The World Bank’s struggle to redefine its role in a globalized economy has raised a fundamental question: Do we really need a World Bank?

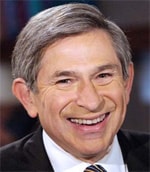

No sooner had the dust settled after the controversial departure of the World Bank’s former president Paul Wolfowitz—amid allegations that his helping his girlfriend’s promotion showed poor judgment and undermined the bank’s anti-corruption credentials—than the very need for maintaining such an institution was being queried on Capitol Hill. Then, in September, a panel headed by Paul Volcker, former head of the US Federal Reserve, suggested the World Bank was unable to adequately police itself. Trying times, indeed.

No sooner had the dust settled after the controversial departure of the World Bank’s former president Paul Wolfowitz—amid allegations that his helping his girlfriend’s promotion showed poor judgment and undermined the bank’s anti-corruption credentials—than the very need for maintaining such an institution was being queried on Capitol Hill. Then, in September, a panel headed by Paul Volcker, former head of the US Federal Reserve, suggested the World Bank was unable to adequately police itself. Trying times, indeed.

Responsibility for policing the World Bank had been entrusted to the bank’s Department of Institutional Integrity (INT). But while Volcker and his distinguished colleagues agreed that INT must play a central part in any coherent and forceful attack on corruption, they found it was being denied cooperation and left isolated and ineffective. “What is necessary,” they concluded, “is a fully coordinated approach across the entire World Bank Group, ending past ambivalence about the importance of combating corruption.”

Wolfowitz’s attempts to beef up the bank’s governance and anti-corruption strategy were built around a two-pronged strategy: helping member states combat corruption themselves and instituting “measures to protect and enhance the integrity of the bank’s own operations.”

While INT had “achieved some notable successes,” the panel found that “nonetheless serious operational issues and severe strains in relations with some operations units have arisen, at times contributing to counterproductive relations between the bank and its borrowers and funding partners.” Read between the lines, and a picture emerges of an institution bedeviled by turf wars and open insurrection. Clearly, all is not well on the governance and anti-corruption front.

The panel’s findings couldn’t have been revealed at a worse time. Another recent report by the World Bank’s Independent Evaluation Group (IEG), which reports to the bank’s member nations rather than its management and is charged with reviewing bank programs and priorities, found more fundamental problems: namely, why is such an institution—and along with it most of the other multilateral development banks—still lending most of its money to middle-income countries that are now able to access global capital markets at competitive rates?

The rapid growth of the big emerging economies like Brazil, China, Mexico and India, combined with the equally rapid development of global capital markets, means that middle-income countries no longer need to go to the development banks. They can raise funding through commercial wholesale markets just as cheaply so long as their improved credit ratings are maintained.

The subsidy embedded in old-style institutional lending has all but evaporated. And commercial debt doesn’t come with the conditions or “advice” that is often tagged onto development bank loans. So rather than borrow more from the World Bank and its peers, many of these middle-income countries are paying back their loans ahead of schedule at an average rate of a net $3.8 billion a year.

Yet nearly a third of all middle-income lending still goes to countries that have sorted out their finances so well that they have investment-grade credit ratings. Most of the balance goes to those with ratings below investment grade. That leaves just 7% being channeled to the neediest countries without any credit rating and which therefore find it hard to access capital markets. To many that seems a waste of resources. It also prompts critics to question whether the bank has a meaningful role within the globalized economy. Some, like Adam Lerrick of Carnegie Mellon University and the American Enterprise Institute, argue that without wholesale reform, it will soon be irrelevant.

Lerrick sees the multilaterals as lazy and self-serving: “They could play a valuable role,” he says, “but it’s not the role they want to play. It’s easier to keep pumping money into countries like Turkey and China that can raise it from the private sector.” He also dismisses the bank’s argument that it needs to keep lending to middle-income countries so that it can reinvest the “profit” in areas like healthcare, where private investors often do not venture.

The profit motive is both arguable and controversial. Lerrick believes the bank makes a negative return on its lending activities once all overheads are included. What “profit” it does make derives from the return on the cost-free capital granted to it by the wealthier countries that are its main shareholders. As for the argument that the bank lends to educational or healthcare projects that the private sector wouldn’t touch, Lerrick says, “That’s simply not true because the World Bank only lends with a government guarantee. Given that same guarantee, the private sector couldn’t care whether the money is used doing environmental work in the Amazon or building nuclear missiles. There’s no World Bank project in emerging markets that the private sector wouldn’t fund.”

A Change of Focus

The IEG report calls for the bank to re-focus its engagement with middle-income countries on improving anti-corruption measures, easing income inequality and addressing global environmental problems. It is also widely suggested that in the future the bank should find ways to channel more of its resources toward the poorest and most indebted nations.

So how does the World Bank respond to these challenges? Pablo Guerrero, adviser to the vice president in charge of operations policy for middle-income countries, says, “We have reduced lending substantially in Europe while the top emerging market economies like Russia, Chile and South Africa have been getting very little in loans for the past two to three years.”

And while the larger and more successful emerging countries now have access to capital markets at competitive spreads, Guerrero points out that this is not the case in “the vast majority” of countries in which the World Bank operates. As a result, he says, there has been a dip in the bank’s overall lending to emerging markets combined with a shift toward more needy countries.

“There has been a migration from lending to grant-based loans,” says Guerrero, adding that “these are handled on a country-by-country basis.” That trend is borne out by the latest figures showing grant-type funding to the International Development Agency up from $9.5 billion to nearly $12 billion, while more conventional lending to the International Bank for Redevelopment shrank from $14.1 billion in 2006 to $12.8 billion during this financial year.

While the World Bank’s net income “remains healthy,” according to Guerrero, he admits “returns from loans are still not sufficient to pay all of the bank’s administrative expenses.” Its board is currently discussing the situation and is expected to come up with new decisions on the allocation of resources.

But the key question is not their profitability or otherwise. It is whether the big development banks really do provide funding that commercial lenders would not contemplate. The big Asian economies are a prime example. With their massive trade surpluses and very high levels of savings, the Chinas of this world certainly have the capacity to finance more development programs within the region. But as Rajat Nag, managing director general of the Asian Development Bank (ADB), points out, “The mobilization of savings for regional use is just not happening, as the vast majority of surplus liquidity is still channeled into Western capital markets.”

In vital areas such as infrastructure, Nag says, the private sector is simply not coming up with the goods. The ADB, he argues, should keep lending to middle-income countries like India because improved infrastructure is a precursor for more inclusive economic growth, which in turn leads to poverty reduction. And that is the end goal of the ADB and other development banks.

The means to this end are changing. Nag anticipates more public-private partnerships (PPPs) “because the development banks by themselves don’t have the resources to meet such huge investment demands.” He also sees a change in focus from roads and power-generation projects toward bringing clean energy technologies and energy efficiency to Asia’s fast-growing polluters.

The Multilateral Conundrum

All of the big multilateral lenders are having to redefine their roles. As Varel Freeman, first vice president of the European Bank for Reconstruction and Development (EBRD), points out, “We are all working with economies and societies undergoing profound change—in our case, the transformation seen in eastern and central Europe and the former Soviet Union.”

An American who previously worked in China and Vietnam, Freeman knows that “there are very direct parallels in terms of the challenges and issues we all face.” But he argues that “the EBRD is unique in that its charter specifies it only operates in countries making adequate progress toward democracy.” Its core role is to provide assistance in the transition from Soviet-style, centrally planned economies to free market economies. And that means not just a healthy private sector, but more transparent institutions. “Other institutions don’t have that central focus,” he says.

Freeman admits that middle-income Russia takes the lion’s share of EBRD money but says, “We’re doing more now in the regions rather than capitals, with smaller entrepreneurs and different business sectors where access to private capital is still constrained. And with public-private partnerships we prefer to take the credit risk of the local municipality rather than the sovereign risk. Simply taking the sovereign risk makes you lazy.”

The Inter-American Development Bank (IDB), which has previously played a major role in mitigating the effects of numerous Latin American debt crises, is also changing its approach. Former US treasury official and IDB executive vice president Daniel Zelikow explains that since major client countries like Mexico and Chile can access alternative funding, the bank is going through a “realignment” and moving toward “higher-value financial products.” This may mean encouraging local capital markets by issuing longer-dated local currency bonds, or it could be more knowledge-based, assisting in risk management or allowing sovereign clients to hedge against foreign exchange volatilities.

Indeed, as doubts are cast over the efficacy of so much multilateral lending, “knowledge” has become a buzzword among development bankers. The World Bank, in particular, prides itself on being a source of “global knowledge” in such areas as risk management and helping countries to respond to external shocks or natural catastrophes.

Since such shocks can occur in richer and not just the poorest countries, Guerrero argues that middle-income countries “are interested in developing a fee-based consultancy-style relationship so that they can draw on that knowledge.”

Nag sees the development banks moving toward increased specialization, which in the ADB’s case means its “core competencies of infrastructure and regional cooperation.” Similarly, the IDB is seeking to play a more significant role in solving regional or cross-border issues. “It helps that we have credibility and access to the top levels,” explains Zelikow, “as well as 49 years of experience of putting together and executing investment projects in the region.” Moreover, he is confident that ways can be found to decouple advisory services from lending money.

“Middle-income countries like Mexico,” says Guerrero, “expect to come to the World Bank for non-lending services—provided the bank can keep the costs of doing business in check.” On this point he admits there is scope for reducing non-interest charges.

In its efforts to find a sense of direction, the World Bank is also studying how it works alongside bilateral aid from the large donor countries—especially on the big issues, like the environment or controlling the spread of communicable diseases, that have become known as “global public goods.”

The World Bank aims to increase the size of its contributions toward the poorest or least creditworthy countries, many of them in sub-Saharan Africa. But there are constraints, both in terms of how these economies can absorb major projects efficiently and because they include many countries where corruption has become endemic. The World Bank has launched a Governance and Anti-Corruption Initiative that is currently going through the consultation stage. “All the lessons of last year have been learned,” says Guerrero. But until the bank is seen to have set its own house in order, it will be hard for its staff to push anti-corruption measures on client governments.

Others seem to be doing better on this. “We were the first multilateral to adopt a policy on good governance back in 1995,” says the ADB’s Nag, “and we believe it’s more effective if done at the institution or project level—helping to strengthen the national audit authority or funding modern IT so that procurement is more transparent.” Since development banks have to work in partnership with client governments, he argues that on anti-corruption measures “it can be more effective when said in private.”

|

|

Former World Bank head Paul Wolfowitz, whose tenure ended in controversy. |

“We’ve been pioneers of ethical investment right from the EBRD’s beginnings in 1991,” says Freeman, “and we’re extremely cautious in terms of people with whom we work.” And like other development banks, the EBRD seeks to promote better environmental stewardship both by example and through its investment decisions—either by declining to invest or by promoting clean technologies, energy conservation and carbon trading.

Certainly, the multilaterals are touting their green credentials. “We operate in some of the least energy-efficient countries in the world,” says Freeman, “where up to seven times the amount of energy is used to produce one unit of GDP compared with Western Europe.” In this respect, though, they are no different from the commercial banks that have signed up to the Equator Principles, which require them to vet the environmental and social impact of projects in which they invest.

A Shelter from the Storm

The big development banks may come into their own again should the volatility in financial markets spread into the real economy, triggering a global slowdown—and especially if the contagion spreads to emerging markets. Last year the World Bank’s chief economist looked at the possibility of future market volatility and advised the bank to be ready to respond to any increase in interest rate spreads demanded by capital markets for lending to developing countries and the exogenous shocks this might cause to their financial systems. “We are very much preparing for those contingencies,” says Guerrero.

“Conditions are getting tougher for everyone,” explains the EBRD’s Freeman. “While emerging markets are less volatile than previously, they are more global and therefore linked to what happens elsewhere.”

Nag comments: “Although Asian economies have shown very impressive growth, they remain vulnerable to financial crises.” And while banking systems may now be “more resilient and able to cope with ripple effects than in 1997, our view is we must be responsive. So if that’s what it takes, that’s what we’ll do.”

Ironically, a global recession would give the copper-plated multilaterals a new lease of life. The immediate priority for the World Bank, however, is to cut its costs. It also needs to develop a new range of financial instruments—like the blending of grants from donor countries with multilateral loans—that respond to today’s conditions and needs and not those of 40 years ago. And it must move down the path toward being more of a knowledge-based consultancy than a lending institution.

Five years down the road it is confidently expected that the World Bank will be lending less and providing more services, especially what Guerrero calls “targeted knowledge.” That will be accompanied by ongoing debate about the bank’s “ownership”—its funding and voting structures—with the pressure coming from large emerging economies such as India and Brazil to have a greater say.

As for the possibility that development banks may cease to exist, the ADB’s Nag says, “It would be the ultimate compliment that we could work ourselves out of business.”

AS DOUBTS ARE CAST OVER THE EFFICACY OF MULTILATERAL LENDING, “KNOWLEDGE” HAS BECOME A BUZZWORD

Countries “are interested in developing a fee-based consultancy-style relationship so that they can draw on that knowledge”

—Pablo Guerrero at the World Bank

Jonathan Gregson