Japan’s Nippon Telegraph & Telephone Corp. will use the proceeds to pay for the acquisition of its mobile unit.

In the biggest local debt sale in history by a Japanese corporate issuer, a unit of Japan’s Nippon Telegraph & Telephone Corp (NTT) last month placed 1 trillion yen (US$9.6 billion) of bonds. The deal was twice its original target size, and orders came to more than twice the final volume.

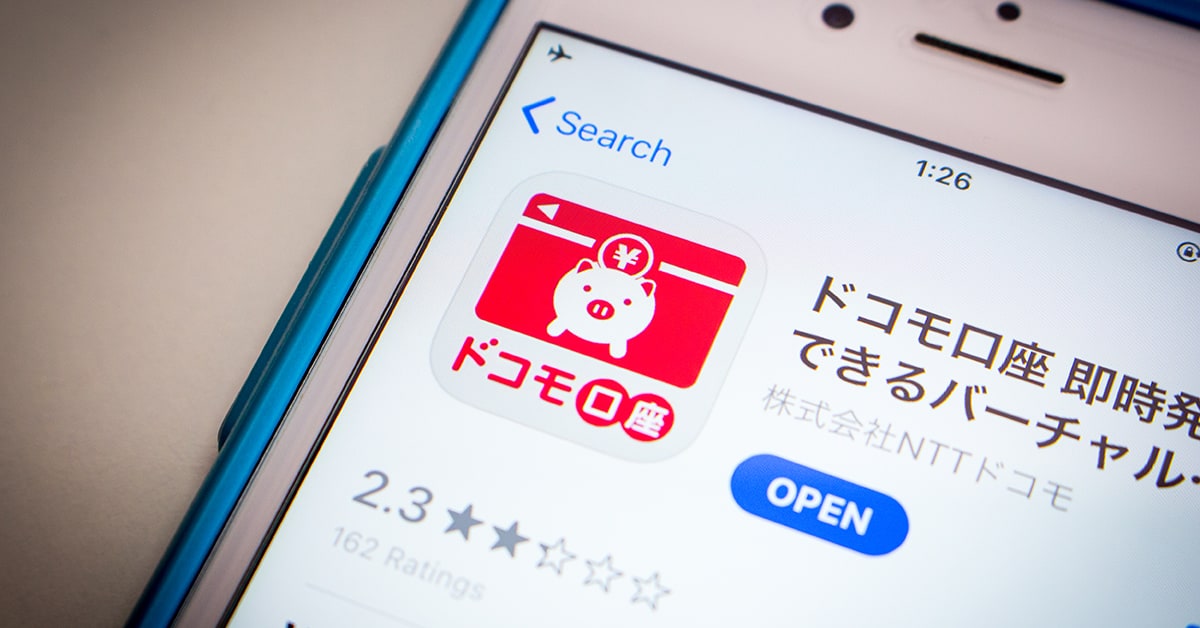

Proceeds of the bonds, raised by NTT Finance, would be used to help repay short-term borrowing for the issuer’s March acquisition of the one-third stake in its mobile unit, NTT Docomo, that it didn’t already own, the company said.

Demand for the offering was strong, in part because of the relatively attractive yields. The 10-year bond’s yield, at 0.38%, was 36 basis points higher than a 10-year Japanese government bond.

Japan’s corporate bond market is small relative to the size of its economy, as companies historically have preferred to borrow from banks. But the size of the NTT deal, in the context of a surging global corporate bond market that saw issuance jump 31% in 2020 to a record $3.3 trillion, suggests this may be changing.