Global Finance rates the best high-touch banks in these low-touch times.

Each December for the past eight years, Global Finance has honored the leaders and innovators in the private banking industry with our World’s Best Private Bank Awards.

These are the institutions delivering top-shelf financial services to the world’s wealthy—entrepreneurs and tech tycoons, wealthy families and family business owners, well-heeled international executives and, yes, the very oldest of old money. Increasingly, these institutions are tapping digital tools to expand their capacity to serve an existing client base while expanding to offer services to a larger number of individuals. The trick is to do so without losing sight of the personal touch that makes wealth advisory so effective.

At the same time, the composition of global wealth is changing, and that, too, is driving change in this niche. As a new generation of wealth rises, it has brought not only tech-savvy but an increased focus on the threat of climate change and the role of private wealth in building a sustainable future for humanity. Additionally, wealth is truly global, knowing no borders; this brings added complexity to financial products and advisory services.

For Global Finance readers, our annual assessments of the World’s Best Private Banks provides a guide to the institutions best positioned to serve their increasingly sophisticated wealth management needs as they build, grow and preserve their fortunes.

Methodology: Behind the Rankings

Global Finance staff select winners for these awards based on entries submitted by banks, company documents and public filings. No proprietary information was sought or shared in the awards process. We consider local market knowledge, global footprint and investment breadth and sophistication. Because metrics are rarely public in this sensitive corner of finance, we incorporate perspective from analysts and consultants. Performance data are also drawn from industry sources such as Scorpio Partnership’s annual Global Private Banking Benchmark. Size and growth are a factor, but Global Finance also considers creativity, uniqueness of offering and dedication to private banking as a core business either globally or regionally.

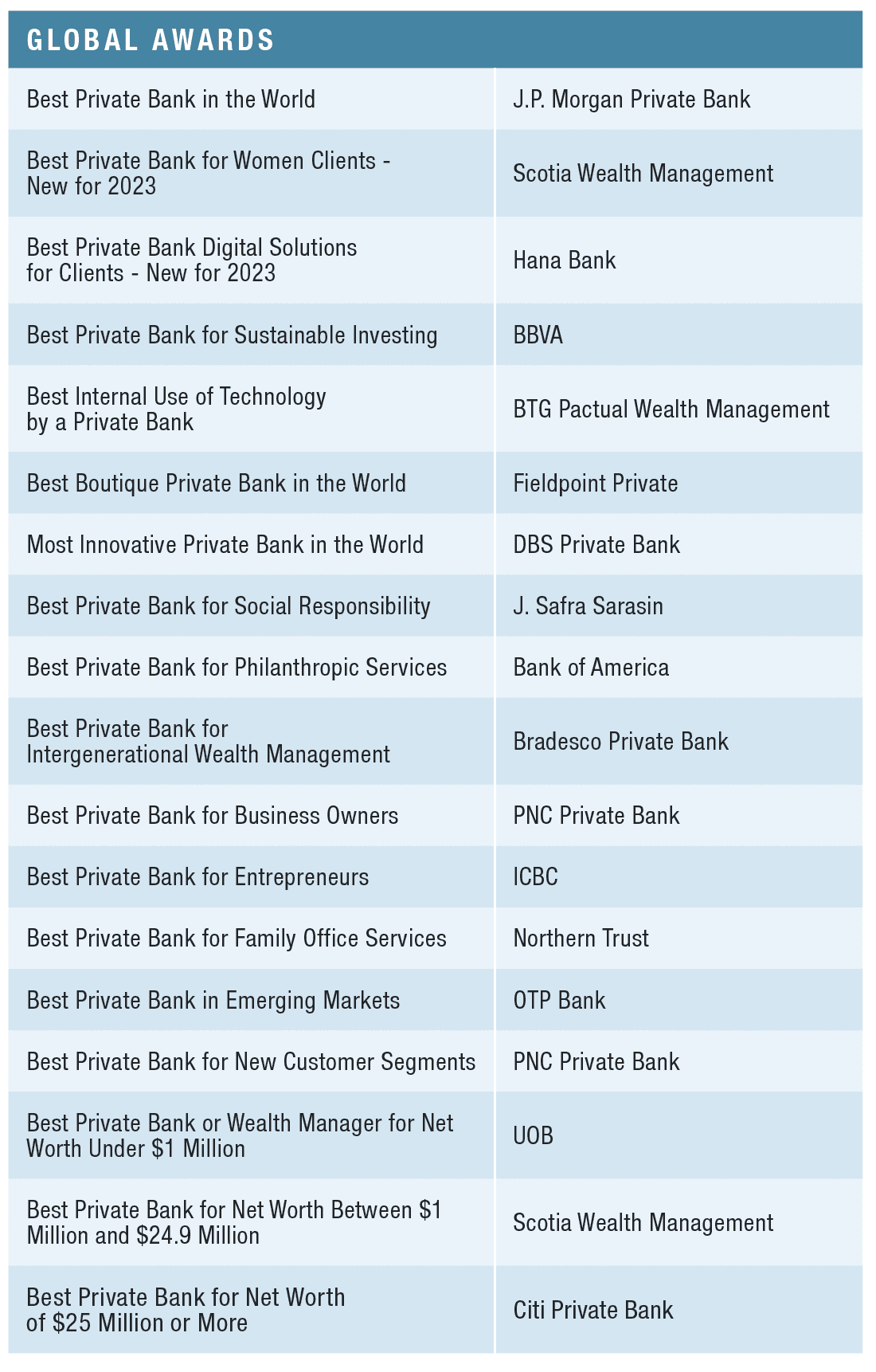

BEST PRIVATE BANK IN THE WORLD

J.P. Morgan Private Bank

A multiyear Global Finance award winner, J.P. Morgan, with client assets of $1.9 trillion, has again been selected as the Best Private Bank in the World. On average, the powerhouse firm brings on a new client with more than $100 million in investible assets every other business day.

“The most sophisticated clients in the world continually turn to us to solve their financial needs and to find a signal through the noise, especially in volatile markets,” notes Mary Callahan Erdoes, CEO of J.P. Morgan Asset and Wealth Management (AWM). This past year, J.P. Morgan invested in talent with 377 new analysts, 162 new client advisers and more than 280,000 hours of training conducted across AWM.

BEST PRIVATE BANK FOR WOMEN CLIENTS

SCOTIA WEALTH MANAGEMENT

The Scotiabank Women Initiative is a signature program designed to increase economic and professional opportunities for all women and nonbinary people, now and in the future. It’s meant to inspire and empower women to take charge of their financial futures. Scotiabank offers creative financing solutions tailored to women’s strategic priorities. Offerings include working capital and inventory financing; and funding for capital projects, expansions, M&A and more. The Scotiabank Women Initiative, launched for Global Wealth Management, followed a successful pilot program. The program was built on the foundation of Scotia Wealth Management’s Total Wealth Plan offering and has transformed the ways in which it serves women clients. The program offers advisers in-depth training, perspectives and strategies to help better support women’s unique wealth management opportunities.

BEST PRIVATE BANK

DIGITAL SOLUTIONS FOR CLIENTS

Hana Bank

South Korea’s Hana Financial Group has stated its mission to become a leading global digital financial enterprise, aiming to transform itself into a “customer-centric, data-driven information company” via the digital innovation of products and services. Its efforts have fast gained critical mass.

Hana has won accolades for its innovative approach to digitization, with its My Branch app proving wildly popular with clients after its launch in April 2021, thanks to the efforts of Hana’s IT development team. The team worked with branch managers—more familiar with the traditional paper-based mode of operation—to create the app, which has originated $1.6 billion of personal loans.

That app and its user-friendly functionality provided a road map for the direction of travel in the private banking franchise. The same flair for digital innovation was displayed by Hana Private Bank’s My PB app, which launched this year and has also proved to be a huge hit with private banking clients.

My PB—particularly tailored to millennial users’ demands—allows clients online access to relationship managers and various services such as deep analysis of all portfolio assets. Hana Private Bank is working to further develop the app and broaden usage for different age groups within its asset management division.

BEST PRIVATE BANK FOR SUSTAINABLE INVESTING

BBVA

Last year, BBVA’s Global Sustainability Office, created in 2020, formed a global sustainability area to design a strategic sustainability agenda for the bank, supporting endeavors for global transformation and developing new sustainable products. The bank has committed to aligning its business activity with the objectives of the Paris Agreement. Private banking clients with their own sustainability objectives now benefit through a variety of new ways in which BBVA has integrated sustainable values into its processes and activities, from screening and weighting in-house investment products or third-party funds (including the sustainability of individual companies invested in) through ensuring that its private bankers have all had sustainability training—preferably with an external certification—to continue advising clients.

BBVA is keeping well ahead of the EU’s Sustainable Finance Disclosure Regulation and other recent European sustainable finance regulations. For example, sustainability-risk information is incorporated into precontractual documentation sent digitally to clients, the objective being to ask clients about their sustainability preferences when making investments, so that an appropriate portfolio can be assembled. Client reporting has also been enhanced to include environmental, social and governance (ESG) criteria with digitally sent data on the sustainability of the client’s portfolio and individual holdings.

In-house fund management is committed to impact investing, through engagement with companies and voting at shareholders meetings, while at the same time investing directly in companies aligned with the UN’s Sustainable Development Goals (SDG). Private bank clients can also benefit from BBVA’s rapid rollout of sustainable financing, including loans for electric or hybrid mortgages and favorable conditions for homes with better energy certification.

BEST INTERNAL USE OF TECHNOLOGY BY A PRIVATE BANK

BTG Pactual

Wealth Management

BTG Pactual understands that investing in learning and continuous employee development is a non-negotiable value. Last year, the bank released an internal training platform, BTG Campus, which, in addition to suggesting specific development paths for different functions, offers self-service training themes. The available topics range from broader subjects, such as communications and corporate grammar, through behavioral finance, to a more targeted approach focused on specific purposes such as onboarding programs developed exclusively for the wealth management team. This way, the company ensures that every new member of the team understands how the area works, how it relates to partner areas and what the new role’s main activities are.

BEST BOUTIQUE PRIVATE BANK IN THE WORLD

Fieldpoint Private

Winner again for the Best Boutique Private Bank in the World, Fieldpoint Private stands out from the crowd. With $5.4 billion in assets under management (AUM) in 2021, and $1.4 billion in bank assets, it is among the top 12% of US banks.

The bank services high net worth individuals (HNWIs) and ultrahigh net worth individuals (UHNWIs) and businesses. The company has also been investing in technology and digital experts to drive growth. This team has built a digital tool suite to manage all interactions between the private bank and registered investment adviser (RIA) partners. These tools enable every adviser within each RIA partner to initiate a transaction or loan on a client’s behalf and to track progress throughout its life cycle. This provides advisers with full, real-time transparency into the status of all banking business and ensures that the adviser can remain at the center of these critical components of their clients’ financial lives.

MOST INNOVATIVE PRIVATE BANK IN THE WORLD

DBS Private Bank

DBS aims to best the competition by transforming itself into an “intelligent bank” via the combination of predictive analytics with artificial intelligence and machine learning (AI/ML) technology used to transform data into relevant, intuitive and hyper-personalized insights delivered to each client.

The bank has embraced the digital-asset revolution via its Digital Exchange, or DDEx, which provides investors the ability to tap into a fully integrated tokenization, trading and custody ecosystem for digital assets alongside the opportunity of tapping alternative capital raising through security backed tokens. These are secured through financial assets such as shares in unlisted companies, digital bonds and private equity funds.

“We take a high tech, smart-touch approach to working with our clients, rooted in the belief that technology can greatly enhance the human touch in wealth management,” says Joseph Poon, group head of DBS Private Bank in Singapore.

“Take, for example, our intelligent banking capabilities to curate insights that are hyper-personalized for our clients’ needs,” he says. “We are well positioned to be at the forefront of delivering value in today’s digitally disrupted world, where key challenges lie in building new ways of engagement to support clients’ evolving needs.”

BEST PRIVATE BANK FOR SOCIAL RESPONSIBILITY

Bank J. Safra Sarasin

One of Bank J. Safra Sarasin’s sustainability objectives is to achieve commercial success while reducing its ecological footprint. It therefore seeks to increase energy and resource efficiency and reduce energy consumption and carbon emissions. J. Safra Sarasin extends opportunities related to these goals across the bank’s operations. The bank captures greenhouse gas emissions and has participated since 2013 in a program of energy efficiency and carbon reduction targets with the Business Energy Agency in Switzerland to reduce its carbon emissions. As a pioneer in environmental protection, the bank installed its own Swiss photovoltaic system on the roof of its Basel head office in 1993. It aims to contribute to goals such as the UN’s SDG and the Paris Agreement. As an engaged supporter of the Science-Based Targets initiative, the bank is committed to setting and externally validating such targets

BEST PRIVATE BANK FOR PHILANTHROPIC SERVICES

Bank of America

Bank of America (BofA) ended its second quarter with more than $117 billion in philanthropic client assets.

Commenting on the bank’s win as Best Private Bank for Philanthropic Services, Jennifer Chandler, head of Philanthropic Solutions for Bank of America Private Bank, notes, “Last year, we had record growth in philanthropic balances. We are on track to bring in another $6 billion this year. We continue to add foundation, endowment, trust and investment professionals to our team to ensure we can provide a bespoke experience to help families effect meaningful change. We doubled the number of philanthropic strategists and continue to invest in our platform.”

The Private Bank’s team of philanthropic specialists works with individuals and families across the Private Bank and Merrill to achieve clients’ personal philanthropic and legacy goals. The bank’s clients have embraced the Philanthropic Solutions group’s services, resulting in 40% growth in sales and 65% growth in AUM in the past five years. BofA saw a record in 2021 for the endowment and foundation investment management business with inflows and commitments of $10 billion.

BEST PRIVATE BANK FOR INTERGENERATIONAL WEALTH MANAGEMENT

Bradesco Private Bank

Bradesco Private Bank’s main event, entitled Family Forum, aims to strengthen its relationship with large clients’ heirs, sharing trends, visions and ideas through lectures with experts offering high-level content and topics addressing relevant issues. Along with that, Bradesco Private created a strategic front to target the Next Generation, aimed at serving the Y (millennial), Z and Alpha age cohorts by understanding their different needs and contexts, and bringing increasingly innovative solutions to management. One of the pillars of this initiative involves educational paths structured to promote development at each stage of life and support families on themes such as family, society, the individual and business.

BEST PRIVATE BANK FOR BUSINESS OWNERS

BEST PRIVATE BANK FOR NEW CUSTOMER SEGMENTS

PNC Private Bank

PNC Private Bank finds itself in not one, but two winning categories among the World’s Best Private Banks 2023. The bank had AUM of $103 billion as of June 30, 2022, and showed positive total gross flows of $62 million, an increase of 185% from 2021.

The bank, which has been integrating its purchase last year of BBVA USA, saw its client base diversify into emerging ($1 million to $3 million investable assets), established HNW ($3 million to $20 million investable assets) and multigenerational UHNW (more than $20 million investable assets).

“The demographics of wealth are changing rapidly,” notes Don Heberle, head of PNC Private Bank. “Sophisticated clients from increasingly diverse backgrounds are turning to PNC Private Bank to help identify and achieve the values, goals and purpose behind their wealth. We consider ourselves to be more than just advisers to clients—we’re confidants, recognizing that each client is unique; and our approach to serving clients reflects that.”

As for its win as Best Private Bank for Business Owners, PNC’s nationwide community-focused delivery model works for individuals, families and business owners. “PNC Private Bank provides … a full personal-advisory services suite to help grow or transition a family business. Clients who are business owners also have access to specialized services that include business insurance, risk management, lending and more,” says Heberle. “Additionally, as part of the larger PNC Bank enterprise, PNC Private Bank works closely with our Corporate and Institutional Banking and our Institutional Asset Management partners on clients who may benefit from the services of those businesses as well.”

BEST PRIVATE BANK FOR ENTREPRENEURS

ICBC

The Chinese megabank’s private banking and wealth management division enjoyed a near doubling of AUM during the period under review and is able to summon the vast heft of its parent as the core of its business model.

ICBC Private Banking (ICBC PB) intends “to deliver financial vitality to the real economy and serve the entrepreneur group and the real economy they represent,” according to Li Baoquan, general manager of the Private Banking Department of ICBC. The bank aims to build an entrepreneur-focused service ecosystem, to strengthen the real economy with comprehensive services, and to develop strength in charitable trust services to assist the succession of business-built wealth.

In September 2021, ICBC PB officially launched the Entrepreneurs Service Center, a sharing service platform to “invite entrepreneurs in.” By the end of this year, there will be 400 such centers, covering 140 cities and regions in mainland China, to provide platforms for entrepreneurs to exchange ideas and create business opportunities.

ICBC PB last year released the Report on ICBC Entrepreneur Wealth Health Index jointly with world-class research centers, establishing in the process the first quantitative wealth health research system for entrepreneurs in China. “During the past 15 years, ICBC PB has always put clients first and played to its advantages to support the development of China’s economy,” says Qian Wei, section head at ICBC PB in Beijing. Looking forward, ICBC PB will continue to improve its service for entrepreneurs, to build a corporate-private integrated service platform and to promote sustained ESG-aligned development of enterprises.

BEST PRIVATE BANK FOR FAMILY OFFICE SERVICES

Northern Trust

The winner for Best Private Bank for Family Office Services for 2021 and 2020, Northern Trust has again taken the top spot in this category.

The bank tells Global Finance that it has “a dedicated Global Family and Private Investment Office (GFO) practice [that] provides a focused set of financial, banking and advisory solutions to the world’s wealthiest families and the family offices that serve them. Today, the GFO’s clients stand at more than 500 families who are situated in more than 30 countries worldwide. In addition, we serve 25% of the Forbes 400 ranking of the wealthiest Americans. The team has more than 265 dedicated service professionals in the US, Europe, the Middle East, Singapore and Australia.”

Besides a suite of wealth management and estate planning services, Northern Trust GFO also has family office technologies that provide comprehensive asset pricing, automated allocation services for accounting purposes, and anchor analysis, providing reporting and data visualization tools.

BEST PRIVATE BANK IN EMERGING MARKETS

OTP Bank

Compared to some regions, Central and Eastern Europe may be small and fragmented, but this emerging region’s growing wealth is yielding an increasingly attractive private banking market. And in OTP, the former Hungarian state savings bank first established in 1949, currently managing more than €9 billion (over $9.3 billion) in client assets, it has produced a nascent global champion, a standout in a region dominated by large Western European banks’ local subsidiaries.

Through successful step-by-step expansion, OTP Private Banking (OTP PB) now has nearly 42,000 clients in 11 countries across the region. It retains around 40% of the Hungarian PB market and 25% of the AUM, but it’s also market leader in emerging market countries as diverse as Bulgaria (DSK Bank), Montenegro (CKB Banka) and Slovenia (SKB banka). Its strategy in Albania is characteristic. Banka OTP Albania was created out of Societe Generale’s local operation in 2019 and this year took over Alpha Bank Albania for €55 million. This strategy of takeover and merger has allowed OTP PB to grow and flourish and seems a template for expansion elsewhere.

BEST PRIVATE BANK OR WEALTH MANAGER FOR NET WORTH UNDER $1 MILLION

UOB

The wealth management business of United Overseas Bank (UOB) gained a shot of adrenaline with the appointment of Chew Mun Yew, formerly of Julius Baer and the Monetary Authority of Singapore, to head the bank’s private wealth division beginning in December 2021. His arrival at the bank marked the combination of its private bank and privilege reserve.

Under Chew’s direction, UOB is focusing on the countries in the Association of Southeast Asian Nations (Asean) as a top priority. To this end, last November it appointed Lena Tan—a 20-year UBS veteran—as Asean regional market head for UOB’s private bank, spearheading the bank’s expansion in Indonesia, Malaysia, Thailand and Vietnam. Meanwhile, a new department in the private bank, created in August 2021, focused on winning prospective HNW clients as well as developing innovative instruments and cutting-edge services.

To help muster his effort, Chew has almost 90 years of UOB’s presence in the region as well as its vast regional network—comprising 500 offices in 19 countries—and the bank’s ability to leverage the cross-sell via its open architecture will certainly make the competition stand up and take notice.

BEST PRIVATE BANK FOR NET WORTH BETWEEN $1 MILLION AND $24.9 MILLION

Scotia Wealth Management

Scotia Wealth Management offers strategic borrowing solutions, customized banking support, and a leading-edge concierge and travel management service. These have helped Scotia to become a prominent bank for HNWIs. Scotia’s Private Banker can set up a loan that allows the client to borrow against a combination of asset classes, all in one place with a single investment line of credit and, importantly, a single point of contact. Clients are able to access hands-on management of time-sensitive transactions in coordination with their other advisers; and they have access to a range of exclusive banking benefits, including preferred foreign exchange rates and certain annual fee waivers.

BEST PRIVATE BANK FOR NET WORTH OF $25 MILLION OR MORE

Citi Private Bank

Citi Private Bank dedicates its strategy to servicing the high end of the UHNW market and works exclusively with clients whose net worth is more than $25 million—well more, in fact. The bank’s strategy has been to focus on serving a smaller number of clients who have both great wealth (above $100 million, on average) and a high level of financial sophistication. The average net worth of new clients is up to $450 million.

One of Citi Private Bank’s key differentiating characteristics is its “globality.” Another is its ability to offer a full suite of solutions from traditional banking products to more-sophisticated offerings such as art advisory and aircraft financing, as well as offering its clients full access to Citi’s institutional offerings in Capital Markets and Advisory.