Microfinance has flourished since its inception, because it combines a desire to combat poverty with pragmatic financial solutions for impoverished individuals. Although its successes have been less far-reaching than hoped by some of its proponents, it does provide a response to the challenges to helping the impoverished gain access to financial services to increase their incomes and financial stability.

While microfinance has existed in rudimentary form since the Middle Ages, its modern structure started to take shape in 1961 when Joseph Blatchford launched Americans for Community Cooperation in Other Nations (now called Accion International) as a community development organization, operating first in Venezuela and later in Brazil. Accion began making loans to small businesses in 1973 and by the 1980s started providing microcredit in those countries.

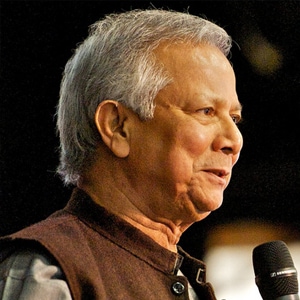

In 1983, Muhammad Yunus founded Grameen Bank in Bangladesh, having started in the 1970s with personal loans to basket weavers. He and the bank were awarded the Nobel Prize in 2006 for their work. In 1984, John Hatch established the Foundation for International Community Assistance (Finca) framed around a concept of village banking programs. Finca started providing these programs in El Salvador in 1986 and in Mexico, Honduras, Guatemala and Haiti in 1989.

These three innovators had no known direct connection, but their shared goal was to assist impoverished individuals in what we now call emerging and frontier markets by providing financial services to which they would otherwise have no access. “Each of those three played a role in creating the modern microfinance movement,” says Tim Ogden, managing director at the Financial Access Initiative, a research center housed at New York University.

The sector has several financial models, but in many cases an umbrella organization—such as Oikocredit International, based in Amersfoort, the Netherlands—gathers funds from individuals, social-investment organizations, governments and other sources and disburses them through microfinance institutions and other organizations.

The sector has had many successes and touched many lives, according to Microfinance Market Outlook 2016 published by responsAbility Investments. The report says that the 100 institutions in its model portfolio have served 31.8 million borrowers. The microfinance sector has created numerous institutions and, therefore, numerous specialized financial jobs. It has enabled the growth of small businesses across the emerging- and frontier-market countries and added to the self-respect of many entrepreneurs.

It has had other successes, including a sea change in attitudes toward impoverished individuals, says Ging Ledesma, Oikocredit International’s investor relations and social performance director, in a telephone interview from Amersfoort. “That’s when people started changing their opinions about poor people—what poor people do with their money—that poor people can actually pay back; poor people can actually save.”

However, the expected outcomes, including the end of poverty, have not materialized. “It was never rational to think that a $100 loan to people making $2 a day was going to be sufficient to lift them out of poverty,” Ogden says.

While organizations such as responsAbility and Oikocredit foresee continued growth for the microfinance sector, several questions overhang its future, including continued access to the amounts of capital required. “The very big question facing the industry right now is how accessible capital is going to be; and if capital gets more expensive, what is that going to mean for those 300 million people [who use microcredit]?” Ogden asks.

Moving into the digital age, a large unknown is the net impact of mobile money, since telecommunication companies operate on the profit motive rather than microfinance principles, Ogden says. He calls mobile money the dominant factor that will affect the microfinance sector over the next five years, as it has had large penetration in countries in which microfinance is important.