IPO momentum is sustained by global stimulus measures that are boosting confidence.

Initial public offering (IPO) volumes hit record highs in the first five months of 2021, with the number of new listings at levels not seen since the dot.com bubble 20 years ago. Asian countries dominate the top ranks in terms of number of deals, according to business research and analysis firm ION Analytics, but the market has been lively worldwide.

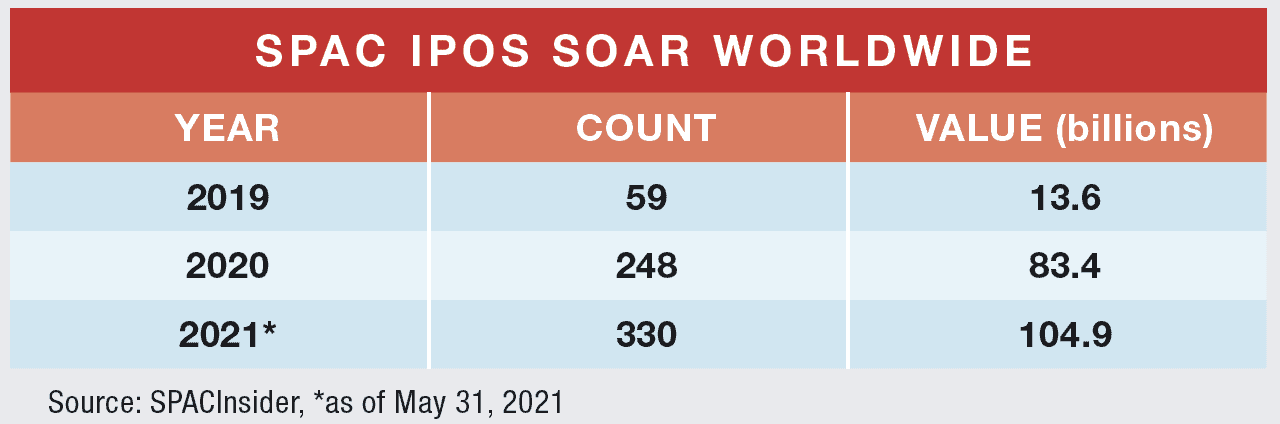

“In EMEA [Europe, the Middle East and Africa], after a bumper first quarter, the market is seeing a slowdown in pace,” says Giovanni Amodeo, ION’s chief data officer. US IPOs also saw a very big first quarter. “The peak of an upward trend started in 2020 and was buoyed largely by SPAC issuance, which hit records this year.”

US exchanges account for 40% of total global proceeds, with the Nasdaq raising a record $39.9 billion as of May 10, according to Refinitiv. Excluding SPACs, the technology sector accounted for 27.1% of new listings.

IPO momentum is sustained by global stimulus measures that are boosting confidence, while rock-bottom interest rates have big investors flush with cash and cheaper stock trading draws in more (and younger) investors. Combined with the tsunami of digitalization brought on by the pandemic, it means a continued dynamic environment for IPOs, especially in tech.

“We are at a pivotal moment in history, with the creation of a new, more inclusive financial environment,” comments Yoni Assia, CEO of trading platform eToro, who expects to raise $10.4 billion for the company’s Nasdaq IPO in the third quarter. “We are witnessing a real financial revolution thanks to zero interest rates and commission-free stock investing. Going public is ideal at this point in time”

And even the recent slowdown in SPACs may be no more than a breather (see chart below). “As companies adjust to the SEC’s fresh guidance, SPAC issuance could resume,” says Amodeo, “albeit at a more sensible pace.”

The IPO juggernaut rolls on.