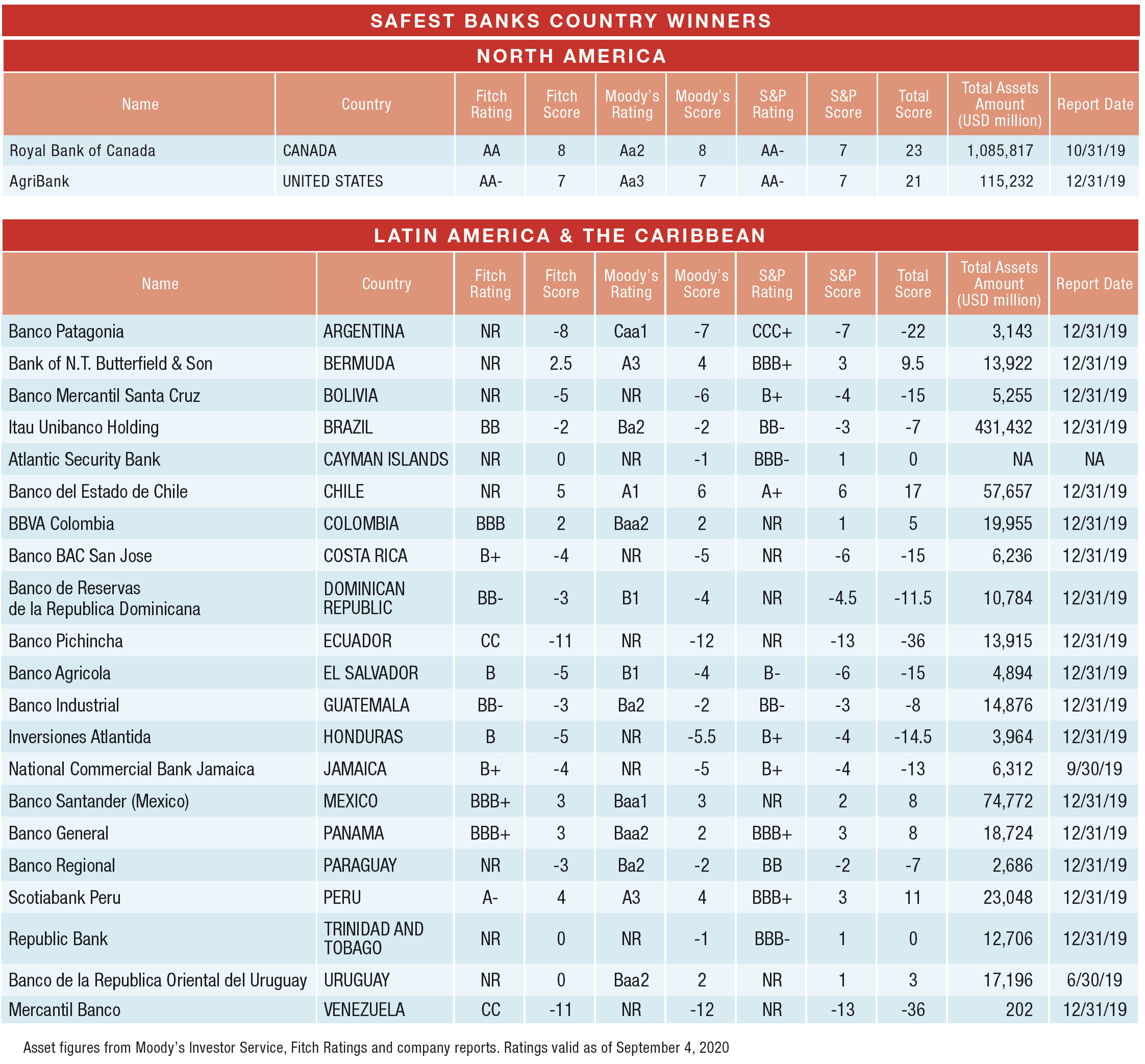

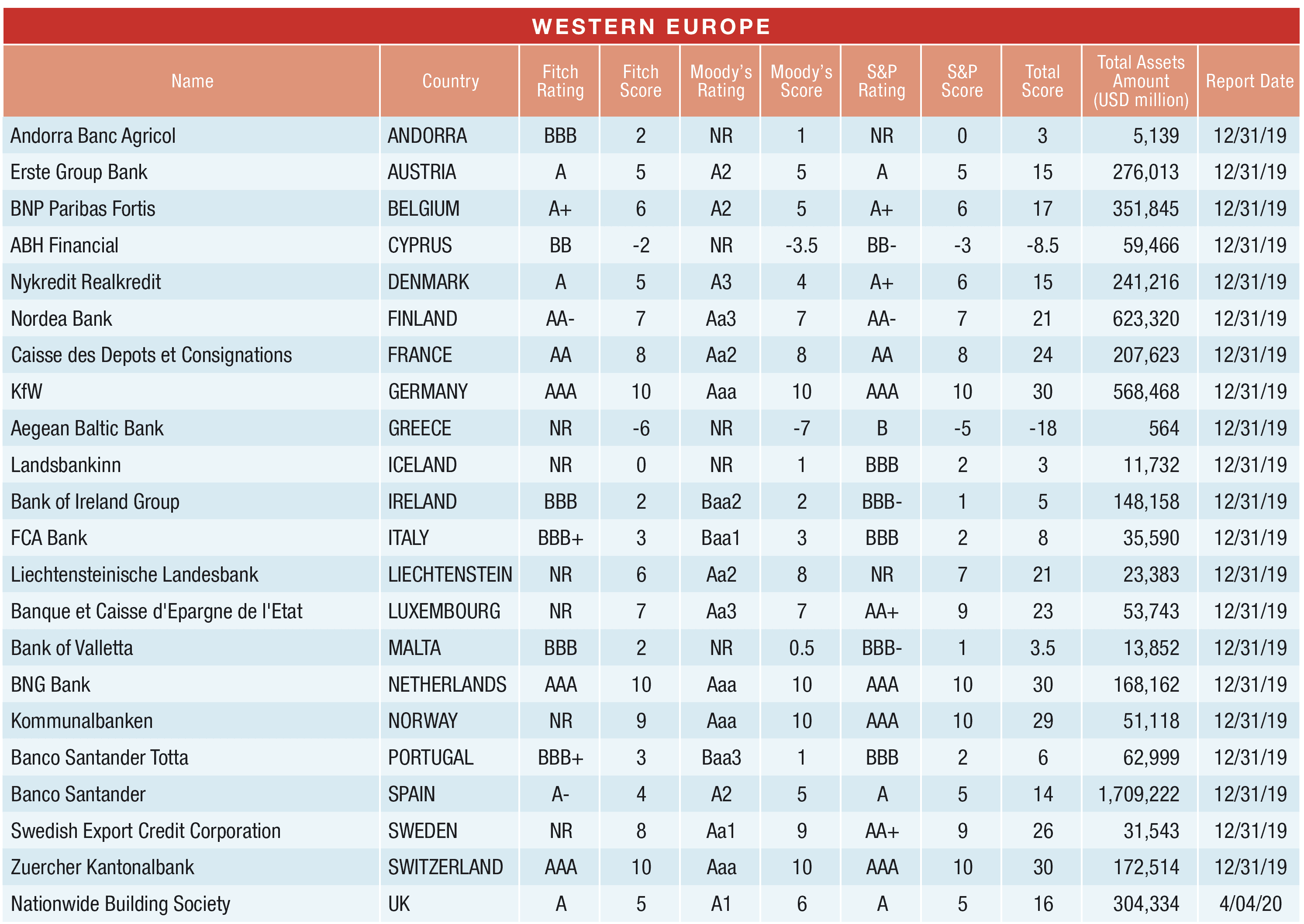

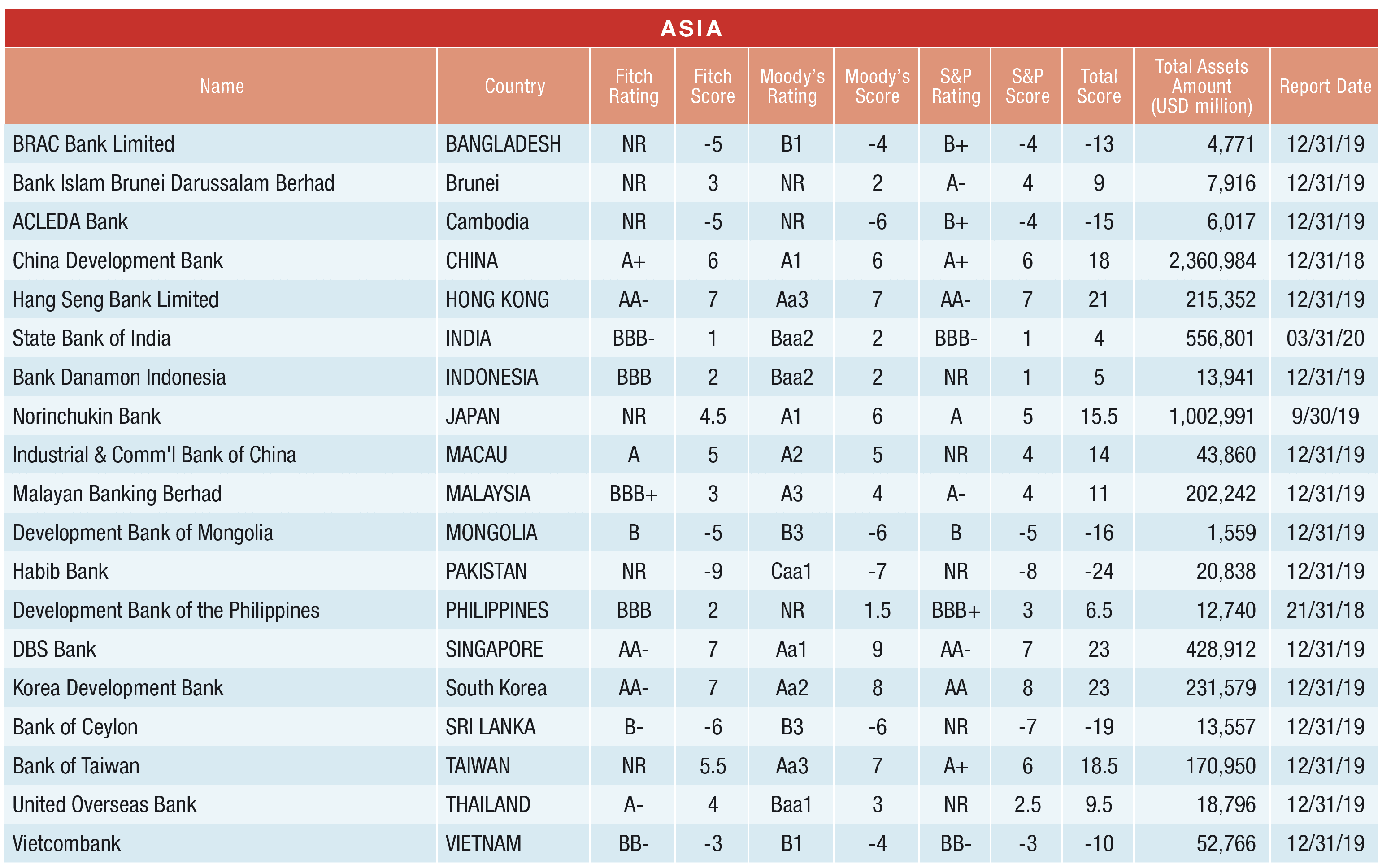

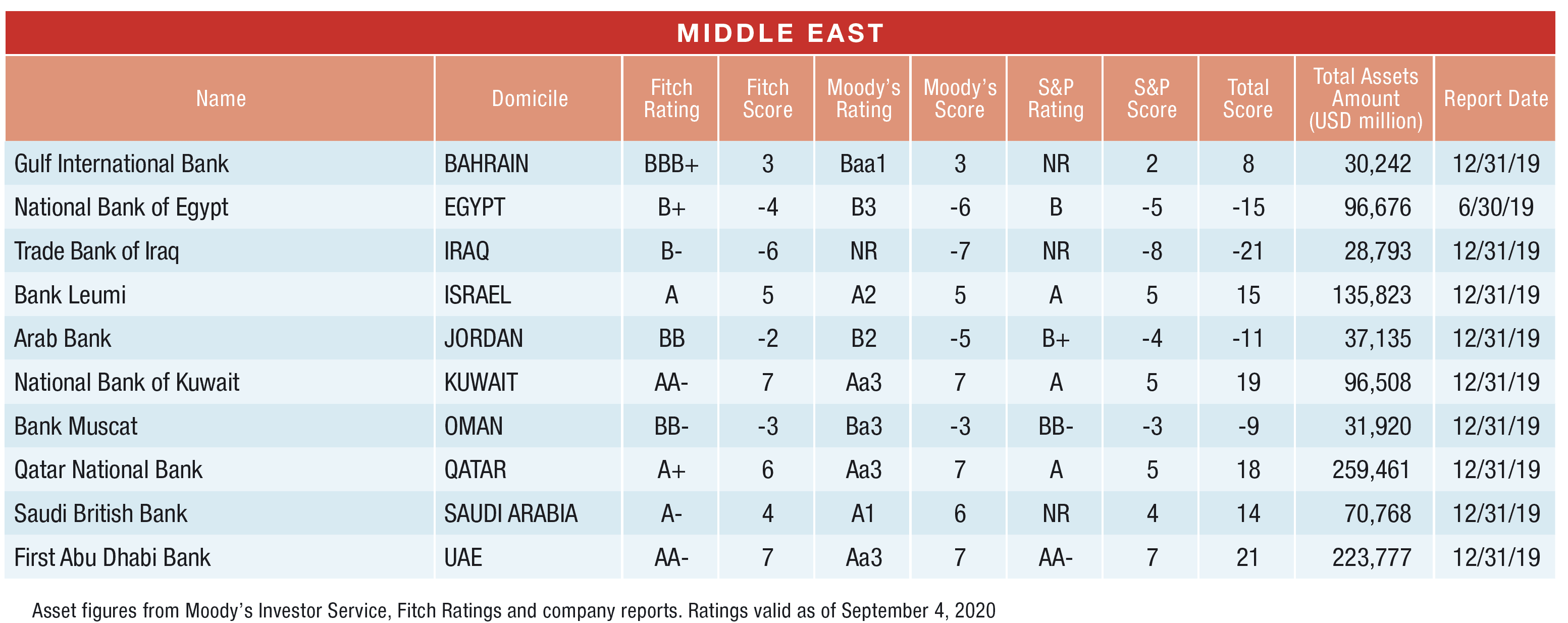

Global Finance names this year’s world’s safest banks by country.

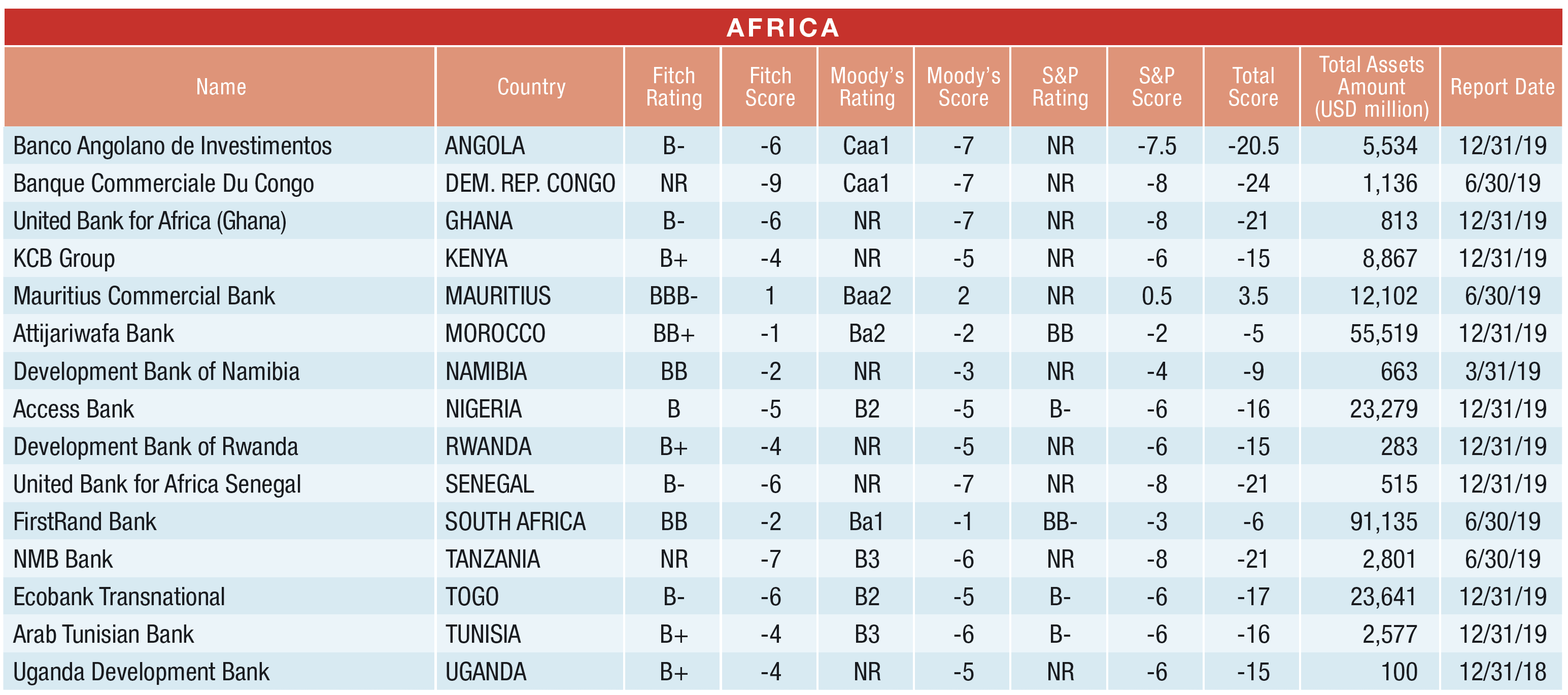

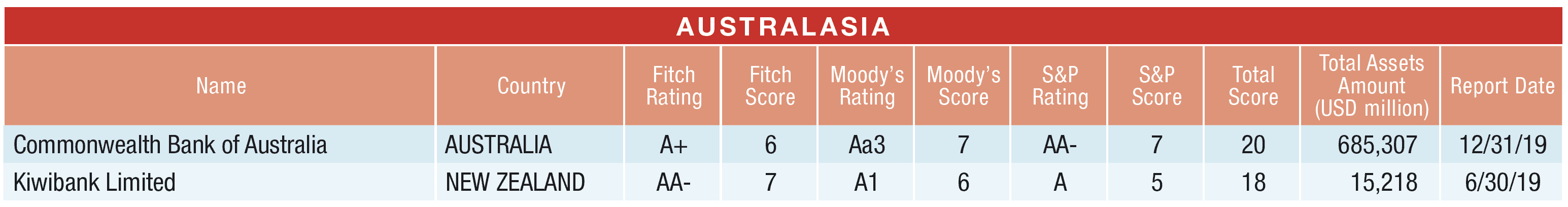

Stress on the global banking system, due in large part to deteriorating economic conditions caused by the pandemic, is the catalyst for the year-over-year changes in the 2020 rankings of our Safest Banks by Country. In previous years, most of the time, fluctuating bank ratings provided the catalyst for variations in the rankings, however this year the high number of ratings downgrades caused the changes–in comparison with the 2019 rankings, where upgrades prevailed. Consistent with turnover in prior years, our rankings included many new banks as approximately 25% of the 112 countries ranked this year experienced a change, up from 111 in 2019. Overall, there were 26 countries with new winners, and additionally three countries are represented for the first time: the Cayman Islands, Rwanda, and Tajikistan. No banks received ranking in Papua New Guinea and Lebanon no winner, as the rating agencies withdrew their coverage of these banking sectors.

In emerging and developing countries, sovereign downgrades caused the follow-on downgrade of banks. The ratings of domestic institutions are constrained by the country rating, as well as any support assumptions, such that any downgrade in the sovereign prompts the downgrade to domestic banks. This was the case in Argentina, as economic deterioration prompted downgrades by Fitch and Moody’s of the sovereign and its banks. Once the dust settled, Banco Patagonia unseated Banco Santander Rio as this year’s winner. As an important note, with every edition of our yearly Safest Bank ranking there is a cut-off date in capturing agency ratings, which was September 4th of this year. Argentina subsequently completed a debt restructuring which both provides some relief and buys extra time to address the county’s economic woes, resulting in additional ratings changes too late to be reflected this year. In April, Fitch downgraded Guatemala and a number of its banks, and Banco Industrial (BI) emerged as the winner, partially due to the fact that BI enjoys more comprehensive ranking because BI receives ratings from agencies Moody’s and S&P, while incumbent Banco Agromercantil de Guatemala does not. Following an April sovereign downgrade by Fitch, the winner in Italy is FCA Bank, whose ratings held steady as the bank has no direct exposure to Italian sovereign risk and is supported by its 50% owner, French bank Credit Agricole, with liquidity. In this case the ratings were not constrained by the sovereign. Citing risks to the sovereign from lost oil revenue and the expectation for persistently low oil prices, Fitch and Moody’s downgraded Oman, and Bank Muscat emerged as the winner while the incumbent, HSBC Bank Oman, was downgraded.

In some cases, the downgrade of the parent company in another country causes follow-on downgrading of a foreign subsidiary. For example, in Croatia, Erste & Steiermarkische Bank replaces Zagrebacka Banka this year as Fitch downgraded the latter in May following the downgrade of parent Unicredit, in an action that reflects the parent company’s reduced ability to provide support to the subsidiary. This rationale was also cited as the catalyst in Thailand as Bank of Ayudhya was downgraded by Fitch in April along with parent MUFG, paving the way for winner United Overseas Bank.

OTP Bank in Hungary was upgraded by S&P in January based on its superior domestic credit profile combined with overall improvements in the funding profile of the banking sector. For some winners, an additional rating provided a needed boost. The winner in the Democratic Republic of the Congo, Banque Commerciale, benefitted from Moody’s initiating coverage in September 2019 with a Caa2 rating which was subsequently upgraded to Caa1 in August 2020. Similarly, in Uzbekistan, Fitch initiated coverage in August 2020 with a BB- rating, which was enough to unseat Uzbek Industrial and Construction Bank. For other banks, simply exhibiting a larger balance sheet breaks any ranking tie, as was the case this year in Australia, Georgia, Israel, Kenya, Nigeria and Tanzania.

Methodology: Behind the Rankings

To be eligible for inclusion in the Country Winner rankings, entities must be among the largest 1,000 banks by assets and also carry at least one long-term foreign currency deposit or debt rating from one of the three major rating agencies. In order to capture the safest bank for each country, the criteria must be broader than for the global rankings, which require a position among the largest 500 banks and rating by at least two agencies.