Study of wealthy Millennials finds more interest in private equity than robo-advisory, and a desire to “do good” as well as get good returns.

Want to save the world? Leave the job to the ultra rich kids. Wealthy Millennials want to do well, but they also want to do good—and in order to that they might have to engage in a few fights with their parents in the boardroom or at the dinner table.

This is one of the main takeaways from “Coming Of Age: The Investment Behaviors Of Ultra-High Net Worth Millennials In North America,” a report by asset management firm OppeneheimerFunds in partnership with Campden Wealth.

The research, which focuses on individuals born between 1980 and 1995 to families with net worth between $25 million and $1 billion, finds only one-fifth (21%) are fully satisfied with their families’ current goals; they plan to make “significant changes” in the family investment strategy once they assume control. How? A third indicate they want to incorporate environmental, social and governance (ESG) standards into their family’s benchmarks, and a third would increase their allocations to impact investments.

These American Millennials also show a keen appetite for the kind of risk that brings rewards. A third said they would invest less in liquid investments, such as hedge funds and private equity, even though they also rate this one of the riskiest areas (second only to emerging markets equities).

“UHNW Millennials are increasingly taking calculated risks with their investments while considering the potential long-term implications of these decisions,” says Ned Dane, head of Private Client Group at OppenheimerFunds.

However, it is noted in the study, these “significant changes” are already under way. While parents and grandparents typically still have final say on the allocation of the family’s assets, many of these millennial scions are entrusted with important advisory or administrative roles, and manage hefty piles—between $25 million and $500 million—some part of which they will inherit.

Last year the Toniic Institute, a nonprofit global organization of impact investors, published a similar survey of investing Millenials, not just in the US but around the world. While respondents were not uniformly wealthy, two thirds indicated they had personal investments of at least $500,000 or were in line to control for inestable family assets of at least $1 million—around the world with with personal investment assets of $500 million to $99 million. Respondents indicated that while the current allocation to impact investments their portfolios is less than 50%, a growing minority (10%) of those surveyed have already moved 90%-100% of their personal assets and/or their family’s assets to impact investing vehicles, and 72% intend to follow within the next five years—even though they recognize these investments as carrying “moderate to high risk.”

However, where there is a will there isn’t always an immediate way. Those surveyed by the Toniic Institute identified their lack of knowledge about impact investing as the biggest hurdle to shifting their wealth to socially or environmentally responsible ventures while maintaining a financial return.

The OppenheimerFund study indicates even high-net-worth Millennials see themselves as lacking knowledge. Fewer than one in three (32%) rated their values-based investment knowledge highly, with almost one in four (24%) perceiving their knowledge to be either poor or very poor, and 42% indicating they would like to learn more.

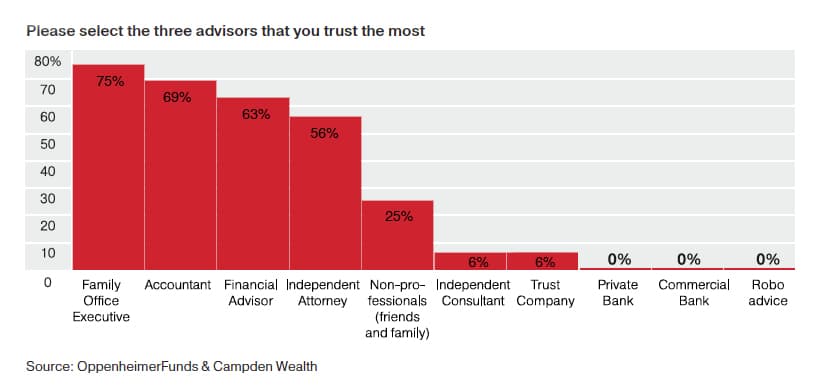

And when it comes to learning more, once again, Millennials defy most expectations. Whereas much has been written about the demise of financial advisors in favor of technological alternatives, UHNW individuals still prefer humans to machines. While nearly three-quarters (71%) of them seek professional advice before making investment decisions, 88% do not rely on robo-advisory services and 56% consider robo-advisory the least trustworthy source of advice after commercial banks.

Where do they place their trust for financial advice? Asked to name their three most-trusted advisors, the vast majority of respondents (75%) included the family office executive, followed by 69% praising their accountants and 63% putting their faith in financial advisors. At the other end of the trust spectrum, private banks, commercial banks, and robo advice, however, were deemed trustworthy by zero percent of these wealthy up-and-comers.

“As Millennials edge closer to taking ownership of the family wealth, it is clear that their views differ from previous generations,” says Dominic Samuelson, CEO of Campden Wealth. The advisors that serve them will have to adapt.