Global Finance commends excellence in pandemic response.

A crisis is a kind of a test: It can bring out the best in us—or the worst. The coronavirus pandemic has been such a test, and while some have failed, many—companies as well as individuals—have passed with flying colors.

Global Finance is pleased to commend a raft of companies from around the world that went above and beyond in responding to the health crisis—whether with support for their employees and customers, for the beleaguered healthcare sector or for the survival of the economy. In recognizing companies and financial institutions for Outstanding Crisis Leadership in 2020, we honor their excellence not only as companies, but as corporate citizens.

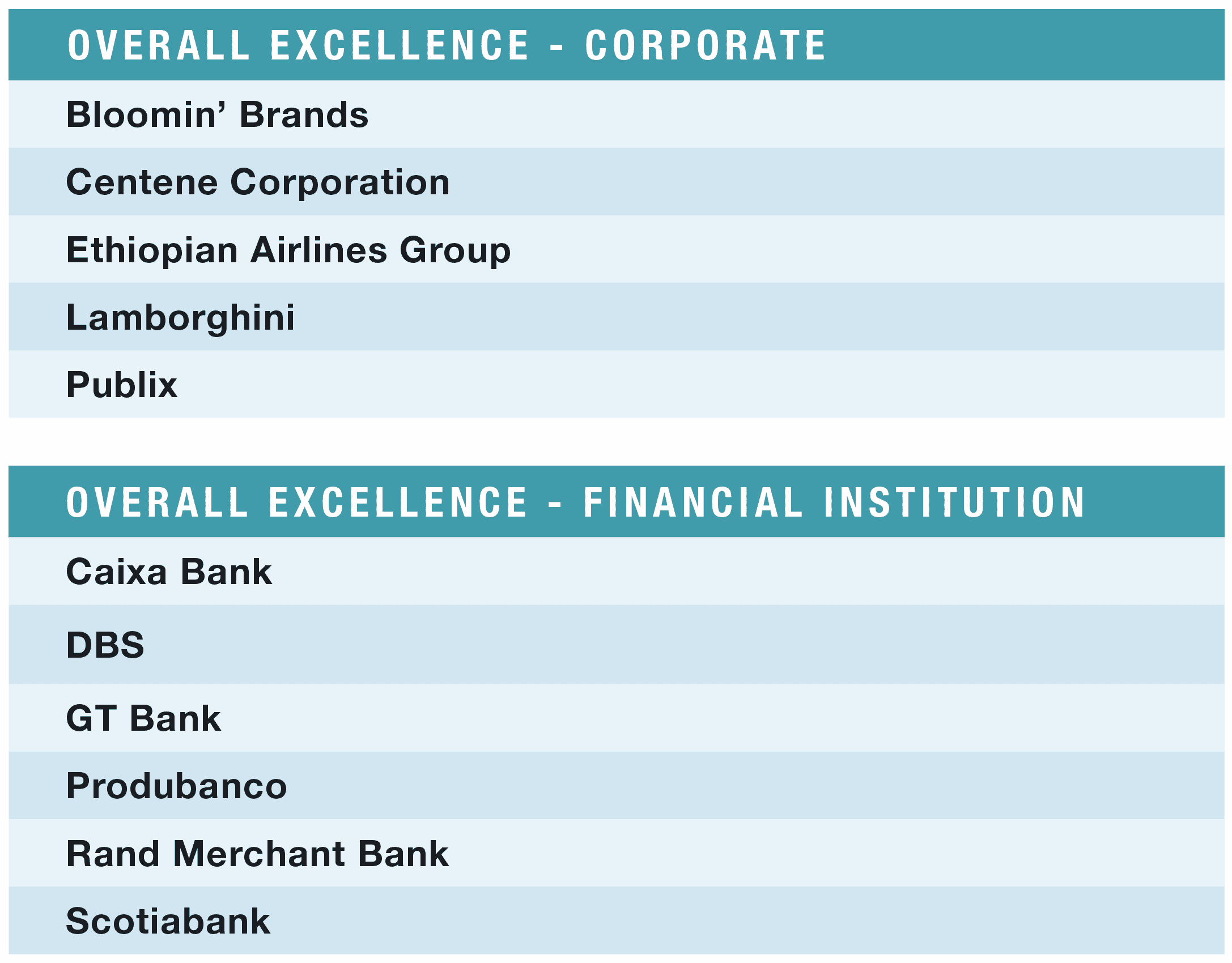

As a media outfit, we can help by broadcasting the stories of these grand efforts, showcasing their success and impact. Our review panel was impressed with the range and creativity of response measures, which were not easy to compare side by side. Highlights included: Guaranty Trust Bank, which virtually built a hospital overnight; Lamborghini, which with equal speed turned its auto upholsterers toward making critical medical parts; Ethiopian Airlines, which adroitly pivoted from carrying passengers to transporting critical medical supplies; Bloomin’ Brands (parent of Outback Steakhouse Restaurants) and RandMerchant, where executives sacrificed their own compensation; and Publix, which ramped up hiring as unemployment soared. Banco Cuscatlan’s provision of aid and food packages to victims of storms reminded us that although Covid-19 has dominated the headlines this year, it isn’t the only crisis we face.

Inspired by their examples, Global Finance is giving 10% of the December issue’s revenue to the United Nations Covid-19 Solidarity Fund, a fund established to channel private-sector support to the World Health Organization to combat the virus.

Selection Criteria

Global Finance sought nominations and suggestions from contributors, and actively encouraged entries. (There was no fee, but our selection was limited to companies that submitted material.) Given the magazine’s focus on finance, it is no surprise that entries from financial institutions outweighed corporates by a large margin.

Evaluating leadership in crisis is more art than science. Initially, each entry was reviewed by two members of a panel of judges. The review, combined with independent research, established some benchmarks, including what constituted common or average response. Although all entrants took various worthy actions, we eliminated those that were deemed to merely meet rather than exceed expectations. In short, it wasn’t enough to let employees work from home or stock physical locations with hand sanitizer for customers. The bottom-line value of donations was considered in light of each institution’s resources.

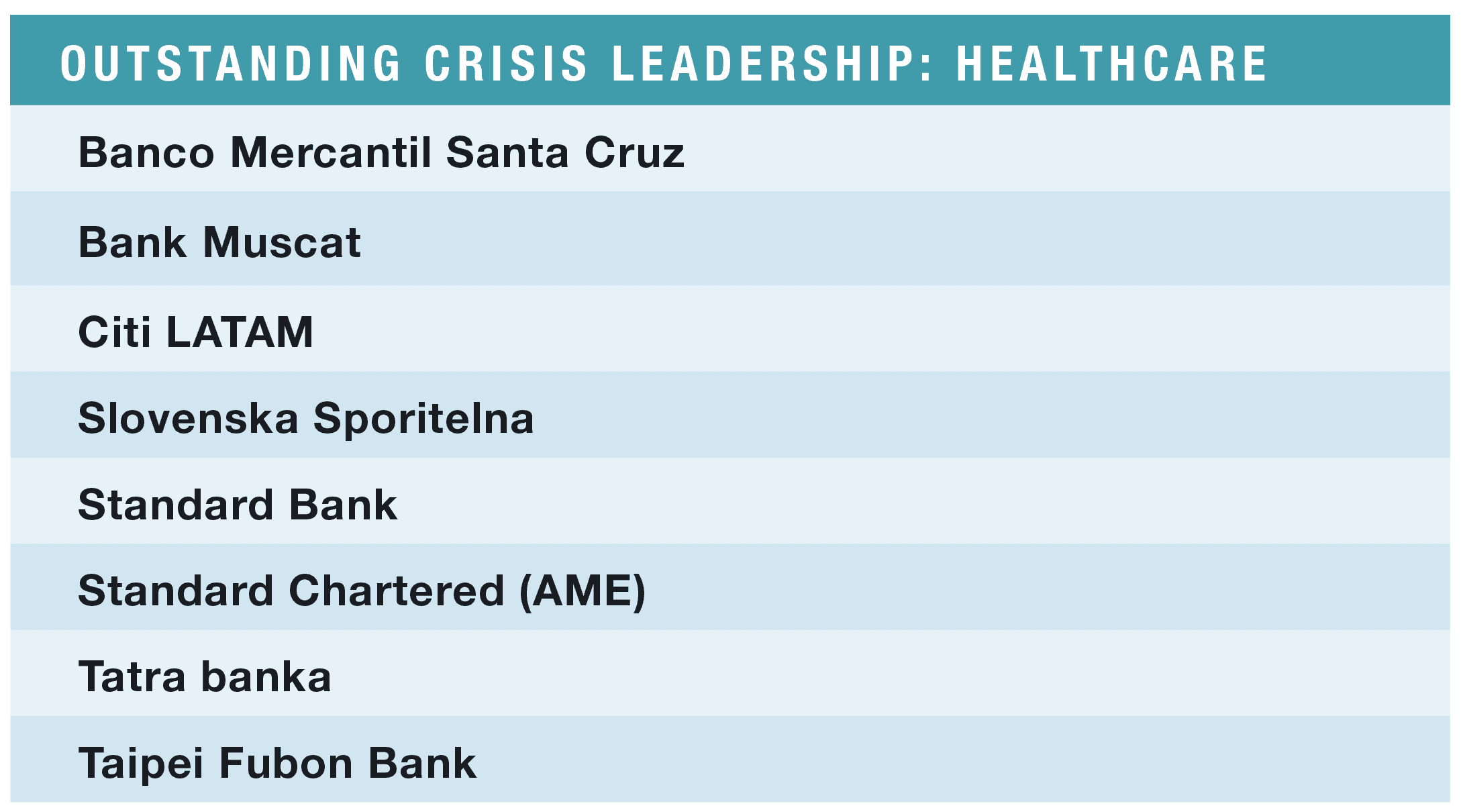

Three categories emerged naturally from the responses. Our Healthcare heroes took measures that directly support the practice of medicine: patient testing and care; research and development of drugs and treatments; and direct provision of medical supplies to hospitals and clinics. Non-medical initiatives to maintain public health, such as food or cash donations, stress counseling, or public distribution of sanitizer or PPE, were classified as Community support. The Community category also included educational material for parents and teachers, morale-boosting entertainment, fitness programs and other peripheral support for communities struggling with social distancing. It also includes actions that helped the business community by fostering innovation or cooperation.

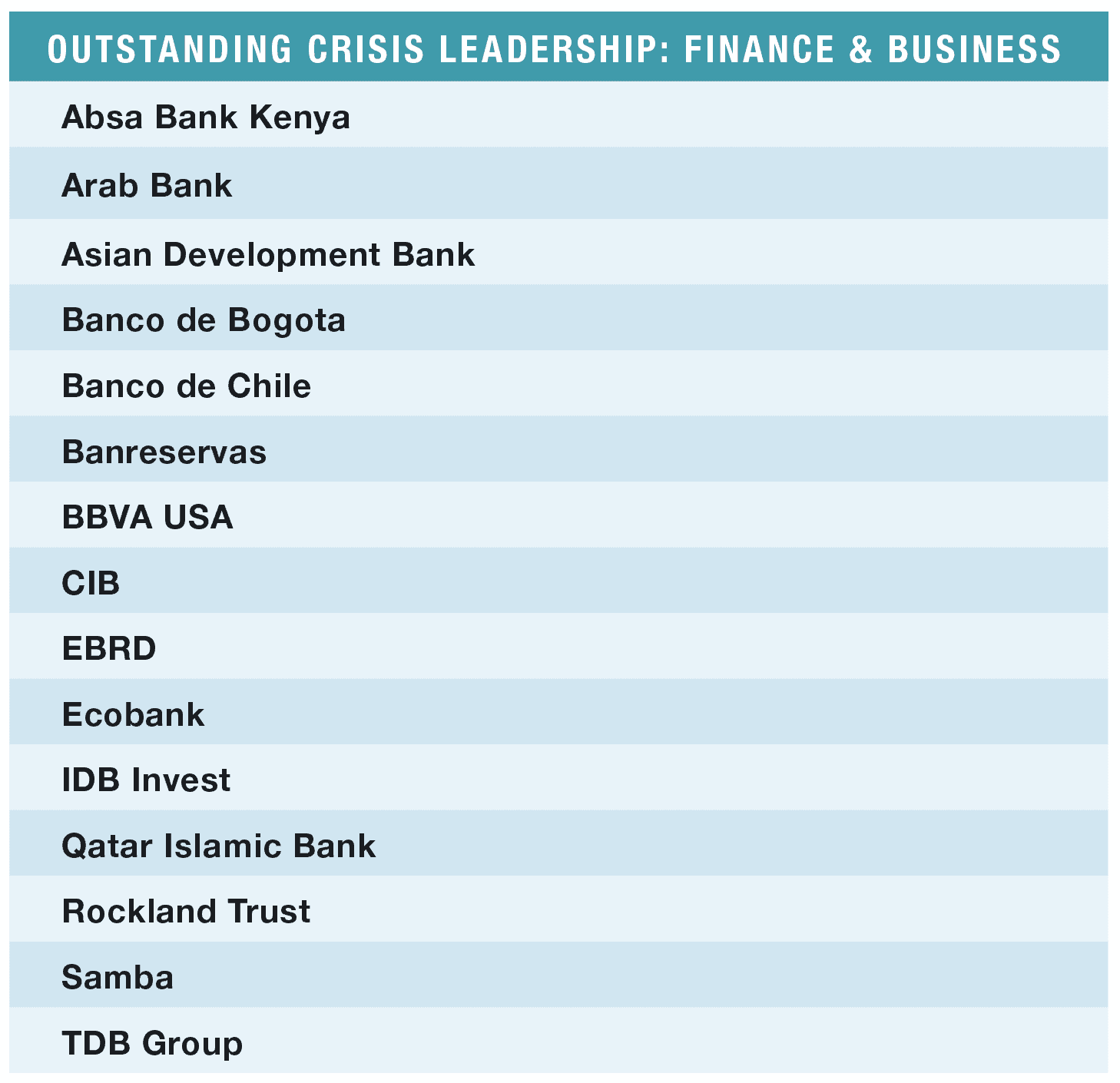

Third, Finance & Business honors those that helped stave off economic collapse by supporting individuals, businesses and even governments. Many banks offered loan payment deferrals, for example, in some cases mandated by their governments. Some supported economic continuity with new products or new uses of data. Banreservas rapidly built a new system to help the government get relief to unbanked citizens. KCB propped up co-ops. Samba Bank received temporary shariah dispensation. Taipei Fubon added flexibility to its corporate working-capital programs.

In addition, the five-person final review panel looked for speed, innovation and ingenuity in response, and breadth of each company’s efforts. The final analysis showed a few institutions that were exceptional in all our categories and by nearly all of our metrics. A larger group stood out in one or two categories, and also showed particular excellence in either speed, innovation or reach. A final group rose above the baseline with one or two specific initiatives.

These pages were reported and written primarily by Andrea Murad, Gordon Platt and Gilly Wright, with support from Joel Kranc, Vincent Nwanma and Lyndsey Zhang.

Methodology: Behind the Rankings

Selection was limited to entities that submitted entries. After an initial review by a panel of three independent judges, those whose efforts were on par with peers (rather than above the average) were eliminated. The remaining entrants were evaluated, scored in each category and ranked separately by each of the judges as well as two Global Finance editors. Scoring took into consideration local conditions and the capacity of the entrant, and awarded points for speed, innovation and cross-border reach.