THE NEW NORMAL

By Hilary Johnson

More companies than ever are launching supply-chain finance programs to reduce costs, ensure the stability of their supply chains and improve working capital efficiency. And growing competition among program vendors is making it easier and cheaper to do so.

Supply chain finance is proving to be no fad but rather business as usual, as more companies adopt its tools and methods, realize its benefits and spread its functionality to corporate outposts worldwide. Indeed, companies have more options than ever before, from proprietary systems offered by global banks to bank-neutral platforms that can accommodate different funding feeds. And the introduction of the bank payment obligation, or automated letter of credit, could help make it easier for smaller, less well known suppliers to get needed credit and even pre-shipment finance.

“Supply chain finance (SCF) is more known, and there’s more information now than before. Providers are finding there are new ways of offering access to more customers and being more competitive,” says Enrico Camerinelli, senior analyst at Aite Group.

In the broadest sense, supply chain finance refers to any payment arrangement between buyers and sellers linked to the process of getting a product to market. Traditionally, it is initiated by the buyer—usually a large company that wants better terms, for example a longer payment cycle, from a supplier. In return, and in order to preserve that supplier’s financial health, the buyer offers some type of recompense, such as access to more affordable credit through a banking partner, or participation in a sophisticated solution that manages and optimizes payments among many participants in the supply chain.

“It certainly made our [extended DPO] initiative easier for vendors to accept. It gives them another reason to want to do business with Big Lots.”

– Poff, Big Lots

Supply chain finance came to the fore during the financial crisis and recession of 2008-09, when credit froze and buyers and suppliers struggled to get products to market. Cash, always important, was suddenly strategic, and many companies issued internal decrees to uncover and preserve as much liquidity as possible.

“Supply chain finance emerged as a critical strategic function,” says Ankita Tyagi, a senior research associate at Aberdeen Group. “It’s now falling much more under the office of the CFO, with treasury and risk management.”

STAYING POWER

Having learned from the stresses of the financial crisis, companies are realizing that supply chain finance remains a good way to improve working capital metrics and preserve liquidity. A survey conducted by Aberdeen Group earlier this year showed that more than 40% of 145 respondents, including companies large and small and in various industries, have a supply-chain finance program in place.

“Part of what’s driving it is that people can zero in on it and can make good decisions that support a company’s strategy. If your strategy is working capital maximization, then there are certain things to do. And if your strategy is ‘always in stock,’ then there are others. There are different levers to pull,” says Mike Giguere, principal in the supply chain practice at PwC.

Michael McDonough, global head of supply chain finance at J.P. Morgan, agrees. “The proposition works whether there’s a liquidity crisis or not. It makes sense. That’s why it has some staying power. It has become a bit more mainstream.”

Banks are jockeying to gain this type of business, playing on their ubiquity across the globe and their willingness to make use of their balance sheets.

At Bank of America Merrill Lynch, for example, the supply chain finance business has enjoyed a 70% uptick in new transactions since the end of last year and a 40% uptick in the use of international supply-chain facilities in the first quarter of this year, compared with the same period a year earlier, says Maureen Sullivan, North American trade sales head in global trade & supply chain solutions at Bank of America Merrill Lynch.

“Supply chain finance has experienced dramatic growth,” Sullivan says. “And it’s for three primary reasons: Buyers are looking for terms extensions, suppliers are looking for liquidity alternatives, and banks have strong appetites to use the balance sheet in support of short-term commercial trade-related transactions, which is the underpinning of supply chain financing.”

“Part of what’s driving [SCF] is that people can zero in on it and can make good decisions that support a company’s strategy.”

– Mike Giguere, PwC

The growth that Bank of America Merrill Lynch has seen is typical for banks worldwide, according to research from working capital advisory firm Demica. Major international banks surveyed across the world are reporting 30% to 40% annual growth rates in supply-chain finance programs, the firm reported.

Smaller banks and their supplier customers may soon be helped to a bigger piece of the pie by a new tool for trade and communication, the bank payment obligation (BPO). Though it’s been in the works for some time, just last month the ICC and SWIFT enacted rules to facilitate use of this electronic letter of credit and means of settlement to facilitate international supply chain finance, even before shipment.

J.P. Morgan’s McDonough notes: “It can be thought of in some ways as in between a letter of credit and open account trading. Supply chain finance is designed for open account solutions, with no letter of credit.” Still, he added, it remains to be seen how quickly, or how dramatically, BPO will change supply chain finance. “Adoption of the BPO will change how some suppliers source risk mitigation and funding, but we don’t necessarily know yet what that will mean in terms of scale.”

HEALTHY COMPETITION

Part of what is driving growth in supply chain finance is robust competition from nonbank players like Ariba, Basware, Paymode-X, Syncada, and PrimeRevenue. Of course, the savings and working capital management benefits are also a key draw.

|

|

Grier, DuPont: DuPont uses various SCF options to drive working capital productivity |

One PrimeRevenue customer, for example, US-based closeout retail chain Big Lots, has realized hundreds of millions of dollars in cash flow improvements since extending its payment terms and signing on with PrimeRevenue in 2006. PrimeRevenue provides a multibank SCF portal linking buyers and suppliers with banks.

The Big Lots program is designed to help suppliers of seasonal items and furniture for the retailer, who are often based outside its home market of the US—accounting for about half of the company’s suppliers. No supplier is required to use PrimeRevenue’s program, but it can be useful in dealing with Big Lots’ longer days payable outstanding (DPO) cycle.

“It certainly made our [extended DPO] initiative easier for vendors to accept,” says Jared Poff, treasurer at Big Lots. “It gives them another reason to want to do business with Big Lots.”

Poff says he considered many different options for supply-chain finance providers, including global banks, but appreciated the “bank-agnostic,” “plug-and-play” nature of PrimeRevenue’s offering, where the banks are behind the scenes.

Multinational science and engineering firm DuPont has also gleaned significant savings by using SCF, and takes a multi-pronged approach to its SCF programs. Donna Grier, vice president and treasurer at DuPont, notes: “For several years, DuPont has worked with key suppliers and partner banks to develop and utilize various financing options for our supply chains to support growth and drive working capital productivity.” DuPont initiated its program four years ago and has since freed up almost $3 billion in cash from daily operations.

Most vendors are expanding their supply-chain finance offerings rapidly across the globe to keep up with customer demand. PrimeRevenue, for example, opened an office in Hong Kong last year and has beefed up business in South America and Europe.

Banks, too, are making sure their customers can access supply-chain finance products wherever they want them, says J.P. Morgan’s McDonough. “US corporates may have a US solution, but now these programs are reaching maturity,” he says. “More and more, we’re seeing clients saying, ‘I’ve got this here, now I’d like to use it elsewhere.’ Supply chain finance continues to widen, in terms of the number of clients adopting it, and deepen, in terms of where it’s being deployed. That’s the biggest driver in terms of market growth.”

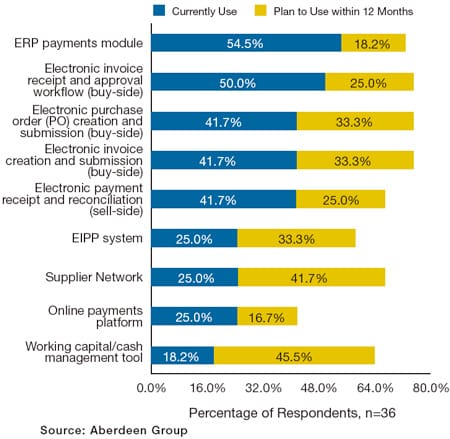

How Companies Are Using Technologies In Support of Supply Chain Finance