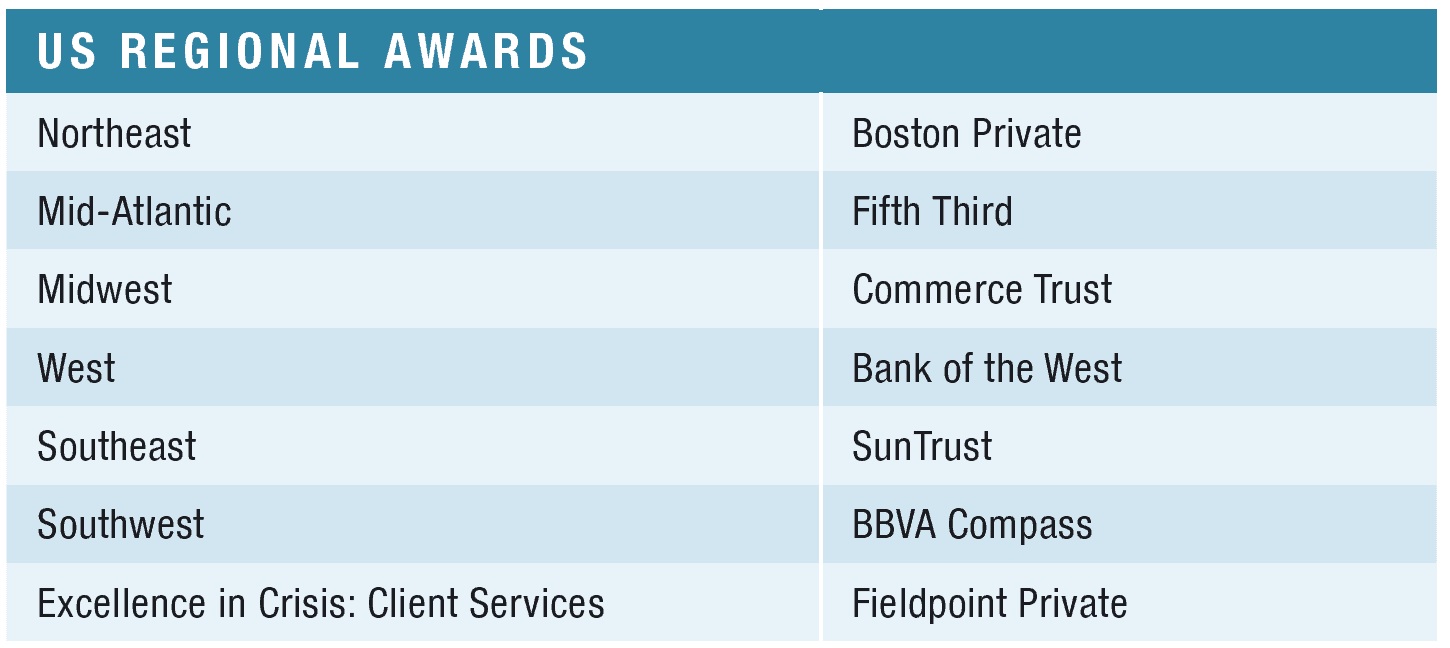

This year’s winners are ramping up the ability to tailor their offerings to specific audiences while offering global-quality, tech-enabled services.

Regional US banks occupy a valuable middle ground. With the heft necessary to offer a range of services and technology solutions, they still provide the personalization many private banking clients seek.

Methodology: Behind the Rankings

Global Finance staff select winners for these awards based on entries submitted by banks, company documents and public filings. No proprietary information was sought or shared in the awards process. We consider local market knowledge, global footprint and investment breadth and sophistication. Because metrics are rarely public in this sensitive corner of finance, we incorporate perspective from analysts and consultants. Performance data are also drawn from industry sources including Scorpio Partnership’s annual Global Private Banking Benchmark and Asian Private Banker magazine’s regional league tables. Size and growth are a factor, but Global Finance also considered creativity, uniqueness of offering and dedication to private banking as a core business either globally or regionally.

NORTHEAST

BOSTON PRIVATE

Boston Private has offered comprehensive advice and white-glove service for more than 30 years, supported by technical expertise geared to help clients simplify their lives and achieve their goals. “It’s about the potential of that wealth: what it can achieve; how it can help; whose lives it can change for the better,” says Paul Simons, president of private banking, wealth and trust.

The bank likes to emphasize that its service extends beyond the assets it directly manages. For several years, according to Simons, the bank helped assess trusts that a client held in other institutions. Based on this work, it was able to strengthen the client’s intergenerational trust strategy.

To maintain contact with clients during the Covid-19 pandemic, Boston Private launched new communications including weekly podcasts and regular webinars. It credits these new features with helping to drive a 25% increase in web traffic and a doubling of social media engagement.

MID-ATLANTIC

FIFTH THIRD

Fifth Third offers both strong community ties and world-class capabilities. To that end, the wealth and asset management team has transformed its client onboarding process, eliminating previously manual steps. What once took nearly a month can now be completed in a matter of days. Last year, Fifth Third also launched Transfer to Transformation, an initiative that helps manage wealth-transfer issues and estate planning for African-American clients; these households are owners of $1 trillion to $2 trillion in wealth across the US, but few currently use wealth planning strategies.

Clients appear to be paying attention to these changes. Fifth Third’s assets under management (AUM) have jumped some 20% over the past several years.

MIDWEST

COMMERCE TRUST

Commerce Trust has been a leading provider of investment management, private banking and other services since 1906, offering a seamless approach to clients’ wealth management needs, local decision-making on loans, in-house mortgage and credit card processing and a strong digital product offering. Its parent has also invested heavily to expand its digital banking capabilities and develop new loan and deposit platforms.

The bank has further stretched its capabilities during the Covid-19 crisis. When elective surgeries and noncritical procedures were temporarily halted, the private bank worked with Commerce’s mortgage company and credit card group to provide payment forbearance for clients, including doctors and senior medical administrators, experiencing cash flow difficulties.

WEST

BANK OF THE WEST

As part of BNP Paribas, one of the top wealth managers worldwide, Bank of the West is able to deliver a broad spectrum of local resources along with international financial strength. The firm supplies customized plans and solutions to individuals, families and entrepreneurs who want to navigate the complexities of building and managing wealth in a changing world. As a leader in sustainable finance, it has established a name for protecting the planet and improving lives through policies that restrict funding of activities it believes to be environmentally harmful.

AUM in the private banking group increased 4.1% in the year that ended in June, to $15.5 billion.

SOUTHEAST

SUNTRUST

SunTrust, now part of Truist Financial, offered customized financial and wealth management services since 1890 and today provides solutions for physicians, attorneys, athletes, entertainers and others with complex needs. It can call on the capabilities of the entire SunTrust bank to serve its clients broader needs, including credit and lending teams, trust and estate experts, and mortgage and insurance specialists.

SOUTHWEST

BBVA COMPASS

BBVA built its success on what has been a winning combination for the industry as a whole in recent years: a holistic approach to wealth management and attention to digital innovation. The bank’s global wealth clients who own businesses can leverage technology like RealTime Positive Pay, which issues alerts for potentially fraudulent transactions on check or electronic payments. In the US, BBVA is the first bank to offer true RealTime Positive Pay fraud prevention, which verifies check and ATM transactions as they happen; and RealTime ARP, which automates the check reconciliation process and provides reporting capabilities for processing account data.

Its collaborations with other providers, including fintechs, gives BBVA a close look at industry trends as well as ideas for improving its own products and services, says Hector Chacon, head of global wealth. For instance, BBVA Compass collaborates with Google to offer consumers a digital bank account through Google Pay.

“You need to be very fast in identifying trends in the industry and staying ahead of the curve,” Chacon says.

EXCELLENCE IN CRISIS: CLIENT SERVICES

FIELDPOINT PRIVATE

Fieldpoint Private shines in this new category, which honors excellence in response to the Covid crisis. The wealth advisory and private banking boutique mounted an aggressive effort through the Small Business Administration’s (SBA’s) Paycheck Protection Program (PPP), securing its clients access to 61 loans—42% of new loans issued by Fieldpoint for the year thus far—and saving 1,400 jobs.

To accomplish this, the Fieldpoint team worked nights and weekends to ensure its PPP submission technology functioned flawlessly and to navigate the SBA’s software, which crashed several times.

“Over the course of three weeks, we created a product and gained approval for a lending specialty that previously was not in our model,” says COO Steve Scott.

The bank also sourced two new technology solutions to help overcome glitches in the government’s software. Employees executed the project from their kitchens, dens and attics. Meanwhile, Fieldpoint also provided meals to more than 500 front-line health emergency staff and first responders through the peak of the crisis.