Last spring’s seize-up in the global M&A market eased as companies rethought their business plans and sought a leaner profile.

Given the collective paralysis the business world experienced early last year as it addressed the Covid-19 pandemic, the volume of merger and acquisition (M&A) activity in 2020 was surprisingly solid. Global M&A volume in 2020 totaled $3.6 trillion, down about 5% from 2019, Refinitiv reports.

Early on, the prognosis had been much bleaker.

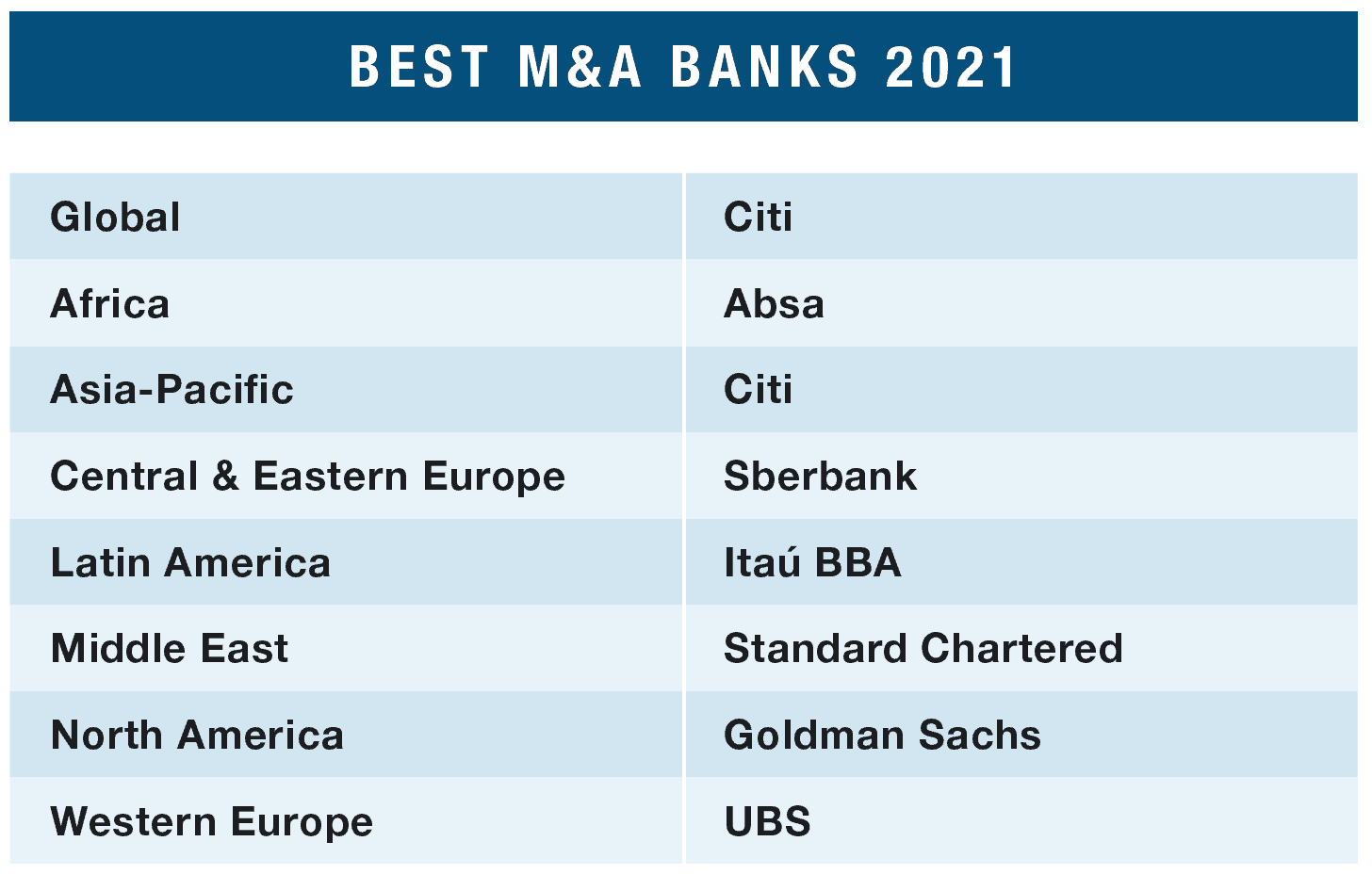

“In the March-to-May time frame, the markets came to almost a complete standstill. That type of halt is virtually unprecedented,” says Cary Kochman, co-head of Global M&A at Citi, which Global Finance ranked as Best M&A Bank globally and in the Asia Pacific region. Midway through 2020, deal volume had fallen 41%, according to Refinitiv.

While shocking, the collapse wasn’t surprising. As the pandemic took hold, companies understandably focused on protecting their employees, operations and liquidity. Most M&A plans were shelved. Heightened trading volatility and reduced earnings visibility made it difficult to transact, slowing the volume of deals in the pipeline, says Philipp Beck, head of M&A for Europe, the Middle East and Africa at UBS. Mobility restrictions and tightened foreign direct investment regimes added further difficulty.

The drop in M&A was nevertheless short-lived.

“When we reflect on the last year, it’s fair to say the year can be cut in two halves,” Beck says. After screeching to a stop, the market roared back as market conditions normalized and lockdown restrictions eased.

A Changed Environment

Yet, as issuers ventured back to the M&A markets, many changed their approach to reflect a changing business model, says Jason Langan, a managing partner in the M&A transaction services practice and national M&A industry leader for financial services at Deloitte & Touche. With consumers growing accustomed to working remotely and some still leery of heading back to stores and bank branches, he says, companies are acquiring technology capabilities that connect them with customers in new ways.

“I’m seeing a ton of insuretech, health tech and auto tech,” says Langan.

The pandemic “made people particularly decisive,” says James Mutugi, head of M&A at Absa Bank in South Africa. “Companies with noncore businesses that they’d previously toyed with exiting but hadn’t done so, now were starting to.”

Private equity funding loomed large in deal volume in 2020. The value of private equity deals across the globe totaled $555.1 billion, up 5% from 2019, according to law firm White & Case. And with everyone from professional athletes to musicians buying a piece of special purpose acquisition companies, SPACs are starting to play a critical role in the M&A market—especially in the US. Several years ago, about 5% of sell-side business deals involved SPACs, Kochman says; that’s since jumped to about 40%.

While overall deal volume across the globe held relatively strong in 2020, it varied by region. Western Europe reported one of the strongest comeback stories. Overall deal values jumped by 35% year over year, driven in part by the number of megadeals in the region, says Matt Toole, director of deals intelligence at Refinitiv. Western European companies were involved in six of the 10 largest deals of 2020.

UBS, 2021’s Best M&A Bank in Western Europe, was a key player in many megadeals. It advised the Advent/Cinven consortium on the $19.3 billion acquisition of ThyssenKrupp’s elevator technology business and Siemens Healthineers on its combination with Varian Medical Systems, a cash deal valued at $16.4 billion.

Central and Eastern Europe also saw an active year in M&A, says Andrey Shemetov, senior vice president of Sberbank and head of its SberCIB unit. Sberbank, Best M&A Bank in the region, expanded its M&A activity across a range of industries including oil and gas, infrastructure and transportation and technology. It was among the bookrunners for the $1.1 billion initial public offering of Ozon, the leader in Russian e-commerce.

“We expect more transactions with technology companies in the next 12 to 18 months,” Shemetov says. As the M&A market rebounded, he adds, Sberbank boosted its deal pipeline, thanks in part to struggling smaller businesses that became receptive to M&A discussions. He also sees growing cross-border M&A activity, driven by favorable capital markets conditions across the globe.

More companies on the continent are looking to expand outside it. For example, Absa, Best M&A Bank in Africa, acted as joint buy-side financial adviser to South Africa’s Bidvest Group in its acquisition of UK-based PHS Group for about $642 million. PHS is a top hygiene service provider in the UK, Ireland and Spain.

“The acquisition was in line with Bidvest’s stated strategic intent to expand its presence beyond South Africa in niche, asset-light businesses that will benefit from Bidvest’s capabilities and expertise,” Mutugi says.

The growing interest in renewable energy will impact M&A in Africa, Mutugi predicts. In early 2021, for example, an infrastructure investment fund managed by Old Mutual Investment Group Namibia acquired a majority stake in a solar photovoltaic plant, also in Namibia.

Standard Chartered, the UK-based multinational banking and financial services group, took Best M&A Bank for the Middle East, where it has operated for more than a century.

“We have a deep presence and understand doing business in this part of world,” says Rajesh Singhi, head of M&A for Africa and the Middle East.

Sovereign entities and groups owned by sovereign entities often play in many M&A deals in the Middle East, Singhi says. At the same time, as the region’s economic decision-makers strive for greater efficiency, they also look with approval on privatizations. Partly for that reason, a growing number of international investors are showing interest in the region.

“Historically, deals weren’t sizeable enough” to attract foreign interest, Singhi says; and the level of disclosures was often not as robust as outside investors required.

That’s changing. Standard Chartered was lead senior manager last year in the acquisition by an international consortium of a 49% stake in Abu Dhabi National Oil Company’s Gas Pipelines Assets.

“We brought sector knowledge, product knowledge and risk appetite,” says Singhi.

Deal values in North America dropped by about 23% between 2019 and 2020, but the number of deals inched up about 8%, a result of strength in midmarket deal-making, says Refinitiv’s Toole. Goldman Sachs, Best M&A Bank in North America, advised on 218 deals worth $459.8 billion and was the only firm to advise on 200-plus deals, according to GlobalData.

“The way in which the North American capital markets responded to the crisis was impressive,” says Citi’s Kochman. “Companies figured out how to operate with broken supply chains, within a virtual environment, and still manage the health of their employees.”

In the US, monetary injections that roughly equaled the amount deployed throughout the financial crisis of 2008-09, along with fiscal stimulus measures, “laid the foundation for companies to swiftly reconfigure operations, customer interfaces, and address delivery and last-mile challenges,” he says. The pandemic also prompted companies to take a closer look at five-to-seven-year plans that often had been gathering dust on shelves. “Plans for structural changes are now being implemented.”

In Central and South America, deal volume fell by more than half, Refinitiv reports. Brazil’s Itaú BBA, the corporate investment bank of Itaú Unibanco and Global Finance’s 2020 Best M&A Bank in Latin America, advised on 44 M&A deals.

Asia, the first region to shut down as the pandemic took hold and one of the quickest to recover, didn’t see as many megadeals as some others. “There aren’t as many large target companies,” says Toole. Overall deal values were up by 16% while deal volume slid by 4%. Citi, Best M&A Bank in Asia Pacific, acted as financial adviser to SK hynix, the South Korean semiconductor manufacturer, on its $9 billion acquisition of Intel’s NAND memory and storage business.