Banks are responding to the Covid-19 pandemic with innovations that could mark out the direction of their efforts to digitize for years to come.

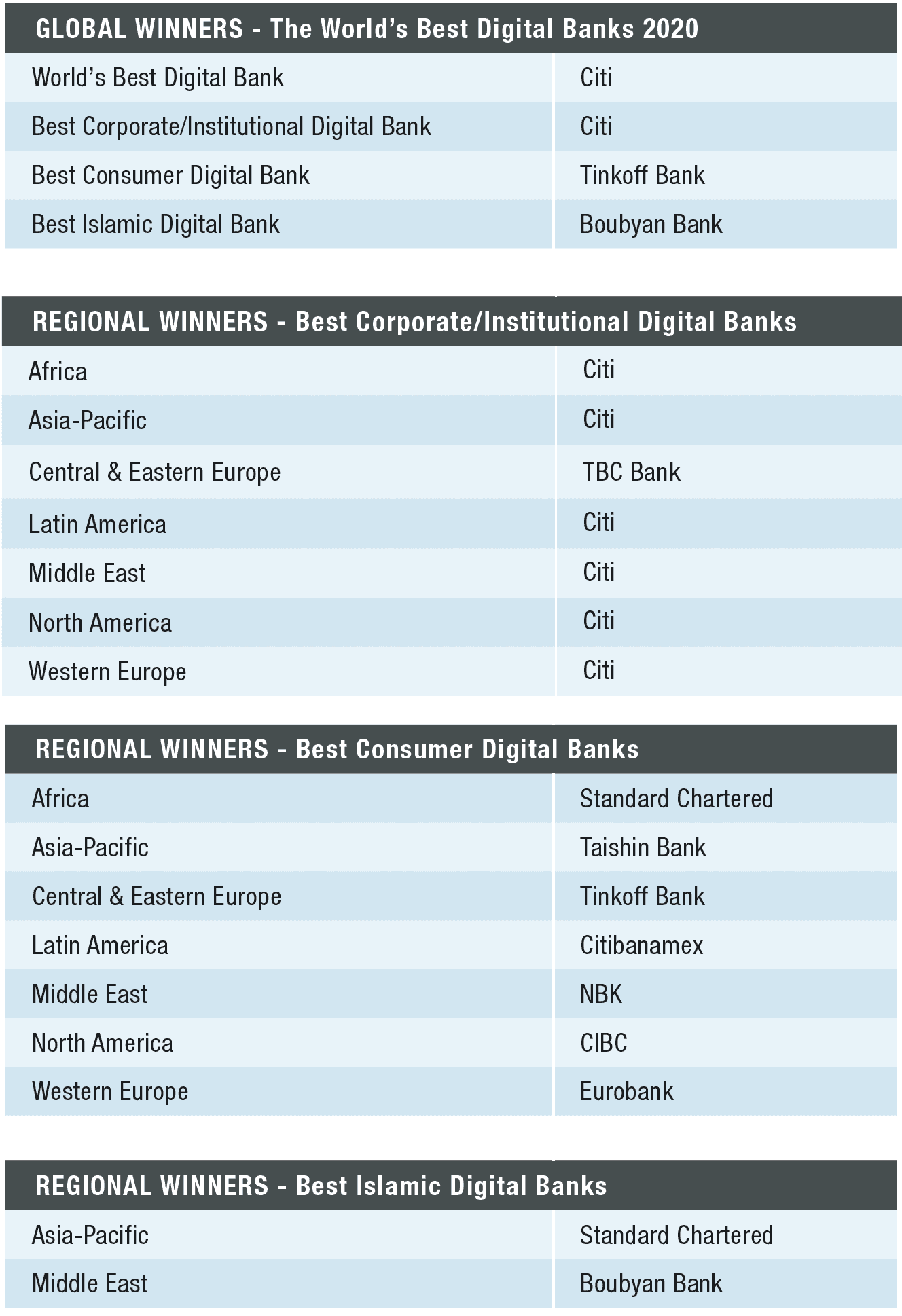

Global Finance’s Digital Bank Awards 2020 are now in their 21st year—coinciding with one of the most challenging for the global economy in living memory. As the Covid-19 pandemic ravages the world, perhaps the one silver lining is that it has focused providers’ efforts to give customers easier-to-use and more personalized digital solutions.

Emerging from a record number of entries this year, our winners distinguished themselves by their ability to pivot and respond to market demand, due in no small part to technology investments that have helped them address problems faced by their consumer, corporate and institutional investment customers during the current crisis. For businesses, the biggest concern has been optimizing cash flows, since greater visibility of data in real time is essential to making quick and accurate decisions. For this, they rely on banking partners to help them make better use of their data.

“We are harnessing the power of data in a number of ways to help our clients,” says Tapodyuti Bose, managing director and global head of Digital Channels, Data & Analytics, Treasury & Trade Solutions at Citi, Global Finance’s World’s Best Digital Bank for 2020. “The journey started with increasing visibility and transparency for our clients to view their banking information across the globe. This has now shifted into transforming our client interactions to being data-driven and focused on actionable insights.”

Citi recently started piloting digital experiences driven by client recommendations. “We leverage the data we have to analyze and derive suggestions to help client treasuries make informed decisions and become more efficient, whether it is on bank account rationalization, credit utilization, or cash forecasting,” Bose says.

It isn’t just corporates that are the beneficiaries of more sophisticated data analysis, however.

“Data and AI [artificial intelligence] are at the center of everything we do,” says Anna Mikhina, vice president of Lifestyle Services Development at Tinkoff Bank, this year’s winner as Best Consumer Digital Bank. “Our customers give us permission to use their data so we can provide a better, more personalized experience for them.”

AI-powered predictions help the bank resolve customer issues before they arise, she adds. For example, when a client starts typing a question in Tinkoff chat, it can suggest the rest of the question and immediately give a personalized answer. Tinkoff fully resolves 50% of all customer requests with chatbots, without any involvement from humans. It also uses AI to provide a more engaging customer experience.

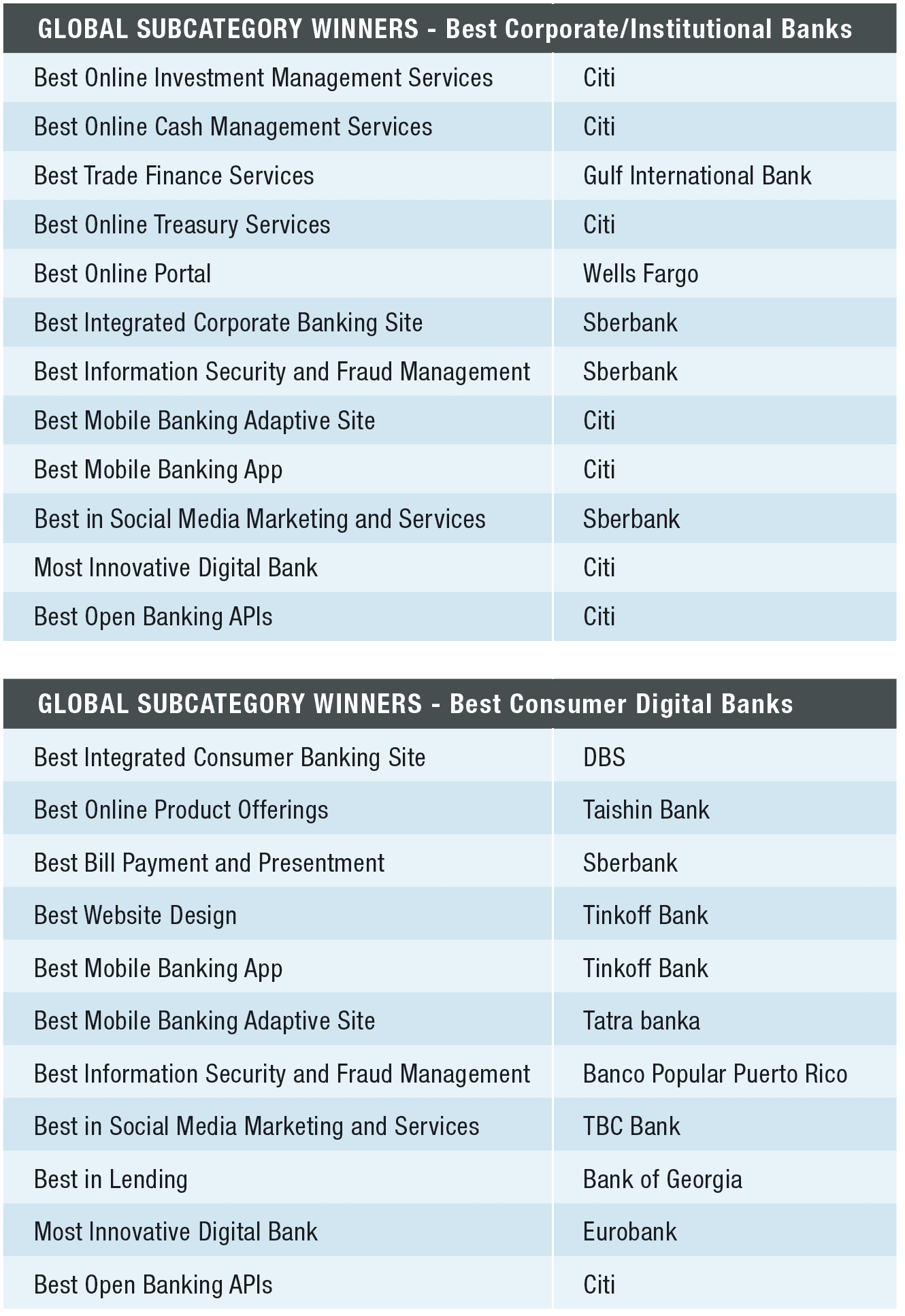

Sberbank, a multiple subcategory winner, introduced a single workspace system (SWS) this year for operators at its corporate customers’ service centers, while an AI solution using natural-language processing is helping the bank save 7,000-plus hours of person time per month.

Sberbank has integrated robotics into its K7M [which stands for ‘credit in seven minutes’] credit process, because this is the time it takes between a customer applying for a loan and collecting the money. K7M encompasses all banking processes, including anti-fraud and credit checks.

Perhaps and even bolder move is the decision to rebrand as Sber, as the Russian bank looks to business beyond banking by launching its own “SmartMarket” in the same vein as Apple’s AppStore or Google Play. With a family of virtual assistants, called Salute, Sber will soon be launching a TV streaming device called SberBox, and a gesture and voice recognition smart speaker, SberPortal.

To empower micro, small and medium-size enterprises (MSMEs), Bank of Georgia Group launched Optimo, a digital solution that gives them prompt and easy access to critical data on their businesses. Standard Chartered, meanwhile, deploys machine learning to ingest and analyze high volumes of non-bank data, enabling more accurate credit decisioning that helps drive financial inclusion.

Some banks are taking financial advice digital. NAV Planner is a financial advisory solution that DBS Bank launched in April. Using big data, it enables customers to plan and monitor their financial goals, offering insights and recommendations tailored to their life stage and financial circumstances.

This type of smart data-driven decision-making can give a bank the edge over competitors, but it also saves time and money.

API Enhancements

Providing a bridge between the customer information in a bank’s database and its applications and programs, application processing interfaces (APIs) enable a flow of data between systems in a controlled yet seamless fashion. While APIs aren’t new, advances in analytics have made them a valuable tool to enhance services and reduce costs and time.

Wells Fargo recently entered into a data-exchange agreement with a leading financial data aggregation and analytics platform, powered by an API, to securely share its customers’ financial data with more than 1,400 third-party financial apps, allowing both consumers and small-business customers to manage their finances on the platform of their choice.

In July, TBC Bank, the winner of Global Finance’s 2020 award for Best Corporate/Institutional Digital Bank in Central and Eastern Europe, went live with software provider Capital Banking Solutions’s open platform, CapitalBanker and CapitalConnect. An open back-end, API-based solution, it brings real-time support for loans and deposits to TBC’s clients in Uzbekistan and Georgia.

Taishin Bank, winner of our 2020 Best Consumer Digital Bank award for Asia-Pacific, values the role that APIs play in improving the client experience.

“Nowadays, APIs have gotten progressively more indispensable to the client experience as the simplest and most efficient way for corporations to target specific moments in the customer journey,” says Maggie Pao, senior vice president of Taishin’s Digital Innovation division. “Moreover, as consumers are exposed to more and more channels and industries, so that the customer journey becomes more and more complex, Taishin Bank expects to provide seamless customer experience through APIs.”

For example, working with bill payment APIs supplied by Financial Information Service Company (FISC), Taishin enables its customers to pay bills anytime, anywhere.

APIs reduce response times in uploading data on an interface, automate processes with a native format within applications and facilitate interaction with other applications within a platform, says Pao: “Taishin Bank has used open API to shorten account time from 10 minutes to one, and allow cross-platform account management to exist on instant messaging platforms. In the past, customers were only able to view their bank account information on a bank platform. Now, with the help of API technology, customers are able to review bank account information in an instant-messaging app.”

Since it began designing services using APIs, whether B2B, B2C, or B2B2C, Taishin Bank partnered with providers including SKM, FamilyMart, OK Mart, FarEasTone and LINE and boasts more than 150,000 merchant partners. “Through APIs, we continue to integrate all enterprise resources and extend our cooperation with partners among different industries, so as to merge financial services into consumers’ daily lives and build a complete life-financial ecosystem,” Pao says.

Remote Options

Struggling to reemerge from the disruptions of 2020, many companies felt compelled to reassess how they manage their operations, especially how they work remotely. Recognizing the need for better digital solutions, Kuwait’s Boubyan Bank helped develop a large public-sector entity in Saudi Arabia in digitizing Umrah payments as contactless cash. The bank also launched a virtual prepaid-card issuance service this year using its own app, eliminating the need to visit a branch. Meanwhile, Eurobank introduced a digital wallet earlier this year, while Tatra Banka has been piloting a subscription-management service that will allow customers to cancel subscriptions using its app. And Canadian Imperial Bank of Commerce has launched an online hub that offer financial advice to customers.

Such innovations could help map out the interactive future for banks and their clients long after the Covid pandemic has faded. The launch of Citibanamex’s Cobro Digital has enabled over 5.5 million digital clients send invoices and payments of up to $400 by using QR codes on their phones. National Bank of Kuwait (NBK) has added Fitbit Pay to its arsenal of contactless payment options. And Banco Popular Puerto Rico announced in June that its Mi Banco digital platform, launched in 2000 with an initial 28 customers, had surpassed the one million mark, with senior citizen sign-ups tripling compared to last year.

Digital banking in the Covid-19 era is no longer the preserve of millennials. For banks that rose to the challenge this year, the coming year will likely require an even more personalized approach to satisfy a much larger and more diverse customer base.