Dramatic growth meets rising regulations and diverse demands.

Steeply rising affluence within the Asia Pacific region (APAC) has driven the robust secular growth of the region’s private banking industry for the past few decades. As a result, assets under management (AUM) have increased faster relative to those in North America and Europe, and this growth shows no signs of abating.

Competition for a share of the wealth-management wallet of the region’s high-net-worth individuals is of white-hot intensity. An ever-sharper regulatory and compliance-focused sales-practice backdrop–with shrinking fees, the aggressive pace of fintech disruption–and the surging demand for sustainable investment products and practices–have rendered APAC’s private banking landscape somewhat forbidding.

To maintain their positions, dominant regional participants require exceptional capabilities. These could be an innovative technological edge; a deep regional footprint; an institutional cross-sell ability; or a full-scale executable grasp of the environmental, social and governance (ESG) zeitgeist—or all of those.

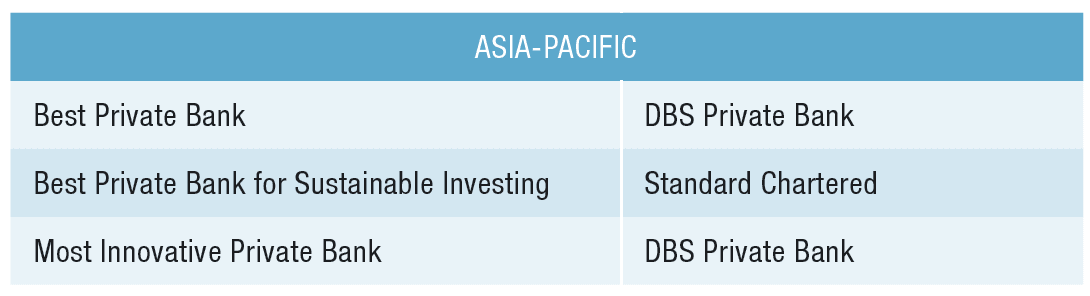

BEST PRIVATE BANK

BEST INNOVATIVE PRIVATE BANK

DBS Private Bank

Singapore’s DBS has definitively overcome last year’s pandemic headwinds via harnessing digitalization—under its existing DBS iWealth platform and with its TeleAdvisory capability, which it launched at the start of the pandemic—to tap into Asia’s family office boom and to champion ESG investments.

The numbers tell the story: Global private banking client assets grew by 264 billion Singapore dollars (about $195 billion) in 2020, a rise of 7% year on year, accompanied by a robust 11% gain in fee income; while discretionary client wealth managed within the CIO Barbell Strategy Portfolio has grown by 26.3% net of fees since its inception in 2019.

DBS’ private bank clients embraced the MSCI EM Asia ESG Leaders Outperformance Trade on its October 2020 launch, with 690 million Singapore dollars of subscriptions allocated to the three-year long/short warrant, which aims to capture the outperformance of ESG versus conventional assets.

The bank has been a critical player in the burgeoning family office segment, having doubled the number of privately held family offices it has helped establish and having grown AUM fourfold since 2019.

With all this, DBS has demonstrated its claim to be Asia’s most innovative private bank, with a surge in its use of artificial intelligence and machine learning since early 2020 under the Intelligent Banking umbrella. Its in-house technology engine has generated some 13 million insights per month. At the same time, the bank has led the way with its industry-first smart triggers that leverage the group’s research capability, vast database and the privileged resources afforded by its corporate and investment banking capabilities.

The bank further demonstrated its innovative nature with the launch early this year of the DBS Digital Exchange—a full-service, members-only digital exchange allowing customers to tap into a tokenization, trading and custody ecosystem for digital assets, including cryptocurrencies.

BEST PRIVATE BANK FOR SUSTAINABLE INVESTING

Standard Chartered Private Bank

Standard Chartered Private Bank voiced an explicit statement about its position and aspirations within the sustainability segment via the launch in January 2020 of ESG Select to identify and curate wealth management strategies according to ESG factors.

The platform’s methodology is tailored to individual asset classes, from fixed income and equities to structured products. It assesses each asset class according to different criteria and uses the same individualized filtering process for fund and discretionary portfolio products.

“We have seen increased interest from many of our high-net-worth clients to include a sustainable element in their investment portfolio,” Eugenia Koh, head of Sustainable Investing and Strategic Engagement at Standard Chartered Private Bank, said in announcing the launch. “Our open architecture approach, which is product agnostic, coupled with our Impact Philosophy, allows our bankers to recommend ESG products that address clients’ impact needs.”

ESG Select’s launch would help the bank address green-washing concerns, she added; and she expressed confidence that “clients will benefit from a more rigorous and systematic investment decision journey.”

Standard Chartered Private Bank serves clients across Asia from its offshore booking centers in Hong Kong and Singapore. The bank returned to profitability in 2019 after a four-year reorganization during which it boosted its AUM and number of relationship managers. Asia is central to Standard Chartered’s private bank franchise: Of the bank’s $73.3 billion in AUM as of the end of 2020, a hefty $64.2 billion was held by clients in Asia. Standard Chartered Private Bank’s focus on ESG operates under the group’s “Impact Philosophy,” which relies on a measurement methodology formulated in line with global Impact Reporting and Investment Standards within the framework of the United Nations Sustainable Development Goals.