Once-temporary measures find longer legs.

The transformation of the North American banking sector continues to accelerate. With new technology, banks can more efficiently leverage advanced analytics to develop convenient and digital offerings.

The sector, which was forced to try new operating models due to the pandemic, adapted quickly with greater client focus by hastening the development of online tools. The improved operating performance also took hold with renewed revenue growth and profitability from greater client-activity volumes that were aided by lower credit costs.

The Covid-19 driven sense of urgency shows no signs of abating. The competitive landscape has only heated up, with most banks deploying considerable resources to upgrade digital platforms and launch dedicated technology labs to accelerate innovation.

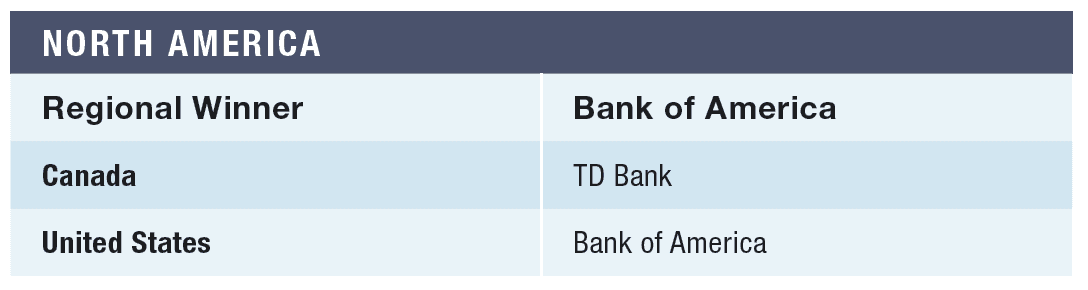

The winner of Best Bank in North America and for the United States, Bank of America (BofA), exhibited resiliency as it assisted its clients with additional banking resources. In turn, customers responded with greater client engagement. Household adoption reached 70%, while digital sales grew to 49% of total sales. Clients embraced virtual financial assistant Erica, with interactions rising nearly four times while users increased 43% during 2021. Person-to-person transactions via Zelle rose 39%, and 86% of deposits are now conducted digitally.

Digital progress is impressive, as the bank received 512 patents covering digital and tech areas like AI, machine learning, information security, data analytics, mobile banking and payments. Consequently, the bank ranks 86 on the top 300 list of US-granted patents, its highest ever.

Commercial customer use of CashPro, a digital platform for payments, liquidity, investment, foreign exchange (FX) and trade doubled during 2021 and has been enhanced with faster payment transactions and greater fraud security.

The Life Plan platform represents the bank’s most rapidly adopted digital feature. It reached 5 million users last year and enables clients to set and track financial goals based on their life priorities. Greater visibility is available with an updated virtual account management system. It helps commercial clients’ treasury operations with a more in-depth global view of their financial position, with integration into CashPro and FX platforms.

In wealth management, the firm’s Merrill division saw a 79% increase in digitally active clients. With its retirement-plan administrator, clients can utilize a new digital investment advisory program to help them with their retirement-strategy planning.

BofA’s Community Banking division operates through 1,200 financial centers in low-and-moderate-income neighborhoods. The bank’s Community Homeownership Commitment of $15 billion by 2025 has deployed over $8 billion and assisted 32,000 families. The bank is the largest private investor in community development financial institutions, and issued its second Equality Progress Sustainability Bond, for $2 billion, to promote investment in underserved communities and low-carbon solutions.

Meanwhile, north of the border, TD Bank has won the Best Bank in Canada. As the largest bank in the country holding 21% of banking system assets, TD has further enhanced its service capabilities using its Experience Design Center of Excellence, a dedicated hub to create innovative solutions.

By offering a range of robust digital banking products and operating the country’s top-rated mobile app, digital adoption is growing, with 61% of TD customers digitally active. Improvements with digital capabilities include TD MySpend, the bank’s leading personal financial management app with a convenient feature to manage cash flow better.

TD’s commercial bank ranks second in market share for loans and deposits while offering custom solutions for specialty groups in real estate, agriculture, auto and equipment finance. The acquisition of Wells Fargo’s Canadian equipment finance business, meanwhile, enhances the bank’s competitiveness in that sector with expanded financing and leasing solutions.

With a focus on underrepresented markets, TD is partnering with Canada Post to expand access to banking services for Canadians in rural, remote and indigenous communities. TD’s extensive US banking franchise is increasing significantly with the announced $13 billion acquisition of First Horizon. That will help it expand in the Southeast and complements TD’s existing footprint, predominantly in the Northeast. Pro-Forma would be the sixth-largest bank in the US, with $600 billion in assets and serving 11 million clients through 1,500 branches.