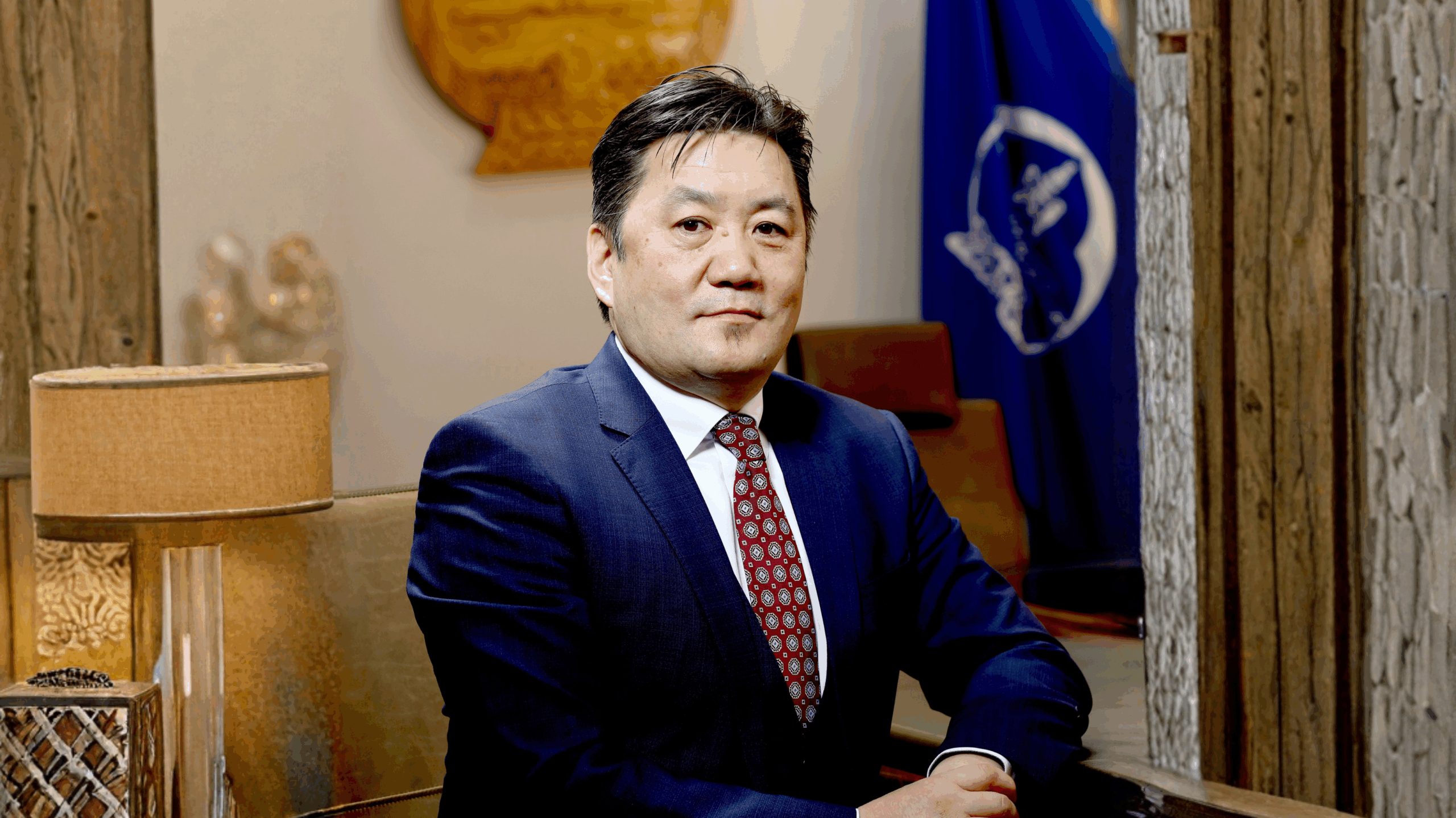

A cautious but upbeat Byadran Lkhagvasuren, governor of the Bank of Mongolia, is navigating volatility in commodities and strengthening ties with regional trading partners.

Global Finance: What is the growth outlook for Mongolia in 2025?

Byadran Lkhagvasuren: Mongolia’s economy is projected to grow by around 5%-6% in 2025, supported primarily by copper production from the Oyu Tolgoi underground expansion, a recovery in agriculture following last winter’s losses, and steady growth in the service and construction sectors.

That said, we remain cautious. Global economic uncertainties and geopolitical tensions could weigh on export markets and investor sentiment. Commodity markets are mixed: copper is performing strongly, but coal has been more volatile, which already affected reserves earlier in the year. Inflationary pressures and climate-related risks—such as dzud [extreme winter conditions that lead to mass livestock death]—also remain domestic challenges.

As the central bank, we are taking a conservative stance. We are ready to use all available policy instruments—monetary, macroprudential, and regulatory—to safeguard price and financial stability. At the same time, we stress the importance of fiscal prudence and economic diversification to reduce dependence on volatile commodities. The overall outlook is positive, and it is worth noting that the country’s credit outlook remains stable, reflecting international confidence in Mongolia’s medium-term potential.

GF: How stable is the country’s foreign exchange reserve position?

Lkhagvasuren: As of August 2025, Mongolia’s foreign exchange reserves reached a record US $5.68 billion, covering around six months of imports and providing a strong buffer against external shocks.

In the first half of 2025, reserves came under pressure from weaker commodity prices—particularly coal—together with global trade tensions and softer market conditions. Since July, however, the picture has improved. Reserves recovered due to stronger copper prices, higher income from reserve management activities such as gold monetization, and more resilient demand from major partners, including ASEAN economies, which helped offset weaker demand from the US. Our financial sector also secured additional external funding from international markets, supported by investor confidence in Mongolia’s medium-term outlook.

Looking forward, long-term stability will require reducing reliance on a narrow set of commodities. Government efforts to diversify mining exports, improve infrastructure, and enhance the investment climate are crucial.

GF: What was the rationale for increasing the policy rate this year?

Lkhagvasuren: Inflation accelerated in the second half of 2024 and remains above 8%, exceeding our target band. While global supply-side shocks—such as commodity price volatility and supply chain disruptions—played a role, core inflation remains persistently elevated, reflecting strong domestic demand. Wage growth, which has been significant in recent years, has also added to these pressures. Against this backdrop, the Bank of Mongolia began tightening its stance at the start of 2025 to prevent inflation from becoming entrenched. Our priority is to bring inflation back within target, stabilize expectations, and safeguard financial stability.

GF: Is there an equitable balance in the country between fiscal policy and monetary policy?

Lkhagvasuren: Our mandate as a central bank is not to evaluate fiscal policy choices, but to conduct monetary policy within the fiscal environment in which we operate. Our responsibility is to safeguard price and financial stability, regardless of the fiscal stance.

Of course, when fiscal and monetary policies are aligned, the impact is stronger. But as a neutral institution, our role is to use the tools at our disposal to manage inflation, anchor expectations, and support sustainable growth.

GF: Why is Mongolia seeking more active engagement with ASEAN countries?

Lkhagvasuren: ASEAN economies are among the fastest growing globally, with dynamic markets and deepening regional integration. Strengthening Mongolia’s engagement with this group offers clear benefits: expanded export markets, more diversified investment flows, technology transfer, and enhanced financial cooperation to build resilience.

On the central banking side, Mongolia is an active member of the SEACEN community of central banks. We were honored to host the SEACEN Human Capital Conference and Course for Central Bankers in Ulaanbaatar this summer, highlighting our commitment to regional dialogue and capacity building.