit 5.8% in 2024, according to the World Bank.

China

Pan Gongsheng: B+

China’s GDP growth hit 5% in the first half of this year, a solid result considering the country’s ongoing real estate crisis, weak domestic demand and burdensome local government debt. However, the second quarter’s base effects account for some of this strength. But that growth rate comes in the context of deflation—China’s GDP deflator is zero and threatening to turn negative. Producer prices have been declining for two straight years, and consumer prices rose by an average of just 0.2% in the first half of the year.

The People’s Bank of China (PBoC) has indicated a sharp focus on the domestic bond markets as a monetary policy tool. In July, the bank launched temporary repo or reverse repos to optimize open market operations and ensure the banking system’s liquidity.

This indicates a radical shift in the PBoC’s monetary policy thinking under Pan Gongsheng, who took over as governor in July last year. In September, the PBoC cut its benchmark seven-day interest rate by 20 basis points to 1.5% and dropped commercial banks’ reserve requirements by 50 bps.

Pan has emphasized monetary policy stability amid widespread calls for radical easing, forecasting that inflation will increase to 1% by year end. The PBoC’s second-quarter monetary policy implementation report, said that prudent monetary policy should be “flexible, moderate, precise and effective.”

Hong Kong

Eddie Yue: B+

The Hong Kong Monetary Authority (HKMA) sets policy in lockstep with the United States to maintain the Hong Kong dollar’s peg to the US unit at a tight 7.75-7.85 per greenback. Reflecting Federal Reserve policy dynamics, it therefore mirrored the Fed’s 50 basis point cut on September 18, for a 5.25% benchmark rate. Governor Eddie Yue once again displayed his quiet competence, with the HKMA noting in a comment following that rate decision that Hong Kong’s financial and monetary markets continued to operate in a smooth and orderly manner, with the Hong Kong dollar exchange rate remaining stable.

India

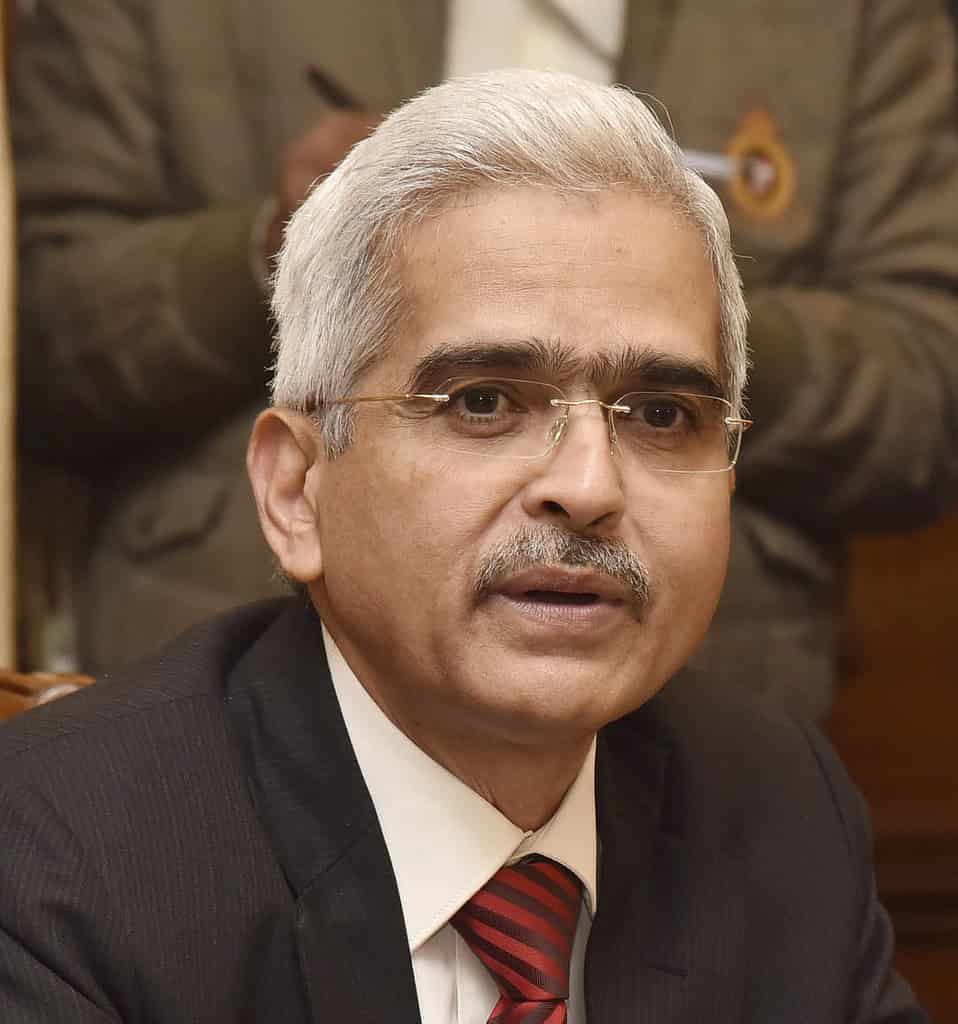

Shaktikanta Das: A+

GDP growth hit 7.8% in the first quarter, moderated to 6.7% in the second and is on track to hit the Reserve Bank of India’s (RBI) full-year 7.2% growth target.

Governor Shaktikanta Das voiced confidence when he spoke at a conference in August in Odisha, India: “I would like to say with all humility and sincerity and with all confidence that the Indian growth story is intact,” he said, noting the plus-7% growth registered across India’s main economic sectors in the first quarter, including investments (+7.5%), services (+7.7%), manufacturing (+7%) and construction (+10.5%). Crimped government spending and a weak performance from the agricultural sector (+2%) capped a stellar growth performance.

Retail inflation eased to 3.54% in July from 5.08% in June, versus a market consensus of 3.65%. It was the softest rise in consumer process since August 2019, and marked the first time inflation remained within the RBI’s target 4% range in five years, albeit assisted by base effects.

Das presides over an ever-strengthening domestic financial system, with robust capital adequacy, low levels of non-performing assets and solid profitability at the banks and non-bank financial companies (NBFCs). This system is anchored in an improving governance ecosystem focused on risk management and internal controls under the umbrella of ESG-focused structures.

“As risks evolve and new challenges emerge, the reserve bank as a regulator and supervisor constantly focuses on being vigilant, adaptive and proactive about the regulatory frameworks and supervisory systems to safeguard the stability of the financial system,” said Das in a speech to the College of Supervisors in Mumbai in June.

Indonesia

Perry Warjiyo: A-

Bank Indonesia Governor Perry Warjiyo has placed the risk of capital outflows at the center of his radar amid calls for a reduction in policy rates as inflation moderated to just 2.13% in July, the slowest reading in two years. He might also have a sharp eye on the rupiah, which has fallen 6.6% against the US dollar this year, even against relatively high domestic interest rates—the benchmark rate sits at 6% after a 25 basis point cut on September 18.

“We held at 6.25% while waiting for better global conditions, when there’ll be room to cut,” said Warijo at a quarterly press briefing in Jakarta in August, referring to the decision to stay rates in July.

Japan

Kazuo Ueda: B+

Kazuo Ueda is not scared of springing surprises on the market, as he did in July when he pushed for a hike in the policy rate to a target of “around 0.25%” from 0%-0.1%, contrary to the market consensus. In doing so, he continued to unwind 17 years of ultraeasy money in Japan—a process he kicked off at the start of his tenure in 2022. This unexpected hike came during a profound and prolonged period of yen weakness, and tightening did the trick for the yen, which surged against the dollar and Asian currencies.

The impact of the yen’s weakness on Japanese inflation might yet prove fortuitous, as wages continue to rise and the elusive prize of rising household consumption draws nearer. Core CPI hit 2.7% in July—a five-month high—as import-dependent Japan felt the full impact of all-time low yen weakness.

“Initial wage settlements … are at their highest level in three decades … and the probability of achieving a stable 2% inflation rate has increased enough to justify the outlined policy normalization,” said Ueda in a speech delivered to the Peterson Institute for International Economics in May.

Kazakhstan

Timur Suleimenov: Too Early To Say

National Bank of Kazakhstan (NBK) Governor Timur Suleimenov has presided over healthy domestic-demand-led GDP growth since assuming office in September last year, boosted by infrastructure project spending, oil sector investment, educational facility construction and housing modernization. Bank lending to small businesses increased by 24%, and the overall loan mix as of December was 53.3% for the consumer sector and 46.7% for the business sector. Growth came in at 5.1% for 2023 against a moderating inflationary backdrop; CPI declined to 9.5% in January versus 20.7% the previous year, still ahead of NBK’s 5% target. This has allowed for a reduction in the base rate since August 2023 in four increments totaling 225 basis points, bringing the rate to 14.25% in August.

Kyrgyzstan

Melis Turgunbaev: Too Early To Say

The National Bank of the Kyrgyz Republic (NBKR) held policy rates steady at 9% following its July meeting, in the face of moderating inflationary pressure and economic recovery. Real GDP increased 8.8% in the first quarter and inflation was subdued at 5.2%—inside the NBKR’s 5% to 7% target.

The Asian Development Bank forecasts GDP growth at 5% for this year, driven by reduced growth in construction and services. The country’s often-turbulent political backdrop has given way to relative stability since 2021, and the country has benefited from ADB financing in the form of public sector loans, grants and technical assistance initiatives totaling $2.6 billion. A notable ADB financing last year was a $40 million project to promote climate-resilient agricultural value chains.

Laos

Vathana Dalaloy: Too Early To Say

The governor of the National Bank of Laos Republic, Bounleua Sinxayvolavong, was removed from office at the start of July in the face of a burgeoning economic and financial crisis exacerbated by the collapse of the Lao kip, which lost more than 30% of its value against the US dollar last year, propelling inflation that rising fuel prices had already stoked. Basic food security and nutrition are in jeopardy in the landlocked country, according to the Asian Development Bank.

Bounleua was replaced by acting Governor Vathana Dalaloy, who previously served as the central bank’s deputy governor.

The country is locked in a debt spiral—its external public debt-servicing costs surged to $950 million last year from $507 million in 2022, with the national debt totaling around 125% of GDP, and 44% of government expenditures going toward debt service.

Talk of a failed state is widespread amid stagnant wages and collapsing education and health services. The kip is shunned within the business community in favor of dollars or Thai baht, and the black market is the effective arena for business transactions; exports were valued at $8.2 billion in 2022, but only $2.7 billion entered the country. The received wisdom is that China, to whom much of Laos’ external debt is owed, will not allow the country to go bust. For now, chaos reigns.

Malaysia

Abdul Rasheed Ghaffour: B+

Bank Negara Malaysia Governor Abdul Rasheed Ghaffour, in office since July last year, has kicked off his tenure in great style. In the second quarter, GDP surged to its highest level in 18 months to 5.9%, via a fortuitous mix of buoyant household spending and stronger exports and investment.

That represents an about-face from the start of this year, when the ringgit came under extreme pressure, collapsing to a 26-year low versus the US dollar in February and recovering subsequently by over 3%. The inflation dynamic is reasonably benign, with headline and core inflation averaging 1.8% in the first half, although BNM projects an average 2%-3.5% rate for the rest of the year, as fuel-subsidy cuts add to inflationary pressure. Benchmark rates are expected to remain unchanged at 3%.

Mongolia

Byadran Lkhagvasuren: A-

Governor Byadran Lkhagvasuren is presiding over an enviable external position and growth dynamic as he approaches five years at the helm of the Bank of Mongolia (BOM). The current account balance is in surplus thanks to surging 2023 coal exports. The BOM has meanwhile executed deft debt management thanks to past liability exercises, with no debt maturities to repay until 2026. External sovereign debt and swap lines to the PBoC have been paid down (to the tune of 6 billion Chinese renminbi), and foreign exchange reserves have surged 23% to $4.7 billion.

Non-performing loans in the banking system fell to 5.3%, the lowest level since 2015, and of the 33.3% growth in credit last year, the bulk was in the retail segment, with loans to the mining sector moderating. At 5.5% in the first half, inflation was inside BOM’s 6% target level, plus or minus 2%, and likely to remain restrained. At the same time, the growth trajectory is positive. The economy grew 5.6% in the first half thanks to strong mining and transportation sectors and is forecast to hit 6% in 2024 and 8% in 2025.

Citing these accomplishments, global rating agency Fitch upgraded Mongolia’s long-term foreign currency rating to B+ with a stable outlook in mid-September.

Myanmar

Than Than Swe: F

The country faces various economic challenges, including ongoing conflict that disrupts land-border trade with China and Thailand and domestic supply chains. In the six months to March, merchandise exports and imports collapsed by 13% and 20%, respectively, according to the World Bank. A staggering 3.1 million individuals were internally displaced, according to a June report from the World Bank, and a third of the population is estimated to be in poverty.

Widespread electricity outages have forced businesses to rely on expensive diesel-generated power. Around 33% of Burmese businesses reported that power outages were their primary challenge in April, compared to 12% as recently as September.

Such a backdrop is inherently inflationary, and the ongoing kyat depreciation, which has dropped around 20% versus the US dollar this year, exacerbates the price pressure.

The World Bank estimates that GDP rose just 1% in the year to March, or around 10% below pre-pandemic levels. Labor market participation is low, with unemployment estimated at 8.1% as of the end of last year. Inflation is expected to moderate to 18% this year from 26.5% in 2023 but will continue to be pressured, not least due to ongoing central bank financing of the fiscal deficit.

Nepal

Maha Prasad Adhikari: C+

Nepal Rastra Bank tightened monetary policy last year to diffuse inflationary and foreign exchange reserve pressure. It raised the policy rate and curbed lending to banks, which had ballooned by more than 500% during the Covid-19 pandemic. As a result, credit growth fell to 4.6% from 13.3% in 2022.

Moderating inflation allowed for a 100 basis points cut in the policy rate in December, and the inflation dynamic continued to improve, averaging 6.4% in the first half of this year on the back of subdued oil and commodity prices. Growth fell to just 1.9% last year from 5.6% the prior year, and is forecast by the ADB to hit 3.6% this year.

New Zealand

Adrian Orr: B+

The Reserve Bank of New Zealand’s Adrian Orr presides over the third recession in less than two years. His campaign to overcome ingrained inflation—and hit the RBNZ’s 1%-3% target—has taken its toll on the country’s low-productivity economy.

Indeed, such is Orr’s hypervigilance on silencing inflation that he stated at an RBNZ press conference in May that the bank had considered raising rates at that month’s policy-setting meeting. In the event, the official cash rate was held steady at 5.5%.

“The disappointing part is how stubborn domestic inflation remains. We don’t determine productivity; we just deal with the product we’ve got,” said Orr in an interview in May. He noted that inflation for many parts of the economy had fallen, “but we are now at the stubborn tail, which is not surprising.” GDP growth was just 0.3% in the first quarter. The chorus from the New Zealand financial media is that Orr’s draconian inflation campaign is inflicting substantial damage on New Zealand’s economic fabric.

Pakistan

Jameel Ahmad: B

The hope is that Pakistan is turning the corner after over three years of economic turmoil. The signs are encouraging. From an all-time 22% high in benchmark rates, the State Bank of Pakistan has trimmed by 250 basis in two moves since June. That comes on the back of moderating inflation, which was 11.1% in July and hit the single-digit level—9.6%—in August for the first time in three years, having ballooned to 30% last year. In July, Pakistan reached a staff-level agreement with the IMF for a $7 billion bailout, and a new state budget containing ambitious tax collection levels was passed.

Philippines

Eli Remolona: A-

Eli Remolona, appointed governor of the Bangko Sentral Ng Pilipinas (BSP) in June 2023 by President Ferdinand Marcos Jr., hit the ground running in the first year of his governorship of the Philippines Central Bank. Former Federal Reserve economist Remolona inherited a 17-year policy-rate high of 6.5%. With the five-month headline CPI rate averaging 3.5% in the first half of 2024, inside the BSP’s 2%-4% target, the stage was set for a rate cut.

This well-telegraphed cut was the first from a major Asian central bank since the post-COVID tightening cycle kicked off. The August cut arrived as a 25 bps easing in the overnight borrowing rate. The bank expects to adopt a further 50 bps cut in October to match the Fed’s September rate cut.

GDP growth hit 5.7% in the first quarter and is forecast by the IMF to hit 6% in 2024, supported by recovering domestic demand and exports.

Singapore

Chia Der Jiun: Too Early To Say

Incoming Monetary Authority of Singapore (MAS) Managing Director Chia Der Jiun faced the initial challenge of sticky inflation after assuming office in January—core CPI was 2.9%. He elected to retain a tight monetary stance as expressed in Singapore’s exchange-rate-based monetary policy band known as the Nominal Effective Exchange Rate, or S$NEER.

That was a savvy call; core prices increased by 2.4% in July, the lowest rise since 2022. That month, speaking at the release of the MAS’s annual report, Chia said that core inflation in the city-state is expected to ease significantly in the final quarter and that GDP growth of 2%- 3% is achievable as major sectors of the economy return to pre-pandemic growth rates, an outcome that would significantly improve on 2023’s anemic 1.1% GDP print.

At the annual report release, Chia announced the monetary authority’s commitment of 100 million Singapore dollars (about $76.6 million) to support the domestic financial industry in building quantum and AI technology capability, and he also highlighted the booming Singapore asset and wealth management industry. He inherits a tight ship: the MAS made a 2.8 billion Singapore dollar profit in the 2023-24 financial year.

South Korea

Rhee Chang-yong: B+

The Bank of Korea (BoK) has presided over interest rate extremes since the Covid-19 pandemic. It cut benchmark rates to a record 0.5% low in May 2020 and pushed them up to 3.5% in January, where they have remained. BoK Governor Rhee Chang-yong cited financial stability risk considerations as a determining factor for monetary easing; ensuring financial system stability is one of BoK’s core mandates.

“In terms of price stability alone, the mood is right to discuss interest rate cuts,” Rhee said at a press conference in July following BoK’s decision to leave rates unchanged for the 12th consecutive time, but “market expectations [for rate cuts] do look excessive in some ways.”

This caution is partially explained by the fact that South Korea has the highest household debt-to-GDP ratio, and the Bank of Korea is concerned about a potential surge in mortgage loans on the back of easier money. A weak won, which is off around 7% versus the US dollar this year, has enhanced inflationary stickiness—even though CPI moderated to 2.4% in June, just outside BoK’s 2% target.

Sri Lanka

Nandalal Weerasinghe: A

The country is on track to reverse over two years of economic and financial system turmoil. Gross Official Reserves hit $5.4 billion in May, a $1 billion gain since the end of 2023—a singular rebound given the collapse of reserves to a record low in 2022—and the rupee appreciated against the US dollar and local Asian currencies.

GDP growth is forecast to hit 3% in 2024 following a 2.3% contraction last year, boosted by a 50 basis point cut in the benchmark standing deposit facility rate and the standing lending facility rate in March, to 8.5% and 9.5%, respectively, afforded by a sharp contraction in inflation, which rose a scant 2.4% in July. The only cloud hanging over a commendable performance by central bank Governor Nandalal Weerasinghe is the ongoing government offshore debt restructuring negotiations, in which new terms are being sought by holders of $12 billion of Sri Lanka’s foreign debt.

Taiwan

Yang Chin-long: B+

The Central Bank of the Republic of China (Taiwan) shocked markets in March with a policy rate increase from 1.875% to 2% following its quarterly meeting. Governor Yang Chin-long said the discount rate tightening was a “little surprising.” Still, he placed it in the context of an uncertain global inflationary outlook, with inputs including the strength of the Chinese economy, supply chain issues, geopolitical risks and climate change.

The central bank’s monetary tightening campaign has been explicit. Since March 2022, there have been six discount-rate hikes totaling 87.5 basis points, accompanied by three reserve ratio requirement (RRR) increases totaling 75 bps, with the last 25 bps RRR hike made in June.

Taiwan’s inflationary backdrop has been clouded by a weak Taiwan dollar. The unit was down by more than 6% over the review period. It hit an eight-year low in July as local equities slumped, led by chipmaker Taiwan Semiconductor Manufacturing amid concerted foreign portfolio selling. Inflation surged to 3.08% in February, up from 2.8% the prior month. But the monetary tightening has begun to bite, and core CPI increased by a scant 1.99% in the year to July.

GDP growth declined to 1.31% last year due to soft global demand and weak domestic capital investment, even though post-Covid consumption picked up. Growth surged by 5.83% in the first half of this year, according to the Directorate General of Budget, Accounting and Statistics. The central bank forecasts full-year growth at 3.77%, up from an initial 3.22% projection.

Thailand

Sethaput Suthiwartnarueput: B

The one-day repurchase rate remains at its highest level in more than a decade—2.5%. And action from the Bank of Thailand (BOT) is unlikely as the bank waits for signs of fiscal stimulus from the incoming administration led by Prime Minister Paetongtarn Shinawatra, who assumed office in August. Private domestic demand has weakened this year, prompting calls for a rate cut and increasing the likelihood of a strong fiscal stimulus package, including a 500-billion baht (around $14.6 billion) “digital wallet” handout to 50 million households.

Uzbekistan

Mamarizo Nurmuratov: B+

Growth was robust at 6.2% in the first quarter. That builds on the 6% chalked up last year, propelled by expansionary fiscal policy, frothy private consumption and surging fixed investment. The inflationary dynamic is auspicious, with CPI falling to 8.1% in April from 12.3% at the end of 2022. The IMF projects real GDP growth at 5.4% this year, supported by strong domestic demand.

Vietnam

Nguyen Thi Hong: A

The State Bank of Vietnam (SBV) has monitored household growth closely over the past year. It has overseen 6% credit growth in the banking system, encouraged concessional lending in the residential property market, and pressed credit institutions to reduce operating costs so that lenders can offer lower loan rates to retail customers.

This has encouraged a healthy, diverse growth dynamic. GDP growth was a heady 6.9% in the second quarter of this year, marking the strongest reading since Q3 2022. First-quarter growth was revised up to 5.87%.

Headline CPI averaged 4.08% in the first six months of the year—the highest reading since January 2023, but inside SBV’s 4%-4.5% target—with price pressures emerging from the education and healthcare sectors. Core CPI chalked up a 2.75% increase. Still, the trajectory appears favorable: Headline CPI fell back to 3.45% in August.

| Asia-Pacific | |||

|---|---|---|---|

| Country | Governor | 2024 Grade | 2023 Grade |

| Australia | Michele Bullock | TETS | N/A |

| Azerbaijan | Taleh Kazimov | B+ | B+ |

| Bangladesh | Ahsan Mansur | TETS | N/A |

| Cambodia | Chea Serey | A- | B+ |

| China | Pan Gongsheng | B+ | TETS |

| Hong Kong | Eddie Yue | B+ | B+ |

| India | Shaktikanta Das | A+ | A+ |

| Indonesia | Perry Warjiyo | A- | A- |

| Japan | Kazuo Ueda | B+ | TETS |

| Kazakhstan | Timur Suleimenov | TETS | N/A |

| Kyrgyzstan | Melis Turgunbaev | TETS | N/A |

| Laos | Vathana Dalaloy | TETS | N/A |

| Malaysia | Abdul Rasheed Ghaffour | B+ | TETS |

| Mongolia | Byadran Lkhagvasuren | A- | B+ |

| Myanmar | Than Than Swe | F | TETS |

| Nepal | Maha Prasad Adhikari | C+ | B- |

| New Zealand | Adrian Orr | B+ | A |

| Pakistan | Jameel Ahmad | B | C- |

| Philippines | Eli Remolona | A- | TETS |

| Singapore | Chia Der Jiun | TETS | N/A |

| South Korea | Rhee Chang-yong | B+ | A- |

| Sri Lanka | Nandalal Weerasinghe | A | A- |

| Taiwan | Yang Chin-long | B+ | A |

| Thailand | Sethaput Suthiwartnarueput | B | B+ |

| Uzbekistan | Mamarizo Nurmuratov | B+ | B+ |

| Vietnam | Nguyen Thi Hong | A | A+ |