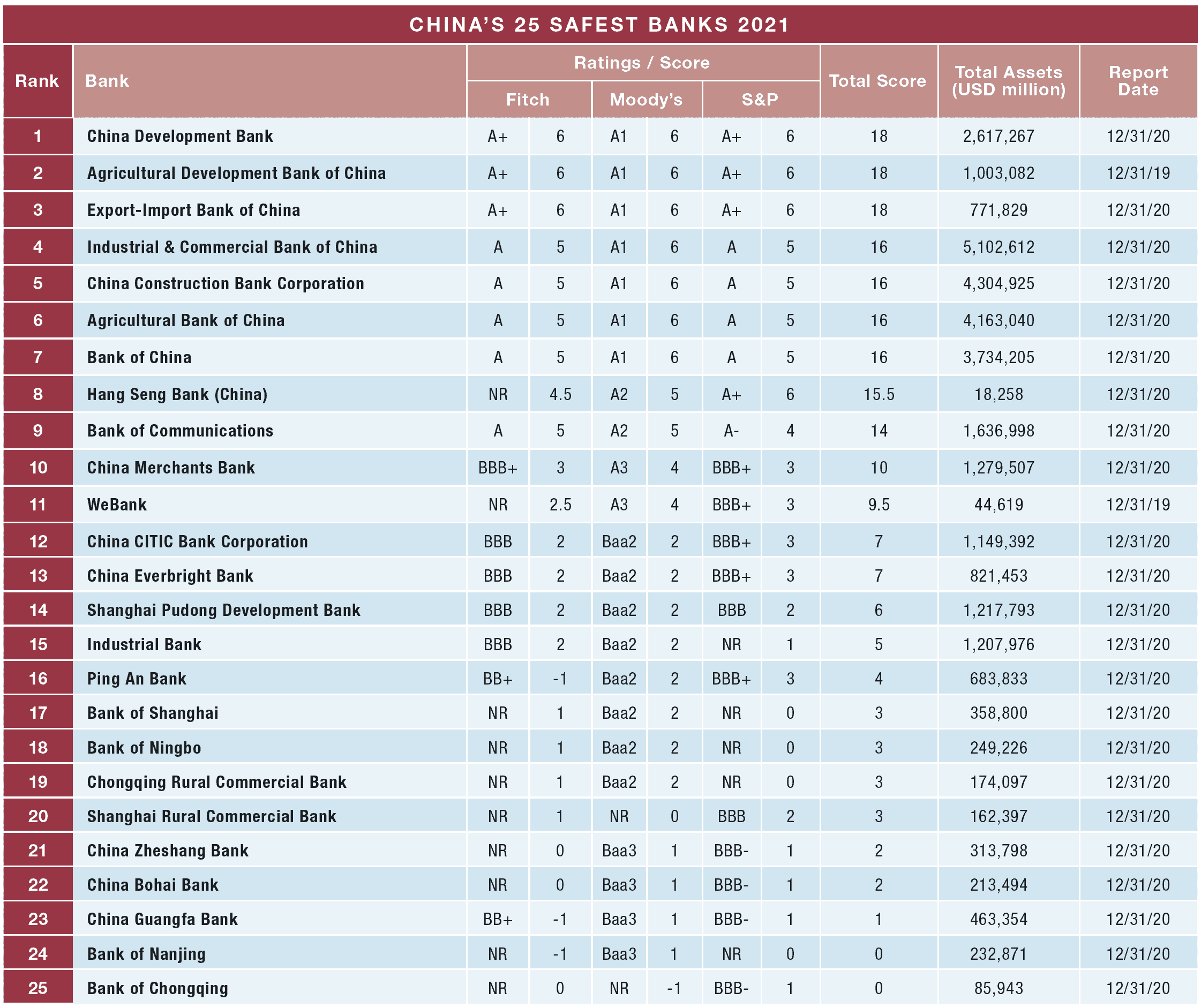

Global Finance names this year’s top 25 safest banks in China.

As the crisis phase of the pandemic recedes, national economies are recovering in fits and starts, with varying degrees of progress and intermittent setbacks due to several factors, including fresh waves of Covid-19 and scarcity of commodities and components, which has slowed production and disrupted global trade. This dynamic is particularly acute for China’s slowing economy, which registered only 4.9% growth in the third quarter of this year, down from 7.9% in the second quarter, and a whopping 18% in the first quarter. The banking sector is under stress as the recovery loses momentum.

In addition, banks face rising risks from exposure to the Chinese property sector and real estate developers. This exposure has steadily grown over the years as banks are eager to lend to this dynamic sector. Real estate has been a significant driver of growth for the banking industry as well as the country as a whole, contributing approximately 25% of GDP. After years of unrelenting growth in construction of large commercial and residential properties, there is now tremendous overcapacity—most notably in the residential segment—and the risk of failure for many projects and developers is increasing. As significant risks remain, our 2021 rankings of the Safest Chinese Banks provide a valuable reference point for this banking system.

Steps to Reduce Leverage

The government continues to act on its intention to reduce the Chinese economy’s reliance on the property sector. In January 2021, officials at the People’s Bank of China (PBoC) and the China Banking and Insurance Regulatory Commission (CBIRC) imposed regulatory measures to de-leverage the system. While the “three red lines” initiative outlined key leverage metrics property developers must comply with in order to have continued access to financing, restricting the ability for developers to refinance amid deteriorating real estate prices may add additional stress on these companies. Officials imposed a regulatory cap on property-related exposures at the banks, and as a result, loans to property developers fell 6% during the first half of the year, according to Moody’s. Still, outsized leverage remains.

At the center of this growing crisis is the massive property development conglomerate known as China Evergrande Group, whose financial condition is deteriorating rapidly as it deals with the stress of servicing a heavily leveraged balance sheet. The CBIRC attempted to soften the risk Evergrande poses to the system by conveying the opinion that it will not have a major impact on the banking sector, as risk exposure isn’t large at individual banks. Maybe so, but the risk of the company failing can’t be dismissed, and while it remains to be seen to what degree the government may intervene to provide stability, a more widespread downturn in the sector is expected. This is likely to significantly accelerate the already rising credit costs for the banks, further eroding profitability, particularly for the smaller banks in our rankings.

As is the case every year, our rankings involve some shifting positions. Banks that rise in our rankings, and new banks entering the Top 25 Safest Chinese Banks are frequently the result of new coverage of a bank by one of the rating agencies. Such is the case for Ping An Bank, which rose in our rankings to No. 16 from No. 21 and now holds ratings from each of the agencies as S&P initiating coverage in November 2020 with BBB+ long-term rating. Chongqing Rural Commercial Bank is a new entrant this year at No. 19 as Moody’s initiated coverage in January 2021 with Baa2 citing its solid financial profile relative to mid-sized Chinese bank peers. Another new entrant is China Zheshang Bank at No. 21 which experienced two positive rating actions as it was not only upgraded by Moody’s to Baa3 from Ba1 but was also picked up by S&P which assigned a BBB- rating in February 2021. As a result of these new bank, Shenzhen Rural Commercial Bank and China Minsheng Banking Corporation fell out of this year’s rankings.

Methodology: Behind the Rankings

The scoring methodology for the Safest Chinese Banks follows that used in our other Safest Banks rankings. A rating of AAA is assigned a score of 10 points, AA+ receives nine points, down to BBB- worth one point and BB+ worth -1 point, and so on. When a bank has only two ratings, an implied score for the third rating is calculated by taking the average of the other two and deducting one point. When a bank has only one rating, an implied score for the second rating is calculated by deducting one point from the actual rating, and an implied score for the third rating is calculated by deducting two points from the actual rating.