The economic uncertainties of the past few years have made cash forecasting far from an exact science—but it’s more important than ever.

Regardless of size, location or sector, the ability to organize funds to make the best use of them while ensuring liquidity is paramount to companies—and is thereby a significant treasury function.

It is not surprising that cash flow forecasting is the top priority for companies for the next two years, according to the findings of the 2021 European Association of Corporate Treasurers’ survey of multinational companies. Meanwhile, nearly half of firms (48%) that participated in GTreasury’s 2021 Cash Forecasting and Visibility survey indicate they have difficulties generating cash flow forecasts.

Forecasting provides an understanding of the opportunities and risks ahead—both necessary insights for corporate treasuries to better understand their businesses while making them more effective and resilient. In addition, companies are increasingly relying on their banking partners’ expertise, services and technology to help them handle their cash holdings better.

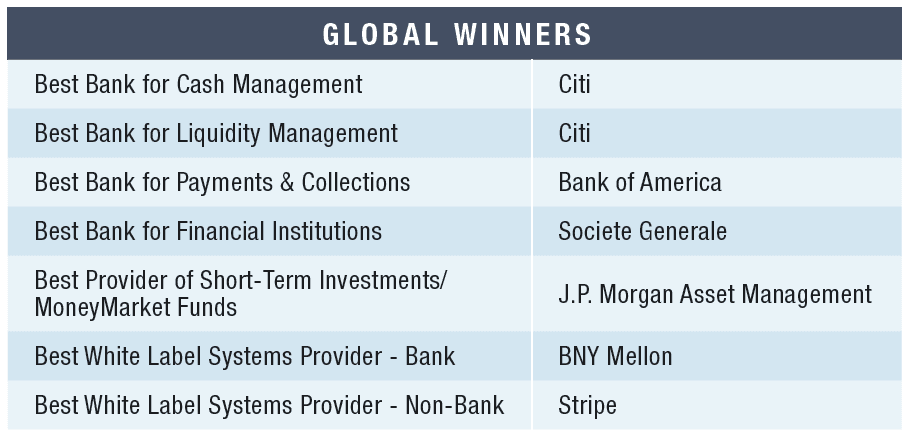

“The new world of rising rates, tight supply chains and shifting trading corridors is creating new liquidity challenges,” says Stephen Randall, global head of Liquidity Management Services at Citi, the winner of our Best Bank for Cash Management and Best Bank for Liquidity Management awards. “Technology is a key enabler as companies strategically manage liquidity to fund rising working-capital funding requirements and to increase real-time business flows.”

Citi supports clients with advanced technology “to forecast their cash flows better, centralize and access liquidity across more markets than any other bank, distribute funding where needed on a 24/7 basis within our clients’ desired treasury controls, and centrally invest excess cash into an array of short-term investment instruments,” Randall adds.

Recent examples include Citi Real-Time Liquidity Sharing, which makes it easier for companies to put intraday liquidity to use in real time across their footprint and currencies. A partnership with Cashforce enables Citi clients to extract disparate business data across their enterprises, normalize their data and support agile decision-making using provided analytics tools.

Bank of America (BofA), which took home the Best Bank for Payments & Collections award, has also looked to boost cash forecasting with technology.

“AI and machine-learning technologies can automate the analysis of large data sets in seconds,” says Fernando Iraola, co-head of GTS Global Corporate Sales and head of GTS Latin America at Bank of America. “Not only that, but these technologies are dynamic and can continue learning over time as patterns change in a company’s underlying cash flows. New innovative solutions like CashPro Forecasting are quickly adopting these technologies as corporate treasury teams look for ways to automate, improve and simplify their cash forecasting processes.”

Embedding Finance

E-commerce platform providers are riding a wave of banking-as-a-service (BaaS) integration with their offerings, and companies are reaping the benefits.

Stripe Treasury launched its BaaS application programming interface (API) in December 2020. The offering enables its platform users to build a full-featured, scalable financial products. The vendor, the winner of this year’s Best White Label System Provider–Non-Bank award, has partnered with a network of global banks, including Barclays, Citi, Evolve Bank & Trust and Goldman Sachs, enabling marketplaces to offer access to ACH and wire transfers, interest-earning accounts, payments funds and other services to help manage cash flow.

For companies that want to eliminate the middleman, new direct-to-consumer sales channels let companies collect valuable consumer data more quickly, bring offerings to market faster and increase sales opportunities while personalizing customer experiences.

For example, BofA launched its Recipient Select service in October 2021. The service lets consumer beneficiaries, or “recipients,” select how they receive their payments via a client-branded web portal.

“Advances in technology over the last few years have brought companies closer to their customers, who these days could be anywhere in the world,” says Faiz Ahmad, head of Global Transaction Services (GTS) at BofA. “One outcome of this is that companies have to respond to customer demands for different payment options. Solutions like Recipient Select let our clients’ customers choose how to be paid while relieving clients of the operational burden of connecting to every single payment system.”

BNY Mellon, the winner of the Best White Label System Provider–Bank award, offers private-label services to North American banks that give those banks the opportunity to leverage BNY Mellon’s global network, experienced trade experts and state-of-the-art online trade processing and financing solutions to best serve their clients.

BNY Mellon also leverages The Clearing House’s real-time payment system to provide corporations with an instant digital consumer bill-pay service, available through the bank’s white-label offering.

More than 1,000 financial institutions rely on Societe Generale, the winner of the Best Bank for Financial Institutions award, to process a wide range of international transactions. Offerings include Instant Payment, Swift’s low-value payment initiative, WebClear and the International Information Network project, as well as the bank’s foreign-exchange tools like Pay FX and Auto FX. With a global client base, deep market-making capabilities and worldwide market access, Societe Generale provides liquidity to its clients when it’s needed. The bank ranks third globally in euro clearing for banks and provides clearing in a further five currencies due to its longstanding footprint in Eastern Europe and Western Africa.

Money market funds (MMFs) can free up treasury professionals from the business of evaluating counterparties and trading securities while offering a high degree of transparency. This year’s Best Provider of Short-Term Investments/MMFs award winner, J.P. Morgan Asset Management, won for two of its AAA-rated funds—the JPMorgan Prime Money Market Fund, which invests in high-quality, short-term obligations that present minimal credit risk, and the JPMorgan US Government Money Market Fund, which invests exclusively in high-quality, short-term securities that are issued or guaranteed by the US government or US government agencies. Both funds adhere to environmental, social and governance (ESG) principles.

Greater visibility into cash flows and more accurate forecasts empower treasuries to meet their short-, medium- and long-term liquidity requirements while helping them select the proper investment tools and services to match the appropriate risk and return and make their cash work harder.

Thanks to ever-improving technology, treasurers can rely on greater automation to assist their working-capital operations. They also have an abundance of payments offerings from which to choose, as well as real-time cash and liquidity management systems at their fingertips. Meanwhile, banks play an increasingly crucial role in the march toward real-time treasury, while corporate treasurers will continue to seek banking partners that can help them navigate this ongoing transformation.

Methodology: Behind the Rankings

Global Finance editors select the winners for the Best Treasury & Cash Management Awards with input from industry analysts, corporate executives and technology experts. The editors also use entries submitted by financial services providers, as well as independent research, to evaluate a series of objective and subjective factors. It is not necessary to enter in order to win, but experience shows that the additional information supplied in an entry can increase the chances of success. In many cases, entrants are able to present details and insights that may not be readily available to the editors of Global Finance.

This year’s ratings are based on the period from January 1, 2021, to December 31, 2021. (Companies with different fiscal year reporting have the option to submit data from the fourth quarter of 2020 through the third quarter of 2021.)

Global Finance uses a proprietary algorithm with criteria—such as knowledge of local conditions and corporate customer needs, quality of product and service offerings, financial strength and safety, market standing, compliance and excellent customer service—weighted for relative importance. The algorithm incorporates various ratings into a single numerical score, with 100 equivalent to perfection. In cases where more than one institution earns the same score, we favor local providers over global institutions, and privately owned banks over government-owned ones.

The winners are those financial services providers that best meet the specialized needs of corporations engaged in global business. These top-notch finance institutions are not always the biggest, but rather the best—those with qualities that companies should look for when choosing a provider.